Michael Blann/DigitalVision via Getty Images

I first encountered OmniAb (NASDAQ:OABI) in researching its former parent, Ligand Pharmaceuticals (LGND), for a 12/2020 article, “Ligand: Scalable Growth”. At the time OmniAb was one of Ligand’s three major discovery platforms.

This article discusses OmniAb as a standalone business having recently (11/02/2022) been spun off from Ligand.

OmniAb had a rough opening day as a public company and has since partially recovered

Seeking Alpha’s historic price listing for OmniAb on 11/02/2022 shows it dropping >50% from a high of $5.13 to $2.41. During Ligand’s Q3, 2022 earnings call (the “Ligand Call”), CEO Higgins gave a rundown on key deal points as follows:

- While retaining their same share ownership in Ligand, after the split Ligand’s shareholders received 4.9 shares in OmniAb;

- Matt Foehr and Charles Berkman, respectively formerly president and general counsel for Ligand, will become CEO and Chief Legal Officer for OmniAb;

- Avista Healthcare will become an ~15% shareholder of OmniAb;

- roughly half of Ligand’s workforce of 150 people will move to OmniAb;

- OmniAb will have starting cash of ~$95 million with prospects for $35 million in partner milestones with the anticipated launch of teclistamab in the coming months.

He emphasized the ongoing viability of OmniAb’s business model. In response to an analyst question during the Ligand Call, Higgins said that the spinoff pretty much achieved its objectives in everything except timing. He was disappointed that it took considerably longer than expected. However the end result was as planned. OmniAb is:

… a well-capitalized company [with] focused management and Board, a new equity, strategic equity investors, spinning them off in strength in terms of business news, news flow and financial momentum.

As for its initial price, this is simply a short-term trading dynamic. It is partly reflective of the fact that larger shareholders are precluded from owning companies of its size with no operating history. It is common for spinoffs to take up to 6 months to season and for the shareholder mix to rebase.

OmniAb offers biotech investors an intriguing differentiated and scalable business model

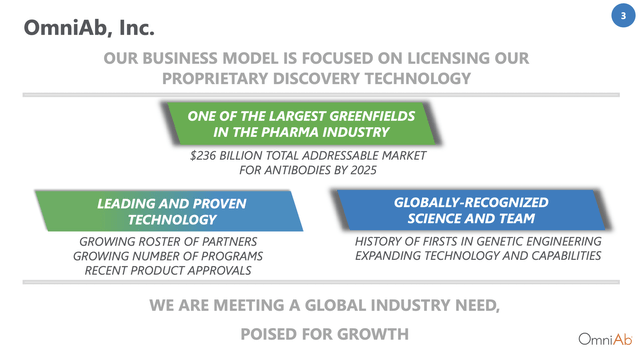

OmniAb’s business involves the discovery of antibodies, using its proprietary suite of transgenic animals, which it then licenses to pharmaceutical companies. OmniAb’s slide presentation (the “Presentation”) prepared for its 11/2022 Stifel Healthcare Conference, describes both the potential for the business and OmniAb’s achievements to date.

Its initial slide sets out the market in which it operates and its business model.

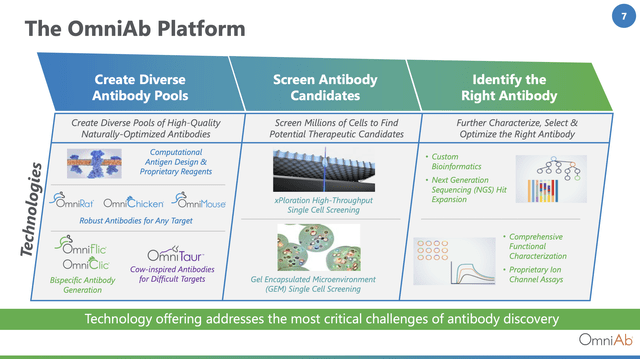

Subsequent slides describe its tripartite platform in which it:

- Creates diverse antibody pools;

- screens antibody candidates; and

- identifies the right antibody.

These start with slide 7 describing the specifics of the process:

Its subsequent slide 8 describes the advantages of its “naturally optimized antibodies”. It characterizes its antibodies, developed from an iterative process by immune systems in its engineered transgenic animals, as having superior specificity and developability profiles. It touts its system as increasing the efficiency and probability of success of therapeutic antibody discovery.

Subsequent slides 9 and 11-13, provide further details of these three platform components. Slides 9 and 11 focus on how its four species, rat, mouse, chicken, and cow, form a development platform creating multiple options addressing partner goals. Slide 12 describes its antibody screening process; slide 13 how it works with its partners to select the right antibody for the partner’s goal.

