Pekic

My base case is that we are on the precipice of a recession, probably one that is arguably by design and is triggered by the Fed’s determination to combat inflation at all costs. In my base case, there will be employment losses and not just from already announced tech-related job cuts but mainly due to the freezing of the housing market exacerbated by persistent mortgage rates that are well above 7%. Wherever the U.S. housing market goes, so does the global economy and unfortunately, it is likely going south.

Both SoFi Technologies (NASDAQ:SOFI) and LendingClub (NYSE:LC) are FinTech/digital banks whose business models include material exposure to unsecured personal lending. Needless to say, in a recession with employment losses, this business model is challenged. Unlike, the large and regional U.S. banks, both SoFi and LC are not benefiting from higher interest rates or trading volatility that compensate these banks for credit losses. So these digital banks need to carefully navigate these challenging macro settings and prove that they will not only survive but thrive as the economy recovers.

There are two key challenges and fears currently:

- Both these firms rely on investors/partners to buy some of the loans they originate. Due to interest rates and fears of a recession, investor risk appetite is waning and many are on the sidelines. As the Fed raises rates and there is a lag in repricing the assets’ yield, the net spread for investors is compressed especially if these investors rely on market interest rates to fund the loans.

- There are uncertainties on whether loan losses will be outsized in the forecasted recession. It appears that recent origination tranches are already seasoning in line with pre-pandemic models, in other words, after a long benign period, credit losses are normalizing. It will likely get worse if/when unemployment climbs.

The good news is that the share price of both SoFi and LC reflects these challenges somewhat. However, the details matter, and in this article, I will compare and contrast both firms positioning in light of the recession that I expect.

SoFi

The reaction to the Q3 earnings report was telling. Initially, the stock rallied 20% before giving it all away and more. The retail investors were puzzled as, on the face of it, SoFi delivered a strong beat with “adjusted EBIDTA” growing strongly and guidance wasn’t that bad either.

There were at least five bullish SA articles in a row (for example, here) stating that SoFi has “decimated the bear case”. And that the share price decline was a “bear raid” and Wall Street manipulation, etc.

The key point, however, that most of the retail folks missed are that it was a low-quality beat. In fact, SoFi has been accumulating significant risk on the balance sheet to the tune of ~$7 billion in personal loans and surprisingly without booking any reserves for it given its accounting classification as Held for Sale (“HFS”). In other words, most retail investors have missed the fact that SoFi is not a predominantly unsecured personal lender just as we are probably entering a recession. This article explains this issue in great detail.

Notably, the SoFi bulls have countered my article by suggesting that SoFi will be selling down this exposure quickly and that I am blowing this out of proportion. Well, now that the 10-Q has been published, I will demonstrate why I believe that the bulls are misguided and SoFi is likely to hold the personal loans for much longer than expected. So in other words, some SoFi shareholders are not really understanding the credit risks it faces now compared to its pre-banking charter days.

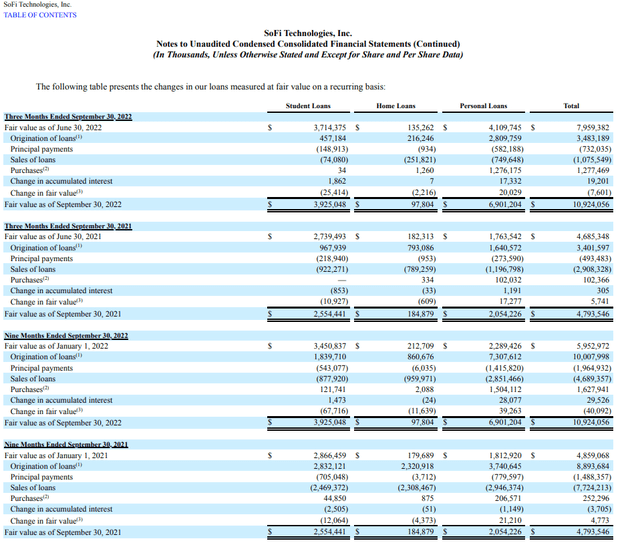

Consider the below table from the 10-Q:

SoFi 10-Q

A few observations from the above:

Firstly, it is clear that SoFi is now (by assets) a predominantly unsecured personal lender with EOP loans outstanding of $6.9 billion. This has also driven a large proportion of the year-on-year revenue growth, as highlighted in the 10-Q:

Loans interest income increased by $101.7 million, or 113%, primarily driven by increases in non-securitization personal loan and student loan interest income of $94.1 million (202%) and $10.0 million (43%), respectively, which were primarily a function of increases in aggregate average balances for personal loans and student loans of $2.9 billion (179%) and $1.2 billion (57%), respectively. The personal loan average balance increase was primarily attributable to higher origination volume combined with a higher weighted average interest rate earned on whole loans and longer loan holding periods.

