Dennis Diatel Photography

Recently, investors in Ethereum (ETH-USD) have been wondering what will happen to Ethereum’s price after The Merge.

Will The Merge hype fizzle out after the event? Will it be the typical “buy the rumor, sell the news”?

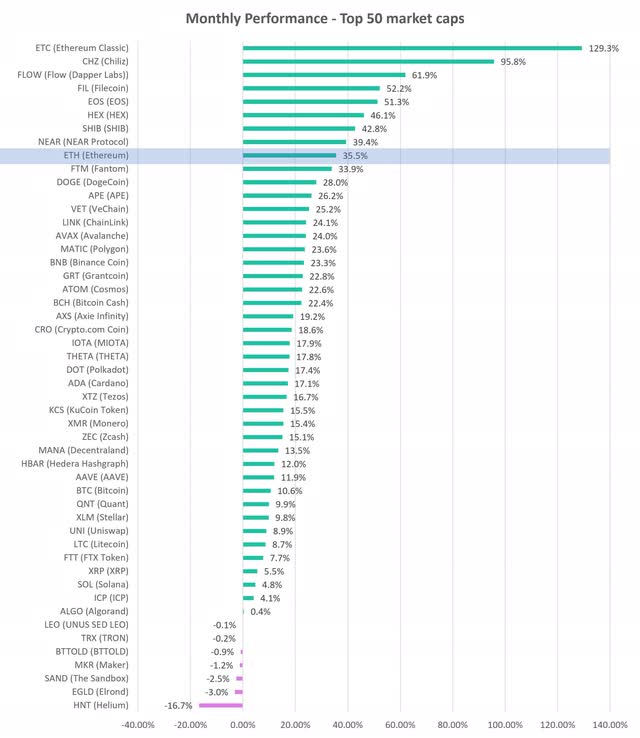

ETH price is up 36% in the last 30 days, and up 114% since its lows ($882) in June. It’s one of the best-performing altcoins in the top 50.

Crypto 30-day Performance (altFINS.com)

Some of that is due to general market trend reversal spurred by slowing pace of inflation, but a great deal of outperformance is related to the upcoming Merge.

In this brief article, I will lay out some arguments why I personally think that ETH will appreciate in price following Merge.

Let’s first review what’s the big deal about The Merge.

The Ethereum protocol was launched in 2015 and brought with it a truly revolutionary concept of smart contracts. Smart contract is basically software that enables DeFi, NFT and other Web 3.0 applications to run on blockchain.

Each transaction on a blockchain has to be validated by node operators or validators. At the time of Ethereum launch, the most established mechanism for such block validation was Proof-of-Work (PoW), which is also used by Bitcoin (BTC-USD).

However, while PoW works fine for Bitcoin, which is considered mostly as a store of value or “digital gold”, it does not scale for applications with high transaction volumes like DeFi, NFT, Metaverse, Play-to-Earn (P2E) or Move-to-Earn (M2E).

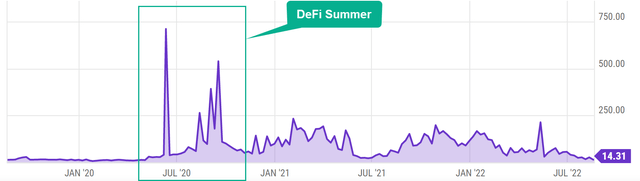

If you’ve ever done an on-chain transaction on Bitcoin, you know that it takes painfully long and is expensive. Web 3.0 applications need scalable, fast and cheap transaction approval mechanism. PoW was Ethereum’s weakness, which was soon apparent during the “DeFi Summer 2020” when DeFi applications exploded to the scene (Uniswap, Aave, MakerDAO, Compound, etc.). Transactions were taking long and gas fees spiked through the roof:

This weakness was also exploited by competing layer 1 (L1) protocols that were launched to address the scalability issues such as Solana (SOL-USD), EOS (EOS-USD), Avalanche (AVAX-USD), Fantom (FTM-USD), Cardano (ADA-USD), Polygon (MATIC-USD), Oasis Network (ROSE-USD), and Near Protocol (NEAR-USD). All of them use Proof-of-Stake (PoS) consensus mechanism.

ETH scalability issue is also why layer 2 (L2) solutions have been launched such as Optimistic rollups and Zero Knowledge (ZK) rollups.

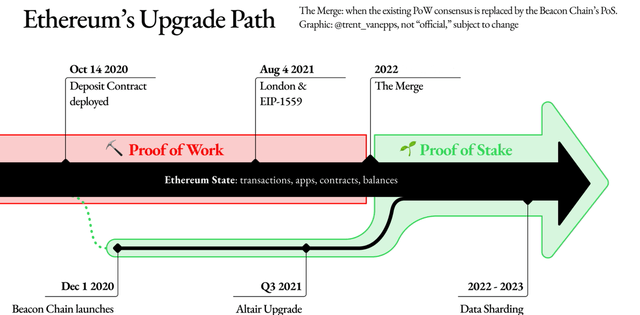

Following the “DeFi Summer 2020”, it became painfully obvious that Ethereum cannot scale and the community decided to migrate from PoW to PoS consensus mechanism. Instead of miners, PoS relies on ETH stakers to validate transactions. That’s cleaner, faster, more scalable and cheaper.

