gguy44

(This article was co-produced with Hoya Capital Real Estate.)

Introduction

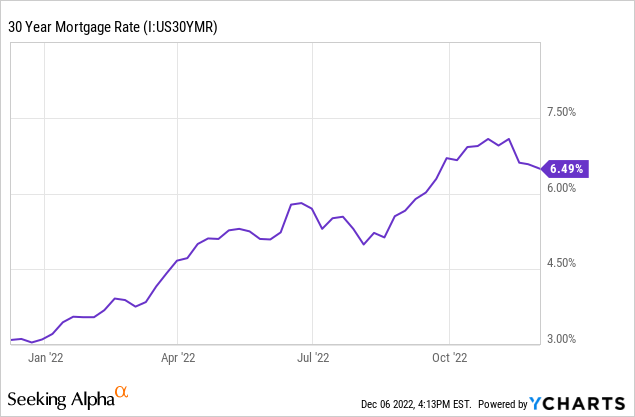

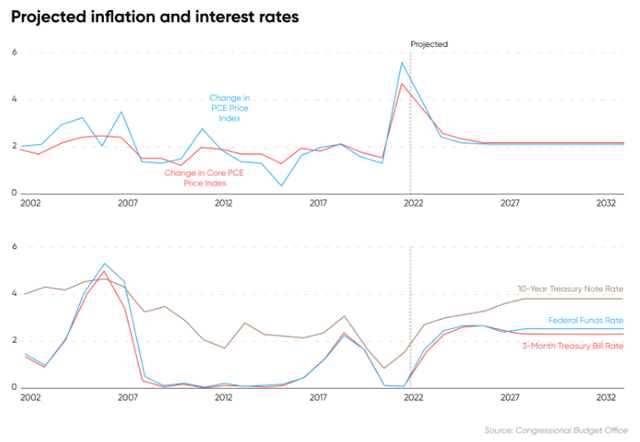

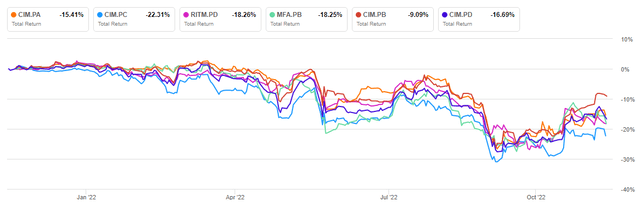

The next chart shows why most preferred stocks issued by mortgage real estate investment trusts, known as mREITs, have suffered since 2021.

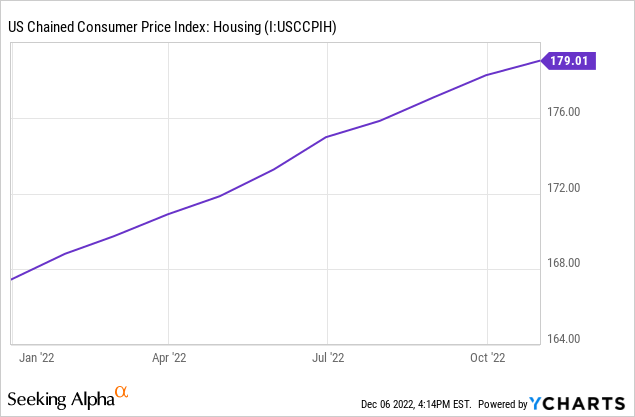

Even with the recent 50+bps pullback, today’s 30-yr mortgage is still the highest since 2002 and twice what buyers were paying at this time last year. Limited supply of homes for sale has push up housing prices, resulting in a double whammy to buyers’ ability to afford to buy or upgrade a house.

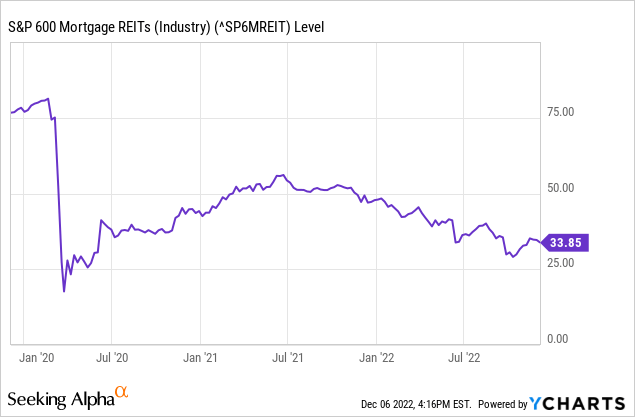

Home prices are up 80% since the COVID pandemic hit. Since many mREITs also make money by servicing mortgages, both of the above factors effect the supply of new or refinanced mortgages. The next chart shows how these factors almost got mREITs back to where they sold during the height of the COVID panic.

After an overview of the Chimera Investment Corporation (NYSE:CIM), I will review two of the preferred stocks:

- Chimera Investment Corp. 8.00% Series A Cumulative Redeemable Preferred Stock (CIM.PA)

- Chimera Investment Corp. 7.75% Series C Fixed/Float Cumulative Redeem Preferred Stock (NYSE:CIM.PC).

