They Made What Over The Last 5 Years? Nils Jacobi

Our article on Eagle Point Credit Company Inc. (NYSE:ECC) was received with all the enthusiasm of a wet blanket, and investors found innovative ways to not acknowledge reality in the comment stream. You might disagree with the thesis, but you won’t ever blame us for a lack of clarity on where we stand.

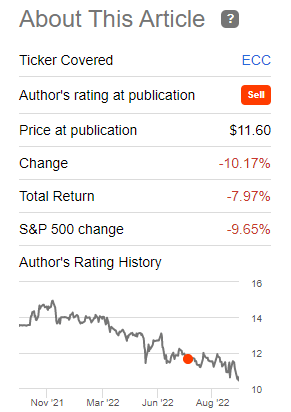

What ECC and CLO indices do in that time frame is to be decided, but we would not be expecting total returns anywhere in the ballpark of that 14.4% yield. This total return for ECC also is likely to face the massive headwind of premium compression. If we trade at or below NAV in a recession, it would be hard to avoid negative double-digit returns. We rate the shares a sell.

Source: The Story Of 1% Adjusted Total Annual Returns For 5 Years

Despite the premature celebrations on ECC declaring a special distribution, the fund did indeed go in the direction we expected.

Returns Since Last Article

Today, we will go over where the CLO market stands and update our outlook for ECC.

Credit Stress

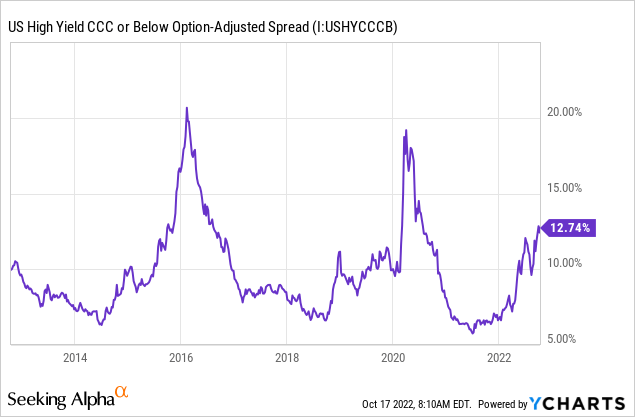

The US High Yield CCC or below Option Adjusted Spread index is a good proxy for generalized junk level stress. This initially moved lower, right after our article was released and has now pole vaulted to 12.74%.

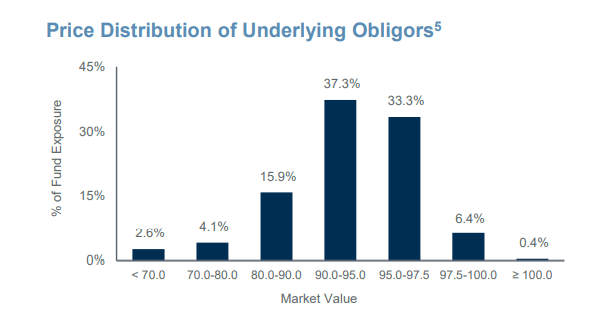

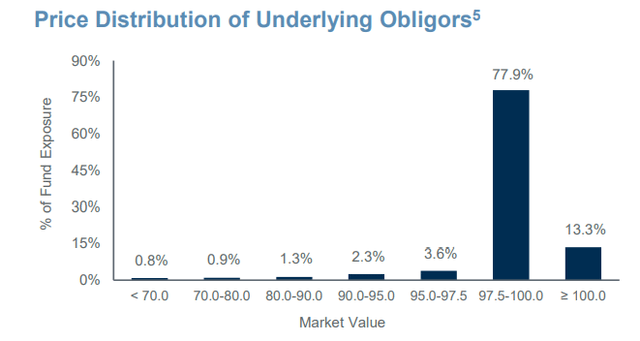

Our reflection on this tells us that this is well suited for the current conditions and is pricing current problems quite well. This is very different than the comatose conditions in late June 2021. Back then we were pricing for no defaults till 2030 and bidding premiums on (PTY) all the way to 30%. We expect this pricing is also well reflected in the ECC holdings, with only 6.8% of the holdings being priced above the 97.5 mark.

ECC Sept 2022 Update

In January of this year, we were at 92.2% for the same benchmark.

The fund is well set up here if we don’t hit a recession as we will see a very good recovery in prices. Of course, our base outlook still continues to be for a recession, so we don’t think you are getting a spectacular deal here with ECC.

Recent Performance

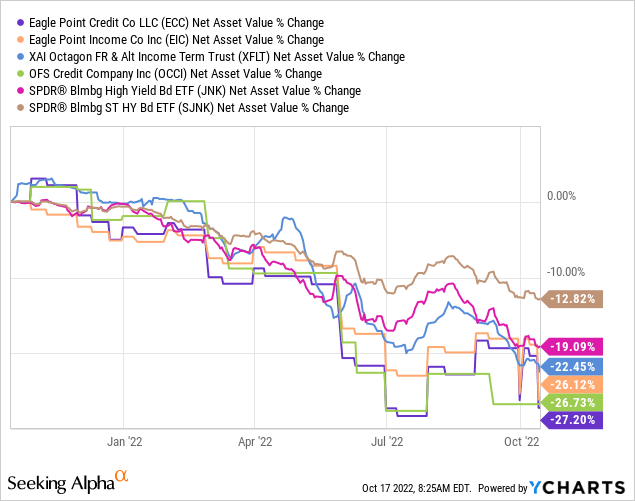

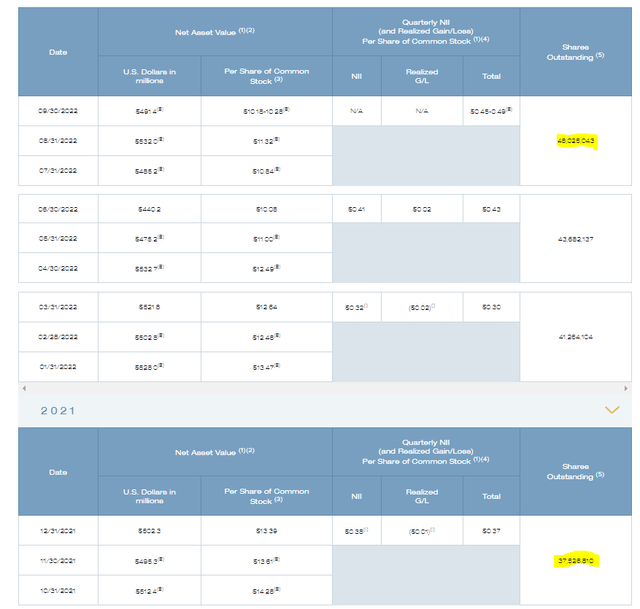

Over the last 1 year, NAV has dropped 27.20%, and that has been in line with other CLO funds like XAI Octagon FR & Alt Income Term Trust (XFLT), Eagle Point Income Company (EIC) and OFS Credit Company (OCCI).

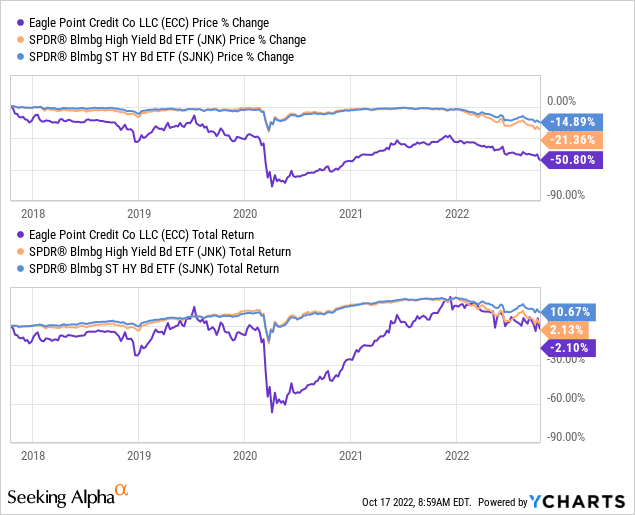

We threw in SPDR Bloomberg High Yield Bond ETF (JNK) and SPDR Bloomberg Short Term High Yield ETF (SJNK) to show how hard CLO funds have been hit. ECC’s NAV drop would have been worse, had it not been for issuance of about 10.5 million shares above NAV.

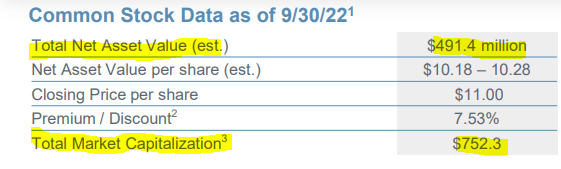

Since ECC’s premium is modest, this funding adds just a little bit to NAV per share. The bigger thing it does do is prevent forced selling of CLO assets to pay the very large distributions. This is not a minor benefit for a leveraged company. Net assets were $491.4 million, but total assets were $752.3 million.

ECC Sept 2022 Update

If you envision a climate where $120 million of equity could not be raised, total assets would have to move $200 million lower. That would be some very high pressure selling. Even ECC’s secondary securities, like Eagle Point Capital 6.6875% Notes (NYSE:ECCX), Eagle Point Credit Company Inc – 6.75% NT REDEEM 31/03/2031 (ECCW) and Eagle Point Credit Company Inc – 5.375% NT REDEEM 31/01/2029 (ECCV) have strong coverage requirements and could trigger selling. For now, the equity window remains open for all these CLO funds and that prevents a downward spiral.

Total Returns

Over the last 5 years, ECC has delivered price returns of Negative 50.80% and total returns including distributions of Negative 2.10%. This compares to price returns of Negative 14.89% for SJNK and Negative 21.36% for JNK. Total returns for SJNK were at Positive 10.67% and JNK at Positive 2.13%.

The leveraged loan index from S&P delivered a positive 13.87% in total returns over the last 5 years. None of this information should be shocking to anyone following the math and the longer-term performance of CLOs and junk. It might come as a surprise to people suggesting that CLOs can comfortably deliver double-digit total returns in all environments. Just like with XFLT, though, the current price drop is welcome and improves the probability of better returns for ECC.

With ECC holding predominantly CLO equity (compared to a lot of higher-tier ones for XFLT), we are not ready to upgrade this to a hold rating just yet.

The Two Big Hurdles

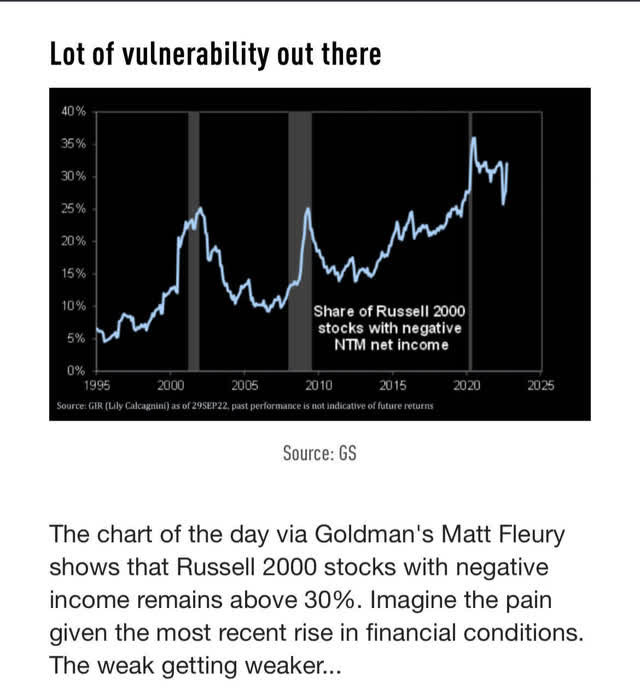

One primary reason we did not drink the CLO Kool-Aid was the chart below.

This will take time to work itself out and in the interim, CLOs will likely deliver poor to extremely poor, total returns.

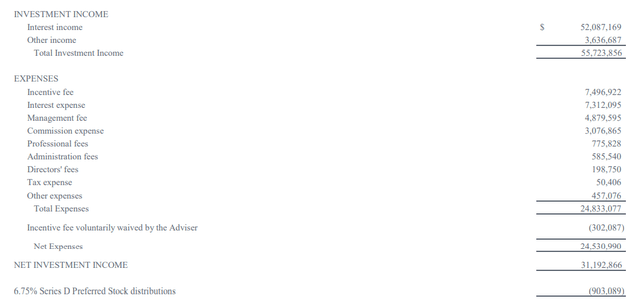

The other big hurdle remains the expense ratio. ECC’s June 2022 run-rate was at about $50 million annualized, including the preferred share distributions.

That works out to about a 10% expense ratio on the approximate $500 million in net assets. So shorter-term movements aside, we think total returns will still be negative 12 months out and are maintaining a sell rating at this point.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment