jetcityimage/iStock Editorial via Getty Images

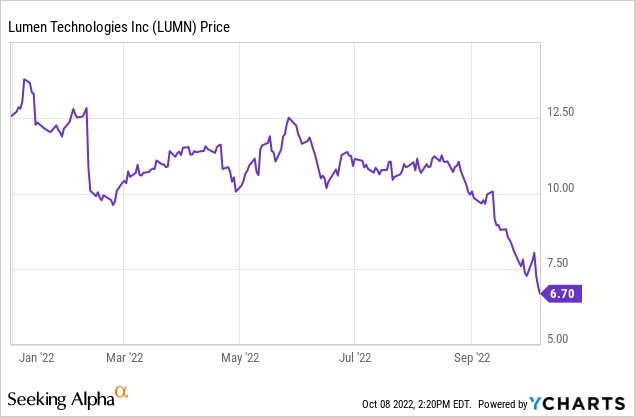

Shares of Lumen Technologies (NYSE:LUMN) have struggled for years, but 2022 has been particularly terrible. Rising interest rates, inflation, and the slowing global economy have caused the telecom company to fall even further out of favor with investors. Lumen stock has lost nearly half of its value this year, including a 31% slide just in the past month.

This sharp decline has left Lumen stock trading at its lowest level in more than three decades. Furthermore, its already-high dividend yield has ballooned to 14.9%, based on the stock’s Friday closing price of $6.70.

Ironically, Lumen just completed a pair of divestitures that generated a sizable cash windfall and improved the business’ long-term growth profile. Investors shouldn’t fear the near-term earnings and cash flow headwinds that Lumen faces. The recent plunge in Lumen stock represents a fantastic buying opportunity.

Dispositions complete

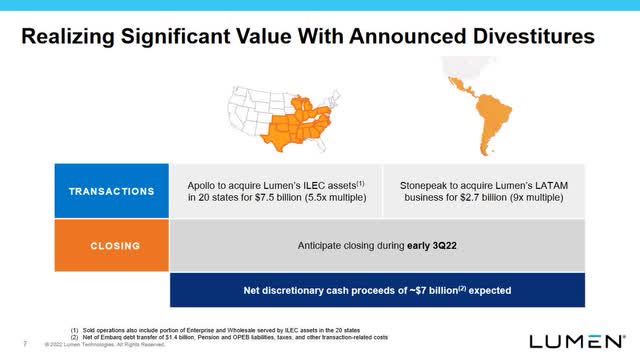

On August 1, Lumen completed the first of its two major asset sales. The company divested its Latin American operations to alternative investment firm Stonepeak for $2.7 billion in cash.

Last Monday, Lumen closed on an even bigger asset sale, divesting its ILEC (incumbent local exchange carrier) business in 20 states to affiliates of Apollo Global (APO) for total consideration of $7.5 billion. After closing adjustments, pension plan contributions, and approximately $1.5 billion of debt and finance lease assumption, net proceeds came to $5.3 billion.

Thus, Lumen generated pre-tax net cash proceeds of about $8 billion from these two deals. Earlier this year, management estimated that discretionary proceeds would total around $7 billion after tax. Given that Lumen entered 2022 with $2.9 billion of federal NOLs, I suspect that it will incur less than $1 billion of deal-related cash taxes, putting its net proceeds a bit higher.

Lumen has begun to use the proceeds to pay down debt. Soon after the LatAm sale closed, the company’s Level 3 Financing subsidiary repaid $700 million of its term loan. The company also repurchased $390 million of public debt at a slight discount to par. Lumen likely used the remaining $1.6 billion to repay the $800 million it had drawn on its credit facility as of June 30 and replenish its cash balance.

Since closing the ILEC sale, Lumen has repurchased another $3.07 billion of debt for approximately $2.9 billion. The company also announced that it will redeem approximately $317 million of debt scheduled to mature between 2023 and 2025 in the next few weeks.

In total, these moves would reduce Lumen’s debt from $29.4 billion as of June 30 to around $22.7 billion. And even after these debt paydowns, I estimate that Lumen would have around $2.5 billion of cash that it could use for further debt reduction or other purposes.

Good news or bad news?

Given how dramatically Lumen stock has tanked in recent weeks, investors appear to be treating the divestitures (and particularly the Apollo deal) as a net negative.

