SolStock

Introduction

Tattooed Chef (NASDAQ:TTCF) is a plant-based frozen packaged food company that sells its own branded products in major supermarkets as well as white-labeled products for customers.

The company has managed to grow revenue, but this has come at a great cost. Expenses are climbing far faster than revenue and margins are deteriorating.

I’m rating TTCF as an avoid until they can demonstrate that the business can improve margins alongside revenue growth, which, quite frankly, I’m skeptical they can ever achieve.

The Financial Numbers and Trends Are Worrying

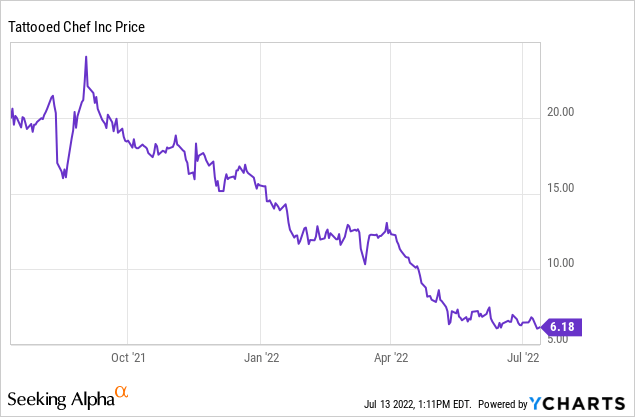

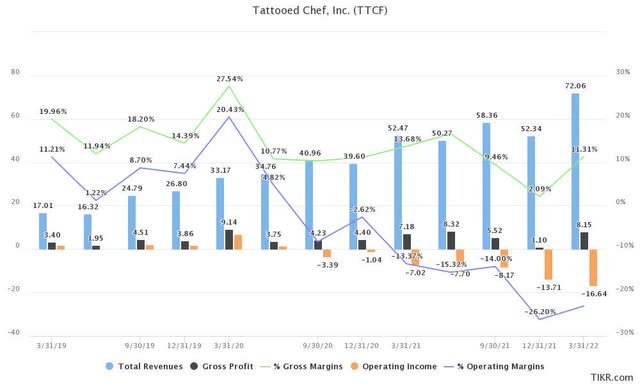

Tattooed Chef’s revenue last quarter grew a respectable 37%, however, operating costs grew 75%, far outpacing revenue growth. Gross profit grew a measly 13.5%. The fact that TTCF’s gross profit margin is declining with revenue growth and operating costs are skyrocketing makes it the company look ugly, and the stock price has declined from well over $20 per share a year ago to around $6 today.

TTCF Revenue, Expenses, and Margins (TIKR.com)

Tattooed Chef has been profitable in the past, however, they shifted in 2020 to a strategy of cutting margins to increase top-line growth. Unfortunately for Tattooed Chef shareholders, the market environment no longer tolerates such a strategy and the stock has severely underperformed as a result.

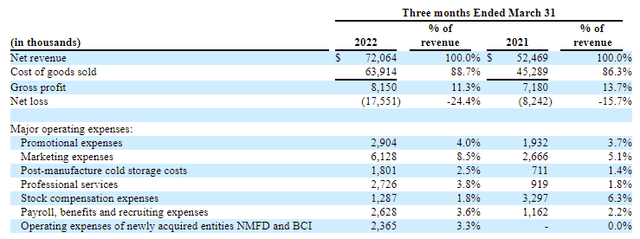

Digging into the numbers further, we can determine that the increased spending is mostly from increased promotional and marketing expenses.

TTCF CQ1 Expenses Breakdown (SEC Filing)

Although there were some impacts to gross margins outside of Tattooed Chef’s control in CQ1 2022 such as increased shipping costs, it remains concerning that they would proceed to spend so heavily on marketing and promotional expenses when they can barely make a gross profit. It seems they only care about top line growth at any cost. A strategy that is not productive to the long term compounding returns.

Going Forward in 2022

Tattooed Chef has guided for $280-285 million in revenue with 10-12% gross margins in 2022. The company is on pace to spend $100 million on opex this year while generating just $34 million in gross profits on the high end of guidance (12% gross profit margin on $285M revenue).

This means Tattooed Chef is likely to see an operating loss in excess of $66 million this year, or about $50 million remaining given they already lost $16 million in Q1. Cash flow in Q1 was also abysmal as despite posting a GAAP net loss of just $16 million, the company burnt through $26 million of cash on operating expenses in the quarter, meaning they’re on pace to burn around $100 million this year. At the end of Q1, Tattooed Chef had just $57 million of cash on the balance sheet. Furthermore, the company has a current notes payable of around $5 million that they’ll have to pay off within the next 12 months.

This ultimately means that Tattooed Chef likely only has 2-3 quarters of cash left. It is unlikely they’ll be able to take on much debt to continue funding losses, so their only option is likely to be an equity raise. This has the potential to dilute existing shareholders considerably and could cause the stock price to decline further.

Valuing Tattooed Chef

Valuing a company like Tattooed Chef is tricky.

Currently, Tattooed Chef has 82.24 million fully diluted shares outstanding. The company has total debt obligations of $7.174 million, and cash of $57.417 million. This means that with the stock trading at around $6.10, the company has a total fully diluted enterprise value of $451.4 million.

This means the company currently trades at an enterprise value of 1.6 times 2022 sales or close to 15 times gross profit at the midpoint of guidance. I would encourage investors to use a gross profit multiple rather than a sales multiple given margins are so low with Tattooed Chef. This strikes me as still moderately high. Very few food distributors will ever trade near 15 times gross profit. Tyson Foods (TSN) trades at an EV of under 1X 2022 sales and an EV/GP of under 5 with 15% gross profit margins. Even large established brands with dominant positions such as Kellogg (K) trades at 2022 EV/S of 2 and a 2022 EV/GP of 7, and that is with gross profit margins exceeding 30% (three times higher than TTCF). Granted TTCF does have better growth prospects than traditional larger peers, but if they cannot bring costs under control, there may not be a future for TTCF.

How Tattooed Chef Could Potentially Turn It Around

If Tattooed Chef cut costs, they may be able to once again return to profitability. However, cutting marketing and promotional costs may result in revenue declining.

Nonetheless, if Tattooed Chef can continue to scale the business, improve gross margins, and cut costs, then perhaps there is a world where they can reach cash flow break-even and eventually maybe even generate some cash to be returned to shareholders one day. This would require a substantial turnaround from current trends.

Conclusion

Tattooed Chef is trying to break into one of the most difficult competitive industries and sectors in the world. They’re trying to differentiate by targeting plant-based consumers, and there is indeed some demand for their products, but the company’s costs have spiraled out of control and it appears they will be running out of cash soon. When that happens, investors are likely to see dilution in the form of an equity raise. Further risks include rising input and labour costs that cannot be easily passed on to consumers given the competitive nature of the industry.

Ultimately I feel Tattooed Chef is best avoided for now.

Be the first to comment