Secondly, it appears that loan sales have decreased significantly year-on-year as well as sequentially. And more importantly, it appears that SoFi had repurchased $1.26 billion of loans that they previously sold to investors. So on a net basis (purchases less sales of loans) has added on ~$500 million of loan assets.

In essence, it appears that SoFi is (perhaps quite intentionally) materially increasing the personal loan assets on its balance sheet and intend to hold personal loan assets for longer than previously. The reasons for this could be its lower cost of funds now as a bank and that it wants to continue to generate NII from holding these assets. It is also clear, though, from the market that investors’ appetite for these assets is waning in light of higher interest rates and recession fears. This message has also come through LC 3Q earnings calls.

It seems, though, that it is holding assets for longer and longer as confirmed by the Q3-2022 earnings call transcript as opposed to selling these assets (as you would expect from HFS assets):

Chris Lapointe

Yes. So what I would say is our strategy hasn’t changed. Given the flexibility that we now have with the bank, we’re able to hold loans for a longer period of time. And that was certainly something that we did in Q3 as well as Q2.

What I would say is having the bank provides us with sufficiently additional flexibility and a new source of funding which allows us to grow that balance sheet and hold loans for a longer period of time. There are a few ways that we can grow loans on the balance sheet and generate net interest income. We can either originate, which has been the primary source of driving volume in terms of personal loans, but we can also repurchase loans.

Whatever the reason may be, whether it is a change of strategy or the investors remaining on the sidelines, the outcome is very clear – SoFi is now holding large balances of unsecured lending for longer.

So what if SoFi will hold these assets for longer?

Well, the concern is that SoFi is not taking any reserves for these since it is classifying them as Held For Sale (“HFS”).

This issue (and concern) is explained in the attached article:

With the company currently in transition to deposit-based funding, Wedbush’s David Chiaverini thinks the two major concerns’ weighing on investors’ minds and impacting sentiment are: “1) the switch to held-for-investment (HFI) accounting for SOFI’s loans from its current practice of holding loans as held-for-sale (HFS) could ultimately weigh on EPS as this switch should ultimately lead to higher loan loss provisioning (LLP) in accordance with CECL (current expected credit loss), and 2) the sustainability of gain on sale income and hedging gains is being called into question given these hedges appear to be over-earning relative to origination levels.”

Chiaverini addresses both these issues. As for the former, while the analyst admits the move to HFI accounting could “weigh” on EPS, he notes that talks with the company suggest it does not plan on moving to HFI accounting “anytime soon.” There is no restriction for the timeframe when HFS loans must be sold, and so long as a company shows it plans to sell at some point in the future, it is able to “designate” loans as HFS. During its deposit funding transition, SoFi’s plan is to lengthen the timeframe in which it holds loans – from its previous practice of holding them for 3 months to 6 months. “In theory,” notes Chiaverini, “SOFI could extend this timeframe indefinitely as long as it intends to sell the loans prior to maturity.”

Now anyone with a banking background dealing with credit risk will know that credit events manifest as loans season, rarely do they occur in the first few months of taking a loan. Now if SoFi holds these loans for longer, say 9, 12, or 18 months, material loan losses will become much more visible later on. Clearly, if a recession happens, then all bets are off. To provide some numbers around this, in a normal economy (say pre-pandemic conditions), the lifetime losses on such loans (given the SoFi portfolio) are expected to be in the range of ~$500 million. If a recession takes place, this number will be much higher. As a point of reference, LC recognizes upfront an equivalent reserve at a coverage ratio of ~7% for a similar FICO portfolio.

Personally, I do not believe SoFi will materially sell down its personal lending balances for two reasons. Firstly, if it does, that will impact its NII revenue line and therefore will materially slow growth in “adjusted EBITDA” terms. Secondly, even if it does want to do so, currently there is no sufficient investor appetite to buy these loans at par. The evidence clearly points to the fact that SoFi is making net repurchases as opposed to selling down loans. If these were so attractive now, why would investors sell them back to SoFi?

Now, let’s switch to the non-NII revenue line in the lending segment as per the 10-Q commentary.

An increase of $43.8 million (53%) in personal loan origination and sales income, which was attributable to increases of $45.8 million related to personal loan interest rate swap positions primarily driven by increases in interest rates, and $26.9 million related to fair value adjustments primarily driven by higher origination volume in the 2022 period. These increases were partially offset by $21.8 million higher loan write offs, which were primarily attributable to a higher average loan balance and elevated charge off rates in the 2022 period.

It appears that effectively all of the revenue growth and some (~$46 million) is attributable to the interest rate hedging activity as opposed to sell-down activities. If interest rates stabilize or reduce, then this will not be a recurring item or potentially reverse. Interestingly “elevated charge-off rates” are beginning to show despite the young age of the portfolio.

