zhongguo

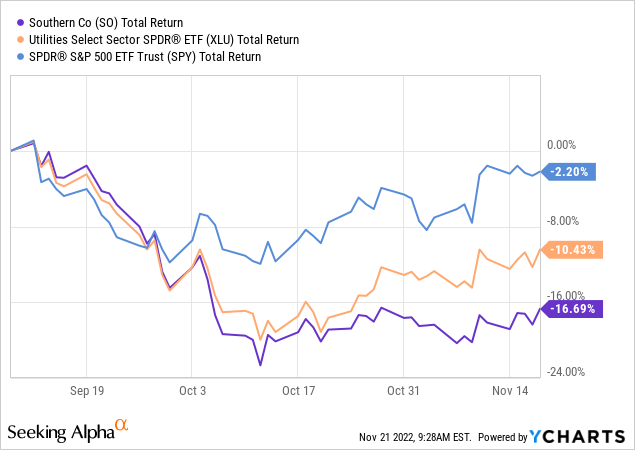

After falling over 20% in one month, the beaten-down utility sector (XLU) reversed course in mid-October and, after the market’s euphoric reaction to the October CPI report, resumed its upward rebound on hopes of a Fed pivot due to falling inflation.

I noticed that one stock on my watchlist has significantly lagged behind this bounce, and it happens to be one of my favourite defensive stocks for stable performance, solid income, and reliable dividend growth.

In this article, we’ll take a closer look at Southern Company (NYSE:SO): its balance sheet, current valuation, dividend strength, and growth outlook to determine whether its recent underperformance offers a great buying opportunity.

Near-Term Risk, Long-term Stability

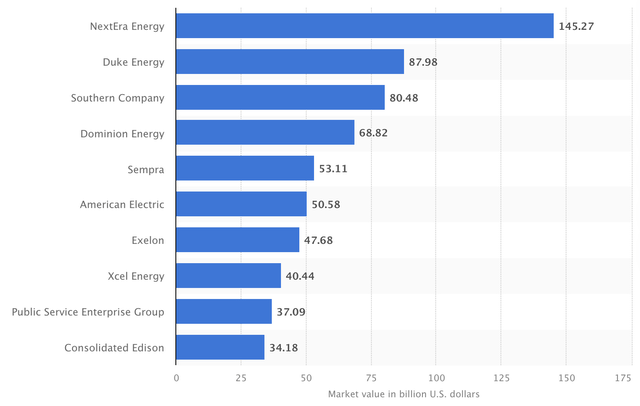

Serving over 9 million customers across the Southwest, Atlanta-based Southern Company is the second-largest US utility by customer base and third-largest by market cap behind only NextEra (NEE) and Duke Energy (DUK).

Largest US Utility Companies (Statista)

Its diversified operations provide electricity in Alabama, Georgia, and Mississippi and natural gas in Georgia, Illinois, Tennessee, and Virginia. Its subsidiaries Southern Telecom and Southern Linc provide fiber optic and cellular communication services, while PowerSecure, which Southern acquired in 2016, is the leading microgrid installer in the US with an 85% market share. Microgrids are small-scale, self-sufficient energy grids for smaller discrete areas such as military bases, hospitals, sports stadiums, islands, etc. They typically include renewable energy sources, so PowerGrid also provides energy efficiency project engineering and installation services.

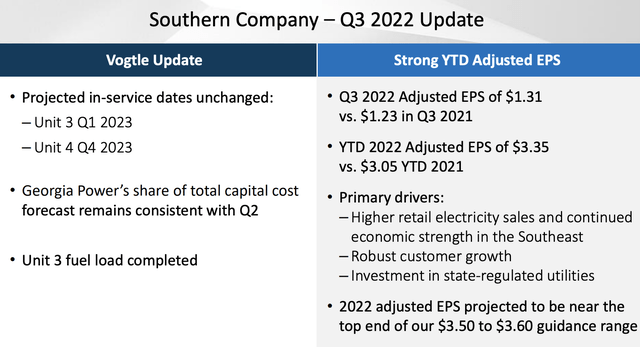

Operationally, Southern Company has had an excellent year like most other utilities, reporting 24% YoY revenue growth and 13% EPS growth in its most recent Q3 report. Forward growth projections are more in line with its historical levels at around 6% each, which is still quite respectable and double its dividend growth rate. Its current asset mix is 50% natural gas, 20% coal, 15% renewables, and 15% nuclear, although the share of renewables and nuclear energy will grow in the coming years as the company closes in on its goal to be 100% net carbon neutral by 2050.

