Dimitrios Kambouris/Getty Images Entertainment

Investment Thesis

The market has punished the streaming space after Netflix, Inc.’s (NFLX) stalled growth in 2022Q1 — but while this raises doubts about the size of the total addressable market, it also puts pressure on Netflix, the streaming leader, to stop sacrificing profitability in pursuit of subscribers. This will come in the form of higher prices, a crackdown on password sharing, more intense efforts to reduce churn, and less of a race to the bottom with out-of-control content spend, as the industry evolves, consolidates, and follows suit.

With Netflix’s long-term hegemony no longer something to take for granted, one of the stronger media/streaming contenders is Warner Bros. Discovery, Inc. (NASDAQ:WBD). The early days of the merger will make 2022 a “messy year”, but CFO Gunnar Wiedenfels did call out the greater-than-expected opportunity for cost savings, by cutting back on shared marketing and other expenses. Management sounds to be well in control of the situation, and will bring greater focus to the WarnerMedia assets. I make the case that WBD is deeply oversold.

2022Q1 Earnings Call Wasn’t Bad, Despite Lukewarm Market Reaction

Although the Discovery-WarnerMedia merger closed after the quarter-end, the 2022Q1 earnings call included a peek under the hood of WarnerMedia, from WBD management. The market’s reaction was lukewarm, but given that WarnerMedia is roughly 2.4x the size of Discovery, based on relative shares of the merged company, there were bound to be some post-deal frictions, as management imposes its vision for the new media giant. At the same time, expectations for $3B of synergies remained intact. Some highlights from the 2022Q1 earnings call:

- Discovery’s 2022Q1 standalone results were good, for example, with a 13% y/y increase in total revenue, and GAAP EPS of $0.69/share for the quarter.

- Limited advertising visibility, due to the macro environment.

- In pro forma total, ~5M paid net subscriber adds and over 100M global D2C subscribers for Discovery and WarnerMedia combined. This compares to 222M, for Netflix.

- WarnerMedia’s underwhelming cash flow reportedly reflects how AT&T (T) management was investing with gusto into HBO Max, to get it started.

- WBD management is promising more financial discipline.

Some disappointing 2022Q1 revelations included the following:

- WarnerMedia’s contribution to the profit baseline for 2022 is expected to be around ~$500M lower than originally anticipated.

- WarnerMedia free cash flow declined by $2.6B y/y, and was significantly negative.

-

For the past 15 months, WarnerMedia had roughly $40B of revenue and virtually no free cash flow.

However, there were also off-setting positives in the commentary:

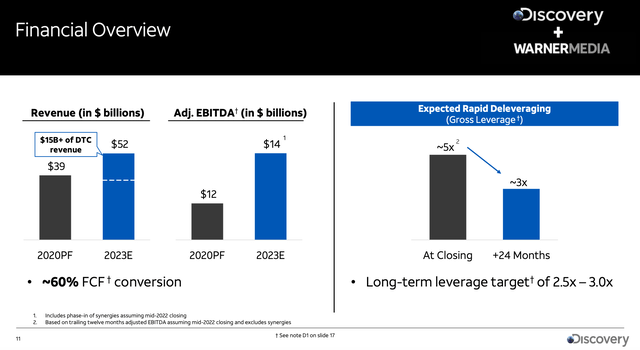

- Starting leverage of ~4.6x times is below the initially modelled 5x.

- $3B of cost synergies now expected to be a conservative estimate.

- AT&T management invested heavily in “chunky investments”, without a “solid analytical, financial foundation and meeting the ROI hurdles” — leaving “a ton of opportunity” for improvement.

- Reiterated financial targets for 2023 — e.g. 2.5x-3x gross leverage, 24 months after closing.

- Better-than-expected results on the Discovery side of the combined company, by “a couple of hundred million dollars”.

More generally, management seems to have a clear idea of what’s going on, and what to do about it. There’s been some moderate insider buying. With the early axing of CNN+, the possibility of restarting an HBO Max deal with Amazon (AMZN), and a renewed commitment to the theatrical window, it doesn’t look like there will be many sacred cows, as they drive for both streaming and financial performance, and make decisions based on the “data that’s available and clean financial analysis”.

