Sundry Photography

Cisco (NASDAQ:CSCO) is an innovative pioneer in the IT industry. The company is going through a major business model transformation from a pure hardware provider to a software and subscription focused company. So far its strategy is working well as Cisco beat analyst estimates for both revenue and earnings per share in the quarter ending July 2022. In addition, management exuded practical confidence with regard to future guidance in their earnings call. Given the macroeconomic headwinds such as high inflation and supply chain constraints, it was a shock to see Cisco doing well. Many large technology companies such as Meta (META) and Netflix (NFLX) have been slashing jobs. But Cisco has announced plans to boost spending by $1 billion next year, in order to increase employee pay and encourage them to stay with the company. Cisco has bought back a staggering 54 million shares in the quarter and authorized stock repurchases of up to $15.2 billion for the future.

Long term the company has many tailwinds ahead from growth in hybrid work, hybrid cloud, IoT, 5G, Wi-Fi and even it’s ultra fast 400G switches. The cloud market alone is estimated to be worth over $1 trillion by 2028. While the Internet of Things (IoT) industry is expected to be worth over $2.4 trillion, which is staggering.

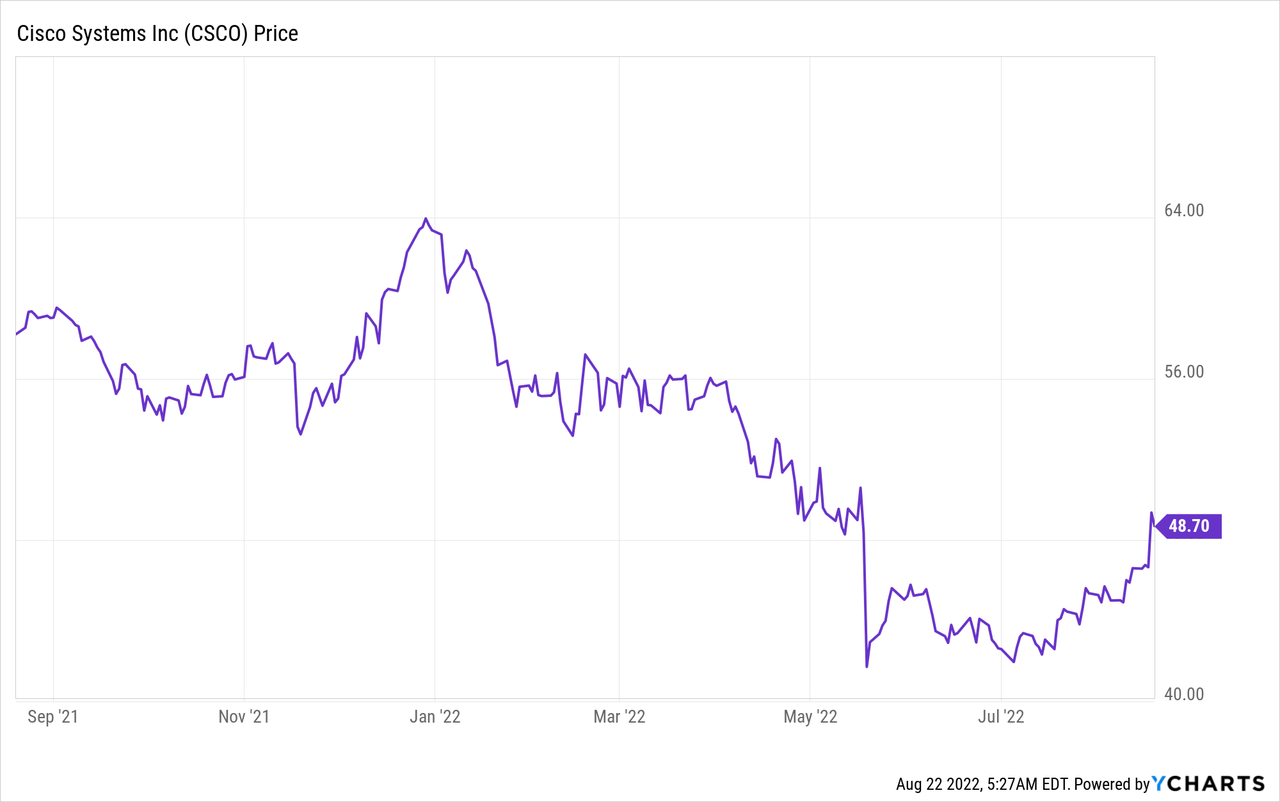

The stock price has popped by ~14% since July but is still down 23% from all time highs and is undervalued relative to historic multiples. In this post I’m going to break down their recent earnings report in more detail, let’s dive in.

Transforming Business Model

Cisco has a history of selling hardware, such as switches, routers and access points with embedded software inside. But over the last few years the company has focused on selling subscriptions via a recurring revenue model. This transformation is working great so far as over 44% of the company’s revenue now comes from subscriptions. The company measures its new business model via two classic Software as a Service (SaaS) metrics Annualized Recurring Revenue [ARR] and Remaining Performance Obligations [RPO], I will explain more on these later with easy to understand definitions.

Cisco Switches with monitoring software (Cisco.com)

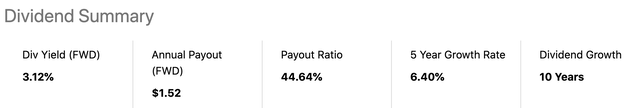

Cisco pays a solid dividend of 3.12% [FWD] which is a rarity for the technology sector. It has an A Rating by Seeking Alpha for Yield and Growth. The company has executed 10 years of dividend growth with a 5 year growth rate of 6.4%.

Cisco Dividend (Seeking Alpha) Dividend Cisco (Seeking Alpha)

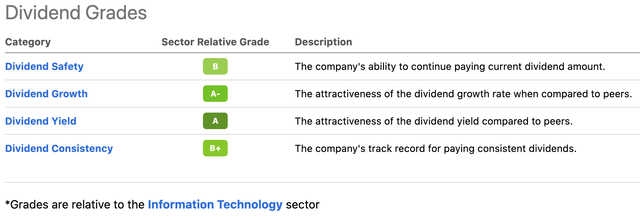

Solid Financials

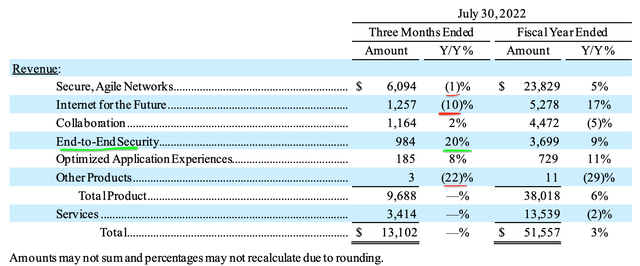

Cisco generated solid financial results for what the company calls Q4 FY 2022. The company generated $13.1 billion in total revenue which was flat in terms of growth but beat analyst consensus estimates by $327 million. For the fiscal year of 2022, revenue was $51.6 billion up 3% year over year.

Total product revenue for Q4 was $9.7 billion and service revenue was $3.4 billion both flat year over year. Its flat product sales was driven by a variety of factors. Firstly, sales of switching products declined for both campus and data center lines, which was driven by supply constraints. The company saw growth in its Catalyst 9000, Nexus 9000 and Meraki switches which are aimed at companies operating with a hybrid IT setup.

Its Enterprise routing product line saw a slight decline which was driven by a decline in Edge and SD-WAN but growth in Access. This growth can be awarded to its Meraki wireless offerings and double digit server growth

Cisco Revenue by Category (Cisco)

Its Internet for the Future segment was down 10% due to declines in Cable, Edge and Optical but this was offset by strength in web scale revenue which was a positive. The work from home trend has continued to boost Collaboration Revenue, which was up by 2%.

Strength in Cybersecurity

Cisco saw blistering growth of 20% in its End to End Security offering. The Cybersecurity industry was worth approximately $139.77 billion in 2021 and is forecasted to grow at a rapid 13.4% CAGR up until 2029. Therefore this could be an unexpected extra growth driver for Cisco moving forward. Its “Zero Trust” networking solution is also expected to benefit from the hybrid work style as companies need to secure their workforces. Its Optimized Application Experiences generated solid growth of 8% which was driven by double-digit growth in its SaaS based offering ThousandEyes.

SaaS Style Metrics – Positive Trends

As mentioned prior, Cisco’s business model transformation to more of a software and subscription focused company means metrics such as ARR and RPO are very important, let’s dive into each.

