onurdongel

In an already-tough market for capex-oriented industrials, Columbus McKinnon (NASDAQ:CMCO) hasn’t done itself any favors with an outlook that led sell-side analysts to lower their short-term expectations for both revenue and margins. With that, the shares have lost about a third of their value since my last update on the company, underperforming not only the industrial sector, but other plays on industrial motion/automation as well.

I don’t believe the long-term story at Columbus has changed as dramatically as the valuation, but it’s clear that the market isn’t interested in capex plays at a time when industrial orders are contracting, margins are still under pressure, and demand is likely to cool off noticeably in the second half. While margin worries are going to understandably weigh on sentiment for a while longer, I do think this is a beaten-down name worth another look.

A Rockier Path To Normalization

One of the big questions in the second half of 2020 and since has been how companies would navigate the turbulence of the sudden sharp drop in demand from the initial phases of the pandemic, followed by the V-shaped recovery and subsequent normalization in demand.

My impression is that a lot of this turbulence is what’s behind the recent underwhelming guidance from Columbus McKinnon. The initial outlook for FY’23 (given at the time of the last earnings report in late May) was weaker than expected, including weaker project-based orders in the fiscal fourth quarter, and it looks as though companies have become increasingly cautious about their capex plans in the near term. While factory and warehouse automation is still a “when, not if” question for most companies/industries, “when” is a question that can still lead to a lot of near-term uncertainties.

Columbus McKinnon has likewise not been helped by the challenging cost environment. Pricing action has been more modest here than for many industrials (mid-single-digits), which has fueled pressure on margins from increased labor, material, and logistics costs. It also raises a question about value perception for CMCO’s product offerings – is the company’s pricing power limited because it is shipping orders where the price was already set, or is the company limited in how far it can push pricing? I believe it’s more the former, and that margins will improve throughout this fiscal year, but there’s definitely some risk here and the company does need to see some relief in its supply chain challenges.

Still A Strong Transformation Story

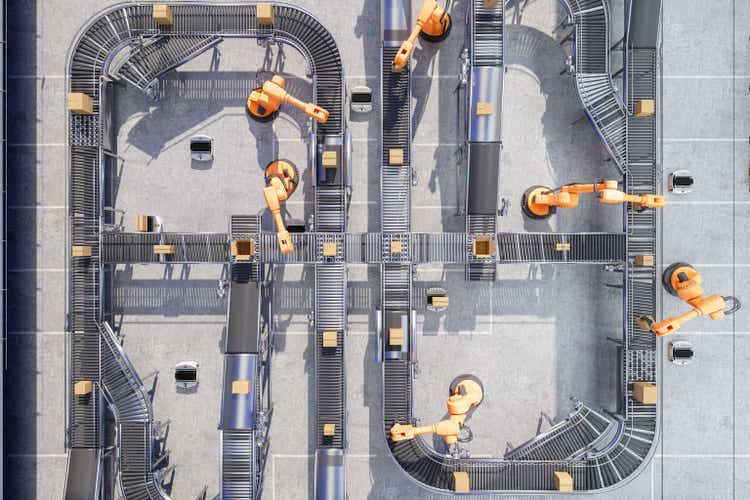

The main driver for CMCO for the last couple of years has been the company’s ongoing transformation from a more commodity-type material handling company toward a more dynamic assortment of automation-enabling technologies, led by its specialty conveyor, linear motion, and controls automation segments.

This is still a valid story, and one that management believes can drive mid-single-digit organic revenue growth over the next four years. Add in further M&A and the revenue growth rate could hit the double-digits over that period.

My bullishness on Columbus McKinnon remains underpinned by my view of the company as an enabler and “arms merchant” for the significant transformation of factory and warehouse automation that is already underway and going to continue through the decade. Many of the company’s products are the “business end” of automation; products that actually move materials through a plant or warehouse in response to control system inputs.

I expect ongoing investment in capacity and automation in end-markets like food/beverage and life sciences, and I likewise expect to see ongoing investments in logistics automation – all of which can and should drive demand for lifting solutions, linear motion products, and specialty conveyors. I likewise expect the company to continue to look for M&A opportunities in areas like conveyors and specialty motion – technologies and components that enable automated mobile robots, guided vehicles, and so on.

To be clear, though, this is a “jam tomorrow” story. I do expect to see more evidence of slowing orders and slowing capex investment across industrial end-markets over the next few quarters as companies digest and integrate what they’ve already built and as they look for more clarity on economic growth/demand in light of cost pressures, higher interest rates, and so on. With that, I think the likelihood of outperformance on the top line is lower for the near term, and most of the financial upside (if there is any) will be on the margin side if supply chain pressures ease.

The Outlook

I don’t expect a lot of near-term momentum in EBITDA margins; with the exception of the pandemic year, EBITDA margins have been in the 15% to 16% range for a few years now, and I think that is likely to be the case for this year and maybe the next as well. After that, though, I think the combination of increasing demand for higher-value products and further cost reduction / efficiency efforts can drive EBITDA toward the high teens and maybe into the low 20%s over the next five years.

I’m still looking for 5% to 6% long-term revenue growth (in line with my prior expectation); I’m not making explicit M&A forecasts at this time, and I think Columbus McKinnon can generate roughly 2x GDP growth on the back of its improved portfolio of automation-enhancing material handling products as it piggybacks the ongoing factory/logistics automation trend. While I do see some risk to margins in the short term, I do still expect free cash flow margins to improve into the low-to-mid teens over the long term as the company leverages its cost and mix enhancement efforts (including running the legacy lifting business with a greater focus on profitability).

The Bottom Line

Reductions to near-term estimates take a bigger bite out of DCF-based fair values, and that’s the case here, but I still believe that the price decline in the shares has outpaced the near-term deterioration in the business outlook. With that, I think the shares are priced for a low-to-mid-teens long-term annualized total return.

The short-term hit to my margin and revenue assumptions likewise impacts the margin/return-based EV/EBITDA valuation, but I still believe an 11x EBITDA multiple is supportable (versus 12x before). With that, I still get a fair value in the low $40s.

It’s not an easy time to step in and buy Columbus McKinnon shares, particularly as the overall economic outlook could get weaker from here, further hurting sentiment for capex-driven companies like this one. Still, for investors who can take short-term pain in the pursuit of longer-term gains, I think these shares are worth at least a spot on a watch list to see how management handles the near-term margin challenges over the next few quarters.

Be the first to comment