Q3 Summary (Southern Company)

The company’s main risk is its nuclear power exposure, and specifically the completion of reactors 3 & 4 at the Alvin W. Vogtle Electric Generating Plan, which the company has operated since 1987. The project’s problems are well-documented, so I won’t go into too much detail here. In short, Southern Nuclear first proposed the plan in 2006, and it was eventually approved under the Obama administration in 2009. The new reactors were originally scheduled to be operational by the end of 2017 at a cost of $14B.

However, the primary contractor and reactor supplier Westinghouse filed for bankruptcy in 2017 due to losses from its nuclear projects, and Southern Nuclear stepped in to oversee construction and find a new primary contractor. After a number of further delays, inspection issues, and cost overruns, reactors 3 & 4 are finally entering their testing phases and are slated to be operational by the end of 2023 at an end cost of at least $30B, approximately $10.4B of which Southern is directly responsible for as it owns 46% of the plant via its subsidiary Georgia Power.

Vogtle Reactor Facts (Southern Company)

Similar to the moratorium on new nuclear projects after the Three Mile Island accident in 1979, SO’s near-term price movement might be affected by events unfolding at the Zaporizhzhia Nuclear Power Station in southeastern Ukraine, which Russians have controlled since their initial invasion in March. Shelling activity around the facility has increased over the past few days, with nuclear watchdog groups worried that Putin may try to create an electricity outage that could threaten the reactor core’s cooling system.

A nuclear meltdown at Zaporizhzhia, Europe’s largest nuclear plant, could dwarf the Chernobyl disaster and spark a new public and political backlash against nuclear power. Even in such an event, I doubt that Southern Company’s Vogtle plans would be affected since it is finally near completion after 16 years of planning, but investors should be aware that externalities surrounding Russia-Ukraine conflict could play a large role in SO’s returns if things take a turn for the worse at Zaporizhzhia.

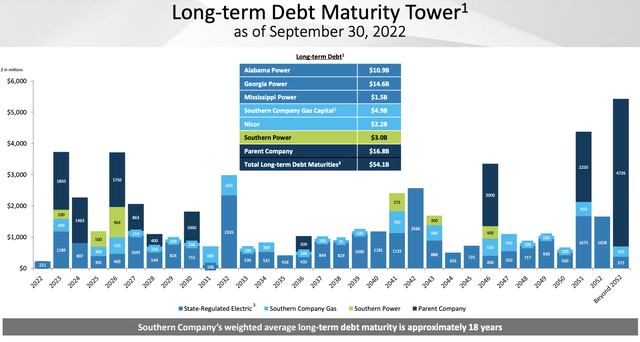

When completed, the Vogtle project will mark the first new US nuclear units built in over 30 years, and together with its first two (currently operational) reactors it will be the largest nuclear facility in the country, generating over 4500 megawatts of electricity and powering over a million homes. At this point it seems like the project will be a success and may help to improve Southern’s margins and growth profile, especially after 2026 when its debt obligations lessen significantly. Barring any major setbacks at the Vogtle plant, Southern should be able to cover its debt obligations and dividends comfortably with over $7.3 billion in current cash and credit liquidity.

Debt Maturities (Southern Company)

A secondary concern is management risk, with longtime CEO Tom Fanning planning to step down from his role by the end of the year. Fanning has been with Southern Company for over 40 years, beginning as a financial analyst with them in 1980. He may stay on in a consulting capacity until the Vogtle project is completed and operational, but the company has not announced a successor yet. During his tenure at Southern, Fanning held C-suite roles at multiple subsidiaries before ascending to COO in 2008 and finally chairman and CEO in 2010, so it will certainly be hard to find someone with such intimate knowledge of the business to replace him.

Slow and Steady Wins The Race

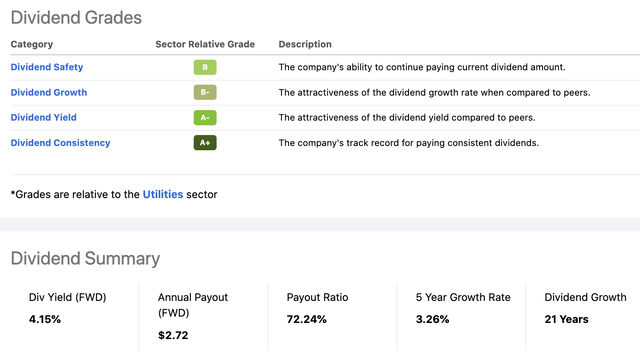

Southern Company is one of my favourite core income stocks simply because its performance is so consistent and boring. It has a higher-than-average 4.12% yield, a fairly low dividend CAGR (compound annual growth rate) of 3.22%, and a solid payout ratio of 72% compared to its closest peer DUK, which compares a bit worse on multiple fronts as we can see below.

SO Dividend Summary:

Seeking Alpha

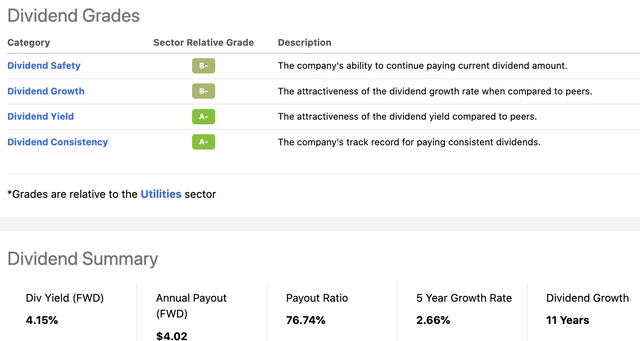

DUK Dividend Summary:

Seeking Alpha

While younger investors might prefer utility stocks with higher dividend CAGRs and lower yields and payout ratios like WEC or NEE, older investors seeking higher but still safe yields may be better off with SO. Seasoned dividend investors know that there are some advantages to slow and steady dividend growth as well. There is peace of mind in knowing that SO’s dividend raises will come like clockwork, and there is no need to question SO’s ability to cover its dividend let alone cut it. This is largely because the company’s revenue and earnings growth rates remain well ahead of its dividend CAGR.

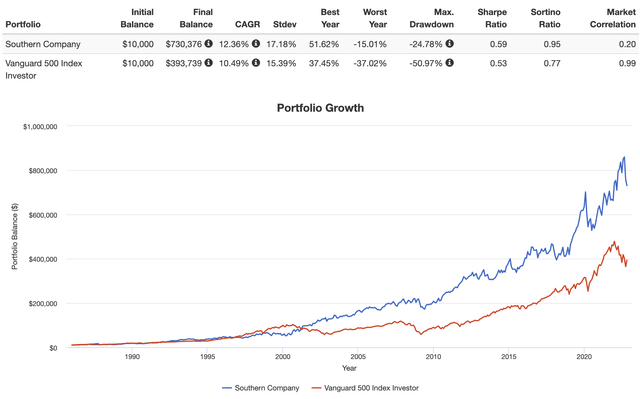

The downside to slower dividend growth of course is that stocks like SO become less attractive when Treasury yields surpass their own because a longer holding period is required for an investor’s yield-on-cost to rise to a level high enough to justify the risk proposition in holding a stock over a no-risk Treasury bond compared to a stock with a similar yield but higher dividend growth. On the other hand, SO’s business is extremely stable and the stock has low relative volatility with a 5-year beta of only 0.51. Short of a literal nuclear meltdown, in terms of long-term, low-risk wealth compounding potential, there are few stocks you could do better with than SO as we can with its performance against the S&P 500 since 1985:

SO vs S&P 500 Returns (PortfolioVisualizer.com)

Note the rather incredible metrics above. Over nearly four decades, a large utility company with low dividend growth not only averaged a 2% higher CAGR than the S&P 500 and returned nearly double, but it did so with far less risk.

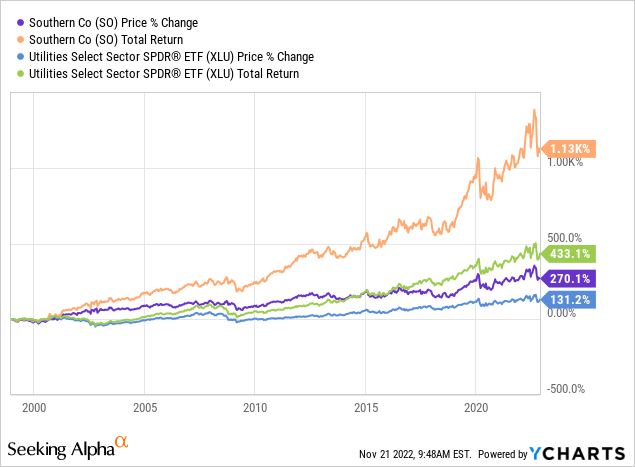

Furthermore, although SO has underperformed the utility sector index over the past 10 years, we can see that over a longer period reinvesting its dividends would have driven an investor’s total return from SO to nearly three times that of XLU. It may be boring, but over the long term the market is won by patient buying and holding of steady compounders.

Conclusion

Zooming out from the current moment, Southern Company has been one of the best risk-adjusted wealth compounders among utility stocks, and the company’s practice of promoting from within has created a disciplined management team that has weathered multiple recessions and interest rate environments with relative ease. It’s dividend yield and growth are adequate and safe, and Southern is well positioned for future years of steady growth now that most of the construction troubles from the Vogtle plant are behind it.

Most great buying opportunities occur when doubt surrounds a company’s prospects or the market become worried that a capital-intensive project like Vogtle will hurt its investment thesis. Today marks yet another day of SO sitting out the rally in utilities, but I rate it a strong buy on current relative weakness around the $65 level.

Be the first to comment