martin-dm/E+ via Getty Images

Article Thesis

New Residential (NYSE:NRZ) is a well-managed REIT that heavily invests in mortgage servicing rights. Those benefit from rising interest rates, as there is a lower risk of mortgages being refinanced. Still, NRZ has seen its shares pull back quite a lot in recent weeks, which has New Residential’s yield climb to a highly attractive level of 11.5%. The recent move to internalize management is also a positive and will provide a compelling cash-on-cash return. When we consider that further dividend increases are possible in the coming years, New Residential could be a compelling high-yield investment at current panic prices.

Panic Selling Despite MSR Portfolio Becoming More Valuable

New Residential has, like many other mortgage REITs, experienced a lot of selling pressure in recent weeks. Over the last month, shares are down 22%, while the VanEck Vectors Mortgage REIT Income ETF (MORT) is down 17% over the same time frame. Over the last year, New Residential has outperformed the mREIT ETF, however, with respective returns of -19% and -34%. Mortgage REITs perform badly in the current interest rate environment as rising short-term rates pressure the spread between short-term and long-term rates. Since mortgage REITs usually borrow short-term and lend long-term, a declining spread is bad for their profitability and also hurts their book value. Mortgage REITs declining in the current environment thus makes sense, although the reaction might still be overdone. In New Residential’s case, rising interest rates could be a positive, however, at least for one of its business units.

New Residential heavily invests in (excess) mortgage servicing rights, which allow the company to capture a portion of each monthly mortgage payment of the related mortgages. When many mortgages are being refinanced, the value of New Residential’s mortgage servicing rights portfolio declines. Since mortgage refinancing depends on how high interest rates are, New Residential is thus exposed to moves in interest rates when it comes to its MSR portfolio. When rates drop, more mortgages are being refinanced, which leads to a lower MSR portfolio value. That was the case in 2020, for example, and is one of the reasons why New Residential was heavily impacted by the pandemic. This led to earnings and book value declines and also forced New Residential to cut its dividend.

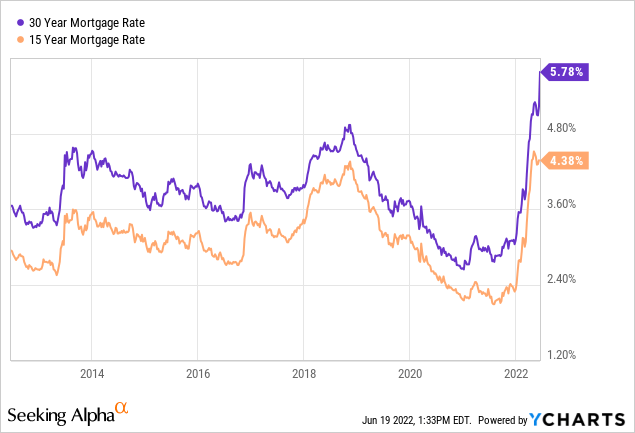

But in recent months, mortgage rates have risen drastically:

Mortgage rates have recently exploded upwards, with 30-year mortgages being more expensive than at any point over the last ten years. This will mean that almost no one will refinance in the current environment, which should make New Residential’s mortgage servicing rights portfolio more valuable, all else equal. That’s not New Residential’s only source of earnings, and there is a negative impact from rising rates in other business units. New Residential’s mortgage origination business will not do as well in the current environment, due to fewer mortgages being sought by potential home buyers. But still, New Residential is not experiencing headwinds from all sides, and it is thus surprising to see that the company has recently sold off more than the average mortgage REIT, with most mortgage REITs being more negatively impacted than New Residential.

In 2020, New Residential suffered when rates dropped drastically — for them to suffer to a similar degree now, when the contrary happens, is not very logical, I think. The near-term outlook for New Residential is thus not as bad as the stock’s price movement suggests.

Internalization Is A Good Thing

New Residential recently announced that management would be internalized and that the company would also pursue a name change in the coming weeks. Internalizing management is a good thing. Not only will it lead to significant cost savings, but it also leads to better alignment between investors and managers. Externally-managed REITs sometimes have a tendency of chasing growth as it leads to rising fees for the external manager. But chasing growth is not necessarily the best thing for investors, as there might be alternatives that create more shareholder value, such as debt reduction, buybacks, or dividends. With management getting internalized, New Residential’s management will be better-aligned with investors in the future. In the past, management has been pretty solid already, but might be even more shareholder-focused/shareholder-friendly in the future.

