shaunl/iStock Unreleased via Getty Images

Despite approving Microsoft’s (MSFT) bid of $95 a share back in April this year, shares of Activision Blizzard Inc. (NASDAQ:ATVI) still sits 22% below the bid price as Wall Street bets the deal will fail to go through. The FTC is seeking additional data from the two companies as part of its antitrust review. The FTC is reportedly looking into the merger’s impact on competition between gaming consoles, the handling of consumer data by Microsoft if the merger goes through, and working conditions for game developers.

The 2020 Vertical Merger Guidelines can provide us with insight as to how the FTC will look into these topics. This article will argue that, based on the guidelines, the merger is highly likely to go through. It will also argue that Activision’s stock offers an attractive opportunity for investors seeking protection from recent market volatility.

Microsoft Is Tiny

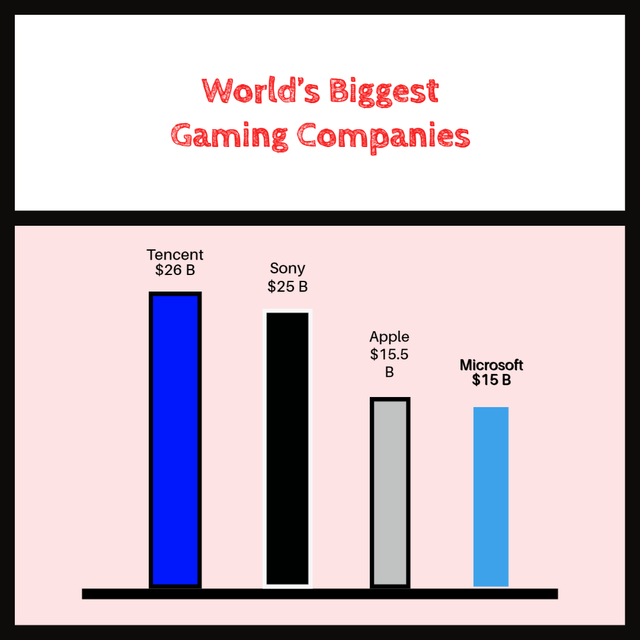

One of the biggest obstacles facing the deal in the mind of investors is Microsoft’s status as a tech giant; it is the third-biggest company in the world by market cap. But Microsoft is a relatively small player in gaming, with revenues of roughly $15 billion during the company’s 2021 financial year. Tencent’s gaming revenue in 2021 was about $26 billion. Microsoft’s main competitor, Sony, has revenue comparable to Tencent at roughly $25 billion. If Microsoft closes its Activision acquisition, it would have about $24 billion in revenue. This indicates that the merger would add a fourth big player in gaming rather than establish a leader, something the FTC could actually welcome.

Microsoft lags Gaming competitors (created by author using regulatory filings)

There is no clearer demonstration of Microsoft’s small size in gaming than the 25 million subscribers it has to its Xbox Game Pass. That number is dwarfed by Sony’s PlayStation Network, which has four times as many subscribers.

The Caveats

Based on the 2020 Vertical Merger Guidelines, the agencies would seek commitments from Microsoft that it would not use its acquisition of Activision to advantage Xbox over other competitors. One example of such practices would be to make the Call of Duty franchise available exclusively on Xbox. In an interview, Microsoft President Brad Smith said the company has no intention to take games off platforms, quite the contrary:

We’d like to bring it to Nintendo devices, we’d like to bring the other popular titles that Activision Blizzard has, and ensure they continue to be available on PlayStation, and that they become available on Nintendo.

Microsoft has a history of doing that with Minecraft, where the company expanded the game to more platforms following the acquisition rather than make it exclusive on Xbox. That could be encouraging for the regulators, but they are likely to want more than Microsoft’s word.

Another issue mentioned in the guidelines is the use of consumer data. Microsoft could potentially use additional consumer data it acquires from the merger to benefit its platforms. Mobile games in particular are notorious for their data collection practices, regulators might want to have a closer look at what Microsoft’s practices will be like and could find grounds to block the deal.

The company has already committed however to respecting the privacy of consumers and to not use data in a way that favors it competitively.

We will continue to respect the privacy of consumers in our app stores, giving them controls to manage their data and how it is used…We will treat apps equally in our app store without unreasonable preferencing or ranking of our apps or our business partners’ apps over others.

These verbal commitments won’t be enough to appease regulators, but they do accomplish two things: 1) Make it impossible for regulators to prove Microsoft would gain monopolist powers from the mergers. 2) Give the regulators room to negotiate with the company on the use of data and its app store practices. If the company, in good faith, changes its app store principles to encourage competition and respect consumer privacy, the FTC cannot then claim the deal will harm competition. What the FTC can do however is discuss and set a framework for implementing these principles in a manner it would approve.

Risks

This article will not deal with risks that could occur post merger, given it is recommending a merger arbitrage. With more than $104 billion in cash and cash equivalents on its balance sheet, there is very little doubt Microsoft would not be able to pay the money. One potential risk however is that adverse market conditions could see Microsoft walkway from the deal, similar to the situation with Elon Musk and Twitter. Microsoft might view paying the breakaway fee of $2 billion as a better option, although the pedigree of the firm means the deal is unlikely to fall through over that. The real risk with further deterioration in market conditions would be further declines in ATVI’s price. This occurred in 2020 when many merger arb funds turned to forced sellers of target companies. Obviously in that case the potential return becomes more attractive, but investors wouldn’t get as much protection from volatility as they would have wanted.

The biggest risk however, and the one that kept me from buying the stock, is that investors would do well if they just stomach the volatility and make use of some of the amazing deals the market offers. Sure, an almost risk-free 30% is a good return, but does it compare to a “once in a generation buying opportunity“?

One regulatory risk is that the FTC has withdrawn from the 2020 Vertical Merger Guidelines. An introduction of new guidelines before the merger closes may alter how regulators view mergers like the one between Microsoft and Activision. Yet the deal is still likely to get the green light when considering the factors the FTC wants to update in future guidelines.

Conclusion

Activision’s stock represents a compelling opportunity, given that buyers would make 30% from here in roughly 13 months. There are little risks to this scenario, given Microsoft has the money and the deal would likely face little regulatory pushback. Regulators will consider the impact the merger would have on competition in gaming, but Microsoft’s small size relative to competitors means the deal intensifies competition rather than kill it. The 2020 Vertical Merger Guidelines also indicate that regulators will look at how consumer data could potentially be used, and Microsoft has already signaled it is ready to find a solution that pleases regulators in order for the deal to go through.

Be the first to comment