luza studios

Bitcoin-related stocks have been on a wild ride in recent months. The coin itself remains fairly weak, as rally attempts are having varying amounts of success, and the miners are following suit. Some are seeing bigger rips than others, whether based on short interest, technicals, or fundamental factors. However, one Bitcoin-related stock hasn’t participated, and that’s Soluna Holdings (NASDAQ:SLNH).

I’ve profiled Soluna before and at the time, I said I liked Soluna more than the other Bitcoin-related stocks I looked at. That was back in February, and let’s just say a lot has changed in the interim. Bitcoin went into full meltdown mode since then, and Soluna has been obliterated. It’s worth taking a look, then, to see if the thesis for Soluna has fallen apart, or if this beat down is a chance to buy it cheaply.

Let’s start with the chart.

There’s no way to sugarcoat this, so I won’t; Soluna has been destroyed. Before we look at this chart, I’ll note that when I post a chart to my subscribers, I always note levels to place a stop loss as a way to limit risk. What you don’t want is to buy something and then ride it down 60% or 70%, which is what Soluna has done since early this year. We must always manage risk, and doing so can help avoid bag holding.

Now, if we look at Soluna’s price action we see a stock that is firmly in a downtrend. This isn’t the kind of chart I would normally want to buy because there is no near-term catalyst for an up move. When I look for stocks for my subscribers or myself, I want a stock that is near support or some other sort of catalyst to move higher. I don’t see that with Soluna, particularly since it reported earnings last week and was destroyed by investors. However, for a longer-term hold (as opposed to a trade), I think the value proposition here is quite compelling. More on that in a bit but let’s finish up the chart discussion first.

I’ve highlighted on the price chart the positive divergence I’m seeing when connecting the June and August lows. That essentially means price is moving down while the momentum indicators are moving up, and that’s important because we can use divergences to spot tops and bottoms. Divergences are not guarantees, but they often portend trend changes. In this case, the trend is down so if this positive divergence is right, the downtrend may be at or near exhaustion.

The lines I’ve drawn on the 14-day RSI and PPO are the signs you want to see for a positive divergence. Momentum is moving steadily higher despite very weak price action, and as mentioned, that can often mean the trend is changing. We’ll see, but this has the look of seller exhaustion. This is particularly true given the enormous tail on last Thursday’s candle. The stock finished Thursday something like 35% higher than the low of the day, and I’ll be honest, I’m not sure I’ve seen a tail that huge on anything before. That means the stock was obliterated but found buyers, and in a big way. In concert with the positive divergences, we just might have seen the bottom printed following the earnings report.

Let’s now take a look at the fundamentals and that value case I mentioned earlier.

Still growing despite near-term challenges

As with most Bitcoin-related stocks, Soluna is still very much in its growth investment stage. That requires some faith as an investor, because it isn’t like we can value the company on earnings, because there aren’t any. Still, if you believe in the long-term prospects of the business, it’s cheaper now than it has ever been. If you don’t, well, I suspect you wouldn’t still be reading this.

Soluna reckons it has something like a $1 billion revenue opportunity, which is based on a 2GW total market, and various other assumptions about Bitcoin price and other factors. Given the company’s at a run rate of ~$35 million today, a billion dollars seems extremely ambitious, so I’ll ignore that for now. The point, however, is that Soluna’s model can work for a variety of applications, just one of which is Bitcoin mining. That means the runway is very long and while I’m not sure about a billion dollars of revenue, I do think Soluna can be many times the size it is today. There are nearly endless applications to companies needing computing power for things like pharmaceutical research, video processing, and of course, crypto mining. Soluna is crypto-heavy today but it doesn’t have to stay that way, and that’s part of the appeal.

Second quarter results were challenged to say the least, as the company continues to grapple with lower Bitcoin pricing. We can see revenue actually declined against Q1, which I suspect is a big reason why the stock was destroyed. This is a growth story, so if there is no growth, there is no story. Now, revenue was 5.2X what it was in the year-ago period, so that’s certainly representative of growth, but know that if you own this stock and the company reports declining revenue again, look out below. The reaction to the Q2 report was Wall Street signaling zero confidence in this company’s ability to execute, and if it happens again, it could get cut in half from these levels very easily.

The good news on the revenue front is that revenue declined much more slowly than the price of Bitcoin and that there were one-time factors that produced lower revenue, such as the outage at the Marie facility. Still, we need to see more than this for Q3.

On the margin front, the company highlights cash contribution on an adjusted basis was about flat to the past two quarters despite lower Bitcoin pricing. That’s fine, but adjusted EBITDA was well off the prior two quarters. Soluna says it’s due to lower Bitcoin pricing and higher SG&A costs and growth investments, but again, it appears to me Wall Street isn’t believing in the story. The opportunity for us as investors is to take the other side of that because if – and it’s a big ‘if’ at this point – Soluna can pull it together, the stock is extremely cheap. In other words, the stock is being priced as though there is massive execution risk, so if the company does come through, the reward should be huge.

If you want to ignore the noise of Bitcoin pricing, this is a very useful way to view the company’s growth. BTC-equivalent mining continues to soar, up 18% sequentially in Q2 and 7.5X the prior year comparable period. Average hashrate was 39X year-over-year and +25% sequentially as well, so there’s a lot to like here. There are a lot of catalysts for this growth to continue as the company operationalizes new facilities and optimizes existing facilities, so all looks good there. The problem so far, however, is that this isn’t translating directly to financial success, which is why the stock is $3.

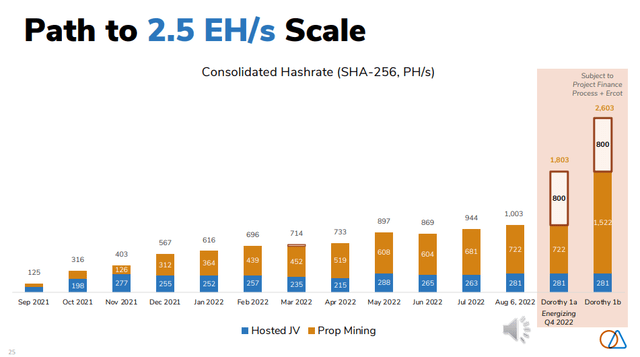

The company saw a peak of 1 EH/s in Q2, although the average hashrate was about two-thirds of that. Going forward, after the company’s Dorothy facility is up and running, it believes it can have 2.5 EH/s, which would go a long way towards boosting revenue and margins. Computing power is all about scale and Soluna hasn’t achieved scale yet. All indications are that it will – or that it at least has a good chance to – but for now, this takes some faith. I’ll say this; if Soluna can get to 2.5 EH/s, the stock should be much higher than it is today, because I think it’s extremely cheap without any future growth.

About that valuation…

I’ve mentioned the valuation a few times, so let’s dig in and see what I’m on about. The first thing about the valuation I want you to know is that one big wildcard with Soluna is the share count. Like many other growth-stage companies, Soluna has been diluting shareholders in order to raise capital. The company’s share count is up ~50% just since the end of 2020, so the struggle is real for shareholders. That means that Soluna’s earnings/revenue/whatever else must increase by 50% just to breakeven on a per-share basis. So long as Soluna continues to dilute shareholders, this will be an uphill battle. The balance sheet is pretty clean at this point because Soluna is diluting shareholders to fund itself, rather than taking on lines of credit, long-term debt, etc. I generally don’t like companies that dilute shareholders into oblivion, so that’s something you must make peace with if you’re going to own Soluna.

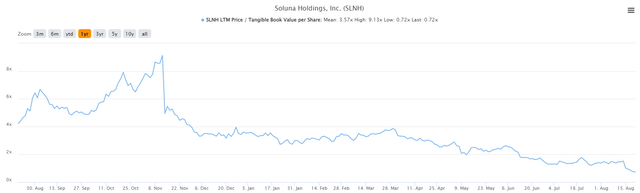

Now, Soluna has no earnings so let’s instead take a look at the company’s value through price-to-tangible book value and price-to-sales. We’ll begin with the former.

Soluna, following its shellacking last week, is trading for 72% of its tangible book value. Now, traditional book value is – in my opinion – a pointless metric because companies can load their balance sheet up with goodwill and other “assets” that aren’t actually worth anything. However, tangible book value means there are tangible assets (hence the name) that could be monetized. This gives a true sense of the value of the company’s assets, and Soluna is trading 28% below its theoretical liquidation value. That doesn’t by itself make the stock a buy, but it sure is interesting if you like the stock long-term. The average P/TBV multiple in the past 12 months is 3.6X, and we’re at 0.7X today.

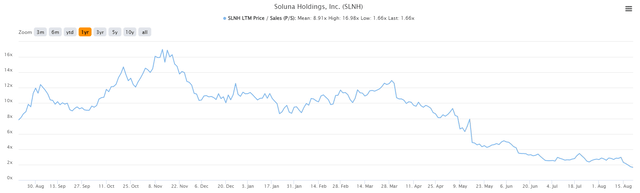

On a price-to-sales basis, the stock is also as cheap as it has ever been. Today’s multiple is 1.7X, versus an average in the past year of 8.9X.

Again, a stock being cheap is not reason enough on its own to buy it, but with the other factors involved, it looks to me like Soluna has been punished enough for its sins.

Final thoughts

If we sum this up, we have a stock that has been absolutely destroyed in the past few months, with the worst of the damage coming off of a weak earnings report. That’s not something you want to ignore as an investor, but there are reasons for optimism.

First, Bitcoin pricing has stabilized in the low-$20k area. If it remains there, or especially if it moves higher, Soluna and other Bitcoin-related stocks should move in sympathy.

Second, Soluna’s tail on the candle last week on earnings day was epic and is likely indicative of a bottom. In concert with the positive divergence I noted earlier, there’s reason to like the stock on seller exhaustion.

Third, the valuation is simply too cheap to ignore, both on P/TBV and P/S. If you think Soluna’s model can work over the long-term, I can’t imagine a better time to buy than when it’s trading for 72% of liquidation value, and a trough P/S multiple. That doesn’t mean it cannot get cheaper, because it certainly can, but from a risk/reward perspective, it’s hard to imagine a better setup.

All in all, I think the risk here is to the upside. Soluna is struggling with factors outside of its control at the moment, but importantly, is on track to achieve its growth goals for additional capacity. If those goals can be achieved, and Bitcoin doesn’t crash to new lows, we could see Soluna a lot higher than $3. This one is speculative so please don’t go meme-stonk style and re-mortgage your house to buy it. Keep risk in mind and size positions accordingly.

Be the first to comment