Klaus Vedfelt/DigitalVision via Getty Images

Sorrento (NASDAQ:SRNE) is an enigmatic company that has drawn my attention. It boasts a major pharma style pipeline. That is a blessing and a curse, as discussed below.

Sorrento’s growing share count is bad news for shareholders

CEO’s of publicly traded companies are an enthusiastic breed, none more so than Sorrento’s CEO Henry Ji. Disappointingly, Dr. Ji abstains from providing quarterly earnings briefings. Seeking Alpha does however include a smattering (three) of presentations he has made in recent years at investor conferences.

Most recently he presented at the 09/2021 Benzinga Healthcare Small Cap Conference. During this presentation he showed his outsized ambition for Sorrento. He responded as follows to the moderator’s question on whether he remained confident as to his previous comment that Sorrento could be in the $100 billion market cap range over the next few years:

My goal is to build a company $200 billion to $400 billion. And we think with the trajectory that Moderna has from $5 billion to $180 billion, it seems doable. We have the pipeline. We have a much bigger pipeline. And meanwhile, we are doing the vaccination, multivalent and our animal testing shows our multivalent strategy works much better than the current Washington or Wuhan-based vaccine.

So that vaccine alone, if we develop it in Mexico, which we believe we are going to be able to testing 50,000 people very quickly, we will get that with potentially can come in here as a priority as a universal booster for antibody, take the Moderna, Pfizer’s or J&J’s, that could be a huge market, especially for developing country like Latin America, other places North America with local chance beautiful.

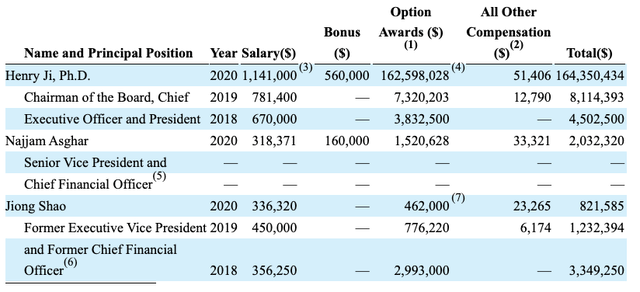

In order to achieve big results one must have vision and goals. CEO Ji certainly has a vision and goals. In checking out Sorrento’s latest available proxy statement with its summary compensation table, I was stunned to find the following from its 2021 proxy:

Sorrento 2021 proxy summary compensation table (seekingalpha.com)

Wow! That is some performance bonus approved at the annual meeting by shareholders in 10/2020. Footnote 4 to CEO Ji’s $162 million option award reads as follows:

(4)

Includes $6,510,980 of grant date fair value attributable to the option to purchase 7,844,554 shares of common stock of Scilex Holding Company that Dr. Ji has agreed to forego and relinquish if it is not approved by our stockholders at the Annual Meeting (see Proposal 5). Also includes $150,317,148 of grant date fair value attributable to the CEO Performance Award, which was approved by our stockholders at our 2020 Annual Meeting of Stockholders held on October 16, 2020.

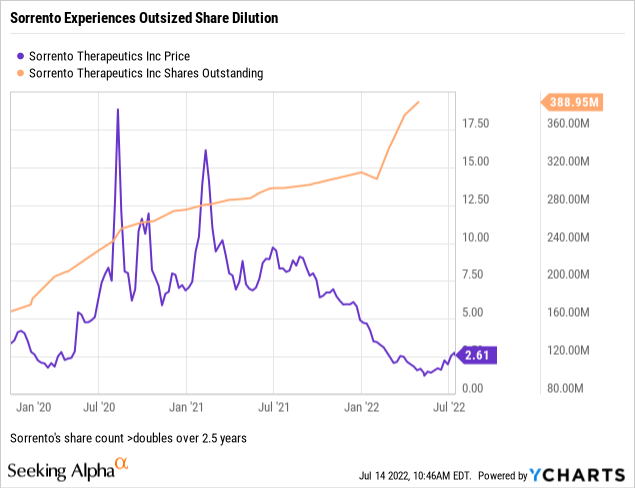

The chart below showing Sorrento’s price trajectory during 2020 and beyond reveals no apparent reason for such shareholder largesse:

It does reveal a pattern of share count inflation coupled with dwindling share price.

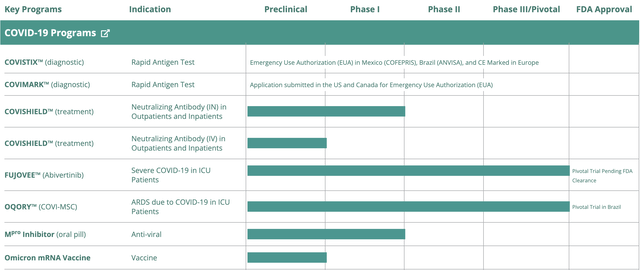

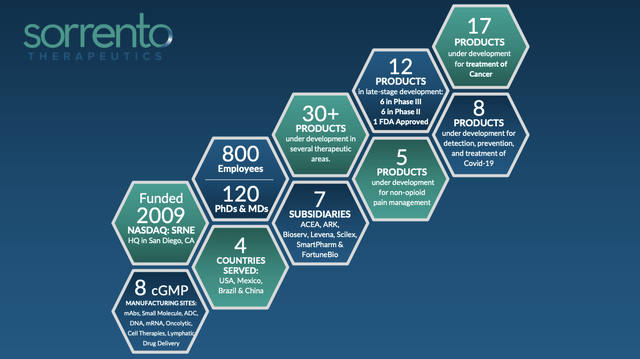

Sorrento boasts a large pipeline of molecules in trials for diverse indications

Sorrento’s pipeline covers multiple areas: COVID-19 (shown below), Immunotherapy (17 trials), Pain (6 trials), Lymphatic Delivery (3 trials), as shown in its website. It has one FDA approved therapy ZTLIDO 1.8%, (lidocaine topical system).

