omersukrugoksu/iStock via Getty Images

Earnings of Union Bankshares, Inc. (NASDAQ:UNB) will likely dip this year as higher interest rates will reduce mortgage banking income. On the other hand, earnings will receive support from hot regional job markets which will boost the loan book. Further, the provisioning for expected loan losses will likely remain subdued as the existing reserves are already very high. Overall, I’m expecting Union Bankshares to report earnings of $2.59 per share for 2022, down 11% year-over-year. For 2023, I’m expecting the company to report earnings of $2.84 per share, up 10% year-over-year. The year-end target price suggests a small upside from the current market price. Further, Union Bankshares is offering a high dividend yield. Based on the total expected return, I’m adopting a buy rating on Union Bankshares.

Strong Loan Growth to Drive Net Interest Income

Union Bankshares’ loan portfolio fell by 1.2% during the second quarter of 2022. This reduction was mainly attributed to a temporary decline in loans to municipal customers. The net drop in loan portfolio size was $9 million during the last quarter, while the company has already recorded new municipal loans of $70.2 million in July, as mentioned in the 10-Q filing. Therefore, the loan portfolio will more than recover its losses in the third quarter of 2022.

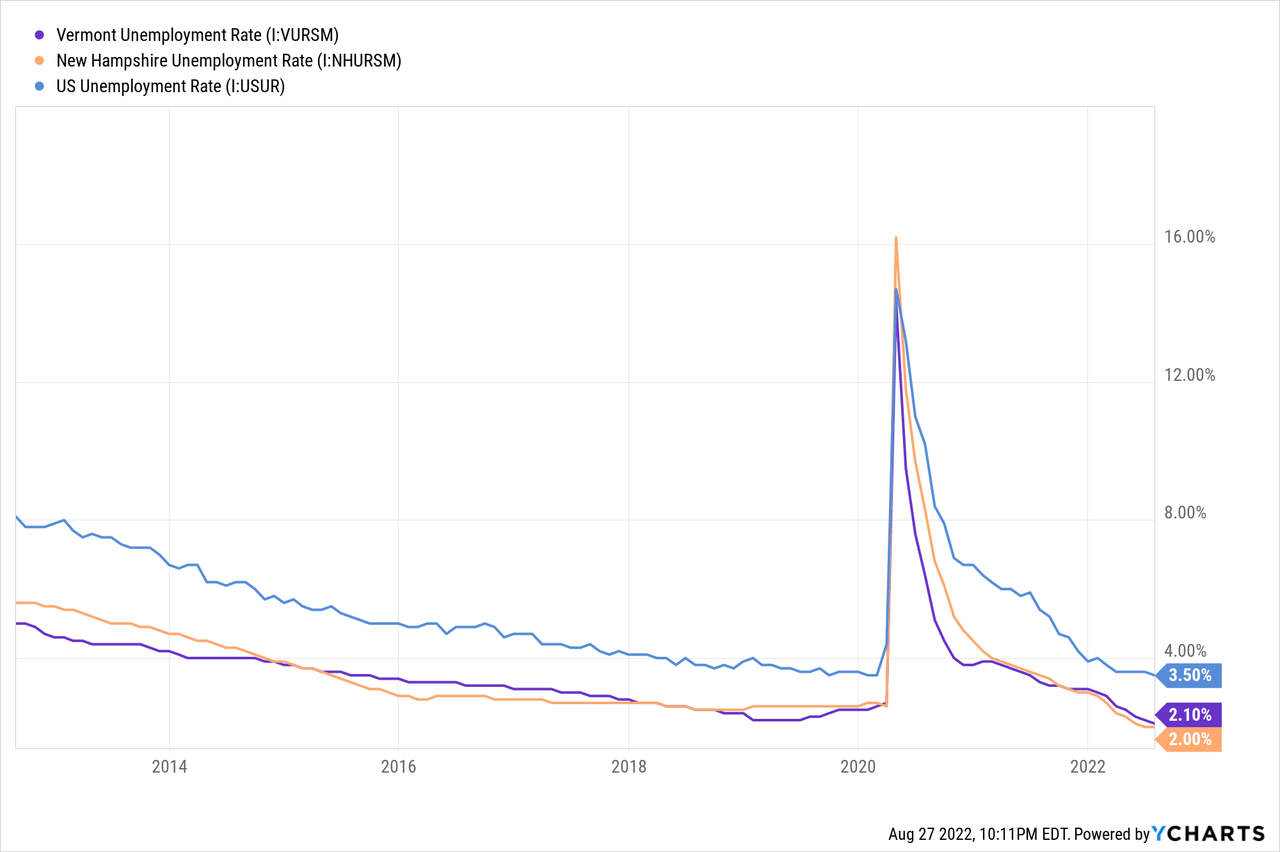

Regional economies will further support loan growth in the coming quarters. Union Bankshares operates in Vermont and New Hampshire, which currently have two of the best job markets in the country. The unemployment rates in these states are amazingly low, which bodes well for loan growth, especially residential real estate loans.

