malerapaso/iStock via Getty Images

Black Friday is typically the busiest day of shopping of the year as businesses temporarily lower their prices and consumers attempt to get the best possible deals on whatever they might need today, but also in the coming year… until the next Black Friday.

I commonly buy two things on Black Friday.

The first one is annual subscriptions ranging from Netflix (NFLX) to expensive investment research subscriptions. It is a great day to enter annual subscriptions because they are often heavily discounted and it allows you to reap the benefits of Black Friday through the coming year.

The second thing that I buy is stocks, and this particular Black Friday, we have lots of great offers available in the market. The broader stock market (SPY) has dropped by around 20% this year due to fears of inflation and rising rates, and some sub-sectors of the market have dropped even more than that.

My favorite investments to buy this Black Friday are publicly listed real estate investment vehicles, or REITs (VNQ) in short:

AvalonBay Communities

They allow you to invest in real estate with the added benefits of liquidity, diversification and professional management.

Therefore, they typically trade at a premium to their net asset value, but today, they are exceptionally priced at steep discounts in many cases.

They have dropped particularly hard in 2022 because the market fears that the rising interest rates will hurt REITs, but we think that investors are overreacting because:

- REIT leverage is at a historic low.

- REIT debt maturities are long and well-staggered.

- Interest rates are rising because of inflation.

- High inflation results in rapid rent growth.

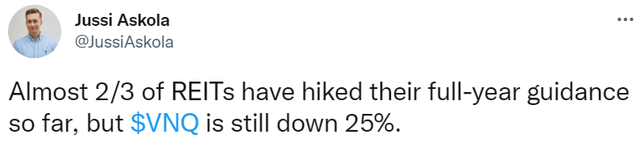

- The overall impact is positive, which is why REITs are hiking their guidance, and REIT cash flow is at an all-time high:

That’s a great buying opportunity for long-term oriented investors.

But not all REITs are created equal. Some are overleveraged, others are poorly managed and some were pricey prior to the sell-off.

At High Yield Landlord, we are very selective as we attempt to beat the market by only buying the REITs that offer the best mix of yield, growth, safety, and upside potential.

This Black Friday, we are adding more capital to ~10 of them. Here are two that are particularly heavily discounted:

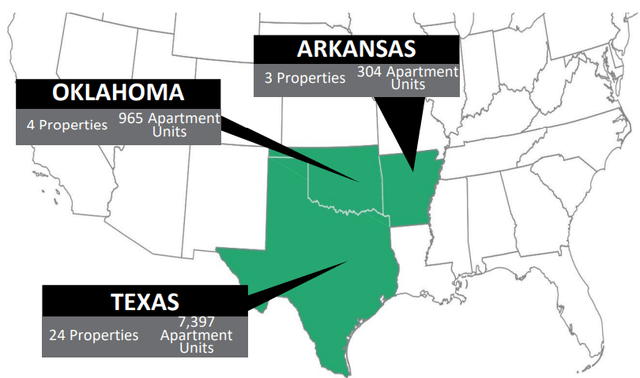

BSR REIT: Texan Apartment Communities at 60 Cents on the Dollar

BSR REIT (OTCPK:BSRTF) is an apartment REIT that focuses mainly on rapidly growing Texan markets like Austin, Dallas, and Houston:

It owns mainly Class B+ / A- Affordable apartment communities such as the ones you can see below:

Vale Frisco Apartments, Frisco, Texas:

BSR REIT

Ariza Plum Creek, Kyle, Texas:

