alfexe/iStock via Getty Images

Second Quarter Earnings

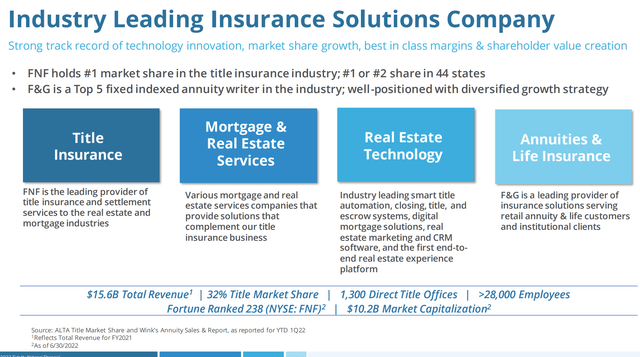

For background, we wrote up Fidelity National Financial (NYSE:FNF) here. The company operates a mortgage title business and also owns a life and annuity insurance business. It earns roughly 75% from its core title business and 25% from F&G, the life/annuity segment.

Below is a business overview slide.

FNF Investor Relations

This slide deck has plenty of background information too.

Last month, FNF reported solid second quarter results with adjusted EPS (excluding 10c of favorable items in the F&G segment) of $1.80 per share, vs expectations of $1.59. They did $2.03 a year ago amidst the mortgage refi craze.

The stock initially fell on a reportedly “large” revenue miss. Excluding portfolio gains and losses however, the company beat estimates with revenue of $3.307 billion vs $3.240 estimates (a 2% beat). Revenue was down 9% year over year, but given the decline in mortgage originations, quite a feat.

EPS fell 11% year over year.

Based on average multiples over time and using a $39 stock price today, the market appears to be pricing in a decline in earnings per share to $3.80 (putting an 11.5x multiple on the core title business and 7.5x on the long tail insurance segment). In both 2022 and 2023, the Street is forecasting well over $6.00 in EPS, suggesting a healthy margin of safety at current prices.

Their title business has already normalized after the mortgage refi boom in 2020 and 2021. In fact, refinancings at FNF were down 68% year over year in Q2, at near record lows. This part of the business cannot get much worse.

Purchase orders were down 11% in the quarter, about as expected and in-line with overall home sales volumes. Pricing (fee per file) was strong however, up 46% driven by higher home prices compared to a year ago.

The commercial financing market is robust today, with revenue up 26% year over year. This illustrates the diversification in their business.

Furthering the diversification argument at FNF is their F&G segment, selling annuity and life insurance policies. While the title segment is negatively impacted by higher interest rates, the F&G segment is essentially a negative duration business (benefitting from higher spreads and yields).

As we have noted many times, F&G is killing it of late, with gross sales up 15% in Q2 and assets under management (AUM) up 29% year over year. Adjusted earnings grew 31% in Q2 year over year. Sequentially F&G’s AUM was also impressive, up $2.8 billion to $40.3 billion at quarter end. Chris Blunt, head of F&G, deserves a lot of credit for expanding their distribution channels (from 1 to 5) at F&G since mid-2020, and growing the business nicely.

Forward Estimates

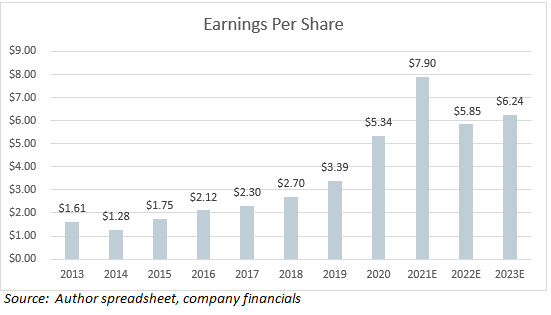

Given the beat, analysts have upped earnings estimates to a bit over $6 per share ($6.22 as of today for 2022). The question as to future earnings is of course foremost on investors’ minds. The housing market is slowing quickly as mortgage rates are now 5.8% (on a 30-year mortgage). The title business had a massive year in 2021, and overall, the company blew away earnings. FNF generated $7.90 in EPS compared to $5.34 in 2020 (and $3.39 in 2019).

