Michael Vi/iStock Editorial via Getty Images

Investment Thesis

Over the last several months as ironSource (NYSE:IS) – which is a thriving growth company in the advertising “app economy” – has continued to drop, I have been buying as much as I can. I believe the stock has simply followed the general downward trend for growth companies since November, despite the business continuing to fire on all cylinders. In other words, just like the 2020 tide lifted all boats, the 2021/2022 tide is drowning all boats, despite not all boats being created equal.

With the stock now trading for low double digit P/E and low single digit P/S, I fail to see how a company with such a growth rate could possibly drop even further, with the stock poised to become a multi-bagger once the macro economy improves and investors become less “risk” averse.

In particular, I will show that ironSource is of similar (if not superior) quality as The Trade Desk (TTD) and Cloudflare (NET), despite being an astonishing 5x cheaper.

Background

I have previously described ironSource as my 2022 top stock: ironSource: My Highest Conviction 2022 Top Tech Stock. Investors may also check out some of the articles by other contributors.

Q1 results

In May ironSource reported its fourth earnings report since IPO. Revenue has grown from $120M to $190M in the last year, coming in at 58% growth. Note that the sequential growth from Q4 to Q1 was 20%. Indeed, the growth rate re-accelerated from 46% in Q1. (Although management apparently expected this result more or less, as the Q1 guidance was up to $185M, so the “beat” wasn’t as large as in Q4.)

Just from these numbers, there are already several things to observe. First, any business growing at 58% is a healthy business. Of course, some companies only grow for a few quarters at such a rate, but ironSource’s multi-year track record is impeccable. Secondly, the reacceleration in the growth rate (the quarter-on-quarter comparison) is especially encouraging as this shows the most recent demand trend for the company’s products.

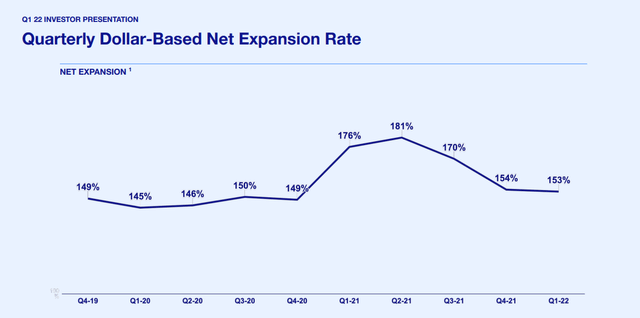

One of the things that has further attracted me to the stock has been ironSource’s incredible and world-class net retention, coming in at 153% in Q1, which demonstrates the stickiness of the company’s suite of products and ability to cross-sell new products to its customers. Customers with over $100k in revenue grew 36% to 397.

Note that net retention is a backwards looking metric, though. For example, DocuSign (DOCU) has seen a quite severe drop in net retention over the last few quarters.

Guidance

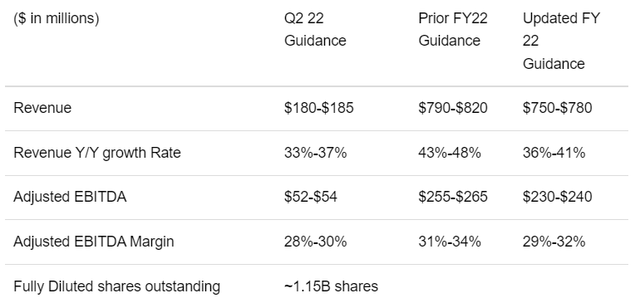

The issue that investors had with ironSource, which led to further downside in the wake of the Q1 report, was the guidance that has been revised downwards.

The Q2 guidance is sequentially slightly down, bringing the growth rate in half in just one quarter. The full year guidance has also been decreased a noticeable amount (~5%).

The guidance was based on reports from its customers (in casual gaming) regarding uncertainty over the macro environment in the second half of the year, as well as some post-COVID digestion. Nevertheless, management also has repeatedly said it didn’t see anything in its own KPIs yet. Hence, the new guidance seems to be the case of management being very prudent.

Note also that ironSource remains a very profitable company (despite as a growth company prioritizing growth), with historical EBITDA margins around or above 30%. ironSource’s long-term goal is over 40%. While this is not quite at for example Microsoft’s (MSFT) 50% margin, Microsoft’s growth is vastly lower, but also comes with a P/S valuation that is 3x higher at about 9x.

Opportunity

ironSource’s business is currently mainly based on the gaming apps. ironSource sees an opportunity to expand its platform to many other verticals beyond gaming. Secondly, Aura is currently just 10% of revenue, with ironSource targeting 20-25% of revenue long-term. Thirdly, ironSource continues to launch new products (both organically and acquisitively), such as a recent marketing product launch. Lastly, ironSource sees a lot of opportunity to continue to expand revenue from its current customers.

ironSource sees a $50B TAM, with a large part coming from the Luna marketing platform.

Valuation

Based on Seeking Alpha data, ironSource trades for about 13x P/E and 3x P/S (both forward values). For a software company, these kinds of valuations are extremely cheap. Arguably, a business with these figures would very likely have been priced at 10 to 20x P/S in 2020. Indeed, some other companies like Cloudflare and The Trade Desk still trade at such multiples. This means that ironSource is on the order of 5x less expensive.

This means multiple expansion alone provides a very large upside. Obviously, in the current environment these multiples are unrealistic (as SaaS multiples have now dropped below the multi-year mean), but the stock is currently priced like it isn’t growing at all. Just imagine you’re doing groceries and you have the option to buy one Cloudflare or five (5!!) ironSource shares for the same valuation. Some might say something like that Cloudflare provides more assurance for long-term growth, but ironSource has actually a stronger record, see below.

So in one scenario, at a 30-40% growth rate (well below its historical growth rate and net retention rate, but in line with the current guidance), revenue will double in 2-3 years. If there’s additional multiple expansion, then there would be even more upside. In that case, the stock could easily be a 4-bagger or more.

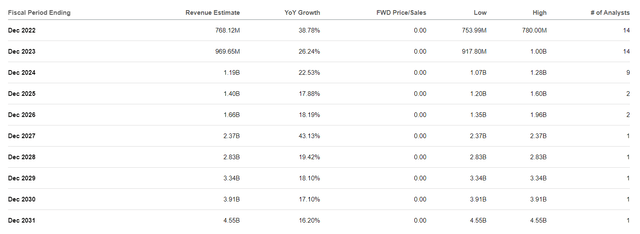

For example, given ironSource’s growth and profitability, it doesn’t seem unreasonable to slap a 10x P/S target on the stock. In that case, in order to become a 10-bagger, ironSource would need to grow its revenue to its current market cap of $2.6B. Although maintaining a high growth rate at the billion dollar scale becomes more difficult, the Seeking Alpha page shows an example of estimates by one analyst.

ironSource vs. Cloudflare vs. The Trade Desk

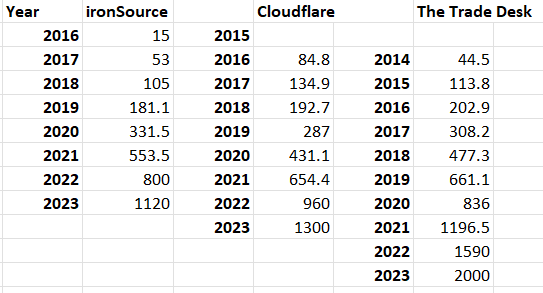

In order to provide some more substance for the comparison against TTD and NET, I have compiled following table. It is bit busy, but it should make sense.

Own work

What is shown below are the historical and projected growth rates of these three companies. But then I have aligned them so that they start roughly at the same revenue scale. For example, TTD had $114M revenue in 2015, Cloudflare had $135M in 2017 and ironSource had $105M revenue in 2018. All three are horizontally aligned in the spreadsheet.

Fast forward, and in five years ironSource will have grown revenue by 10.7x (2018-2023), Cloudflare by 7.1x (2017-2022) and The Trade Desk by 7.3x (2015-2020). This implies that in five years, ironSource has grown by an amount that took the other two about six years to accomplish.

In conclusion, ironSource is proving to have faster multi-year growth as when these two other companies were at a similar scale. If these trends continue, ironSource may even overtake Cloudflare in revenue in a few years. Although Cloudflare hasn’t guided down for 2022, ironSource has consistently been closing in on Cloudflare’s revenue over time. Meanwhile, the comparison against The Trade Desk suggests that if the current trends continue, ironSource may also reach a multi-billion dollar scale in a few years. Of course, TTD and IS have vastly different businesses (one is a software company, the other an advertising company), so the comparisons are merely illustrative.

In any case, the point here is that given the choice between buying one piece of NET or TTD, or five pieces of IS, then ironSource wins by a landslide given that the business has proved to be of similar quality over time, yet trades at a staggering 5x lower valuation.

Investor Takeaway

Regardless of the macro environment, the overall long-term trend of ironSource’s business is quite clearly up and to the right. To that end, ironSource just reported a 58% YoY growth quarter (20% sequential growth) as proof point. While the revised guidance may be a bit disappointing to some, management is clearly taking a prudent approach by lowballing expectations (which some would call a kitchen sink quarter) in anticipation of a more challenging second half of the year.

When it comes to the stock, I like to buy stocks while they’re cheap, and in that regard I have not come across many companies that are growing at such an elevated clip, yet trade lower than many value stocks, as if ironSource isn’t going at all. Obviously, it is impossible to predict exactly how much ironSource will grow over for example the next 10 years (the company has grown revenue by over 10x in the last 5 years), but the current valuation leaves a very wide margin of safety. To be specific, ironSource seems to be 5x cheaper than comparable peers TTD and NET. Investors should take advantage of this opportunity.

Be the first to comment