HBO Max is Gaining Ground and Ranks Well for Consumer Satisfaction

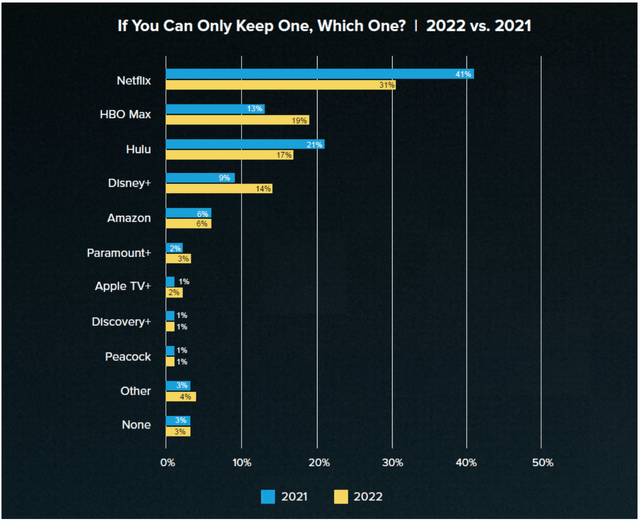

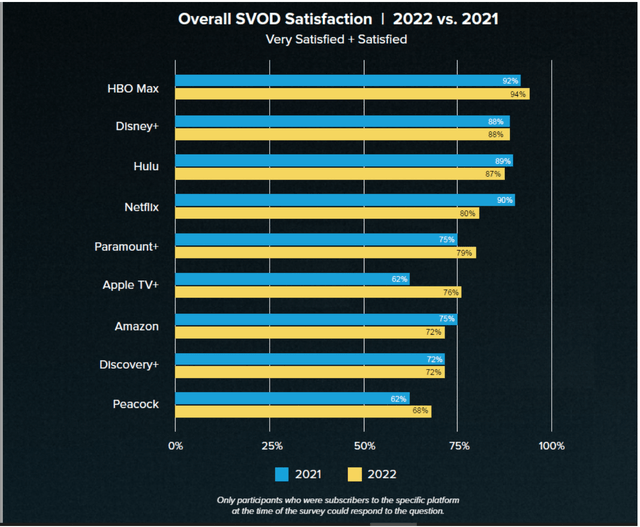

HBO Max appears to have gained a sizeable amount of ground in consumer appeal, in just the past year. The chart below shows a 16p.p. improvement to the survey question “if you could only keep one [streaming service], which one?”, relative to streaming leader Netflix, in 2022 versus 2021. It also surpassed Hulu, while Amazon and Apple TV+ remained far behind in the pack. This could partly reflect fatigue with Netflix, after a long period of lockdowns, but the gain looks too big to dismiss. HBO Max also ranked well on overall SVOD satisfaction, at 94% for “very satisfied + satisfied”.

Source: Whip Media 2022 Streaming Satisfaction Report, Variety.com

Source: Whip Media 2022 Streaming Satisfaction Report, Variety.com

Furthermore, Warner Bros. Discovery was still seeing combined momentum in paid subscriber growth in 2022Q1, even as Netflix stalled. The path to a global subscriber target of 200M+ might not be an easy one, but WBD still has plenty of room for market share gains and global expansion. Discovery+ ranks less impressively, though it serves a different function –– rather than being critically-acclaimed fare, Discovery has arguably been one of the glues that has kept the cable bundle together (along with sports), and it can complement HBO Max in a similar way. If WBD’s D2C growth does stall, then I’d expect this to go hand-in-hand with a slower-than-expected decline of cable.

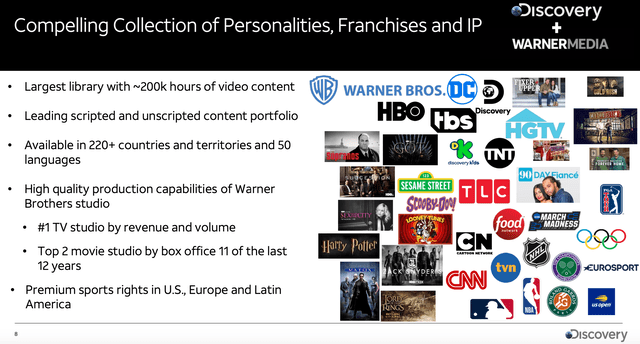

Discovery and AT&T combined investor presentation.

The Silver Lining to Netflix’s Stalled Subscriber Growth – And Overblown Fears of a Streaming Apocalypse

In a recent article on Netflix, I argued that fears of a streaming apocalypse are overblown. The idea that streaming companies will spend themselves into oblivion, over the long-term, makes even less sense now that Netflix is having its own challenges. The first phase of the streaming wars involved a land grab for subscribers, despite the near-term cost, to drive future operating leverage. Netflix could previously sacrifice profitability for growth, and in so doing, it was lavishly rewarded by the market –– this is no longer the case, so we should expect that their approach will change.

I won’t repeat everything, here, but measures like Netflix’s plans to introduce an ad-tier, crack-down on password sharing, and to grow content spend more slowly than revenues, help to indicate where the broader industry is heading — a sounder long-term footing with more focus on profits, versus trying to maximize subscribers, at all costs.