Annualized Recurring Revenue [ARR]

Annualized Recurring Revenue [ARR] is a metric which takes contracts of any length and calculates the revenue they generate over one year. ARR is a great indicator of opportunities to renew revenue because it’s much easier and cheaper to keep or renew existing customers then to find new customers. The company can then “Revenue Stack” on-top of renewed ARR with upsells and cross sells. This also helps with setting realistic targets and predicting growth.

In this case Cisco generated Annualized Recurring Revenue [ARR] of $22.9 billion which was up a rapid 8% year over year, with product growth of 13%, which was driven by several large software transactions.

Remaining Performance Obligations [RPO]

If a customer makes an order and the product hasn’t been shipped or service provided yet then that goes into Remaining Performance Obligations [RPO]. However, if the customer has the right to cancel it goes into “Backlog”. Cisco’s Product backlog has over $2 billion of software orders. In addition, 83% of the software revenue was subscription-based, which is up 2 percentage points year-over-year.

Definition: RPO can be divided into two part, the first is “deferred revenue”. This is the revenue which is contracted to be received but hasn’t been yet. For example, if it’s a 12 month contract and only 2 months have been paid, the remaining 10 months will go into “Deferred Revenue”. The next part of RPO is “Unbilled contract revenue”. Basically if the company has a $50 million 5 year contract and $10 million is received in year 1, the remaining $40 million will go into “Unbilled Contract Revenue”. RPO is a reliable indicator of future revenue in Cisco’s case, approximately half of its RPO is short term in that it will be recognized within the next 12 months.

Cisco’s RPO was $31.5 billion, up 2% year over year. Product RPO popped by 6%, and service RPO decreased by 1%. With total short-term RPO growing by 4% to $16.9 billion.

Total product orders were down 6% in the quarter but it should be noted this was based on tough comparisons from the 31% growth in the year ago period. To put things into perspective product orders for Q4 were the second highest in the companies history.