This migration, however, is extremely complex and was delayed several times. Yet, after two years of preparations and testing, the date for a definitive switch to PoS has been announced: September 15, 2022.

Regarding ETH price action following The Merge, it comes down to this:

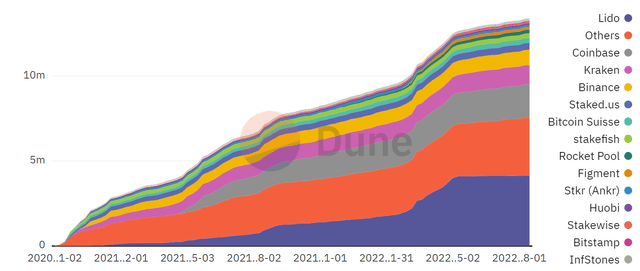

On the negative side, following The Merge (migration from proof-of-work to proof-of-stake), about 13.3m ETH staked so far will begin to unlock, giving their owners a chance to sell it. That’s about 11% of total ETH supply that will be unlocked. But the unlocking will be gradual, over the following 12 months.

Still, this could create some selling pressure from those who want to take profits or have other pressing reasons to raise capital and sell their ETH holdings.

ETH Staked and Depositors (Dune Analytics)

My opinion, however, is that very few will sell because:

1) Most invested at much higher ETH price levels, so are underwater and would be selling at a loss. Even before the migration to PoS, investors were able to stake their ETH and earn staking fees. This staking option opened up in 2020, but ETH volumes staked really ramped up in 2021 when ETH prices were well above the current $1,700 or so. Hence, most of the depositors are at a loss currently.

2) About 33% of staked ETH is through liquid staking platforms like Lido (LDO-USD), which are already tradeble (hence “liquid staking”), so there’s no unlocking event here. When someone stakes ETH through Lido, they receive sETH token in return, which is freely tradeable.

3) ETH staking rewards should double to about 8% APY, which is very attractive. Migration from PoW to PoS will eliminate miners and therefore payments to miners will be replaced by smaller block rewards to staking validators.

4) Big portion of staked ETH is from large validators who are in it for the yield not price gains. In the Dune chart above, we can see that majority of staked ETH so far is concentrated among large platforms and institutions, rather than retail investors.

And that brings me to the Positive side of The Merge event:

1) Higher staking yield (~8%) should attract new ETH buyers, including institutional investors. Following a successful migration to PoS and removal of risks associated with it, institutions will flock to stake ETH, in my view. ETH is the second-largest digital asset and certainly with the most existing utility as well as bright prospects for growth. Add to that an 8%+ APY, and it becomes a very attractive growth and yield investment opportunity, in my view.

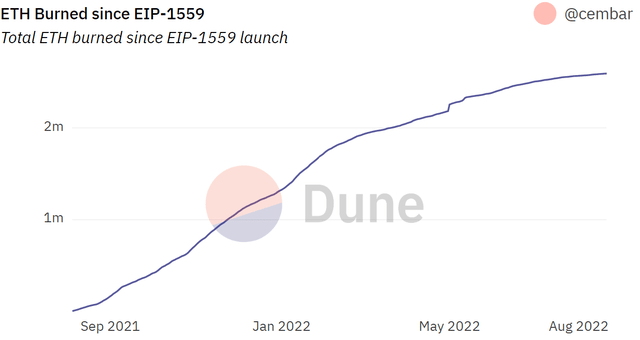

2) It will reduce new ETH minting and could in fact become deflationary (reduce supply) due to ETH burn. Post The Merge, miners will be eliminated and with it much of the block rewards. Also, in July 2021, as part of the London Hard Fork, the Ethereum Improvement Proposal (EIP) 1559 went into effect. It changed the Ethereum’s fee mechanism and introduced burning of ETH. Hence, combination of lower block rewards and burning of ETH should significantly reduce ETH supply inflation or even become deflationary.

3) More “green” aspects could attract some environmentally conscious institutional investors.

4) Higher scalability of Ethereum network should stimulate new development activity on the ETH protocol (defi, web 3.0, NFT…) which ultimately drives demand for ETH. Despite the competition from other L1 solutions, Ethereum has maintained over 70% market share of dApps (decentralized applications). The ecosystem has continued to grow and Ethereum is by far the most adopted network protocol. With dramatically increased scalability, the Ethereum ecosystem should thrive even more.

In conclusion, price of any asset is driven by supply v. demand. Post The Merge, my opinion is that demand will outweigh temporary increase in supply from sellers. This is likely in the near term (weeks) but even more likely long-term (months) after The Merge.

Be the first to comment