Aside from COVID-19, the bulk of its trials are early stage. It lists the following as its phase 3/pivotal trials:

- FUJOVEE (Abivertinib) in treatment of NSCLC,

- PD-L1 (Socazolimab) in treatment of SCLC,

- PD-L1 (STI-3031) in treatment of Cervical Cancer, and

- SP-102 (SEMDEXA) in treatment of Lumbar Radicular/Sciatica Pain.

Its COVID-19 pipeline covers a wide array of COVID-19 therapeutic modalities.

Sorrento pipeline (sorrentotherapeutics.com)

Sorrento issued an exciting press release on 06/24/2021 announcing that it had received an EUA in Mexico for its COVI-STIX. It described COVI-STIX as:

…a sensitive and rapid (approximately 15-minute) diagnostic test for the detection of the SARS-CoV-2 virus nucleocapsid antigen in nasal or nasopharyngeal samples of patients…

It further announced that initial shipments were expected in July. Subsequently in 12/2021 it issued another release touting COVISTIX as a potentially best in class rapid COVID-19 virus antigen detection test. It noted that it was approved and marketed in Mexico and Brazil and was CE marked in Europe.

In terms of production, it was constructing a facility to produce six (6) million COVISTIX tests per month in San Diego. It was also negotiating incentive packages with various states to further enhance production. It has capacity of 30 million COVISTIX tests per month on its near term horizon. Longer term it looks for a potential of a hundred million per month.

Subsequently in 02/2022, Sorrento announced acquisition of majority interest with an option to acquire 100% of Zhengzhou Fortune Bioscience (“FortuneBio”). FortuneBio is a diagnostic product manufacturer with dozens of approved diagnostic products on the market.

One bit of excitement on the COVISTIX front was its 01/2022 announcement that it had a PO for 10 million tests. Unfortunately this was just from its subsidiary Sorrento Mexico to Sorrento. I have been unable to find any more recent entries for COVISTIX.

Sorrento’s operations fall far short of its ambitions

Sorrento, founded in 2006, sports a current market cap approaching $1 billion. It has a hefty short interest of ~14.5%. As I write on 07/12/2022, it has no earnings call transcripts posted on Seeking Alpha. Its latest 10-Q (the “10-Q”) is from 05/2022, covering Sorrento’s Q1, 2022.

Despite its lengthy operational history, its significant market cap and its operational complexity, Sorrento holds no quarterly earnings calls. In order to track its operations one has to follow its SEC filings and its press releases.

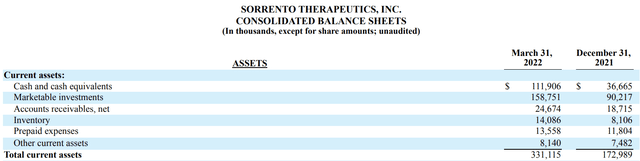

As regards to its Q1, 2022 earnings, it has not filed an earnings press release, a failure that is unique in my too fallible memory. The only way to check out its Q1, 2022 results is through the 10-Q. The 10-Q lists its current assets as:

Sorrento Q1, 2022 (seekingalpha.com)

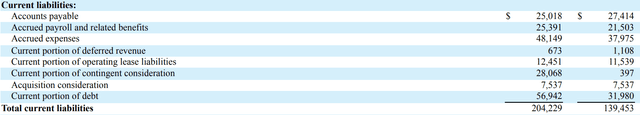

Its offsetting current liabilities are:

Sorrento Q1, 2022 (seekingalpha.com)

It has run up a healthy accumulated deficit during its 16 years of ~$1.427 billion. Its continuation as a going concern for a period of longer than a year is dependent on its ability to continue to fund its ongoing deficits.

Sorrento’s website lists a vigorous and continuous sequence of acquisitions and deals. The end result of these is set out below:

Sorrento 04/2022 presentation (investors.sorrentotherapeutics.com)

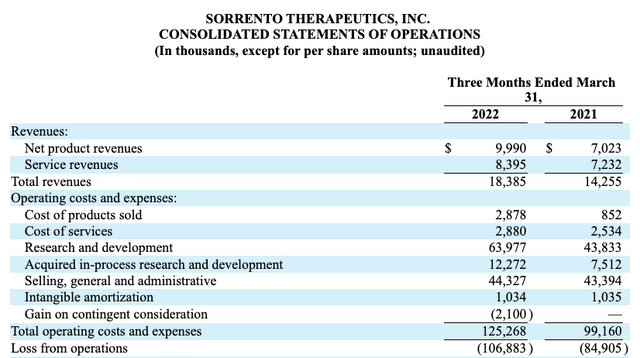

Sorrento is an active company, what about its revenues? Here it come up rather short. The 10-Q tells a bedraggled tale:

Sorrento Q1, 2022 (seekingalpha.com)

Quarterly operating revenues in the range of $14-18 million are proof positive that Sorrento has yet to latch on to a reliable income generator. Net product revenues of <$10 million are particularly disappointing. I would have expected substantially more uptake from its COVID-19 EUAs.

Conclusion

Sorrento Therapeutics is a real puzzler to me. With COVID infections entering a new phase, it should be able to capitalize on its nice COVID pipeline and assets. Why isn’t it?

I do not know the answer. One possibility is that it lacks credibility because of its overstated ambitions which so heavily outstrip its performance. I am steering clear of this one.

Be the first to comment