eyjafjallajokull

Just over a month ago, I wrote on Skeena Resources (NYSE:NYSE:SKE), noting that it was a unique story in the developer space, given that it had a world-class project in British Columbia and was likely to be more insulated from upfront cost creep than its peers. This expectation was due to Eskay Creek being right next to a hydroelectric power station, having existing roads, and a permitted and constructed tailings facility, with the latter being one area where we had seen capex blowouts at other projects currently in construction.

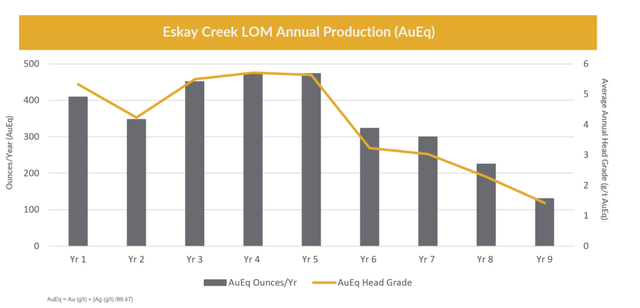

Fortunately, the Feasibility Study provided a welcome surprise, reinforcing the exceptional project economics at Eskay Creek with very modest upfront capex. Meanwhile, the production profile was increased to 431,000 gold-equivalent ounces [GEOs] in the first five years and projected all-in sustaining costs [AISC] remained more than 45% below the estimated FY2022 industry average of ~$1,260/oz. Let’s take a closer look below:

All figures are in United States Dollars unless otherwise noted at an exchange ratio of 0.76 CAD/USD.

Eskay Creek Mineralization (Company Website)

Feasibility Study

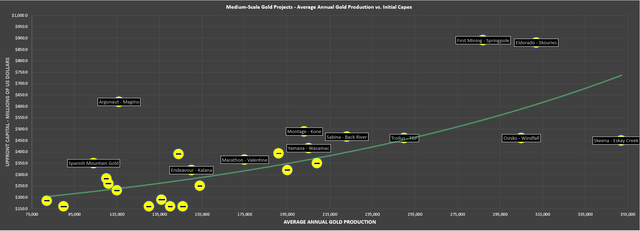

Skeena Resources released its Feasibility Study for its Eskay Creek Project earlier this month and knocked it out of the park in nearly every category. The current study envisions a conventional open-pit mining and milling operation that benefits from existing infrastructure (permitted tailings facility), producing over 350,000 gold-equivalent ounces recovered in concentrate. In the first five years, production is expected to average 431,000 GEOs, and the project could boast margins of more than 61% (all-in sustaining costs: $652/oz), even at a $1,700/oz gold price. The resulting After-Tax NPV (5%) at conservative metals price assumptions is $1.07 billion.

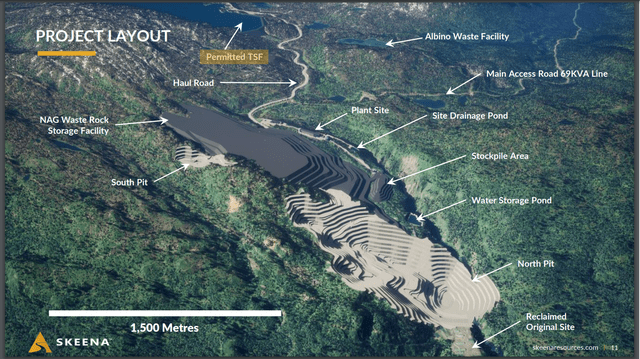

Eskay Creek Proposed Layout (Company Presentation)

The plan is to process over 30 million tonnes at an average grade of 2.99 grams per tonne of gold and 78 grams per tonne of silver, with three phases for the north pit and one phase for the south pit. The only real significant change in scope was the decision to increase mill throughput from 2.9 million tonnes per annum (July 2021 Pre-Feasibility Study) to a staged approach with 3.0 million tonnes per annum to start, followed by a modest expansion to 3.7 million tonnes per annum in Year 5. The total production is expected to be 3.2 million GEOs over the 9-year mine life. Still, there appear to be multiple opportunities to increase production in later years or extend the mine life.