LendingClub

Understanding LC financial disclosures are relatively straightforward. Firstly, it reports on a full GAAP net income basis including all expenses, share-based compensation, and depreciation costs. SoFi reports an “Adjusted EBITDA” number that excludes most of these items.

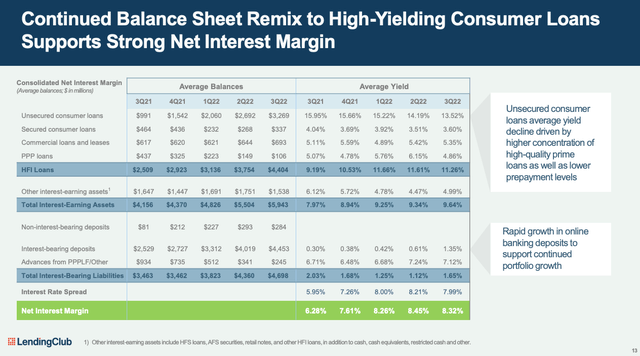

Secondly, it treats personal loan assets as Held For Investment (“HFI”) and therefore, recognizes on day one lifetime expected losses under the prevailing CECL accounting standard. LC’s current loan assets portfolio is shown below:

LendingClub Investor Relations

A few observations:

Firstly, and similarly to SoFi, LC is predominantly an unsecured personal lender as well as selling ~75% to 80% of loans originated through its marketplace. In recent quarters, LC has been de-risking the portfolio ahead of what is expected to be a challenging macroeconomic outlook. As such, the retained portfolio now has an average of 730 FICO score (higher quality borrowers), and as such the average yield has decreased from ~16% to ~13.5% year-on-year. LC, over its 16 years of existence, has originated in excess of $80 billion of personal lending and has the experience of managing through various credit cycles. During the pandemic, the loan loss outcomes delivered by LC were 30% to 50% better than the industry average.

In the current environment, marketplace revenues (non-interest income) are challenged and down 15% quarter-on-quarter. This predominantly reflects the impact of rapidly rising rates where the cost of funds for certain investors is calculated based on the expected yield curve (i.e., factoring future Fed hikes) whereas the gross asset yield is only repriced with a significant lag. As such, certain marketplace investors are on the sidelines until the Fed pauses and credit card interest yields are reset. Given the recession expectations, investors are expected to remain cautious in the interim until the outlook is clarified. This will likely play out over several quarters and well into 2023.

LC’s response is to lean on its balance sheet and add high-quality assets. It is increasingly focused on existing LC members, as the loan loss outcomes are proven to be superior for these customers and the marginal cost of marketing is close to zero. LC is also managing costs conservatively, for example, in Q3 marketing costs have reduced from $62m in the second quarter to $45m in the third quarter.

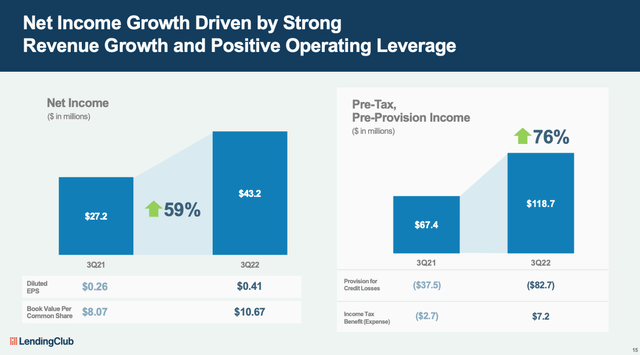

The below slide demonstrates the solid results achieved in Q3 by LC:

LC Investor Relations

As can be seen, LC in Q3 is solidly profitable with net income of ~$43m. Interestingly, the $118.7 million pre-tax pre-provision income metric can be compared to SoFi’s “Adjusted EBITDA” metric (although needs to add depreciation and share-based-compensation as well) – on a back-of-the-envelope calculation, an apple-to-apple comparison to SoFi for Q3 would translate to LC having an “Adjusted EBITDA” of ~$140 million.

Final thoughts

LC should fare better in a recession for several reasons. Firstly, and most importantly, it is appropriately reserved whereas SoFi has not reserved at all on the basis that it “intends” to sell the loans prior to maturity.

Secondly, LC is operating from a position of strength with a much superior unit of economics including lower cost of deposits, higher-yielding assets (albeit slightly lower FICO score), and a much leaner cost base (e.g. marketing costs are less than half SoFi’s). Consequently, LC is profitable on a GAAP basis in spite of loan loss provisions that are recognized upfront for lifetime expected losses. Finally, LC has a decade-plus proven expertise in managing credit risks that resulted in 30% lower loan losses than the industry average. SoFi’s credentials currently remain unproven in the unsecured personal lending space.

To be fair, I also like SoFi’s diversified and multi-product business model and I believe, that in the longer term, it will be successful. There is a place for both LC and SoFi, in my view, in a portfolio. My preferred name though is LC, for the reasons mentioned in this article.

Be the first to comment