According to the company, the deal to internalize management costs $400 million and will lead to savings of $60 million to $65 million. Going with the lower end of that range in order to be conservative, New Residential will thus receive an immediate 15% unlevered cash-on-cash return. That’s a better return than investing in income-producing securities, and also a better return compared to buying back New Residential’s own shares. Thanks to New Residential’s strong balance sheet, paying $400 million is not a problem for the company. On a per-share basis, the move will result in $0.12 in additional earnings per year, thereby boosting earnings per share by roughly 10%. I thus see the internalization of management as a positive, both from a governance perspective and also when it comes to the cost savings and how much NRZ had to invest in order to capture those.

The name change, to Rithm Capital, is not as positive, I believe. It won’t have an impact on profitability, etc. One can also argue that the name is relatively non-descriptive and doesn’t really explain what NRZ is doing. With the “old” name, there was at least some hint at them being active in the housing/mortgage world.

NRZ Is Very Cheap And Offers A Hefty Yield

With New Residential trading at $8.65 at the time of writing, the stock is both pretty cheap and providing a lot of income at the same time.

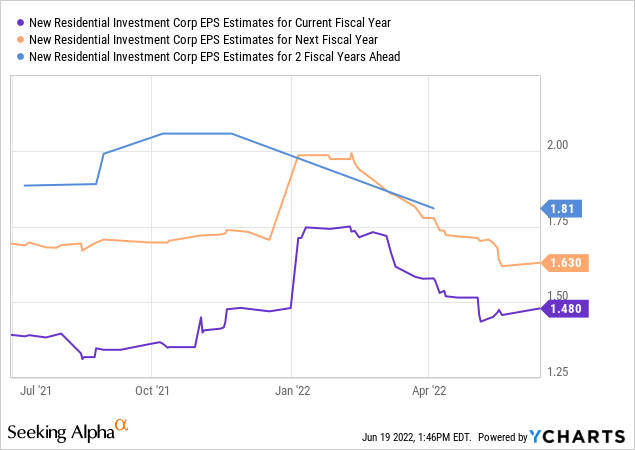

In the above chart, we see that New Residential is forecasted to earn around $1.50, $1.60, and $1.80 in 2022-2024. When we add the cost savings from the management internalization deal, we get to around $1.60 for this year and close to $2.00 for 2024. In order to be very conservative, let’s reduce this number by 20%. This would mean around $1.30 in earnings per share for the current year, climbing to around $1.60 over the next two years. In that scenario, with a 20% margin of safety baked into estimates, New Residential would be trading at around 6.5x this year’s profits and at around 5.5x 2024’s profits. This would be a pretty inexpensive valuation.

The same holds true when we look at book value, which stood at $12.60 at the end of the last quarter. New Residential is thus trading a little less than 0.7x book value today.

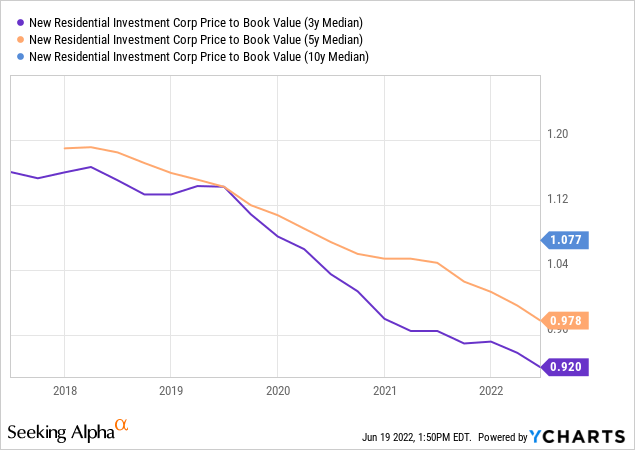

Over the last 3, 5, and 10 years, New Residential traded at 0.92x to 1.08x book value, on average. Going with the lowest of those numbers, 0.92, New Residential currently has a price upside of 33% to around $11.60. There, thus, is meaningful share price appreciation potential, even before factoring in earnings growth and the fact that book value should climb over time as New Residential does not pay out all its profits.

On top of that, investors get a dividend that yields 11.5% at current prices. This seems highly attractive, and dividend coverage seems solid. Going with my pretty conservative $1.30 EPS estimate for the current year, the dividend of $1.00 per share is well-covered, and with earnings forecasted to climb over the coming years, coverage would improve further. This would allow New Residential to raise the dividend, but that would not even be needed due to the already pretty high yield.

Takeaway

In 2020, New Residential has shown that its business model is not ultra-safe. This stock may thus not be suitable for everyone, and position sizes should be chosen accordingly. But at current prices, not too many things have to go right for the company to be a high-return pick. The dividend is hefty, and between management internalization, earnings growth, and a historically cheap valuation, shares could appreciate meaningfully over the coming years.

Be the first to comment