With rates on the rise, refinancing and purchase activity have declined. We have been estimating that EPS would revert to $5 this year in our earlier models, but now see $6 as pretty likely. The company has managed margins and costs better than expected, and the F&G segment benefits from higher interest rates, so that has been a nice counterbalance to the title segment’s weakness of late.

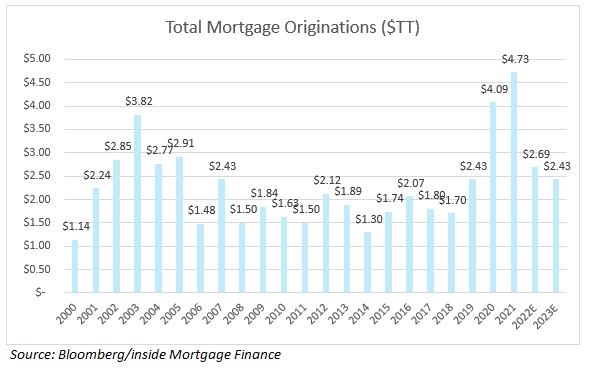

Long term the macro picture for total mortgage originations looks like this (includes refi’s and purchases).

Bloomberg

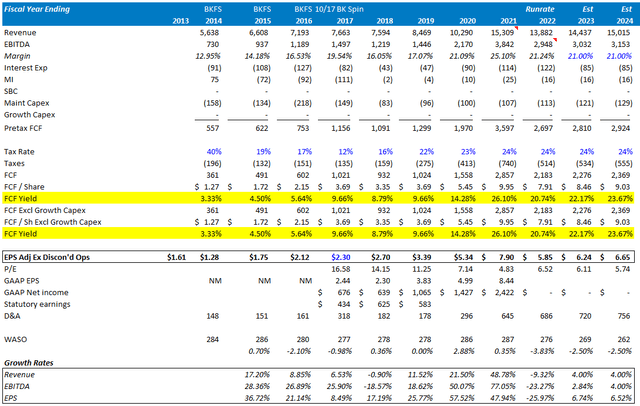

The 2022E figures above are simply run-rate numbers, taking first half results and doubling them. We are already close to 2019 levels. 2022 will end up down 43% versus 2021 using these estimates.

Cleary, most of the excess earnings have been wrung out of the company. The company suggested on the call that refi’s “appear to be bottoming.” They further suggested that the back half of 2018 was pretty similar to what they were seeing in refi activity today.

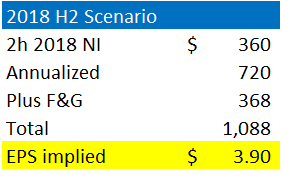

Taking those figures and adding in F&G (which was acquired in 2020), we get this kind of worst case earnings picture.

Source: Author (Author spreadsheet)

We deem this a trough scenario, and with the stock at 10x this, already seemingly pricing in this decline.

On the residential side, FNF closed 6900 orders per day in the second quarter. In July, they have newly booked orders of 6000 per day. That is down sequentially but Q2 is the strongest seasonal quarter.

Refi’s are down 74% in July to only 900 per day, almost a rounding error.

That was the bad news, and we did adjust our model for that.

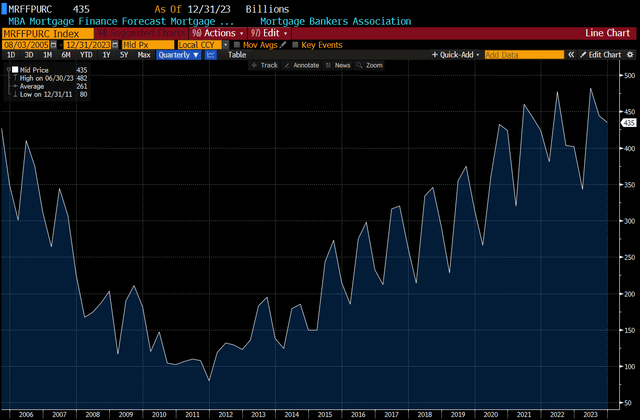

But the bigger driver to earnings is new home purchases. Below are forecasts for new home mortgage originations including commercial from the Mortgage Bankers Association.