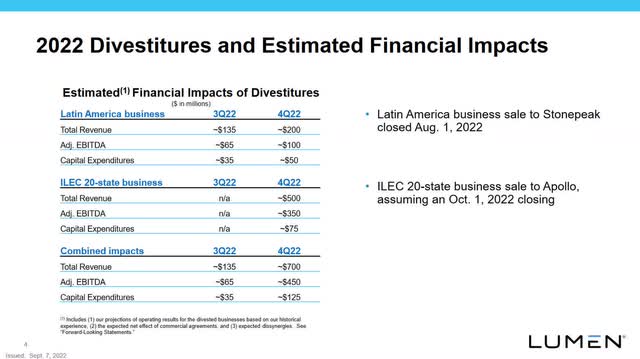

Indeed, the ILEC sale comes with a major drawback: the operations Lumen sold to Apollo have been a huge cash cow in recent years. Lumen estimates that the sale of that business will reduce the company’s adjusted EBITDA by $350 million this quarter ($1.4 billion annualized).

Source: Lumen September 2022 Investor Presentation.

Lumen hasn’t been investing much in these states, so it has been generating roughly $1 billion in annual pre-tax free cash flow from this part of its business, holding working capital constant. Even if Lumen were to use all of the deal proceeds to pay down debt (thereby reducing interest expense), this would at best offset half of the lost cash flow. Thus, the ILEC sale will immediately reduce Lumen’s annual free cash flow by $500 million or more.

This in turn is putting severe pressure on Lumen’s dividend coverage. Fear about a potential dividend cut may be leading income-focused investors to flee Lumen stock.

But on the flip side, these divestitures highlight the underlying value of Lumen’s business. Lumen sold the LatAm business for 9 times EBITDA and the ILEC assets for 5.5 times EBITDA. Lumen’s current enterprise value of $27 billion equates to 5 times go-forward EBITDA. (Adjusted EBITDA totaled $1.81 billion in Q2. Excluding the roughly $450 million contribution from divested businesses, Lumen would have posted adjusted EBITDA of $1.36 billion, which annualizes to $5.44 billion.)

Source: Lumen February-April 2022 Investor Presentation, slide 7.

Considering that the assets Lumen kept are generally more attractive than those it sold, the asset sales provide clear confirmation that Lumen stock’s intrinsic value is far higher than the current price.

Not a safe dividend

While Lumen stock is attractively priced compared to the value of its assets, investors should hold no illusions about the safety of its dividend. There is a very strong chance that Lumen will cut its dividend next year.

Lumen estimates that it will generate $2 billion-$2.2 billion of adjusted free cash flow in 2022. That would easily cover its $1.00 per share dividend, which costs approximately $1.04 billion annually. However, increased CapEx associated with Lumen’s fiber-to-the-premises buildout and the cash flow impact of its divestitures could reduce free cash flow by around $1 billion in 2023 compared to 2022.

This alone would boost Lumen’s dividend payout ratio from 50% of free cash flow to around 100%. Additionally, cash taxes could increase somewhat due to asset sale gains exhausting Lumen’s federal NOLs. Surging interest costs for Lumen’s variable-rate debt will offset much of the interest cost savings from the company’s debt repayments. And the combined impact of inflation and a weak macro environment could cause adjusted EBITDA to decline in 2023 compared to the recent run rate.

In short, free cash flow is quite likely to fall below $1 billion. Obviously, Lumen could slash CapEx to prop up free cash flow, but that would be shortsighted.

Aside from these fundamental factors, Lumen hired a new CFO earlier this year and recently announced that Kate Johnson will replace Jeff Storey as CEO in November. These leadership changes increase the likelihood that Lumen will change course on capital allocation.

What is Lumen stock worth?

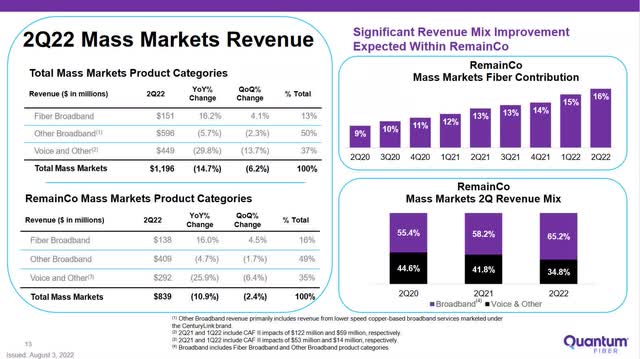

Generally speaking, Lumen’s remaining business is more attractive than the pieces it divested. In the 16 states where it retained its ILEC business, Lumen’s footprint is less skewed towards rural markets and the company is much further ahead in its fiber rollout. Meanwhile, North America and Europe are economically stronger than Latin America.

Lumen’s ILEC sale reduces exposure to declining voice and DSL revenue. (Source: Lumen Q2 2022 investor Presentation, slide 13.)

