mikhail badaev/iStock via Getty Images

by Darren P. Clipston, CFA

Credit spreads represent the excess yield over U.S. Treasury rates that “risky” bonds need to return to potentially compensate investors for taking on incremental default and liquidity risk. Credit spreads are often part of financial condition indices since they reflect the cost and availability of financing for corporate borrowers and give a sense of the default risk outlook. On this last point, when perceived or actual risks around corporate solvency and liquidity emerge, segments of the corporate bond market reprice lower, at times dramatically so.

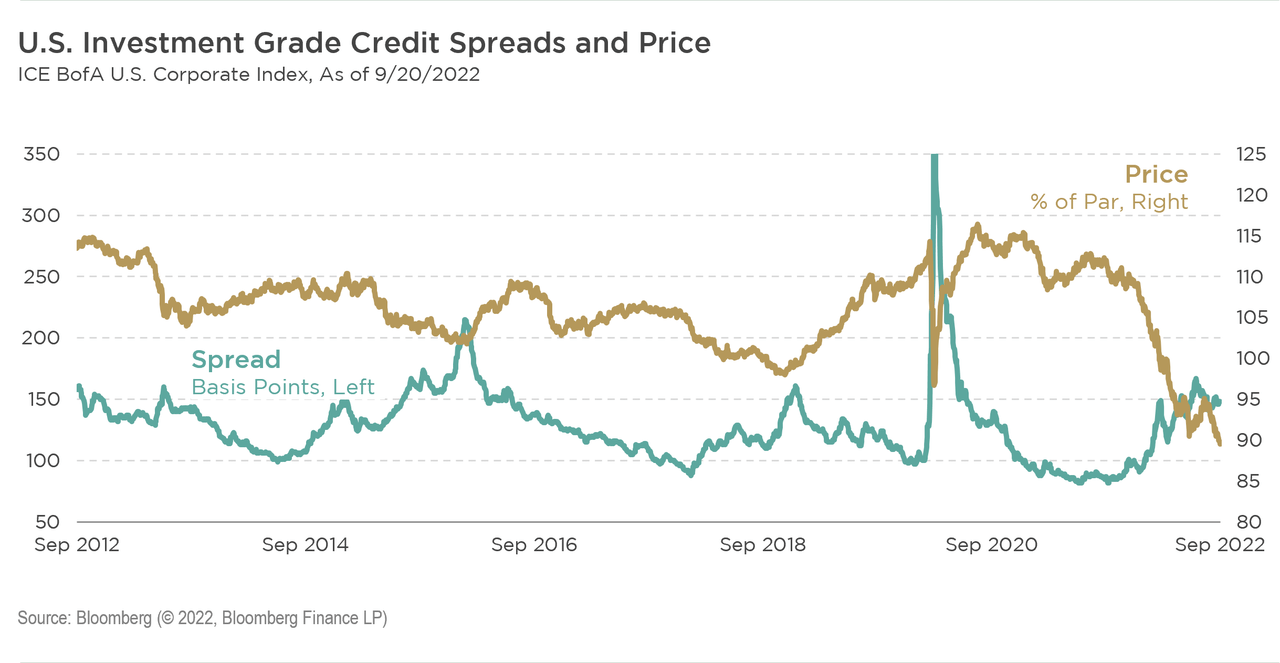

The chart below shows the spread over Treasuries, in basis points, and average bond price of the ICE BofA U.S. Corporate Index. The inverse relationship is fairly obvious, underscoring the point that spreads and volatility are related and tend to broadly move together.

After this year’s sell-off, corporate bonds are now at their lowest prices in over a decade. However, while elevated, credit spreads are not at comparable extremes. As U.S. Treasuries have sold off, Treasury yields have risen dramatically in 2022. Therefore, the discounting of corporate bond prices, closer to assumed levels of distressed recovery, has been more the result of higher Treasury yields. To put it another way, the year-to-date change in corporate bond prices is more a function of the duration sell-off rather than a reflection of extreme credit risk.

In effect, those waiting for a recession signal in the form of an extreme widening in corporate spreads might be missing the bigger signal that corporate bond prices are already flashing. We believe any impending economic slowdown likely may feature less extreme spread dislocations than past cycles. For example, during the recent COVID crisis, Treasury yields declined to generational lows, and dramatically wider credit spreads were left to do the discounting in corporate bond prices.

This cycle, we do not believe credit spreads will likely go as wide, which is important when considering financial conditions and the forward return outlook. It is important to note that corporate bond performance can turn positive even from a less extreme starting point in terms of wide credit spreads. All it may take is for Federal Reserve policy and economic news to pivot toward a more risk-supportive outlook.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment