PeopleImages

Let food be thy medicine and medicine be thy food.”― Hippocrates

Today, we take a longer look an interesting small cap, dietary supplement maker. The stock has been thrashed since early 2021, but the company is pushing towards cash flow break even status and the stock has picked up some recent insider buying. An analysis follows below.

Company Overview:

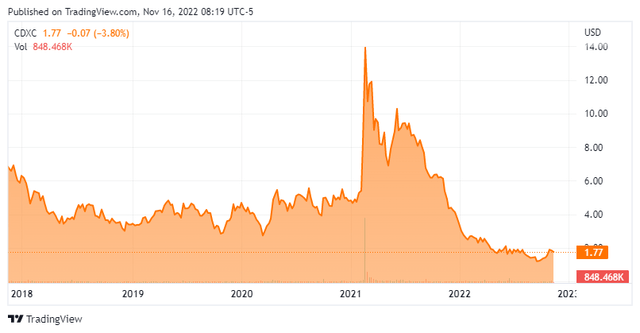

ChromaDex Corporation (NASDAQ:CDXC) is a Los Angeles-based commercial-stage bioscience concern focused on the development of dietary supplements that promote healthy aging. The company is essentially a one-product wonder, selling a proprietary form of nicotinamide riboside branded as Tru Niagen in 15 countries. ChromaDex was formed in 1999 as a quality verification and analytical chemistry business for food and food-related products and went public in 2008, when it reversed merged into mining concern Cody Resources. Its stock’s first trade was conducted at $11.70 a share, after giving effect to a reverse 1-for-3 split in 2016. ChromaDex metamorphized to a consumer product concern in 2017 when it purchased Tru Niagen maker Healthspan Research and subsequently divested of its legacy assets later that same year. Shares of CDXC trade around $1.75 a share, translating to a market cap of approximately $135 million.

Nicotinamide Adenine Dinucleotide, Nicotine Riboside, and Tru Niagen

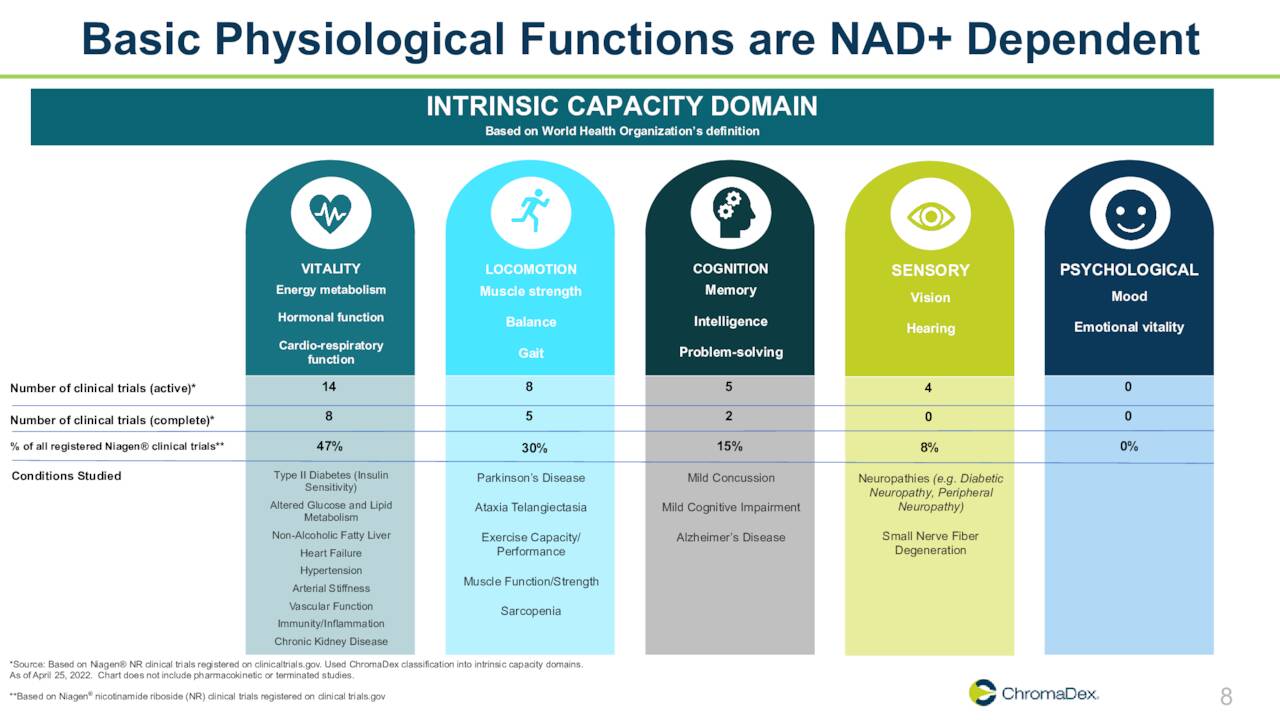

The main ingredient in Tru Niagen is nicotinamide riboside, a novel form of vitamin D3 and a precursor to nicotinamide adenine dinucleotide (NAD+). The latter is an essential coenzyme that regulates cellular metabolism and is necessary for the proper functioning of the mitochondria. Amongst many benefits ascribed to NAD+, it’s thought to play a role in healthy aging, with middle-aged people possessing ~50% less than during their young adulthood. Age is not the only factor in NAD+ depletion, as it’s also influenced by poor diet, excess alcohol, and disease. The decline can be reversed through calorie restriction, exercise, and supplementation with NAD+ precursors such as Tru Niagen. First brought to market by Healthspan in 2013 under the brand name Niagen, the health literature contains over 450 clinical studies related to NAD+, its precursors, and their effect on health – many of which are produced or sponsored by ChromaDex. Niagen has received regulatory acceptance from the FDA, Health Canada, the EU, and the Therapeutics Goods Administration of Australia. FY21 sales of Tru Niagen totaled $56.7 million, representing an increase of 20% over FY20.

May Company Presentation

In addition to its branded sales, ChromaDex markets the ingredient form of Niagen to (primarily) other food and supplement producers, including Nestle (NSRGY), from which it received a $4 million upfront fee emanating from a supply agreement inked in 2018. That said, sales to Nestle under that accord have not been particularly meaningful. Ingredient sales totaled $7.4 million in FY21, down 19% from FY20.

Although the company did divest of most of its legacy assets in 2017, it kept its analytical reference standards and services business, which provides research-grade, plant-based materials to food, pharma, and other industries for multiple applications. This segment generated FY21 revenue of $3.3 million, up 12% from the previous year.

Approximately 35% of the company’s total net sales are generated outside the U.S.

Approach

With essentially one product, ChromaDex’s main objective is to raise sales by engendering awareness and expanding distribution in a dietary supplement opportunity that is estimated at $36 billion domestically and $120 billion worldwide. Tru Niagen received a big boost in recognition on February 24, 2021, when the company released data from a Phase 3 trial, revealing that patients with mild-to-moderate Covid-19 receiving Turkish standard of care (SOC) plus a protocol of nicotinamide riboside, L-serine, N-acetyl-L-cysteine (NAC), and L-carnitine tartrate experienced a 3.5 day reduction in recovery time versus SOC plus placebo. Turkish standard of care includes hydroxychloroquine or favipiravir. News of this development sent shares of CDXC soaring 143% to an intraday high of $23.66 in the subsequent trading session, eventually closing at $18.74 on enormous volume of 119.4 million shares, nearly double the number outstanding.

Two weeks thereafter, ChromaDex announced a retail distribution deal with Walmart (WMT) which added 3,800-plus brick-and-mortar locations and ecommerce site walmart.com to its commercial footprint that at the time primarily included its own website and Amazon (AMZN).

Dismal Stock Performance

Despite these encouraging developments, its stock is down over 80% since that one day spike, as sales momentum has slowed to a trickle. After growing net sales 47% in FY19 and 28% in FY20, the onboarding of Tru Niagen by Walmart has not translated to a reacceleration of sales momentum, which was 20% in FY21 and only 5% in 1H22 vs 1H21. The clinical trial news amounted to nothing with the FDA – protecting the vaccine makers – sending the company a warning letter stating that its product was not approved for the mitigation, prevention, treatment, diagnosis, or cure of COVID-19, and making any representations as to its effectiveness in the treatment of said disease would cease immediately. Although, by that time, the market already knew that Tru Niagen, or any protocol containing it, was never going to be approved for COVID-19.

Also, as a side note, ChromaDex has been in an ongoing legal spat with Elysium Health over a variety of issues, including contract breaches, patent infringements, and claims of fraud since 2016, which has served as a distraction to the small company – Elysium is mentioned 111 times in the company’s latest 10-Q – and a significant drag on cash flow, having spent $24.9 million on legal fees in the past 24 months (ending June 30, 2022).

That said, the market has punished shares of CDXC for slower sales growth versus expectations.

