courtneyk

SoFi Technologies Inc. (NASDAQ:SOFI) rose after the financial technology firm reported earnings at the start of the month and raised its net revenue and adjusted EBITDA guidance for 2022.

However, a new issue for SoFi emerged in August, and it has very little to do with the company’s performance. Due to mounting valuation losses, one of SoFi’s largest institutional shareholders, Japan-based SoftBank, has begun to liquidate its significant position in the financial technology company.

With more stock sales on the way and an already high short interest ratio, SoFi’s sales multiple may finally be corrected.

Core Problems Remain Unaddressed

I’ve already mentioned SoFi’s three interconnected core issues: slowing sales growth, an unjustified high valuation, and the fact that SoFi can only generate profits on an adjusted EBITDA basis.

However, in addition to these core issues, which I have detailed here, SoFi is facing headwinds from a large institutional investor, which could cause problems for the stock in the near term.

Why SoftBank Constitutes A Problem

Masayoshi Son, the CEO of SoftBank, is well-known for his role in the establishment of the technology-focused Vision Fund, which has made large (both successful and unsuccessful) bets on companies such as SoFi Technologies, WeWork (WE), DoorDash (DASH), and Uber Technologies (UBER).

However, the fall in tech valuations over the last year has resulted in a record loss of $23.1 billion in the second quarter, prompting a reevaluation of the fund’s investment strategy. To reduce risk, the Vision Fund sold a significant amount of SoFi stock in August. SoftBank’s transactions can be found in the SEC’s Edgar Database (Link).

On August 5, Softbank sold 5.4 million shares at an average price of $7.99 per share, followed by 6.7 million shares at an average price of $8.17 per share three days later.

SoftBank sold 4.7 million shares at a weighted average price of $7.42 on August 9, and another 5.9 million shares at a weighted average price of $7.79 on August 10.

SoftBank increased its sales the next day, selling 9.0 million shares at a weighted average price of $7.75.

SoftBank sold another 18.2 million shares between August 12 and August 17 at prices ranging from $6.82 to $7.80.

SoftBank sold 49.9 million shares in total in August. The Vision Fund still owns 45.4 million SoFi shares, representing a 4.9% equity stake. I believe SoftBank will sell the remainder of the fund’s investment in SoFi stock in the coming weeks and months, which could cause problems for current investors who may face renewed selling pressure and a larger stock overhang.

SoFi Remains A Heavily Shorted Stock

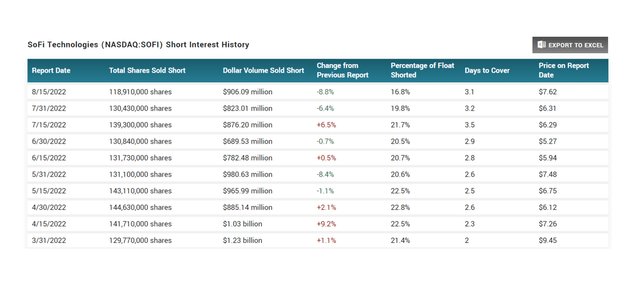

Slowing sales growth and a highly inflated valuation have set the stage for a quick setup. SoFi is still one of the most shorted stocks, with a short ratio of 16.8% based on float as of August 15.

The short interest ratio has fallen slightly from its peak of 22.8% (144 million shorted shares) in the second quarter, but bearish investors have been proven correct by taking a short position on SoFi, as the stock fell 44% in the second quarter.

Short Interest History (Marketbeat)

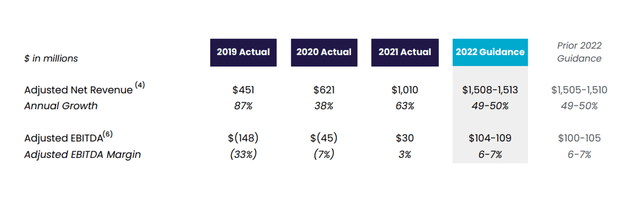

Market Reaction To Guidance Raise Fundamentally Wrong

SoFi’s stock soared 28% after the company raised its sales guidance for 2022 by $3 million and adjusted EBITDA guidance by $4 million, representing percentage increases of 0.2% and 3.7%, respectively.

Adjusted EBITDA (SoFi Technologies)

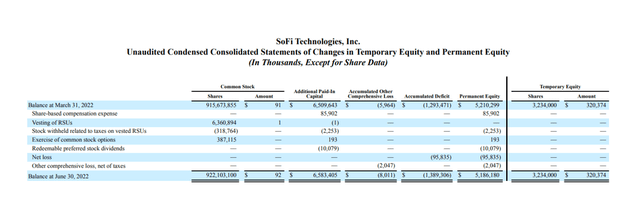

What I also find unjustified is that SoFi continues to trade at a sales multiple of 4.5x despite consistent net losses. SoFi has yet to turn a profit, and according to the most recent equity table in the 10-Q report, the company has accumulated $1.39 billion in lifetime losses (shown as SoFi’s accumulated deficit in the fifth column from the left).

Lifetime Losses (SoFi Technologies)

Why SoFi Could See A Higher Valuation

The Department of Education is planning to forgive up to $10,000 in student loan debt for low- to middle-income borrowers. The U.S. government also announced two days ago that the student loan pause would be extended until the end of December. Borrowers with student loans will be required to resume making scheduled payments beginning in January, which could help SoFi generate a larger profit from its student loan portfolio.

My Conclusion

SoftBank’s sale of SoFi stock is a red flag, and because the Vision Fund still owns a significant amount of stock, future stock sales could exert significant pressure on SoFi’s stock price. The fund could dump another 45 million shares on the market, which would most likely have a negative impact on SoFi’s stock price.

Furthermore, I reiterate my belief that the price increase following earnings was completely unjustified and that SoFi remains overvalued with a sales multiple of 4.5x. The short interest ratio remains elevated as well, indicating that a large portion of the market believes SoFi is overvalued.

Be the first to comment