Bloomberg

This includes estimates through 2023 from MBA.

Through the cycle, from 2014 to our 2022 estimates (which take out the excess 2021 earnings), FNF has compounded EPS by a remarkable 20.9% annually (using a below-Street $5.85 for 2022 earnings). FNF alone has generated only 11.5% returns for shareholders, a respectable figure but adding in the BKH spin-off in 2017 (and assuming zero gains on that since 2017), and FNF would have been a 15.1% annual gainer (vs 11.6% for the S&P).

The company, despite mortgage originations virtually flat from 2013 to 2018, still managed to grow EPS from $1.61 to $2.70, or 10.9% per year in that time.

Author spreadsheet

The long-term trend is undeniable, but like 2014 and 2015, EPS will stagnate a bit next year and perhaps even into 2024. We use a conservative forecast of $5.85 in EPS in 2022 and only 6% growth next year.

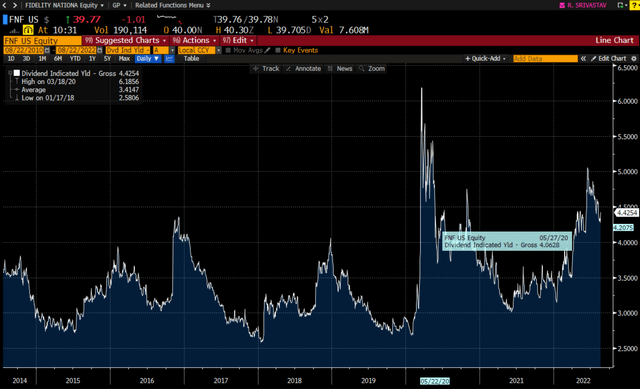

On the plus side, the stock yields 4.6%, a near record (and only higher in its history for a brief moment in March 2020).

This is a chart of FNF’s yield.

Bloomberg

Investor’s are paid nicely to wait.

The Street seems to expect a permanently slower pace of growth through 2025, with EPS only reaching $6.33 by then. We take the “over” by a long shot, but the “under” perhaps in 2023. Disruptors seem not to have had any impact that we can see (with market share fluctuating around 33%).

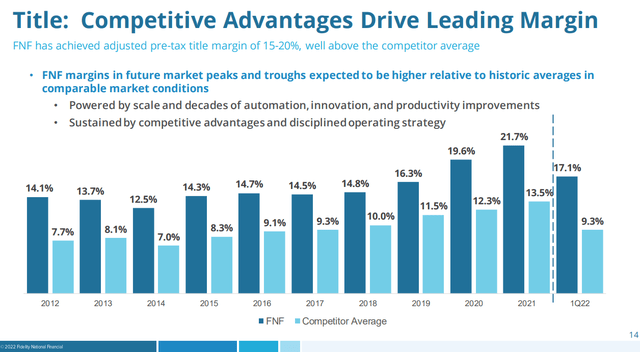

This is a scale and relationship driven business. It is worth noting what a terrific business model this is. Their margins are structurally much higher than their peers. And there are not very many peers either; getting into the title business takes vast amounts of data, time and capital.

