Morsa Images

Thesis

MercadoLibre (NASDAQ:MELI) has been one of the big pandemic winners, seeing its stock price skyrocket almost 300% since March 20 lows, but then also falling up to 68% afterwards. Even though there was a demand-pull forward, e-commerce in LATAM (Latin America) still has massive tailwinds and expected to grow from a $98 billion industry to a $165 billion industry in the next 3 years, according to Statista. Another e-commerce darling rose up, even though not as much, and fell down again is Amazon (NASDAQ:AMZN). In this article, I will iterate why I believe that MercadoLibre is the better e-commerce play.

MercadoLibre, Amazon performance (Google)

Throughout the article, I will refer to MercadoLibre as MELI, its Ticker, and Amazon as AMZN, also its Ticker.

The three advantages of MercadoLibre

To start, I own shares in both companies, with Amazon actually being my largest position. Amazon is much more than e-commerce, and it’s common knowledge that AWS is the most interesting part of Amazon, but e-commerce still accounts for the majority of the revenue, so I believe this is a reasonable comparison.

MercadoLibre has been a great compounder since its founding in August 1999 and developed a fantastic e-commerce ecosystem, with several advantages over Amazon’s e-commerce system. The three main points I want to talk about are:

- 3P marketplace

- Payments

- Credit

3P marketplace as the superior model

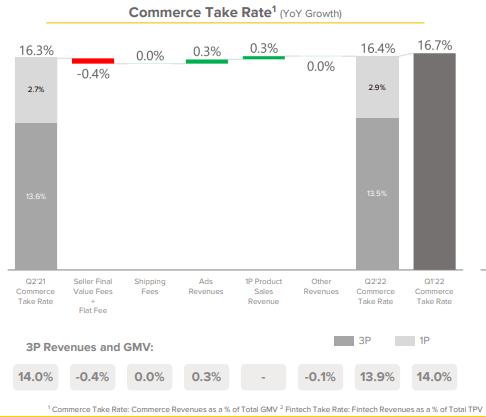

MercadoLibre primarily is mainly a 3P marketplace, which means that third-party sellers are selling their products through the marketplace and MELI just operates the infrastructure (both online and offline) and takes a cut. This take rate includes shipping fees through the company’s logistics operations (Mercado Envios) and advertising operations (Mercado Ads). These two services are similar to Amazon’s logistics and advertisement business. We can see that the commerce segment of MELI had a take rate of 16.4% in Q2 22. These are very healthy margins that are only achievable with a 3P marketplace model.

MercadoLibre Commerce takerate (MercadoLibre IR)

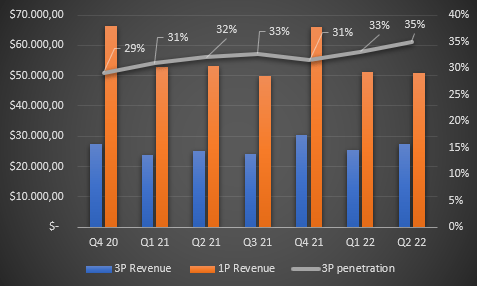

If we compare this to Amazon, we can see that the majority of its commerce revenue still comes from the 1P business, but we see the trend going in the right direction. The 1P business is a terrible one for Amazon. Early in the company’s story, the website didn’t have all the items customers were looking to buy at reasonable prices. So Amazon went and created private label products called Amazon Basics. These products started to ramp up revenues, but at a high cost. These products are often sold at cost or even at slight losses. On top of that Amazon also needs to fulfill these orders. Regulators hate the business because it takes sales away from small players selling on Amazon. These small sellers that sell in the 3P segment generate a nice take rate for Amazon, probably at least 15%. Not only does Amazon lose money selling 1P, but they also cannibalize its highly lucrative 3P business doing so. Luckily Amazon recently shared that they are considering exiting the private label business, a long-awaited move for shareholders. MercadoLibre already has a highly profitable 3P marketplace, giving it a lead against Amazon, but Amazon is making steps in the right direction.

Amazon sales mix (Authors model)

Integrated payments into the ecosystem

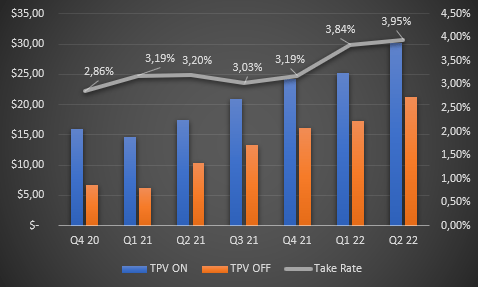

Mercado Pago is MELI’s fintech and payments segment, one of its biggest advantages. What started as a simple way to process transactions on the MercadoLibre marketplace quickly turned into an industry-leading payment system in the whole LATAM region. Much like the PayPal (PYPL) story, which started as a payment method for eBay (EBAY), Mercado Pago is going the same way. Mercado Pago also includes Mercado Credito, which I’ll talk about more in the next segment. Pago has seen hyper-growth adoption over the last years, growing by 104%, 71%, 81%, 113% and 107% year over year in the last 5 quarters. The three KPIs to measure Pago’s success are TPV (total payment volume) ON (the MercadoLibre marketplace), TPV OFF (the MercadoLibre marketplace) and the take rate. In Q2 2022 TPV ON reached $30.2 billion and TPV OFF reached $21.2 billion, a combined run rate (Q2 numbers projected out to the next 3 quarters) of $205.6 billion in TPV. We can also observe that the Take Rate has steadily increased from 2.86% in Q4 20 to 3.95% in Q2 22. What makes TPV OFF the marketplace especially interesting, is that it works as a cheap customer acquisition by bringing people into the ecosystem, who then eventually might use other products like the marketplace.

