Christa Boaz/E+ via Getty Images

The homebuilder sector has been battered in 2022 as investors have abandoned interest rate cyclicals.

The iShares U.S. Home Construction ETF (BATS:ITB) is down over 37% YTD. Most investors expect the sector to continue to fall despite sporting a 7.5X PE.

Homebuilder Chart (Trading View)

In this article, we will review some recent homebuilder earnings calls and provide some evidence that there are structural reasons why housing demand is greater than most investors realize.

ITB Overview

ITB is a top heavy ETF whereby the top four homebuilders account for over 41% of the ETF. Lennar (LEN) is by far the largest holding of the ETF.

Well known homebuilder related stocks such as Home Depot (HD) or Sherwin-Williams (SHW) make up the other large percentage of the ETF.

ITB is the most liquid homebuilder ETF but is really quite comparable with SPDR S&P Homebuilders ETF (XHB).

Interest Rates

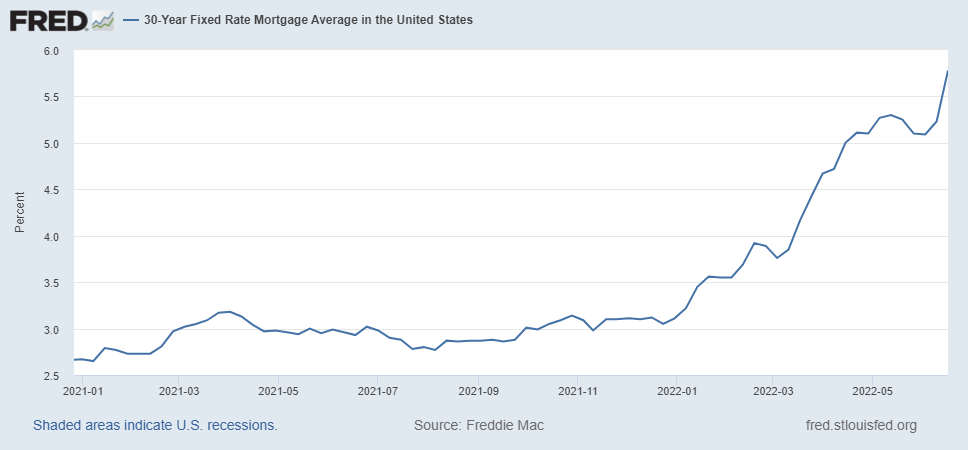

As the Fed has embarked on a tightening cycle and the bond market has sold off this year, mortgage rates have skyrocketed. The 30 year mortgage rate has almost doubled.

St. Louis Fed

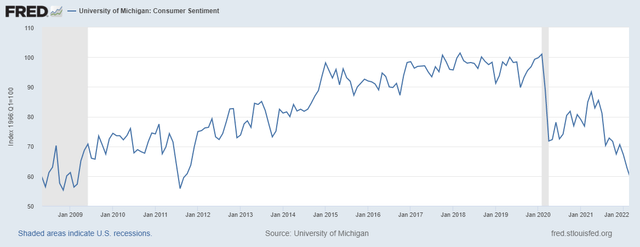

The rapid rise in mortgage rates has been accompanied by a dramatic fall in consumer confidence.

Clearly, a big ticket item such as a new home would suffer due to rising rates and plunging consumer confidence.

Lennar Results

Lennar is the largest holding in the ITB ETF. In many ways, the Lennar results were viewed as the bell weather for the industry. Last week, Lennar noted that there was weakness in the housing sector but they also seemed to suggest that demand was stronger than expected. “The weight of a rapid doubling of interest rates over six months, together with accelerated price appreciation, began to drive buyers in many markets to pause and reconsider. We began to see these effects after quarter end,” Lennar executive chairman Stuart Miller said in the Q2 earnings report.

During the Q2 conference call, Mr. Miller was quick to point out that land impairments are not on the horizon.

I think it’s important to recognize, we have virtually no land impairment risk in our backlog. Our margins remain healthy. We remain focused on recognizing that prices are going to move around a little bit and we’ll continue to build efficiencies in the way that we create value for our customers. But our land acquisition model and our land acquisition program has been rock solid and I think the market is going to have to fall an awful lot for us to start talking about impairments once again. That’s a throwback to the last financial crisis and we just don’t — we have a lot of room in margin. We have a lot of adaptability in our program long way before we start thinking about impairments.

In 2008, homebuilder stocks were battered by land impairments and investors have been skittish about the issue again in 2022.

Housing Starts Have Plummeted

Last week there were two important data points that highlighted the slowdown in housing. Firstly, housing starts plunged 14.4% to a seasonally adjusted annual rate of 1.549 million units last month. This was the lowest level since April 2021, the Commerce Department said last week.

The other important metric that investors focus on are building permits. According to the Commerce Department, permits for future homebuilding declined 7.0% to a rate of 1.695 million units.

Clearly, the housing market has weakened under the burden of higher rates and falling consumer confidence.