Some areas to improve on the study discussed were as follows:

- further optimization of resource modeling and mine planning to improve mining selectivity and potentially grades

- the incorporation of the newly discovered 23 and 21A West Zones to extend mine life, which could be presented in an updated FS in H2 2023

- additional metallurgical work to optimize the flow sheet with a focus on grinding, aimed at reducing grinding power requirement and the size of the grinding mills

- optimization of the project through geometallurgical modeling to potentially improve ore blending opportunities

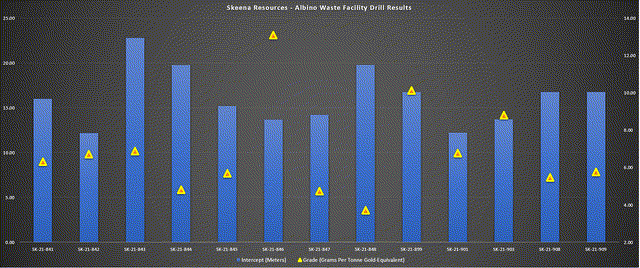

AWF Drill Results (Company Filings, Author’s Chart)

In addition, a favorable outcome at the Albino Waste Facility would be a game-changer, opening up an additional 300,000 GEOs of reserves with ultra-low extraction costs, given that the material is sitting under 2 meters of water. This would significantly improve the mine life after Year 5 when grades begin to drop, given that drilling to date has seen gold-equivalent grades average well over 5 grams per tonne. To summarize, while the current study is already very impressive, it massively understates the project’s true potential.

Eskay Creek Expected Production Profile (Company Presentation)

One of the key assets that aren’t discussed with juniors and, in some cases, is lacking is the management team. However, Skeena’s CEO Walter Coles has assembled an excellent team over the past few years. In addition to adding Shane Williams as Chief Operating Officer, who was VP of Operations and Capital Projects at Eldorado (EGO) and led the team that brought Lamaque from PEA to commercial production in 18 months, he also has open-pit development experience with roles at Rio Tinto and Kaunis Iron. On top of this, Coles recently appointed Randy Reichert as President, a veteran with 30 years of experience, which includes being VP of Operations at B2Gold (BTG).

Outside of the obvious climate differences (northern BC vs. Mali), the Eskay Creek Project is an excellent fit for Randy Reichert, who was previously General Manager at the massive Fekola Mine, B2Gold’s flagship operation that transformed it into a million-ounce gold producer. In addition to being part of the development team and leading the transition from development into operations at the massive high-grade open-pit mine (5 million tonnes per annum, but since expanded), he also worked at the formerly producing Snip Mine, a project that Skeena owns in BC, and was General Manager at Kupol with Bema Gold.

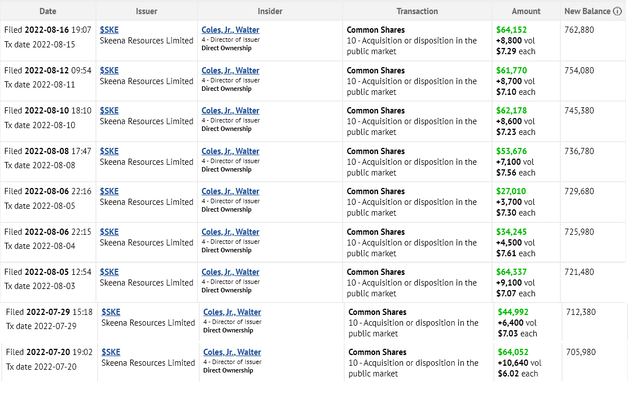

These additions have de-risked Eskay Creek construction and potentially eventual production (assuming permits are granted) and could lead to further optimizations to the mine plan by drawing on the experience of Skeena’s COO and President. This is a differentiator vs. most juniors, where one is hoping they are bought out in many cases so that a competent team can build and run operations to avoid a Pure Gold Mining (OTCPK:LRTNF) repeat. Given the robust economics and the strong team in place, it’s little surprise that the CEO continues to purchase shares in the open market. As shown below, over 55,000 shares were purchased since late July alone, with an additional ~20,000 shares purchased in early July, representing more than US$400,000 of purchases.

Skeena – CEO Insider Buying (SEDI Insider Filings)

Capex & Eskay Creek Economics

While Eskay Creek’s project economics are phenomenal (~352,000 GEOs per annum at sub $700/oz costs), it’s ultimately the after-tax internal rate of return [IRR] and upfront capex that dictate whether a project moves forward, assuming permits are granted. In fact, in some cases, a project can be very impressive. Still, if a company has a market cap to upfront capex ratio below 0.25 to 1.0, there’s little hope of funding the project without massive shareholder dilution. Given the inflationary environment we’re in, this has been one key item to watch, especially given that one would be wise to model a 10% cost overrun in the current environment to be on the safe side for greenfield projects.