Prices will probably rise further, and there has been more expressed intent to keep content spend under control, with CEO David Zaslav, for example, vowing not to win the D2C content spending war. If anything, Netflix will face more pressure on content spend, since it doesn’t have the same top-notch legacy IP to lean on as WBD and others. The plan to merge HBO Max and discovery+ together is also an indication of rebundling to come — with more industry consolidation, things may start to have the appearance of a new oligopoly in the streaming space.

Recall that the average American household watches ~8 hours of TV/day. Households contain multiple members with varying interests, and many services like Netflix don’t have sports or live news, which may help to explain the slow decline of cable and an average of ~4.7 streaming services per U.S. household. The box office is also now reportedly nearing pre-pandemic levels.

The Valuation is Inexpensive, Even if You Don’t Believe in the Deal’s Projected Synergies

The bullish case for Warner Bros. Discovery has never rested on achieving peak Netflix-like multiples. It would only require reaching multiples that would seem reasonable (e.g. ~12x EV/EBITDA) for a leading and enduring industry player that produces beloved content that is not easily substitutable with anything else. Lately, Warner Bros Discovery has traded at the following multiples relative to pro-forma 2020 results, assuming an enterprise value of about ~$88B (~$34B market cap plus ~$54B in total net debt):

- EV/Revenue of 2.3x pro-forma 2020 revenue.

- EV/EBITDA of ~7.3x pro-forma 2020 EBITDA.

If the projected synergies materialize, the valuation looks cheaper:

- EV/EBITDA of ~6.3x the 2023 EBITDA projection.

- The recent market cap is ~4x estimated 2023 free cash flow.

Given the messiness of the merger, it could very well take longer to achieve this level of performance — but single-digit multiples would seem to factor-in some margin of safety. Discovery has also had a free cash flow (FCF) conversion rate among the “top end of its peers”, at 64% (yielding $2.4B of FCF in 2021), after swallowing up Scripps Networks Interactive in 2018, so management has some track record with delivering on its plans.

Discovery and AT&T combined investor presentation.

The set-up looks even better if we consider the recent ownership structure. AT&T shareholders, notoriously preoccupied with dividends, were allocated 71% of the newly formed (and non-dividend-paying) media giant. That’s a lot of shareholders to potentially turnover, but dissatisfied AT&T shareholders have now had three months to dump their shares. While WBD’s stock price could certainly go lower, this shareholder dynamic has nothing to do with fundamentals, and the downward pressure won’t last indefinitely.

Among the relatively few notable investors worth keeping an eye on, Michael Burry has taken a position in Warner Bros. Discovery, and I wouldn’t be surprised to see others taking greater notice of the media/streaming space. Berkshire Hathaway (BRK.A), for example, had initiated a position in Paramount Global (PARA) in its most recent 13F.

Some Risks

Of course, there are risks to the investment case, as well. WBD has its hands full with the merger and deleveraging, so it won’t be able to buy back stock for a while, and operationally, there could be more frictions than expected. In terms of recession risk, this seems like it should be the least of investor concerns, although it would certainly be nice to nail the bottom as maximum fear takes hold. With higher interest rates, the “real rate” of interest is ultimately what will matter, not nominal rates –– inflation should end up boosting revenues, as well, eventually. But there could be disruption from inflation, as adjustment takes time.

Fear of a streaming apocalypse also looks too pessimistic. Players with the best content will have pricing power, and WBD management and others have signalled that they’re not out to maximize spending. Netflix has already started to break its own rulebook. One wildcard is if the war in Ukraine spills over, with further global economic repercussions — this is beyond the scope of this article. Or maybe Zaslav & Co. will engineer another mega-deal, just as the merger realizes its value and the stock price is on an upswing?

All of these concerns should be put in context of the significant stock price pullback. It may take a while for the messy merger and fears to blow over, but it looks like more than enough risks are priced-in, say, for a 2-year horizon.

Final Thoughts

With indiscriminate selling by AT&T shareholders, and fears about a streaming apocalypse, macro headwinds, and a looming recession, WBD looks deeply oversold. It’s always difficult to gauge the bottom, but the downward pressure won’t last indefinitely. AT&T shareholders have had more than three months to bail, and WBD is now trading at single-digit forward multiples and markedly less than recent deals for WarnerMedia, ignoring that Discovery is now included.

One persistent concern has been the potential for a structurally unprofitable industry, as consumers easily churn in and out of numerous streaming options. Such risks should be considered, but it seems near-sighted to assume that the tactics and strategies of the first phase of the streaming wars won’t evolve as the industry consolidates and matures. WBD’s management is intent on approaching the business with financial discipline, and looking beyond the “messy year” of 2022, it won’t take too long to find out how well this goes.

Let me know your thoughts and feedback on WBD.

Be the first to comment