Nikada/iStock Unreleased via Getty Images

Introduction

Inflation and slowing economic growth in recent months have been negatively affecting consumer confidence and sentiments around the world. In times like this, it’s natural for consumers to prolong purchases of discretionary items especially if the discretionary item provides little additional value to their current belongings while commanding higher prices. This is the exact situation Apple (NASDAQ:AAPL) is in today. Because of inflation, the company needs to raise the price of its products; however, I believe consumers will not react positively to this move.

Inflationary pressures in labor, commodities, and even the supply chain are pressuring the entire world. As such, many analysts expect Apple to raise the prices of its new iPhone 14 line-up. I believe the new pricing increase, which I believe to be necessary for Apple, will result in lackluster sales due to low consumer sentiments and the strong U.S. dollar. Revolutionary upgrades are getting rarer and rarer especially after the new 5G phones were released with the iPhone 12, and cellphones have become another commodity. Therefore, despite Apple’s strong brand power and ecosystem, I believe investors should sell Apple ahead of the likely iPhone price increase.

iPhone 14

Apple will likely increase the price of its iPhone 14 due to inflation. CPI, consumer price index, for June 2022 showed an increase of 9.1% year-over-year, and the PPI, producer price index, for June 2022 showed an 11.6% increase year over year. As such, inflation is being felt by all parties in the economy from producers to consumers likely leading to a price hike in Apple products.

Pricing

Numerous analysts have pointed to a likely price hike on iPhone 14 pro models. iPhone 13 pro and pro max cost $999 and $1099, respectively. The new iPhone 14 pro and pro max is expected to cost $1099 and $1199, respectively, which shows a $100 price increase. The move, as stated above will be to protect the company’s margins. Further, Apple is expected to introduce iPhone 14 Max replacing the $699 mini-series with a price tag of $899. The base model for iPhone 14 is expected to stay at $799.

The pricing structure is unique. Apple is expected to increase the price of the iPhone for only pro models while maintaining the price of base models, which seems weird since inflation should be impacting all four models. The reasoning behind this move is likely that Apple wanted to maintain the sales volume during low consumer sentiment periods by keeping the base models at the same price. However, to keep its revenues and margins, Apple is expected to increase the price of its pro models and entice more customers to upgrade to the pro models. As such, to convince consumers they wish to purchase an expensive model voluntarily, Apple has focused a plethora of new updates on only the pro models. The pro models will likely be the only models potentially supporting a 120hz display, a new notch design, a titanium frame, and a new a16 bionic chip leaving the base iPhone 14 models with almost no updates.

Apple is in a bad position. The majority of the consumer who bought the iPhone 13 purchased the base model. However, the company is attempting to entice customers to buy the pro models instead of the base model for iPhone 14 with a plethora of upgrades. While this strategy may work, I believe otherwise. I believe the majority of consumers will find upgrading to iPhone 14 base models unnecessary especially in times of low consumer sentiments as it will not feature a new notch design or a new chip. Apple has focused the majority of upgrades on pro models in hopes of enticing customers to buy a more expensive model; however, I believe this move will only diminish the demand for the new base models. Further, I believe there are not enough number of consumers wishing to purchase the pro models to offset slower demand. This was seen in iPhone 13 where the base models accounted for the most sales.

What If…

If iPhone 14 base model and iPhone 14 may also receive a price hike of $100 to $899 and $999, respectively, then I believe the situation will be even worse for Apple. Consumers buying these models will not only pay $100 more, but they will see a very minimal upgrade from the iPhone 13 models.

Consumer Sentiments and Strong Dollar

Low consumer sentiments in the U.S. and a strong dollar for foreign countries will likely deter a significant portion of consumers from purchasing a new iPhone this year.

As the chart below shows, U.S. consumer sentiments are in a free fall due to the slowing economic growth and high inflation, which will likely hamper some demand for the pricier iPhone.

A strong dollar relative to other currencies are an even greater risk for Apple. Japan is one of the biggest foreign markets outside of China, and Yen has been showing significant weakness against the dollar. Compared to a year ago, the Japanese Yen’s value against the dollar fell about 25%. As such, Japanese consumers will feel an even greater price increase for the new iPhone compared to the U.S consumer. On top of that, Apple has already increased the price of the existing iPhone 13 in Japan by 19% due to inflation. Further price hikes in the new iPhone 14 model will likely hamper demand, especially during times of higher inflation and lower consumer sentiment.

Historical Valuation

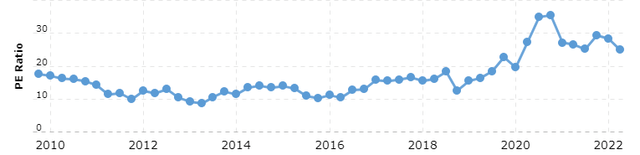

Apple, looking at its historical valuation multiple, is trading at a premium today despite some negative outlooks and lackluster growth expectations. As the chart below shows, Since 2010, Apple has been trading at a 10~20 price-to-earnings ratio compared to today’s 25. Apple, however, is not offering strong growth prospects either. The company is expected to grow at an average of 4.07% year-over-year each quarter for the next four quarters. Therefore, considering the premium valuation and negative growth outlook, I believe there are more risk potentials than reward opportunities for Apple today.

Risk to Thesis

There is a reason why Apple is one of the most valuable companies in the world. The company successfully created an ecosystem of both hardware and software products that continue to expand and become embedded in the consumers’ lives. For example, Apple hardware products including the iPad, MacBook, iPhone, Air Pods, and Apple Watch all seamlessly connect with each other providing a unique experience. As such, Apple has been taking market share from its competitors, which may work to offset potential slowing demand coming due to price increases. Apple’s strong product offerings and branding may prove to be more resilient than my expectations. However, even if this proves to be true, I believe Apple’s high valuation leaves more downside risks than an upside potential maintaining my negative rating on the company today.

Summary

Apple is a strong brand and a strong stock. Apple will most certainly be relevant for years to come; however, I believe today is not the best time to buy the company’s stock as there may be more risk than reward potential. The company is expected to increase the price of its new iPhone 14 to combat inflation, which in my opinion will bring negative results for the company. Low consumer sentiments, a strong dollar, and upgrades only focused on the most expensive models may potentially lead to consumers choosing to delay their purchase of discretionary electronic goods for a year. Therefore, I believe investors should avoid Apple.

Be the first to comment