FNF investor relations

Management and Spinoff of F&G

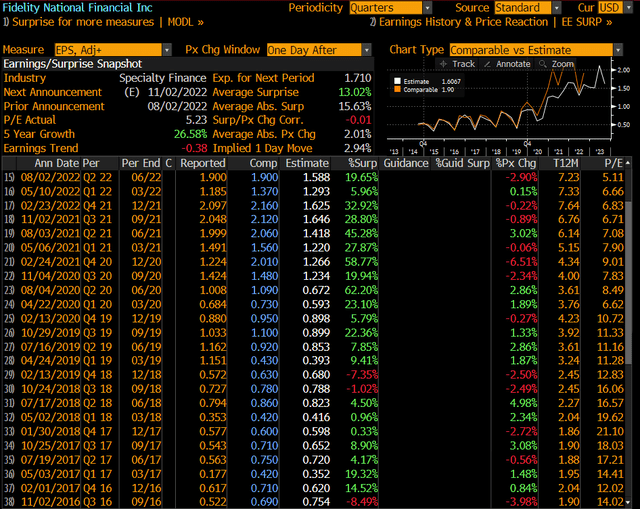

As most know, we spend a lot of time on management, and look for high quality ones. In that regard, owner, founder and chairman Bill Foley is as good as they come. The surprise factor on the upside is impressive with respect to quarterly earnings. The have only three quarters where they “missed” estimates dating back to 2016, with most positive surprises in the double digits.

FNF earnings surprises (Bloomberg)

But more important than that is their track record of both M&A and incubating businesses over time. Read our initiation piece here for more on that. The stock has been an absolute beast in terms of generating long term returns for holders (16% IRR’s which works out to $10 turning into almost $600 in 29 years). They have done numerous spinoffs including Fidelity National (FIS), a now $64 billion market cap company.

We see a lot of value again at FNF, with 15% of their F&G stake on the docket to be partially spun out of the company in early Q4 this year. F&G originally expected to double their AUM from $25 billion to $50 billion in five years, but have managed to get to $40 billion in just two years.

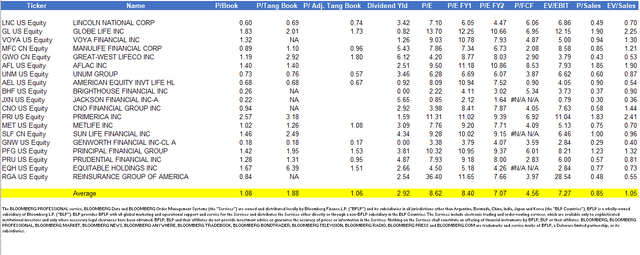

F&G does well in rising rate environments as mentioned, a nice contrast to their core title business. FNF will keep 85% of the F&G business and essentially IPO the 15% to existing holders. We think F&G, as one of the highest growth insurers in their industry, should trade at a premium to the group, which averages an 8.6x P/E multiple.

Going forward, the company thinks they can grow EPS at a double-digit rate at F&G. We think 9.5x earnings is fair.

Here are annuity/life comps.

FNF Comps (Bloomberg)

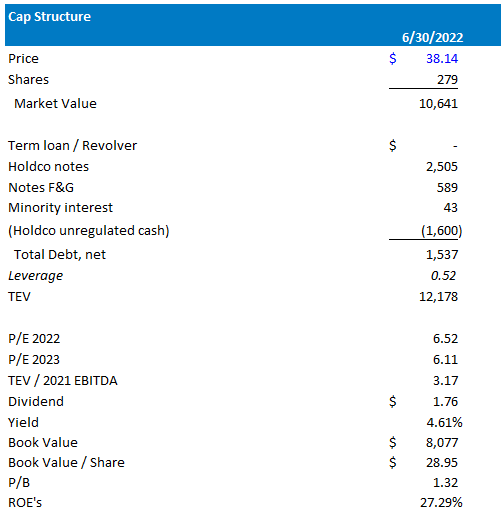

Capitalization and Model

Cap Structure (Author spreadsheet)

The company has $1.6 billion of unrestricted cash at the holdco and continues to buy back lots of stock (under a $500mm buyback authorization). The balance sheet is investment grade rated.

Here is our model.

Author spreadsheet (Author spreadsheet; Co financials)

Note that we are below Street estimates in 2022, but a tad higher in 2024.