Profitability and Margins

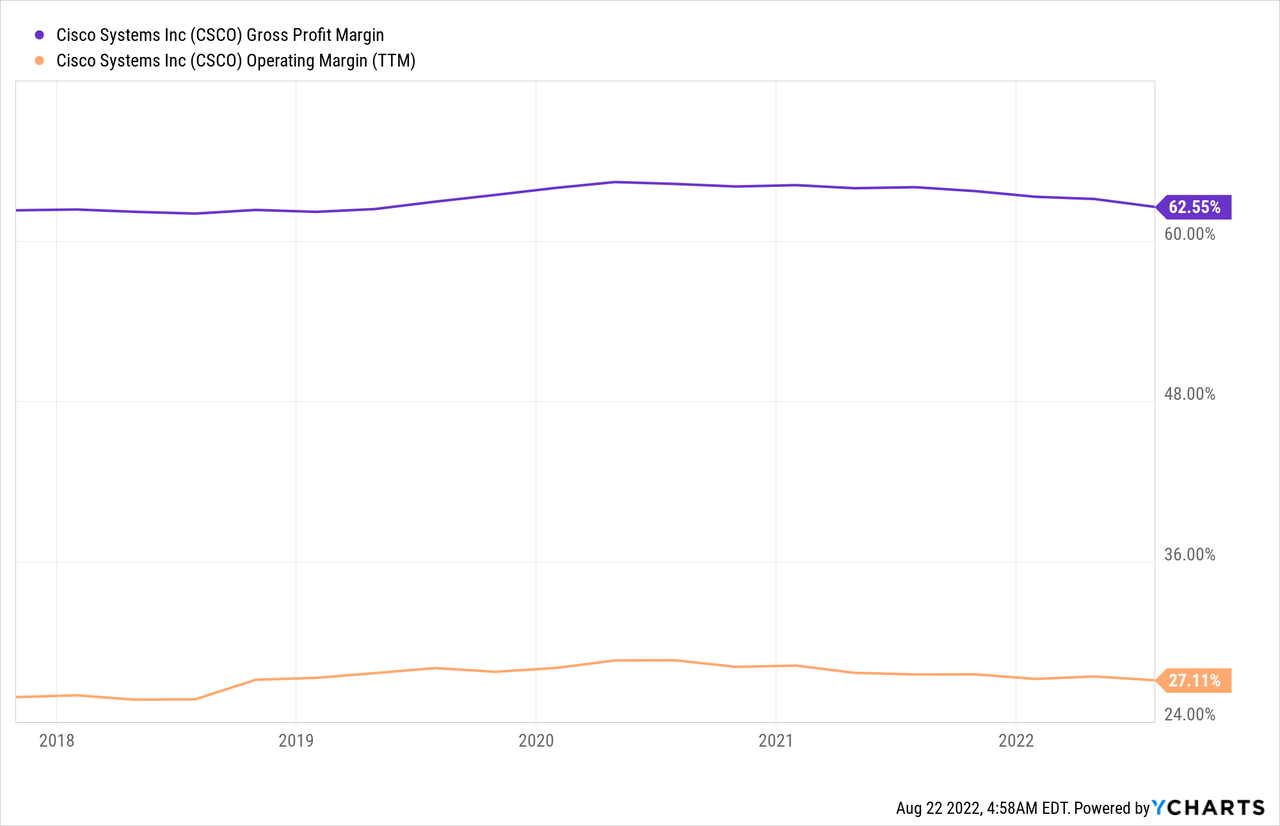

On a non-GAAP basis, The company’s total gross margin was 63.3% which was down 230 basis points year over year. Its Product gross margin was 61.3%, down 370 basis points and service gross margin was 69%, up 160 basis points year over year. The decline in product margin was due to temporary headwinds caused by higher component, freight and logistics costs.

Despite the headwinds Cisco generated Earning Per Share [EPS] Normalized of $0.83, which beat analyst expectations by $0.01. GAAP EPS was $0.68 which was inline with analyst estimates.

Cisco’s non GAAP operating margin was 32.4% which was down 110 basis points due to the aforementioned macro issues. But it should be noted this is still in line with analyst estimates and higher than the trailing 12 month operating margin of 27.11% as seen on the chart above.

Cisco has a strong balance sheet with Cash, Cash Equivalents and short term Investments of $19.3 billion. With total debt of “just” $9.2 billion which is manageable given the strong profitability.

Optimistic Guidance

Cisco’s record RPO and low cancellation rates give strong visibility into the next quarter (Q1 FY 23) and the FY 2023. Management is forecasting revenue growth between 2% to 4% in Q123. With Earnings per Share on a GAAP basis of between $0.64 to $0.68.

For the FY 2023, Revenue is expected to grow by between 4% to 6% year over year, with Earnings per Share GAAP between $2.77 to $2.88.

Management exuded realistic confidence in Cisco’s Q4 earnings call;

We expect strong performance across our portfolio, driven by our continued focus on innovation and easing of supply constraints to drive solid top line growth and profitability.

While we anticipated some moderation from the unprecedented product order growth of last year, demand signals remained solid.

We do expect to continue to experience higher costs in the short term, driven primarily by higher component, freight and logistics costs, which is reflected in our Q1 guide. However, as you’ll see in our annual guidance, we expect this margin pressure to begin to ease as the year progresses.

Valuation

Cisco is trading at a P/E Ratio (forward) of 13.8 which is 29% cheaper than the IT sector median of 19.45. More importantly, Cisco is trading 10% cheaper than it’s 5 Year P/E Ratio average of 15.33.

Cisco PE Ratio (Seeking Alpha)

Cisco is also trading at a Price to cash flow ratio of 11.89 which is a massive 37% cheaper than the IT sector median. In addition, it is ~13% cheaper than its 5 year average.

Cisco Stock valuation (Seeking Alpha)

As an extra data point Raymond James analyst Simon Leopold has an outperform rating on Cisco but lowered his price target to $59 from $63. The stock is trading at ~$48/share at the time of writing and thus it offers the potential for that gap to close.

Risks

IT spending cutback/Recession

Many analysts are forecasting a recession and thus this may cause companies to reduce IT spending, at least in the short term.

Morgan Stanley analyst Meta Marshall has a neutral rating on Cisco stock with a price target of $48/share which puts the stock at “fair value” at the time of writing. However, Citi analyst Jim Suva has a sell rating on Cisco with a price target of $44, slightly below the $48/share at the time of writing.

Final Thoughts

Cisco is an innovative company which is gradually transforming from a hardware to more software and subscription focused model. The company has surpassed analyst expectations in the most recent quarter and is undervalued relative to historic multiples.

Be the first to comment