bjdlzx

(Note: This article appeared in the newsletter on August 21, 2022, and has been updated as needed.)

Viper Energy Partners (NASDAQ:VNOM) is an atypical royalty company. Most royalty companies purchase an overriding royalty interest in large acreage holdings to run the risk of that acreage never being developed. Viper tends to go the “extra mile” to purchase royalty interests in acreage where development is a priority. Of course, this kind of acreage will be far more expensive because there is no “useless” acreage included. But shareholders benefit from steady growth that reduces the downside risk inherent in a variable distribution entity.

Generally, variable distribution entities are best considered when the distribution is low to non-existent because commodity prices are weak. That is certainly the case for a royalty company like this one.

However, those investors that decide to look at Viper Energy Partners now because that distribution looks very enticing will have an offsetting safety factor from the steady production growth during the next industry downturn. Another safety factor has been the retreat of oil prices from previous highs.

The threat of a possible recession may entice some to read up on this company while waiting for that recession. Others may dollar cost average a position in case the promised recession either does not happen or does not bring the promised lower stock prices with it.

A lot of overriding royalty companies do have “higher highs” in each succeeding business cycle. But the vast acreage often ensures a rough ride to the bottom of the business cycle each time. Here, that “rough ride to the bottom” will have something of a cushion compared to others in the industry.

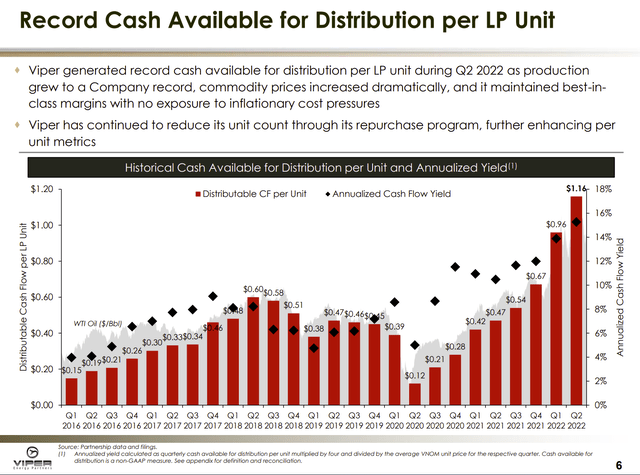

Viper Energy Partners Distribution History (Viper Energy Partners Second Quarter 2022, Earnings Conference Call Slides)

Management made some distribution strategy changes along the way (Note: no K-1 here). Probably the permanent realization was during fiscal year 2020. Management realized that the partnership needed to keep some cash on hand for both acquisitions and debt payment purposes. This partnership was slow to realize that the midstream market demands of self-financing would eventually spread to royalty companies as well.

The good news for shareholders is less dilution in the future. The bad news is of course that 100% of the available cash is no longer distributed. In return, shareholders can expect a cyclical growth strategy from the reinvested cash to accompany a growing distribution stream. For those investors that do not mind holding cyclical companies throughout the business cycle, the emphasis on production growth in the royalty-owned leases makes this partnership a superior choice to many in the industry.

Royalty Company Advantages

Traditionally, royalty companies receive their money “off the top” although negotiated charges can vary from standard terms if both sides agree at the time the royalty is purchased. There is a lack of typical upstream risks (like dry holes and subpar returns).

Royalty companies do not have to pay for drilling and completion costs. So, there is no reinvestment of earnings to keep oil production at a certain or growing level. On the other hand, royalty companies have no determination in the decision-making process of where to drill and what to develop. That is what makes this company so special as management will only purchase acreage that is likely to be developed. So far, management has a very good record with those purchases.