To be conservative, I will assume that the remaining business should be valued at 7 times EBITDA: lower than the multiple for the LatAm divestiture, but above the ILEC deal multiple. This accounts for the potential valuation impact of higher interest rates while recognizing the better quality of these assets.

Even if adjusted EBITDA were to fall all the way to $5 billion next year, this would make the company worth $35 billion. That translates to an equity value of nearly $15 billion: over $14 per share. If adjusted EBITDA held steady at Q2’s divestiture-adjusted level of $1.36 billion a quarter ($5.44 billion annually), Lumen stock would be worth $18 per share at 7 times EBITDA.

Moreover, if Lumen follows through on its current strategic plan, more than half of its remaining ILEC footprint will be fiber-enabled by the end of 2027: up from 13% as of mid-2022. That should help drive a return to revenue and EBITDA growth. It will also make Lumen’s ILEC business far more durable, meriting a valuation in line with the fiber assets sold to Stonepeak. This creates massive upside potential for long-term investors through multiple expansion.

Key risks

As noted above, the combination of rising interest rates, the recent divestitures, higher planned CapEx, and potentially higher cash tax liabilities will crush free cash flow in the near term. If the U.S. were to enter a prolonged recession, it could magnify these impacts and force Lumen to abandon its investment plans or raise additional capital on unfavorable terms.

The growing availability of 5G fixed wireless represents another noteworthy risk. Lumen’s big investments in fiber-to-the-premises could backfire if increased competition for high-speed internet drives prices down or forces Lumen to settle for lower-than-planned market share.

Finally, while Lumen has several attractive growth businesses, a large chunk of its revenue comes from product lines in terminal decline. I currently expect the company to stabilize its top line by 2024 and return to growth shortly thereafter. However, if the revenue declines from legacy businesses accelerate, it could take much longer to turn things around.

Upside dramatically outweighs downside risk

I view all of the risks described above as manageable. First, Lumen now has no meaningful debt maturities until 2025, protecting it against near-term shocks.

Second, while fixed wireless will undoubtedly become more common in the years ahead, it is more of a threat in rural markets. In the urban and suburban markets where Lumen is focusing its fiber builds, fiber-to-the-premises is likely to offer a superior combination of cost and performance.

Third, the pandemic and the current economic slowdown have already hit Lumen’s top line with a double-whammy. The macro environment is likely to became a tailwind rather than a headwind for revenue within a year or two.

On the bright side, the panic surrounding Lumen stock should dissipate when the company returns to revenue and earnings growth. That could happen in as little as two years. With Lumen stock trading for less than half of its intrinsic value, investors who buy the shares and hold for a few years are likely to be well compensated even on a risk-adjusted basis.

Lumen stock could face a near-term bump if and when the company cuts its dividend. But while analysts haven’t adjusted their dividend estimates yet, a cut may already be priced in after the stock’s 31% decline over the past month.

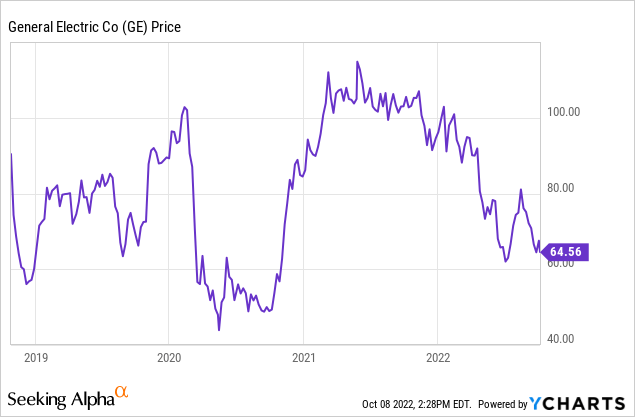

It’s also worth noting that while General Electric (GE) stock fell 40% in the weeks after it slashed its dividend by 92% in October 2018, the stock recovered nearly all of those losses by the following February.

Lumen stock could fare even better than GE if the company uses some of its excess cash to implement a share repurchase program in conjunction with a big dividend cut. A buyback would enable Lumen to capitalize on near-term share-price weakness while also blunting the negative impact of the dividend cut on the stock.

Behind all the noise and near-term headwinds, Lumen has significantly improved its balance sheet and is making smart investments to drive future growth. Investors are effectively punishing Lumen for ramping up fiber investments, due to the negative impact on free cash flow (and, by extension, the dividend), when they ought to be rewarding it for investing in growth. That makes Lumen stock a steal at its current price.

Be the first to comment