Bet_Noire/iStock via Getty Images

Regal Rexnord (NYSE:RRX) manufactures essential products and sells them to appealing end markets. But, the company has poor financial returns, and rising interest rates may hurt product demand and its financial performance. The company is fully valued, given its performance and market state. Any market volatility in the coming weeks may provide a much lower entry point for the stock. The stock may even retest its 52-week low, giving investors a better entry point. I wrote about Regal Rexnord in November 2021, stating that the company is richly valued then and recommended that investors wait patiently before building a position. The stock was trading at $169 at that time. That was the right call, with the stock price touching 52-Week lows in the interim months. The current business environment is radically different and a much more dangerous one for the company with the global slowdown in economic growth.

Revenue Growth May Decelerate with Slowing Economic Growth

In Q2 2022, the company generated an organic sales growth of 12%, and in Q1 2022, the company achieved an organic sales growth of 15%. In the Q2 earnings call, Louis Pinkham [CEO] mentioned that they saw good order growth of 50% from the beginning of 2021 and 30% growth year-over-year. But, according to the company, the firm order growth seen in the last couple of years may moderate. The positive sign for its sales growth in the coming quarters is that the company’s end-markets – aerospace, mining, agriculture, and non-residential construction – remain strong. The company’s sales growth can continue for the next few quarters.

The company increased prices to counter inflation and expand its margins. Some of the commodity’s prices have also moderated in recent months. The company has shown a remarkable improvement in its gross margins in the past two quarters. For example, in Q2 2022, its gross margin expanded by 280 basis points, and its EBITDA margin saw an expansion of 230 basis points. The company’s gross profit stood at 32.1% in Q2 FY 2022 compared to 28.5% for 2021.

The company’s acquisitions allowed it to engineer and sell solutions instead of specific products. The solution-selling focus can increase revenue per transaction, improve margins, and enable customers to buy an entire solution to their business challenges. But, as the CEO pointed out, creating and selling solutions takes time and prolongs the sales cycle.

The slowdown in economic growth can put the brakes on demand for the company’s products in the coming months. The World Bank projects that stagflation risk has increased amid a sharp decline in growth. It expects advanced economies to decelerate from 5.1% growth in 2021 to 2.6% in 2022.

During the Q2 FY 2022 earnings call, the company boosted its earnings estimate to $10.66 per share due to the improvements in revenue growth and margins. Its 2022 EPS would put the forward P/E for the stock at 13.7. The company has traded at an average P/E of 15.7 over the past five years. The company trades at a reasonable forward EV to EBITDA multiple of 10x, which is in line with its five-year average. Given the company’s poor financial returns, the company may face higher borrowing costs compared to industrial companies with much better financial performance. The company trades at a high debt to EBITDA ratio of 3.6x.

Mediocre Financial Performance in the Face of Rising Interest Rates

The company had mediocre financial performance over the past decade. Its return on equity [ROE] has averaged 7.37% [author calculation] between 2012 and 2021, and its ROIC currently stands at just 5.1% [source: Seeking Alpha/YCharts]. The company’s weighted average cost of capital [WACC] is 10.11% [author calculation]. Regal Rexnord’s ROE and ROIC do not exceed the company’s WACC – not a good sign for future returns from this company. With rising interest rates, it will be difficult for Regal Rexnord to generate a good return on its invested capital. Many industrial companies have a much better ROE and ROIC than Regal Rexnord. For example, the companies in the Vanguard Industrials ETF (VIS) have an average ROE of 23.8%, and other industrial companies like Timken (TKR) had an average ROE of 14.6% [author calculation] between 2012 and 2021. Timken’s ROE currently stands at 16.4% [source: Seeking Alpha]. Another competitor, ITT Inc. (ITT), had an ROIC of 16.06%.

Share Repurchase and Dividends

The company spent $471 million in share repurchases between 2014 and 2021. The company has spent $184 million in share repurchases in the first six months of 2022. The company spent more than its operating cash flow on share repurchase, generating an operating cash flow of $104.9 million in the year’s first six months. The company has another $250 million share repurchases authorized by the board. The recently passed Inflation Reduction act by the U.S. Congress imposes a 1% excise tax on share repurchases. This tax takes effect beginning in 2023. So, companies will rush to increase their share buybacks during the remaining months of 2022.

The company’s total dividend payments are increasing even as it spends more money to reduce the total number of shares outstanding. At the end of Q2 FY 2022, the company had outstanding shares of 66,477,529. The company’s share count increased when it issued over 27 million shares to complete its merger with Rexnord PMC. The company has declared a per share dividend of $0.35 with a dividend yield of just 0.92%. The yield is low compared to the 1.45% yield offered by the Vanguard S&P 500 ETF (VOO). Given the company’s current cash flows and financial performance, it would be difficult for them to increase the dividend. Of course, the stock price could drop, pushing up the yield. Even if the company completes the remaining $250 million in share repurchases this year, the share count may reduce by 1.7 million or about 2.5% at the current price of $146.25 [Closing Price Aug 19, 2022] without accounting for dilution caused by executive compensation.

Wait for a Pullback Before Buying

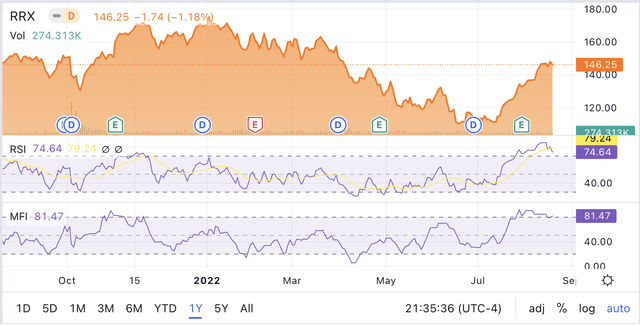

The RSI and MFI technical indicators are at overbought levels. The stock and the market have rallied strongly since their lows in July 2022. The Fed is focused on beating inflation, and it seems like the Fed may hike interest rates a few more times before the end of this year. That means this current stock rally – a bear market rally – may have ended last week, and more turmoil may be in store. Given the company’s poor financial returns, the company may face higher borrowing costs compared to industrial companies with much better financial performance. The stock could also face higher volatility in the coming weeks, given its high debt to EBITDA ratio of 3.6x. Regal Rexnord could see a pullback below $120 if volatility increases in the markets and rates continue rising. The stock’s 52-week low is $108.28.

Exhibit: Technical Indicators for Regal Rexnord at Overbought Levels

Technical Indicators for Regal Rexnord at Overbought Levels (Seeking Alpha)

Conclusion

Regal Rexnord has poor financial returns and a high debt to EBITDA ratio. The investors should pay a much lower multiple, given the poor financial performance. The rising interest rates may decelerate demand and put further pressure on its financial performance. Regal Rexnord has to prove that it can execute well in a challenging economic environment while managing its costs and improving its profitability. The current market volatility may present a better entry point for the stock. Investors should be patient with this stock.

Be the first to comment