2Q22 Earnings and Outlook

This dynamic was at play when ChromaDex reported 2Q22 financials on Aug. 10, 2022, posting a loss of $0.09 a share (GAAP) and Adj. EBITDA (sans legal fees) of negative $2.9 million on revenue of $16.7 million ($14.5 million from Tru Niagen) vs. a loss of $0.08 a share (GAAP) and Adj. EBITDA (sans legal fees) of positive $640,000 on revenue of $17.7 million ($15.4 million) in 2Q21, representing a 5% (6%) decline at the top line. This fall off was blamed on two items. First, the comp was difficult due to shelf stocking by Walmart in 2Q21 to support Tru Niagen’s launch. E-commerce sales actually increased 13% year-over-year. Second, the timing of shipments to Macau, Hong Kong, and Singapore – usually around 14% of total sales – were delayed by Covid-19 related issues. Irrespective of the tough comp, net sales missed Street consensus by $2.2 million and the Far East shipping delays only accounted for ~$1.4 million of the miss. This poor top-line performance was despite the fact that selling and marketing expenses as a percentage of revenue spiked to 47.9% vs. 35.2% in the prior year period, reflecting a TV ad campaign to support Walmart sales.

Further proof that growth momentum had stalled was found in ChromaDex’s sequential performance, where net sales in 2Q22 vs. 1Q22 were down 3%, while gross margin slipped 1.0% to 60.0%.

The most important development was that Tru Niagen was going to be sold in fewer Walmart stores (2,000 vs. the original 3,800-plus) going forward, compelling management to lower its FY22 outlook from 15%-20% revenue growth to high single digits and its gross margin projection from “slightly better than 60%” to “approximately 60%.” As such, ChromaDex indicated that its TV ad campaign would be suspended. Adding to the dour nature of the call was significant turnover in the boardroom, and the departures of the company’s CFO and Chief Legal Counsel. Shares of CDXC retreated 19% in the subsequent trading session to $1.66 and are currently slightly up from that level.

Third Quarter Results:

On Nov. 2, the company reported third quarter numbers. The company had a non-GAAP loss of four cents a share, two pennies above the consensus. Revenue fell just over one percent on a year-over-year to just over $17 million, approximately 10% below expectations. $14.6 million of overall sales came from Tru Niagen.

Leadership did note that “Adjusted EBITDA including total legal expense, was a loss of $1.2 million, a $5.1 million improvement from the prior year quarter and approaching break-even” which was somewhat encouraging. In addition, selling and marketing expense as a percentage of net sales improved 730 basis points from the prior year quarter and G&A costs decreased $5 million from the prior year quarter driven by lower legal expense. Management also maintained that ChromaDex was “still on track to achieve cash flow breakeven or better in the fourth quarter.”

Balance Sheet and Analyst Commentary:

The company executed a small private placement in September 2022 related to a Chinese joint venture, which raised gross proceeds of $3.1 million at $1.25 a share that is earmarked for securing food registration for Tru Niagen in mainland China. In October, the company raised another $7.7 million, net of offering costs, with Nestlé Health Science and existing strategic investors. After which, the company’s cash position stood at just over $20 million.

After third quarter, B. Riley Financial ($2.10 price target) maintained its Hold rating on the stock while H.C. Wainwright reissued its Buy rating and $5.50 price target on CDXC. On average, the analyst community expects the company to lose $0.24 a share (GAAP) on revenue of $72.6 million in FY22, followed by a loss of $0.13 a share (GAAP) on revenue of $84.6 million in FY23.

CEO Robert Fried remains upbeat on his company’s prospects, participating on the private placement to the tune of 80,000 shares. He was joined by beneficial owner and JV partner Pioneer Step Holdings, who purchased 960,000 shares, bringing its ownership interest to 11%.

Verdict:

No one seems to dispute the benefits of Tru Niagen. There is copious amounts of literature to that end, and it is the best-selling vitamin B3 supplement on Amazon. However, it’s challenging to get excited about a company that continues to post net losses and whose growth prospects are not meteoric, especially with Walmart reducing shelf space after only one year. For the company to be successful, it needs other products to push through the same channels and although there has been some talk from management concerning the introduction of another product, nothing is on the immediate horizon. It’s best outcome would be a sale to a larger concern, who would have more marketing muscle to push Tru Niagen awareness.

Also, most of the literature supporting ChromaDex calls for 1000mg of daily consumption to realize its full health-benefit potential. A quick check of the company’s website suggests that 900mg daily will cost $105 per month, making it a beyond the reach of many.

As such, we will stay to the sidelines on this good product, bad stock company.

Health is the greatest possession. Contentment is the greatest treasure. Confidence is the greatest friend.”― Lao Tzu

Be the first to comment