Scott Olson/Getty Images News

Due to fears of a recession, the large financial banks like Wells Fargo (NYSE:WFC) have collapsed in the last few months. Despite the strong earnings rebound and massive capital returns, the stock now trades lower than pre-covid levels. My investment thesis remains ultra Bullish on the bank stock following the passing of the 2022 Fed stress test, though capital returns are likely on the decline over the next year.

Stress Test

A lot of the large banks failed to impress with the 2022 version of the Dodd-Frank Act Stress Test (DFAST). The problem with the test is that the Federal Reserve made the hypothetical scenario tougher than the 2021 test as follows:

- Unemployment rate rises by 5-3/4 percentage points to a peak of 10% and GDP declines.

-

Asset prices decline sharply, with a nearly 40 percent decline in commercial real estate prices and a 55 percent decline in stock prices.

Naturally, a tougher economic scenario leads to larger losses for the banking industry. The Fed estimates total losses were largely driven by more than $450 billion in loan losses and $100 billion in trading and counterparty losses. In total, banks saw losses pile up to the tune of $50 billion in additional losses in this test.

The modified stress test scenario defeats the point of stressing banks to ensure they don’t reduce capital too far in good times and are prepared for the bad times. Once a recession becomes far more obvious isn’t the time to panic and alter the test to more severe results.

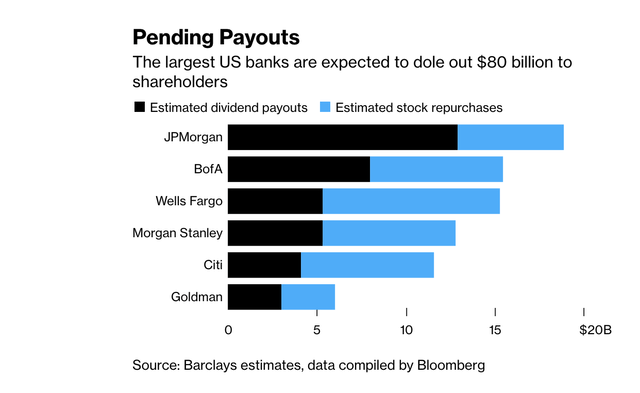

Luckily, analysts appear to agree that Wells Fargo surprisingly shined during the stress test with leading banks like JPMorgan Chase (JPM) and Bank of America (BAC) struggling. Data compiled by Bloomberg forecast the following capital returns by the largest banks:

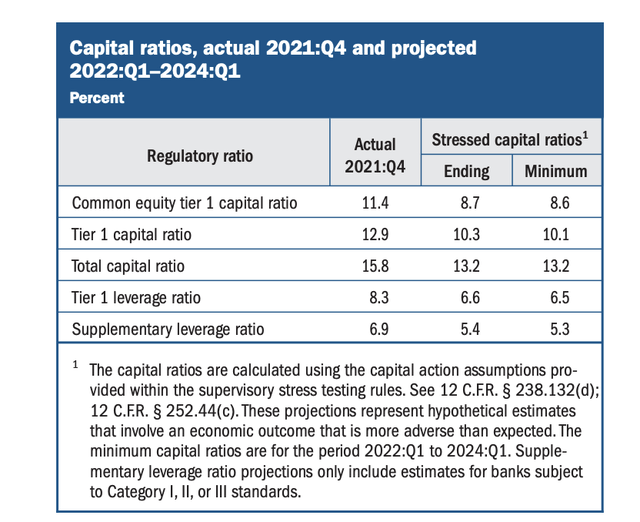

Wells Fargo watched the CET1 ratio fall from 11.4% at the end of 2021 to a minimum of 8.6% during the stress period lasting through Q1’24. Wells Fargo saw the ratio fall 2.8 percentage points while JPMorgan fell from a CET1 ratio of 13.1% to a minimum of 9.8% for a 3.3 percentage point fall. JPMorgan ended up with more capital, but the capital position worsened. BoA saw the position worsen to a larger extent and the minimum capital levels fell to 7.6%.