Skeena Article – August 2022 (Seeking Alpha Premium)

In my most recent article, I noted that while capex could increase from $380 million to $470 million, this would still be one of the cheapest projects on a production profile vs. capex adjusted basis, and I saw a low risk of a capex blowout. It turns out that capex came in near my estimates for the most part, given that I was using a 0.80 CAD/USD ratio, with upfront capex estimated at C$592 million [US$474 million]. This represented a 21% increase from the 2021 Pre-Feasibility Study, related to higher labor and materials costs and an increase in the sizing of the grinding circuit. Meanwhile, though mining costs were up 4% due to higher diesel costs and an increase in PAG tonnes, processing costs were down to the higher mill throughput vs. the previous study and reduced reagent requirements.

The result is an upfront capex bill of ~$450 million at an exchange rate of $0.76 CAD/USD, in line with Skeena’s current market cap, making it a very manageable figure. Meanwhile, the After-Tax NPV (5%) came in at an impressive ~$1.07 billion for a mine plan that didn’t include drilling over the past year, and Eskay Creek is expected to churn out a total of $1.60 billion in free cash flow over its mine life even if the gold price stays below $1,800/oz. This translates to a 1-year payback which is unheard of at these metals prices, and if we include additions to the mine plan from the 23 and 21A West, the After-Tax NPV could head closer to $1.3 billion.

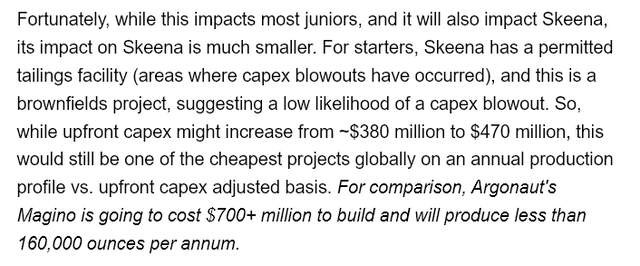

The chart below shows undeveloped gold projects based on upfront capital expenditures and operating costs. Given that this includes many smaller-scale projects, Eskay Creek may not stand out as impressive at first glance, being one of the more expensive projects to build. However, this is simply due to its scale, given that, on balance, smaller-scale projects will cost considerably less to build than one with triple the production profile. That said, Eskay Creek stands out from a cost standpoint, being one of the global lowest-cost undeveloped projects with projected costs of $650/oz.

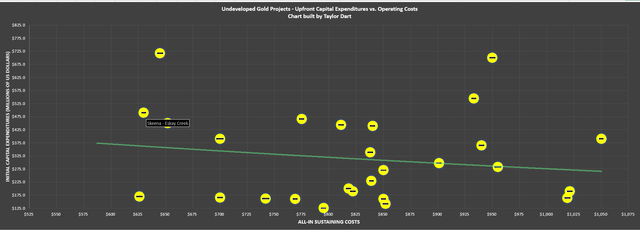

Undeveloped Gold Projects – Upfront Capex vs. Operating Costs (Company Filings, Author’s Chart & Estimates) Undeveloped Gold Projects – Upfront Capex & Production Profile (Company Filings, Author’s Chart & Estimates)

The chart above provides a much better look at Skeena’s Eskay Creek vs. other projects, given that it compares upfront capex vs. the production profile, allowing for more like-for-like comparisons. As we can see, Eskay Creek is well below the trendline for where its costs would be relative to the average, and it’s actually expected to cost similar to build than many projects with half its production profile like Troilus’ TGP Project, Yamana’s (AUY) Wasamac, and Argonaut’s Magino. This is because it benefits from being a brownfield site with considerable infrastructure already in place (roads, tailings, and close proximity to power). So, Eskay Creek is truly one of a kind, with the only real comparison being Osisko’s (OTCPK:OBNNF) Windfall.

In the above chart, I have adjusted estimates for some companies’ capex requirements if they did not have recent studies to provide an accurate representation of where costs would be if they commissioned new studies today incorporating the impact of inflationary pressures.

Valuation

Based on an estimated ~84 million shares on a fully-diluted basis (Q3 2023) and a share price of $5.50, Skeena trades at a market cap of ~$462 million, a dirt-cheap valuation for a company with an estimated NPV (5%) of $1.07 billion. This translates to a P/NPV multiple of 0.43, typically reserved for an earlier-stage developer, a developer with a mediocre project, or a developer in a less favorable jurisdiction. Skeena is none of the three, which makes the current valuation and share price nonsensical.

In fact, I believe that Skeena has a top-5 precious metals project among those not held by majors, with it being even more attractive than De Grey’s (OTCPK:DGMLF) massive Mallina Project (540,000 ounces per annum), given that it’s less capital-intensive (~$450 million for Eskay vs. ~$800 million estimates for Mallina) and boasts higher margins ($650/oz costs vs. $900/oz). Meanwhile, the Eskay Creek Project is in a Tier-1 jurisdiction in British Columbia, is surrounded by majors, and is less susceptible to capex blowouts being a brownfields project. Given these attributes, a more reasonable P/NPV multiple is 0.75, and one could even argue that this is very conservative.

Using a P/NPV multiple of 0.75 with its estimated NPV (5%) of ~$1.07 billion at conservative metals prices ($1,700/oz gold, $19.00/oz silver), we arrive at a fair value of $802 million [US$9.55 per share]. This already points to a 75% upside to fair value from a current share price of US$5.20, but it doesn’t add in any value for the following:

- Albino Lake (under dispute), with the potential to extract 300,000+ GEOs at the cost of less than $200/oz (no mining costs)

- near-mine and regional exploration upside on a property that continues to yield phenomenal results, and newly acquired properties (Questex)

- 23 Zone/21A West Zones, which could increase the mine life at Eskay Creek or fill in gaps in the latter years

- Skeena’s interest in the Snip Project (high-grade ounces in British Columbia), where it has a free-carried interest if its partner Hochschild (OTCQX:HCHDF) chooses to earn in on the project

- any upside in metals prices and a $1,700/oz gold price assumption is brutally conservative for a mine set to operate between 2026-2035

- adding an underground component to Eskay Creek

Even if we are brutally conservative and assume the Albino Lake dispute isn’t solved and only assign value for Snip, newly drilled zones, and regional/near-mine upside (completely ignoring an underground component and newly acquired properties), I see a fair value for this upside of $300 million. If we combine this with a 0.75x NPV multiple (5%) on the current study ($802 million), I see a fair value of $1.10 billion. After dividing this by an estimated 84 million fully-diluted shares in Q3 2023, Skeena’s fair value comes in at US$13.10.

There’s no guarantee that the market will decide to give any value to Snip today nor exploration upside, even if further success looks highly likely given that this is a team that is not missing with the drill bit. Still, the above calculations show that even in a brutally conservative case ($1,700/oz / $19.00/oz silver), and even ignoring all the upside this property has to offer, and purposely using a conservative share count to factor in moderate share dilution, one can make a case for nearly 100% upside to fair value here.

Eskay Creek – Metals Price Sensitivity (Company Presentation)

If one chooses to model higher metals prices ($1,800/oz gold / $21.00/oz silver over the mine life), a positive resolution at Albino Lake, and an increase in the mine life, the fair value for Skeena quickly increases to the north of US$15.00 per share. To summarize, while some projects require using generous multiples, favorably massaging the numbers, and placing meaningful emphasis on exploration upside to generate triple-digit upside from a price target standpoint, this is a project that can withstand even a secular bear market in gold, has incredible upside, and is set to be one of Canada’s most profitable mines later this decade.

Eskay Creek Project (Company Video)

Summary

In a sector where some investors have had the displeasure of running into one or multiple land mines like capex blowouts with Argonaut (OTCPK:ARNGF) and Marathon (OTCQX:MGDPF), production issues with Pure Gold (OTCPK:LRTNF), and permitting issues with Fortuna (FSM), Skeena (SKE) is a simple story with world-class economics. This is because it’s a brownfields project next to existing infrastructure with phenomenal grades and support from the Tahltan Nation in an attractive mining jurisdiction where their biggest hurdles are snow and permits, not security (Burkina Faso), permitting disputes (Mexico), or nationalization (Kyrgyzstan).

Given these favorable attributes (industry-leading grades, ultra-low GHG emissions, modest capex, safe jurisdiction), I see Skeena as a top-5 takeover target, especially for a mid-tier or major looking to increase their exposure to Tier-1 jurisdictions while clawing back lost margins from inflationary pressures. That said, Skeena should have no problem bringing this into production on its own with limited share dilution, especially if it looks at a stream on a portion of silver at Eskay, which would still preserve the phenomenal project economics, but allow them to finance the project with primarily debt/stream.

So, for investors looking for a way to get hidden silver exposure at a sub 0.50 P/NAV multiple or simply looking for a developer with a high likelihood of graduating to producer status without massive dilution and capex blowouts, Skeena is a premier pick in the sector. In summary, I see the stock as massively undervalued even after its recent rally with over 130% upside to fair value (US$13.10), with the potential for an accelerated re-rating if a mid-tier/senior producer makes a move to acquire the company.

Be the first to comment