JHVEPhoto/iStock Editorial via Getty Images

One week ago, adidas (OTCQX:ADDYY) released a profit warning and the stock price declined by almost 10%, dragging down the whole Stoxx Europe 600 Retail. Adidas’ previous outlook was set for a 5% revenue growth and a 7% operating profit margin, the forecasted revision led to a future estimate for a decline in top-line sales at minus 5% and an EBIT margin of 4%. This was due to the further deterioration in Greater China sales, lower consumer demand in the Western market, Russia’s exit, and inventories. Here at the Lab, we already commented about the negative Nike (NKE) inventory result, providing a specific update on Puma’s (OTCPK:PMMAF) implications of Nike’s profit warning. Here at the Lab, we already covered Puma three times this year, so no buy case recap today, here are our main publications:

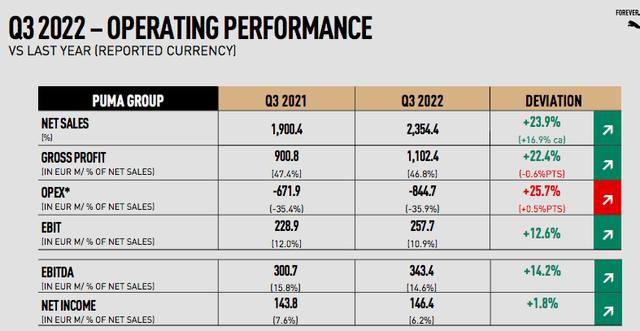

Q3 Results performance

Cross-checking Visible Alpha consensus expectations, Puma outperformed Wall Street estimates thanks to the stronger turnover recorded in the quarter. Indeed, the company achieved top-line sales of plus 16.9%, reaching €2.3 billion compared to the €1.9 billion recorded last year’s end quarter. Excluding currency development consideration, the company manages to grow in all geographic regions. The Americas and EMEA regions grew at double-digit rates, and we see an improvement also in China. We can clearly see that Puma’s strategy is to prioritize taking share in whole sales channels. Going down to the P&L, Puma’s gross profit margin decreases to 46.8%; however, this number was better than anticipated by consensus estimates. The company was negatively affected by a negative channel mix and higher logistics costs, while FX was a positive contributor. The EBIT result improved in value and was 110 basis points lower compared to Q3 2021.

Source: Puma Q3 Results Presentation

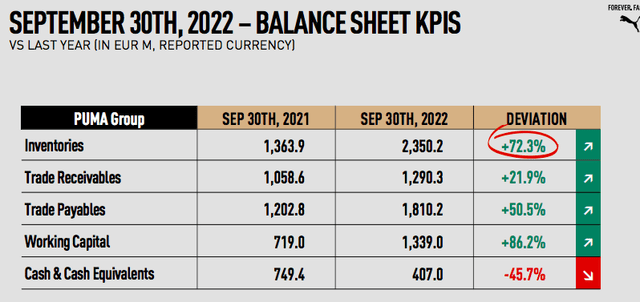

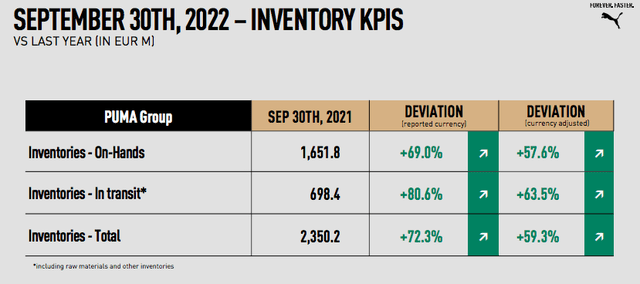

Also important to check is the inventory’s KPI.

Source: Puma Q3 Results Presentation

The German player’s inventory numbers look abnormally high for this time of the year. Just to compare, inventory is 32 days higher than the pre-COVID-19 level in Q3. Total inventories stood at €2.35 billion and were up by 72% on a yearly basis. This is mainly due to inventories in transit (which are up by almost 81%) related to logistic constraints. There are a few considerations that we should include:

- As already mentioned, Puma has strong brand momentum;

- The company is less exposed to China versus its comps;

- US distributors have declared that the second quarter was inventory peak level;

- Even if there is a slowdown projection in sales for Q4, management confirmed its 2022 guidance.

Conclusion and Valuation

Despite a challenging environment with ongoing COVID-19 outbreaks in China, pressure from elevated inventory, raw material cost increases, and supply chain constraints, we still see Puma’s 2022 results as achievable. We like the company’s conservatism; however, reflecting markdown inventory pressure, FX positive development, and higher marketing investments, we decide to lower our operating profit margin from 8% to 7.2% in 2023. Therefore, our target price stands now at €80 per share, confirming our outperforming rating. Despite the strong growth momentum and its outlook confirmation, Puma and Adidas are both down 56% year-to-date. This is not justified in our opinion.

Be the first to comment