Valuation

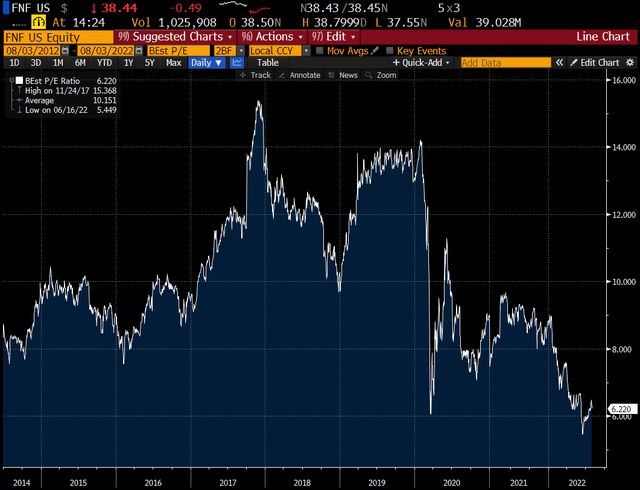

First of all, FNF hit a lower valuation than the pandemic last month and has bounced slightly.

Below is FNF equity on a two-year blended forward P/E basis, to take out any past refi overearning. At 6.2x forward two year earnings, FNF is at record cheap levels.

FNF forward P/E (Bloomberg)

Arguably the consolidated multiple should be lower with F&G in the mix. Before that acquisition in mid-2020, FNF was on average a 10.8x P/E stock. But, we deem 6.2x as just too cheap to ignore.

If we take 10x as the right multiple, then FNF stock today is implying that EPS will drop down to $3.80 per share (after just earning $1.80 in a quarter with housing volumes already vastly lower). That seems pretty unlikely barring an ugly recession.

In 2008, revenue did fall 50% from peak to trough (2006 to 2008) and earnings were negative in 2008. But the company bounced back to profitability in 2009. The housing market today looks vastly healthier (albeit extended today) than the no-doc loan housing bubble of the 2000’s.

If we put a 9.5x earnings multiple on F&G and assume FNF’s core title business is worth 8.85x earnings (in line with First American Financial FAF today), then we get a $53 stock on our current year earnings estimates. That is upside of 38%.

At 8.85x for the title business and 6x earnings for F&G, we get $48, still upside of over 20%.

On a P/B basis, FNF typically trades at 1.7x book, but hit a low of 1.1x book during the pandemic.

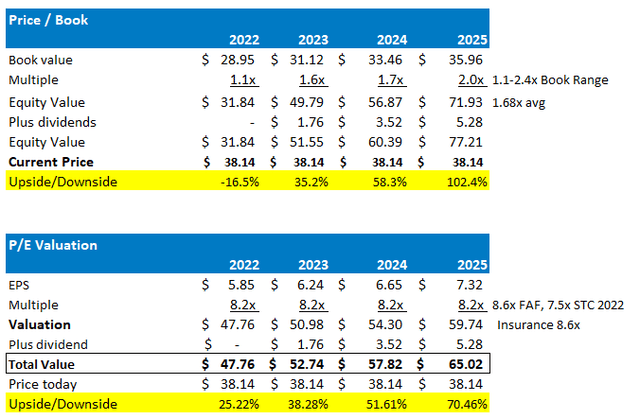

FNF Valuation Scenarios (Author spreadsheet)

This gives us a range of $31 to $70 plus in three years give or take.

Again, a spin off of F&G in Q4 could unlock a lot of this value.

Conclusion

We first wrote up FNF on September 1, 2020. Since then, the stock is up 30% cumulatively, or 14.2% annually including dividends. Despite the 30% decline in FNF this year, the company has still been a market beating stock for us (the S&P is up 21% cumulatively). I have remained long since our initiation piece.

Even better, FNF is extremely cheap. The spinoff should unlock some value in Q4 too. On the negative side, the headwinds to the title business are real but well known at this point. This is a more than average cyclical/volatile industry. Hard to see it not priced into the stock barring a Great Depression.

EPS and home financings peaked in Q2 2021 so we may have another couple of quarters of tough comps. But seem to be fast approaching a bottom.

In contrast to the title business, F&G benefits from higher interest rates and has kept earnings from falling too much.

Finally, we have to mention that we view the business model as best in class. No question it is extremely cash generative. EBITDA is $3.0 billion and capex only $130 million give or take. Management is top notch too. The F&G acquisition was a home run. A great compounder here.

In housing, our long term view is that inflation likely drives home prices higher, but in a worst case is down in the single digits next year. There is a huge shortage of homes in this country, and as wages move higher with inflation, affordability improves.

Be the first to comment