wakr10/iStock via Getty Images

Health Catalyst (NASDAQ:HCAT) has been on my radar for a couple of years, but the valuation has always prevented me from pulling the trigger on a starter position. Now, the company’s 2022 guidance cut and the market-wide sell-off have brought the share price down to an attractive valuation to allow me to finally find a spot for HCAT in my Compounding Healthcare “Bio Boom” Portfolio. I believe the company has the potential to make a turnaround and regain its momentum.

I intend to provide a brief background on Health Catalyst and will discuss its recent setbacks. In addition, I will present why I think HCAT is worthy of a spot in the Bio Boom Portfolio. Then, I will lay out some downside risks that HCAT investors should consider when managing their position. Finally, I will reveal how I plan on establishing a position in HCAT and how I intend to manage the position.

Background On Health Catalyst

Health Catalyst is a healthcare technology company that delivers data and analytics services to healthcare organizations. Health Catalyst’s platform utilizes AI and end-to-end technology to deliver commercial-grade analytics to improve patient engagement, clinical quality improvement, patient safety, cost management, health information exchange, and payer-provider interactions. As a result, the healthcare system can reduce waste, adapt to a changing economy, and manage complex data.

Health Catalyst Overview (Health Catalyst)

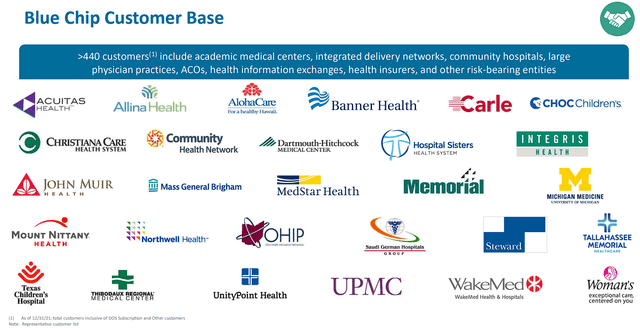

Health Catalyst has over 440 customers which comprise mostly health care providers and institutions looking to make data-driven decisions to help manage their organization, clinical performance, and financial, and operational improvements. In fact, in June, Health Catalyst, published their 300th customer case study that put the company at a documented total of $1.5B in validated measurable improvements and 5.4M lives positively impacted. So, it is safe to say that customers should see a good ROI from using Health Catalyst’s products and services.

Health Catalyst Customers (Health Catalyst)

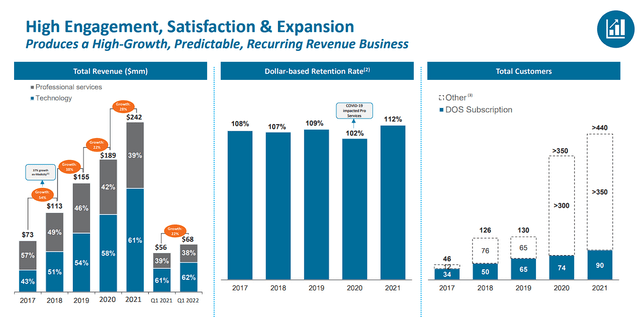

The growing number of customers provides a steady source of revenue that is 90% recurring, which has grown about 23% year-over-year and an average of 33% over five years.

Health Catalyst Growth (Health Catalyst)

In Q2 of 2022, Health Catalyst generated $70.6M in total revenue, which was an 18% increase year-over-year. Their technology revenue was $45.4M, representing 28% growth year-over-year. Health Catalyst’s Professional Services revenue was $25.2M, signifying 5% growth year-over-year. The company’s total adjusted gross margin was 54.7%, which is approximately 35 basis points increase year-over-year. In terms of cash, Health Catalyst finished Q2 with $403M of cash, cash equivalents, and short-term investments.

Recent Setbacks

Despite reporting a strong Q2 that had revenues coming in at the high end of the company’s guidance range, the company also announced that they cut the company’s revenue and adjusted EBITDA outlook for the full year 2022. The company believes their near-term growth is being hurt by the global economic environment.

Primarily, the U.S. health system is suffering labor and supply issues with ballooning costs without a proportionate increase in revenue. As a result, customers are postponing near-term purchasing decisions as they reexamine their budgets. Unfortunately, this resulted in the company experiencing an impact in new customer additions and hurt their dollar-based retention metrics.

The company also lost one of their large enterprise DOS customers that they added in the early stages of the COVID-19 pandemic. Luckily, the company’s customer retention has been tremendously strong with their enterprise DOS customer base. So, this should be a one-off situation and “was primarily driven by near-term cost savings needs in light of their significant financial pressure.”

Health Catalyst has decided to pause their efforts in the life sciences adjacent market. Health Catalyst believes there are prospects in that market, but they are not seeing their investment as fruitful as forecasted. As a result, Health Catalysts is not expecting it to be a major contributor to the full-year 2022 revenue.