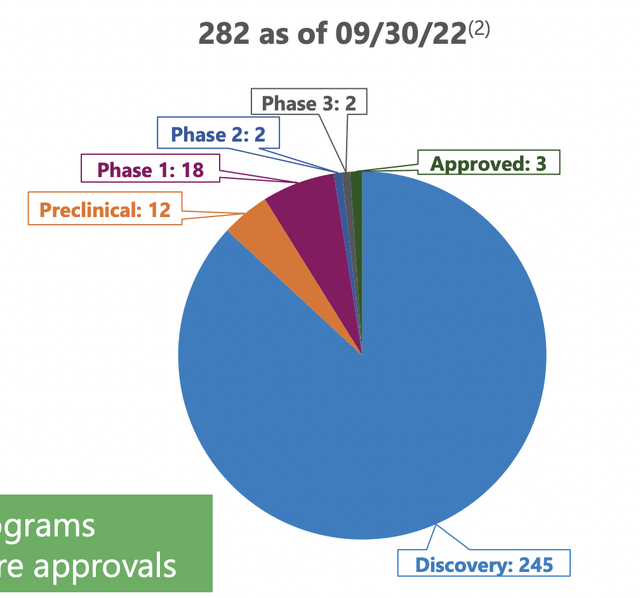

Slide 15 describes how its collection of partner therapies in various phase of development have grown from an aggregate of 16 in 2016 to 282 as of close of Q3, 2022. In 2016 it had but a single program that had advanced to a preclinical stage; all the rest were discovery programs. Its situation has advanced to 282 programs as shown in the excerpt below:

Excerpt from OmniAb “Growth of Partner Programs” slide 15 (seekingalpha.com)

OmniAb’s midterm growth in number and stage of development programs demonstrates exemplary scalability. Slide 18 illustrates a >30% CAGR from 2014 through 2021 in partners and a >25% CAGR from 2016 through 2021 in programs.

OmniAb’s finances are proforma; its business unproven

The completion of OmniAb’s spinoff is little more than a month old as I write on 12/04/2022. Its economic and performance metrics are understandably limited.

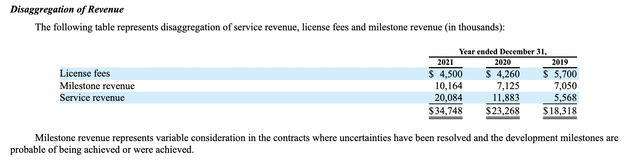

Its S-1 registration statement filed 11/30/2022 describes its revenue sources as:

…typically derived from our license agreements with our partners and consists of: (i) upfront or annual payments for technology access (license revenue) and payments for performance of research services; (service revenue); (ii) downstream payments in the form of preclinical, intellectual property, clinical, regulatory, and commercial milestones (milestone revenue) and (iii) royalties on net sales from our partners’ product sales, if any.

It goes on to describe its revenue to date as:

…revenue from intellectual property and development milestones, and [we] have only recently begun to generate revenue from commercial milestone payments and royalties on product sales this year.

We receive royalty revenue on sales by our partners of products covered by patents that we or our partners own under contractual agreements. We do not have future performance obligations under these license arrangements. We generally satisfy our obligation to grant intellectual property rights on the effective date of the contract.

It lists its disaggregated revenues as:

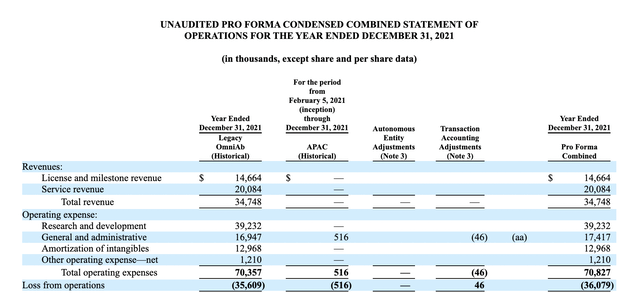

OmniAb’s proforma operating statement shows that its operations for 2021 generated a healthy loss:

This seems to bely its Presentation slide 23 assurances that its operations are close to breakeven and that it has sufficient cash for the foreseeable future. The problem is not with an overly optimistic management so much as it is with the difficulty of getting an accurate handle on this newbie operation.

For example, an 11/18/2022 8K reports:

On November 18, 2022, OmniAb, Inc. (the “Company”) announced that Janssen Biotech, Inc. (“Janssen”) has notified the Company that the first commercial sale (as defined under the terms of the licensing agreement between OmniAb and an affiliate of Janssen) of TECVAYLI™ (teclistamab) in the United States had occurred, and the Company now expects to receive the related $25 million milestone payment and expects to book $25 million of milestone revenue in Q4 2022.

Conclusion

As I see the situation, OmniAb is an exciting opportunity to buy into a company with unlimited potential. I am enthusiastic about its prospects. However, I became an OmniAb shareholder automatically as it was spun off from Ligand.

Those who look at the situation to see if it is worthy of investing new money should be extremely cautious. While it dropped heavily right after its spinoff, it has had a nice run since. After its initial sharp drop, it traded <$3.00 for the rest of 11/2022. It is only during the last few days that it has been able to regularly close above $3.00.

On 12/02/2022 it closed at $3.97. It may be ripe for a pullback. Until it gets a few quarters of earnings under its belt, it is a highly speculative name. Forewarned is forearmed.

Be the first to comment