BSR REIT

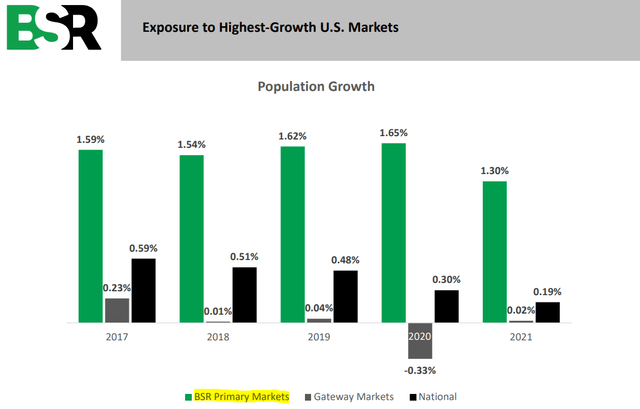

We like these particular assets because they are today experiencing rapid rent growth as increasingly many companies move to Texas to take advantage of the lower cost, no state income tax, and good access to talent. You have all heard about Tesla (TSLA) and Elon Musk moving to Texas, but there are countless other examples and it is driving rapid job and population growth:

It has resulted in rapid rent growth for apartment communities such as those owned BSR because not enough has been built to meet the growing demand.

BSR has been hiking its rents by ~10-15% as leases expire and today, its average rent remains ~10% below market according to our estimates, which provides further growth potential and margin of safety.

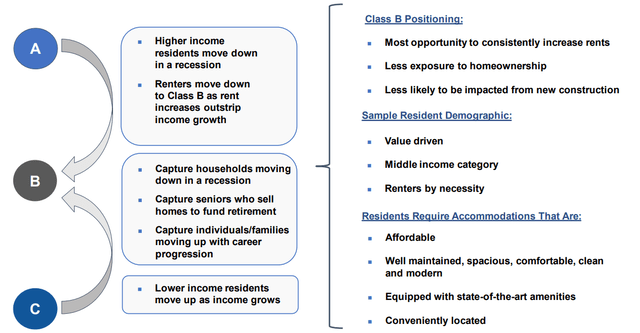

Besides, its rents are just ~$1,450 per month on average. These are Class B+ / A- communities that are well-located and offer good amenities, but they are cheaper than new Class A properties such as those owned by Camden (CPT) because they are typically 10-15 years old. These are the assets that tend to perform the best during recessions as residents of new Class A properties downgrade to BSR’s communities to cut down on cost.

There is always high demand for affordable housing, whether the economy is booming or not:

BSR is also very well managed by a team that has a lot of skin in the game.

The balance sheet is a bit more heavily leveraged than your average apartment REIT, but it is still very reasonable, particularly when compared to what private equity players are used to. The LTV is around 35% and it does not strike as excessive when you consider the resilience of its assets and their rapid growth prospects.

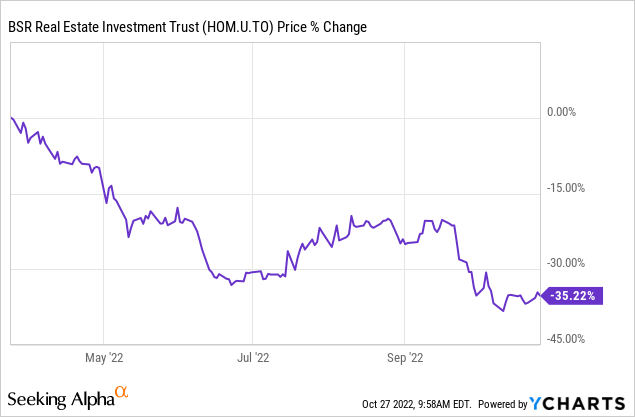

So in short, BSR owns highly desirable assets, has a great management team, and an adequate balance sheet. Typically, you would expect such a high-quality REIT to trade at a slight premium to its net asset value, which would make sense since you enjoy the added benefits of liquidity, diversification, and professional management. But against all odds, BSR is today priced at a near 40% discount following its recent sell-off:

YCHARTS

Because BSR is officially structured in Canada, it must actually disclose quarterly NAV estimates based on appraisals of its properties. The latest one is $22.35 per share, but the share price is currently only $13.65.

The management recently announced that they were launching a share buyback plan to take advantage of this mispricing. They expect to buy back 5% of the units, which would create a lot of value for shareholders. If the share price fails to recover by then, they will likely keep buying more, or eventually, they may consider selling the whole company to unlock the value.