Amazon has tried to push several payment solutions like credit cards and Amazon Pay for years but hasn’t found wide adoption yet with services like Apple Pay (AAPL), Venmo and normal credit cards dominating the payment space in Amazon’s largest operating regions.

MercadoLibre TPV (Authors model)

Mercado Credito grows sellers on the marketplace

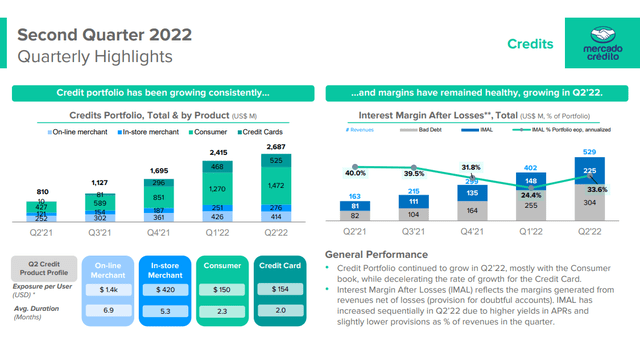

Through Mercado Credito, MELI offers merchants and customers alike the option to take on credit through the Mercado Pago ecosystem. Initially starting as a way for Merchants to finance new products and inventory to sell on the marketplace, Credito grew to a substantial part of the business in the last year, growing from $810 million to $2.69 billion in Q2 22. The growth has largely been driven by the Consumer and Credit Card segments exploding in size, now accounting for 75% of the credit portfolio. This adds a higher risk, but also a higher reward to the portfolio. The merchant credits weren’t a high risk, because payments could be deducted from marketplace sales. After all, everything flows through the MercadoLibre ecosystem, including all the data to drive good analytics and risk analysis. MELI takes on higher risk with the new consumer and credit card business, due to lower predictability of repayments. MELI will learn as they grow this business and increase risk prevention in the long term. I do see this as a vital step though to grow the ecosystem and cement it as the go-to option for the LATAM population. Currently, around 70% of it is underbanked and without ways to take on credit. This gives the MercadoLibre ecosystem another entry point to onboard people.

Mercado Credito (MercadoLibre IR)

Amazon does have a credit business for merchants, but it doesn’t have an existing payment ecosystem to introduce merchants into. Due to Amazon’s focus on North America and Europe, there isn’t the same opportunity to go after a large unbanked population. The American unbanked population was just 5.4% of US households in 2019 versus a current underbanked LATAM population of 70%.

Valuation

Both companies are hard to value with traditional valuation metrics due to high reinvestments into their various business segments like logistics (both), advertisement (both), fintech (MELI) and cloud computing (AMZN).

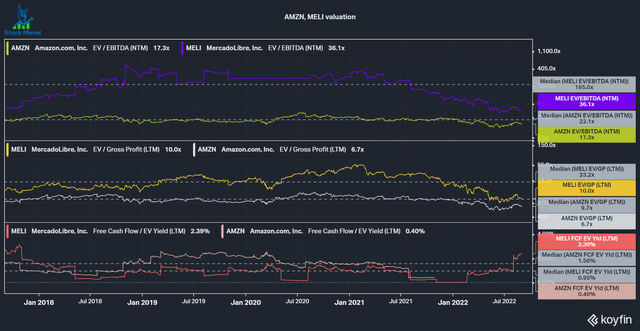

I like to look at the EV/EBITDA, the EV/Gross Profit and the Free Cash Flow yield to get a proxy for the valuation. We can see that MELI has been very richly valued in the past, but recently came down a lot, now trading at a 36x EV/EBITDA versus a 165x average. Amazon is also trading below its average of 22x EV/EBITDA at 17.3x. These metrics do not scream cheap but remember that both companies aren’t optimized for profits and have a lot of operating leverage ahead. The story is similar on EV/Gross profit, where both companies trade significantly under their median 5-year valuation.

On a free cash flow basis, MELI is producing significant free cash flow at a 2.39% FCF yield, meanwhile, Amazon currently has a negative free cash flow, due to a massive investment cycle that pushed capital expenditures (CapEx) from $16 billion a year in 2019 to $65 billion in 2022. Operating cash flow doesn’t take CapEx into account, Amazon trades at a 2.7% Operating cashflow yield compared to a 3.5% median and thus is trading above its average here.

Conclusion

E-commerce is a secular trend with many years of growth ahead. Currently, the sentiment is bad, due to the growth pull-forward during covid and resulting uncertainties for the multi-year trend. I believe that both of these companies are well positioned to continually gain market share in their home markets and increase operating leverage in the future. Keep in mind that Amazon especially has lots of segments to be excited about, but currently, e-commerce isn’t one of them. They need to increase 3P in the sales mix. Amazon is my largest stock position and MercadoLibre is also in my top 10, but I currently prefer MercadoLibre and will add to my position given the current drawdown in the stock.

Be the first to comment