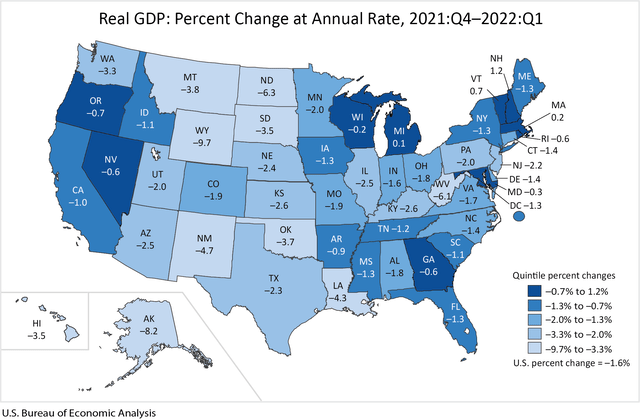

Further, the GDP of both states expanded in the first quarter of 2022 even as the economies of most other states contracted.

Bureau of Economic Analysis, U.S. Department of Commerce

Considering these factors, I’m expecting the loan portfolio to grow by 8% (annualized) every quarter till the end of 2023. As a result, loan growth will propel the net interest income through the end of 2023. However, net interest income is unlikely to receive much support from the rising rate environment.

Around 91.5% of the loan portfolio is made up of real estate loans, including residential, construction, and commercial real estate. As real estate loans usually carry fixed rates, the average loan yield is not very sensitive to rate hikes. Further, non-maturing interest-bearing deposits made up a hefty 60% of total deposits at the end of June. These deposits will be the major source of pressure on deposit costs in a rising rate environment as they re-price frequently.

Provisioning Likely to Remain Subdued

Allowances were a massive 546.89% of nonperforming loans at the end of June 2022, which is quite high from a historical perspective. Allowances were 143.47% of nonperforming loans at the end of June last year. Due to this high coverage, I’m expecting further provisioning for loan losses to be muted in the coming quarters. Further, a majority of the loan book comprises real-estate-backed loans. Therefore, the credit risk will remain muted.

On the other hand, economic headwinds including high inflation and interest rates can worsen asset quality, leading to higher provisions. Further, Union Bankshares may want to increase its reserves ahead of a possible recession.

Considering these factors, I’m expecting net provision expense to average 0.04% (annualized) of total loans in the second half of 2022. For 2023, I’m expecting the net provision expense to average 0.07% of total loans, which is the same as the average from 2017 to 2019.

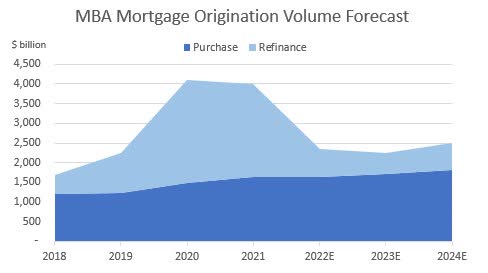

Lower Mortgage Income to Drag Earnings

Noninterest income will likely be lower this year as gains on sales of mortgage loans will decline. The rising interest-rate environment will slash mortgage refinancing activity, thereby reducing mortgage banking income for Union Bankshares. The following chart shows Mortgage Bankers Association’s latest forecast for mortgage refinancing and mortgage purchase volume.

Mortgage Bankers Association

On the other hand, substantial loan growth and below-average provisioning will likely support the bottom line. Overall, I am expecting Union Bankshares to report earnings of $2.59 per share for 2022, down 11% year-over-year. For 2023, I’m expecting earnings to grow by 10% to $2.84 per share. The following table shows my income statement estimates

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 29 | 30 | 32 | 36 | 39 | 43 | ||||

| Provision for loan losses | 0.5 | 0.8 | 2.2 | – | 0.2 | 0.6 | ||||

| Non-interest income | 9 | 10 | 16 | 13 | 9 | 9 | ||||

| Non-interest expense | 29 | 27 | 30 | 33 | 34 | 36 | ||||

| Net income – Common Sh. | 7 | 11 | 13 | 13 | 12 | 13 | ||||

| EPS – Diluted ($) | 1.58 | 2.38 | 2.85 | 2.92 | 2.59 | 2.84 | ||||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

High Interest Rates have Eroded Equity Book Value

Union Bankshares has a large balance of available-for-sale investment securities, which made up 22% of total assets at the end of June. The market value of these fixed-rate available-for-sale securities has plunged in the first half of 2022 as rates have risen. These unrealized losses have bypassed the income statement and gone straight to the equity account, as per relevant accounting standards. As a result, the equity book value per share has slipped from $18.37 at the end of June 2021 to $13.34 at the end of June 2022.