BSR would be a prime target for a buyout because most investors would gladly increase their allocation to Texan apartment communities. A coastal market-focused apartment REIT could pay a steep premium and it would still benefit them by improving their market sentiment since a higher allocation to Texas is typically seen as a positive thing. Private equity players like Blackstone (BX) and Brookfield (BAM) would surely also be interested.

But even if a buyout never happens, we think that BSR is set to deliver strong returns in the long run as it earns rents, its rents keep rising, they reinvest in growth, and its valuation eventually recovers closer to its NAV.

All in all, we expect 50% upside from here, and while we wait, we are set to earn double-digit total annual returns from the yield and growth alone.

Essential Properties Realty Trust: The Best Triple Net Lease REIT Business Model

Essential Properties Realty Trust (EPRT) is already the largest position in our Core Portfolio, but we recently bought more of it because we have become convinced that it is actually superior to STORE Capital (STOR). [STOR used to be our largest holding, but it was recently bought out by Blue Owl (OWL)]

Their business models are similar, but one main advantage that we did not fully appreciate until our recent interview with the management is that EPRT is even more selective and chooses to focus on small, highly fungible net lease properties that are easier to release in case of tenant issues. This means that EPRT will skip large and specialized assets such as steel mills. The CEO noted in our interview that they stay away from “big, chunky, 500,000 square foot industrial facilities in $20-$30 million boxes” as an example, which was probably a subtle reference to STOR’s 5.8% base rent exposure to tenants in the metal fabrication industry.

Both are able to capture a yield premium by focusing on bank-dependent middle-market tenants, but EPRT is even more selective and mindful of the risk that specialized assets present. One of STOR’s biggest tenants is Bass Pro Shops, which is another good example of a large, specialized property that would be hard to release:

Bass Pro Shops Outdoor World

This explains why EPRT typically gets slightly lower cap rates and rent escalations, but its returns remain very compelling and could be even superior once you take the occasional losses into account.

In any case, we think that EPRT’s approach is superior in today’s uncertain world because it results in even stronger fundamentals. Besides, EPRT also has less leverage and faster growth prospects thanks to its smaller size. It is now also priced at an even lower valuation than what STOR was trading at before it was bought out.

This justifies an even larger allocation in our portfolio.

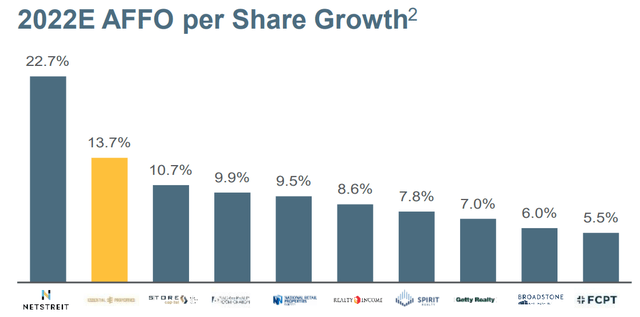

We expect to earn ~12-15% total returns from the 5.6% dividend yield and the ~6-8% annual growth prospects in the long run. In addition to that, we estimate that EPRT has ~50% upside potential as its valuation multiple recovers. This year, EPRT actually expects to grow even faster than that:

Essential Properties Realty Trust

EPRT is an ideal portfolio anchor because we think that it is very likely to deliver above-average returns with below-average risk. I think that this is ultimately why the private equity firm Blue Owl (OWL) decided to buy out STORE Capital and was willing to pay a premium to NAV, despite the rising interest rates and high inflation.

Bottom Line

REITs are exceptionally cheap today. Don’t spend all your money this Black Friday on stuff that won’t give you much utility.

REITs will not just pay you dividends, but their rents will grow with the inflation, and they offer significant upside potential as investors move past their irrational fears of rising interest rates.

Be the first to comment