Diamondback Relationship

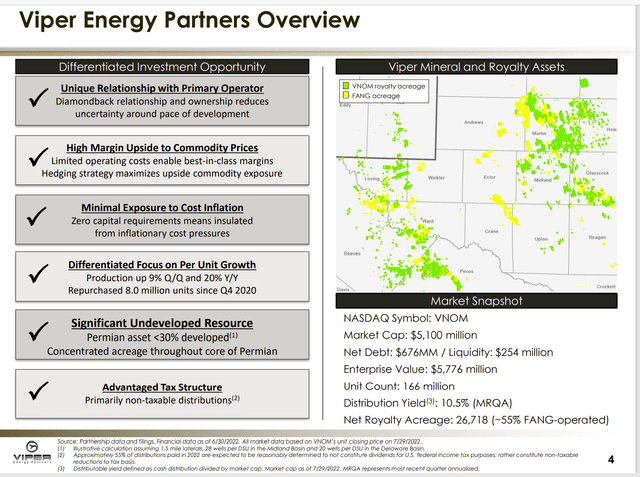

This royalty company is controlled by Diamondback Energy (FANG). The acreage purchased from Diamondback benefits from the organizational relationship. For as long as I have followed this partnership, Diamondback has been active on the acreage that has a royalty interest. That meant an unusual amount of activity in fiscal year 2020 (which was the nadir for many competitors).

Viper Energy Partners Map Of Acreage With Royalty Interest In The Permian (Viper Energy Partners Second Quarter 2022, Earnings Conference Call Slides)

The company not only owns good acreage, but also has top notch operators for the acreage. It does no good to own a royalty interest in acreage where the operator goes broke. This management has severely reduced that type of risk by largely staying with “top tier” operators including (of course) Diamondback.

Those who have followed this partnership for a while know that there have been some forays into acreage operated by others than Diamondback as well as some minor purchases outside the Permian. The above slide, however, remains the major portion (and probably only significant area) of operations.

There is a substantial amount of acreage to yet have producing wells. Probably the unstated advantage of this acreage is the intervals that have not yet been exploited at all. As technology continues to improve, that is likely to result in the consideration of more intervals besides the current focus.

The other consideration is that the unconventional business is relatively young. That has resulted in very low levels of recoverable oil compared to what is in the ground. This is another area that improving technology will likely improve in the future.

There is always a risk that technology stops improving tomorrow (forever). But that has yet to happen. What is far more likely to happen is what we saw back in the 1980s and 1990s, where the improving technology did not quite keep up with the demand. So, there was a period of higher prices until the new unconventional business “filled the gap”. That is nothing close to the same as running out of oil.

The Future

Most royalty companies have tremendous cash flow for their size. Obviously, these companies look far more attractive now than they did back in fiscal year 2020 when distributions were very low or non-existent.

A company like this one with a clear cyclical growth strategy can be purchased at a time like this as long as the investor realizes that there are cyclical downturns (so that investor has a strategy to deal with it).

The emphasis on acreage that will be developed by the top-notch operators keeps production growing. That is not typical for many royalty companies. There will be lower distributions during times of low oil prices. But that low distribution is likely to come with growing production. As was shown on the distribution history above, that characteristic has provided some significant cyclical growth of distributions. For a buy and hold investor, that growth is the key, despite the cyclical nature of many royalty companies.

Right now, the market appears to be forecasting lower oil and natural gas prices long term. There is still a memory of the big price declines back in 2015 and the aborted industry rally in 2018. So, the market is prepared for another shock. Since the expectations appear to be in effect for lower future, there is some cushion against that future happening in the current price of these units.

On the other hand, should the future turn out to be better than expected, the industry could rebound to significantly better pricing than is the case today. A royalty partnership like this one with acreage that is actively being developed would likely command a premium valuation in such a market.

Some investors prefer that royalty companies have no debt. The debt levels here are fairly conservative when compared to cash flow. But a cyclical industry decline that results in weak pricing could also result in a lower percentage of cash flow distributions. This actually happened back in fiscal year 2020. Therefore, income investors need to realize the potential of cash flow variations from this investment before they invest.

Be the first to comment