In both cases, the large financial institutions still ended the periods with vast capital levels able to handle the crushing economic blows. JPMorgan was listed as having a bad stress test, yet the bank still had capital levels of nearly 10% under the worse of scenarios.

The whole problem with this stress test is placing restrictions on stock buybacks right when the market needs additional investments. The Dodd-Frank bill correctly requires banks to keep excess capital in good times to prevent the next financial crisis, but the Fed should allow lower minimums in maximum stress.

Limited Stock Buybacks

The biggest outcome of the stress tests is that large banks are probably going to reduce dividend hikes and stock buybacks. For its part, the Wells Fargo CFO had already announced plans to slow down stock buybacks during Q2’22 and switched the plan to no buybacks during the quarter when speaking at the MS US Financials conference:

…quarter-to-date we haven’t done any buybacks, which probably no surprise to people in the environment. But unlikely we would do any this quarter, just given the volatility that’s there, that’s just prudent — I think, prudent management.

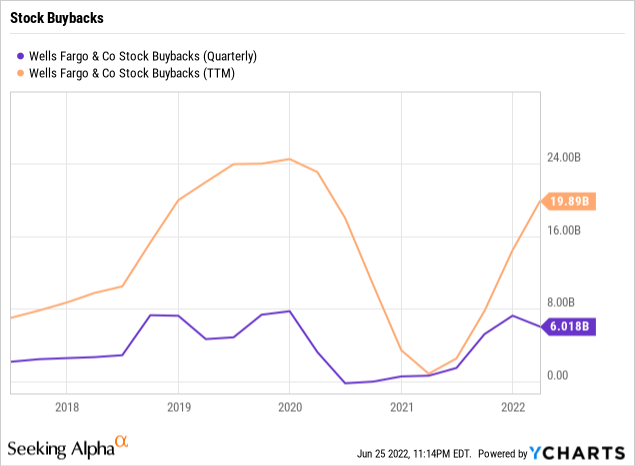

Wells Fargo spent nearly $20 billion on stock buybacks over the last year. The bank had already aggressively spent $18 billion during the current period with analysts predicting only $11.5 billion in stock buybacks over the next year based on the $15.5 billion of total capital returns in the period.

The bank has stated a preference for maintaining minimum capital levels in the 10.1+% range to provide an extra capital cushion. Wells Fargo has a minimum CET1 capital ratio of 9.1% based on the 4.5% CET1 minimum plus capital stress buffer and the additional G-SIB.

My prior EPS targets had speculated on 10% annual share reductions to help boost EPS estimates to $6+ by 2024 considering the covid delayed expense reductions. The bank is in a great position to utilize this downturn to streamline the business after covid lockdowns caused new CEO Charlie Scharf to pause restructuring plans. Wells Fargo entered this year with plans to cut operating expenses to $51 billion for a cost reduction of ~$3 billion from last year.

The economic weakness and sudden downturn in the mortgage business will definitely hurt the revenue portion of the equation. Wells Fargo might actually cut costs below the $51 billion target, if not for inflation headwinds.

The Fed has already hiked interest rates 150 bps this year providing some solid upside in NII, but other businesses will be hurt by any downturn. Unlike other banks though, Wells Fargo can easily cut costs to lower the efficiency ratio to improve profits and set the bank up for a strong rebound when the economy improves.

Takeaway

The key investor takeaway is that Wells Fargo is exceptionally cheap here at $40 with an earnings power heading towards $6+ in a few years. Even with a lower capital return in the next year, the large bank will repurchase a significant number of shares due to the stock price falling.

Ultimately, investors need to use the recent weakness to build a position in Wells Fargo. The large bank has plenty of capital to survive another recession and ultimately thrive in the next economic recovery.

Be the first to comment