I’m expecting further erosion in the equity book value as I’m expecting a 150 basis point hike in the federal funds rate during the second half (including the 75 basis points hike in July). On the other hand, retained earnings will lift the equity book value.

Despite the drop in equity book value, Union Bankshares’ capital is still more than adequate. The company reported a tier I ratio of 11.16% for the end of June 2022, as opposed to the minimum regulatory requirement of 6.0%. Therefore, the pressure on equity poses no threat to the dividend payout. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 638 | 665 | 763 | 779 | 844 | 913 |

| Growth of Net Loans | 9.6% | 4.3% | 14.7% | 2.2% | 8.2% | 8.2% |

| Other Earning Assets | 74 | 148 | 269 | 357 | 314 | 340 |

| Deposits | 707 | 744 | 994 | 1,095 | 1,148 | 1,242 |

| Borrowings and Sub-Debt | 28 | 47 | 7 | 16 | 17 | 18 |

| Common equity | 64 | 72 | 81 | 84 | 63 | 69 |

| Book Value Per Share ($) | 14.4 | 16.1 | 18.0 | 18.7 | 14.0 | 15.4 |

| Tangible BVPS ($) | 13.9 | 15.6 | 18.0 | 18.7 | 14.0 | 15.4 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Attractive Dividend Yield, Small Price Upside Calls for a Buy Rating

Union Bankshares has almost a decade-long history of annual dividend increases. Given the earnings outlook, I believe the company can continue its tradition next year and raise its dividend by $0.01 per share in the first quarter of 2023. This will lead to a full-year dividend payout of $1.44 per share, which suggests a payout ratio of 51%. In comparison, the payout ratio averaged 56% in the last five years. My dividend estimate implies a dividend yield of 5.5%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Union Bankshares. The stock has traded at an average P/TB ratio of 1.80 in the past, as shown below.

| FY19 | FY20 | FY21 | Average | |||

| T. Book Value per Share ($) | 15.6 | 18.0 | 18.7 | |||

| Average Market Price ($) | 37.4 | 23.7 | 31.6 | |||

| Historical P/TB | 2.40x | 1.32x | 1.69x | 1.80x | ||

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $14.0 gives a target price of $25.2 for the end of 2022. This price target implies a 3.2% downside from the August 26 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.60x | 1.70x | 1.80x | 1.90x | 2.00x |

| TBVPS – Dec 2022 ($) | 14.0 | 14.0 | 14.0 | 14.0 | 14.0 |

| Target Price ($) | 22.4 | 23.8 | 25.2 | 26.6 | 28.0 |

| Market Price ($) | 26.0 | 26.0 | 26.0 | 26.0 | 26.0 |

| Upside/(Downside) | (13.9)% | (8.6)% | (3.2)% | 2.2% | 7.5% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.6x in the past, as shown below.

| FY19 | FY20 | FY21 | Average | |||

| Earnings per Share ($) | 2.38 | 2.85 | 2.92 | |||

| Average Market Price ($) | 37.4 | 23.7 | 31.6 | |||

| Historical P/E | 15.7x | 8.3x | 10.8x | 11.6x | ||

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $2.59 gives a target price of $30.0 for the end of 2022. This price target implies a 15.5% upside from the August 26 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.6x | 10.6x | 11.6x | 12.6x | 13.6x |

| EPS 2022 ($) | 2.59 | 2.59 | 2.59 | 2.59 | 2.59 |

| Target Price ($) | 24.9 | 27.5 | 30.0 | 32.6 | 35.2 |

| Market Price ($) | 26.0 | 26.0 | 26.0 | 26.0 | 26.0 |

| Upside/(Downside) | (4.4)% | 5.5% | 15.5% | 25.4% | 35.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $27.6, which implies a 6.1% upside from the current market price. Adding the forward dividend yield gives a total expected return of 11.5%. Hence, I’m adopting a buy rating on Union Bankshares.

Be the first to comment