Housing Demand Remains Strong

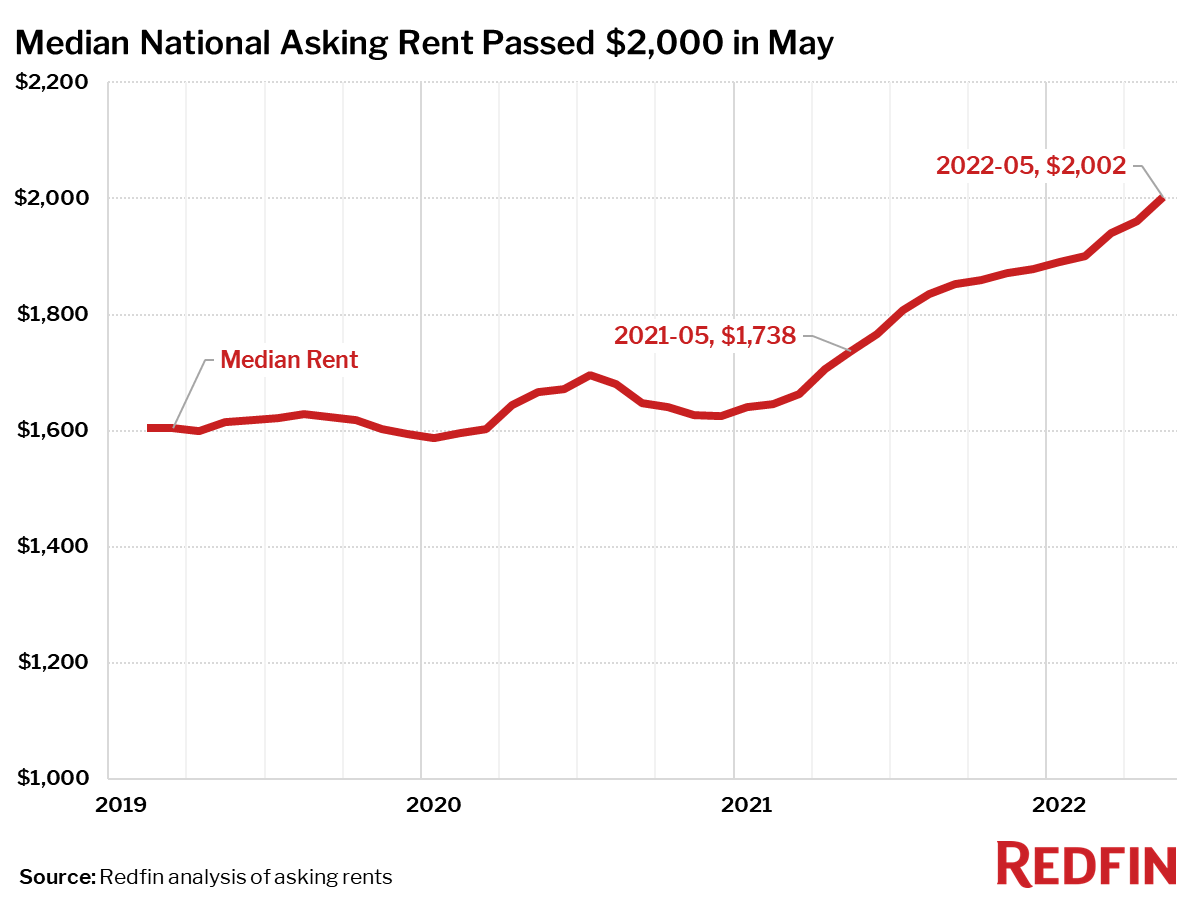

First of all, rents have been skyrocketing across the United States.

In April, the national median rent was $1,827 a month. This was an increase of 16.7% from a year ago. It is expected that the typical rent could exceed $2000 by August 2022.

Redfin

Even though mortgage rates have risen, it has not made home ownership less affordable because rents have also risen. Thus, a young couple starting a new family will most likely be forced to bite the bullet and accept 6% rates rather than deal with the uncertainty of a tight rental market.

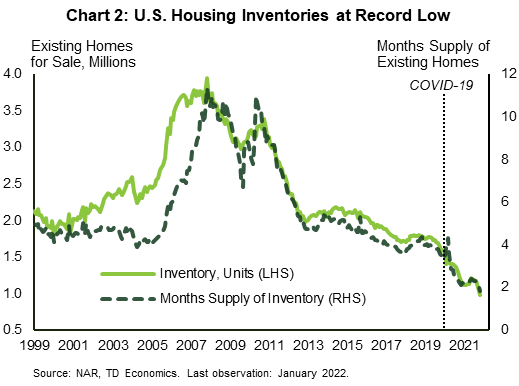

Secondly, there has been a long period of under supply in the U.S. housing industry. After the Great Financial Crisis, there was perpetual underbuilding in the United States. Thus, a supply shortage formed that will take years to fix.

TD Economics

The shortage of homes is a structural tailwind that should buffer a major real estate meltdown this time around.

Valuations Are Low

Lennar is currently trading at 0.93X book value. Other homebuilder stocks are trading at similar valuations. Apart from extremely deep recessions, these types of valuations have generally provided a good floor under the share prices.

Conclusion

There have been many good reasons for the dramatic selloff in ITB. Interest rates have risen extremely quickly and consumer confidence has plummeted. Both permits and home sales are off all time highs. The housing industry has slowed and investors are skittish of a repeat of 2008.

However, the supply situation for housing and the rental shortage should buffer a major crash. With solid balance sheets and low valuations, homebuilders should have seen the worst of the housing correction. Now is a good time to add to ITB unless you expect mortgage rates to rise over 8% or you project a major recession on the horizon.

Be the first to comment