A Potential Bio Boom Turnaround

The Bio Boom Portfolio is made up of healthcare tickers that are highly speculative, however, they offer substantial upside due to a potent upcoming catalyst, projected revenue growth, or a potential turnaround. Typically, these are small to mid-cap companies with volatile tickers that will offer recurrent trading opportunities to help generate substantial profit while developing a “house money” position. These tickers will be traded as long as it is in play or the company graduates to the Bioreactor Portfolio.

Tickers that make it into the Bio Boom Portfolio are often on a candidate watch list for a prolonged period of time until the right conditions are met. Many of the commercial-stage Bio Boom companies are labeled as a turnaround play typically due to the company having a weak commercial launch or industry headwinds. I would label Health Catalyst as a turnaround or temporary headwinds stock at this point in time considering the setbacks listed above. A swift resolution to these issues and we could see the market change its behavior with HCAT.

In order to resolve these issues and get the company back on track, Health Catalyst are going to have to formulate an operating plan that prioritizes a pragmatic solution to the macroeconomic environment that doesn’t hurt growth. The company’s decision to pause their investment in the life sciences adjacent market, as well as the overall reduction in investments in other areas is a great start in optimizing. This should allow the company to make more strategic investments to provide their customers with strong improvements in data and analytics in order to measurably improve their ROI. Considering the healthcare industry’s current headwinds, improvements in the company’s Financial Empowerment Suite, Population Health Suite, and their outsourced services could be vital resources for customers who are looking to make data-driven decisions to manage their practices. Essentially, Health Catalyst has an opportunity to thrive in a stressful economic environment by providing their customers with the services and solutions needed to navigate their economic headwinds.

Indeed, Health Catalyst anticipates that their 2023 revenue growth rate will be impacted by the lower bookings this year. However, they are expecting positive adjusted EBITDA and margin improvements in 2023, which will help move the company closer to profitability. If Health Catalyst can execute their plans of improving operational focus and cost optimization, we should indications of a turnaround and possibly see the company get on track for hitting their target for positive free cash flow in 2025.

So what is the Bio Boom opportunity for HCAT?

The opportunity is the market’s overreaction to slowing growth and possibly a decrease in earnings in the coming quarters. We are looking to take advantage of top-line negativity and will focus on the company’s move towards cash-flow-positive. The goal is to have a respectable position before the company reports year-over-year or sequential growth again and there is an abrupt turnaround in the share price. This could allow an investor to have an attractive cost average for a long-term investment.

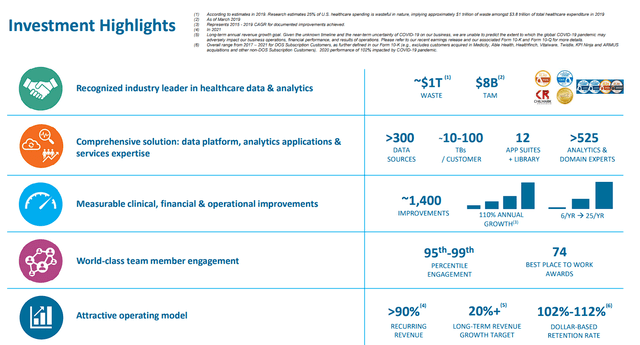

Keep in mind, Health Catalyst is considered one of the industry’s leaders in healthcare data and analytics technology and services, with a strong track record of generating quantifiable improvements for its customers. The company might be dealing with some setbacks and headwinds, but overall, Health Catalyst has a promising operating model with prospects to be the longstanding leader in an $8B market.

Health Catalyst Investment Highlights (Health Catalyst)

Leading Downside Risk

Health Catalyst has a few downside risks to consider, including competition, cash burn, debt, and economic environment. However, my leading risk comes from HCAT’s opportunity… slowing growth and its impact on the share price. The company is expecting their Q3 revenue to “decline a few percentage points sequentially.” In addition, the company is also expecting a hit on margins. Moreover, the company will see a bump in sales and marketing expenses related to their Healthcare Analytics Summit. Remember, the company cut their revenue guidance and their adjusted EBITDA outlook for the full-year 2022.

Indeed, we are already aware of these issues, but the unknown is going to be the market’s reaction to these headlines. The longer the company reports disappointing earnings, the more the other risks (competition, cash burn, debt, and economic environment) will become a bigger threat. We could have another 3 to 6 months of negative headlines that might crush the share price and prevent a recovery for an extended period of time.

As a result, I am giving HCAT a conviction rating of 2 out of 5.

My Plan

The ticker has been punished over the past twelve months, dropping around 81% with little-to-no indications of a technical setup for a reversal. As a result, I am looking to initiate a position under my Buy Threshold of $8.75 per share. Once I have established a starter position, I will look to add the following earnings reports in 2023 until I have accumulated a half-sized position by year-end.

HCAT Daily Chart (Trendspider)

On the other hand, I will be looking to quickly book profits on HCAT. I will set a few sell orders around my Sell Targets in order to transition my position into a house money status for a long-term investment.

Long term, I am expecting to maintain an HCAT position for at least five years in anticipation that the company will reacquire its growth trajectory and will ultimately graduate to the Compounding Healthcare Bioreactor growth portfolio.

Be the first to comment