At the end, I included a link to an article that also review the common and the other two preferred stocks not reviewed here.

Chimera Investment Corporation review

Before I tackle the two preferreds, a top-level review of the issuer is important. While no mREIT preferred has failed, there were issues that skipped payments in early 2020. Seeking Alpha describes this mREIT as:

The company, through its subsidiaries, invests in a portfolio of mortgage assets, including residential mortgage loans, agency and non-agency residential mortgage-backed securities, agency mortgage-backed securities secured by pools of residential, commercial mortgage loans, and other real estate related securities. It has elected to be taxed as a REIT. In addition, the company invests in investment, non-investment grade, and non-rated classes. The company was incorporated in 2007 and is based in New York, New York.

Source: seekingalpha.com CIM

Chimera describes their mission and strategy as:

Our business objective is to provide attractive risk-adjusted returns to our shareholders over the long-term, predominantly through dividends and preservation of capital. We have $2.7 billion in total capital consisting of both common and preferred stock. Since inception, we have declared $5.8 billion common and preferred stock dividends.

We seek to maintain a diversified investment portfolio focusing on investing in residential mortgage loans, Non-Agency and Agency residential mortgage backed securities (RMBS) and Agency commercial mortgage backed securities (CMBS).Our income is generated primarily by the difference, or net spread, between the income we earn on our assets and our financing and hedging costs. We are commonly referred to as a hybrid mortgage REIT because we invest in both non-Agency and Agency mortgage assets. This model provides flexibility in portfolio asset allocation and liability management.

Source:chimerareit.com

They list four asset classes that comprise their portfolio.

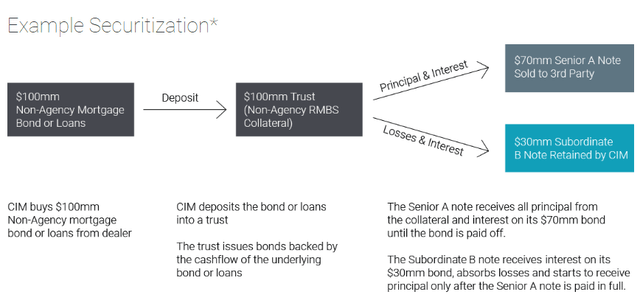

Residential Mortgage Loans: A significant part of our business and growth strategy is to engage in securitization transactions to finance the acquisition of residential mortgage loans. In those securitizations we retain the subordinate RMBS, which typically receive interest income but no principal until the securities senior to them are paid off. This helps mitigate reinvestment risk as principal may not be received for several years after the loan collateral is securitized.

Non-Agency RMBS: We invest in both investment grade and non-investment grade Non-Agency RMBS issued by third parties. We believe this portfolio will provide high risk-adjusted returns over the long-term.

Agency RMBS: We invest in RMBS issued or guaranteed by Ginnie Mae, Fannie Mae or Freddie Mac (Agency RMBS). These securities provide dual portfolio functions by providing both spread income and a source of liquidity for the company.

Agency CMBS: The Agency CMBS we acquire are primarily Ginnie Mae Construction Loan and Ginnie Mae Permanent Loan Certificates. These assets typically have prepayment protection. The borrowers on the underlying mortgage loan generally are required to pay a prepayment penalty if they prepay during the first 10-years of the loan. This prepayment protection generally makes these assets longer duration and thus easier to hedge interest rate risk compared to Agency RMBS.

A key element to their strategy is securitization which provides long-term stable financing and structural leverage to potentially enhance returns and mitigate risk. They provide the following diagram.

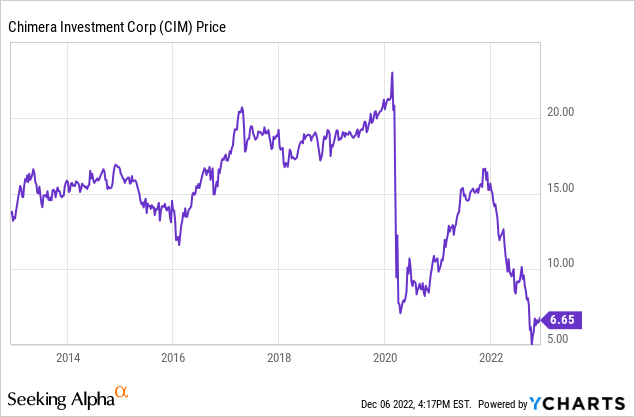

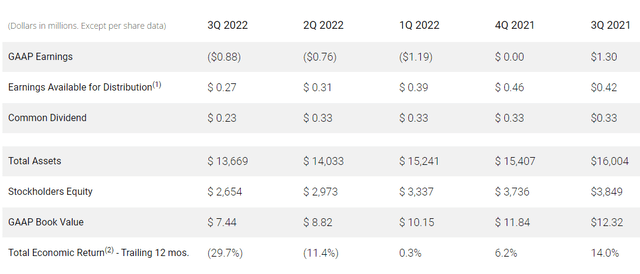

Like other mREITs I have reviewed recently, 2022 is not a pretty picture.

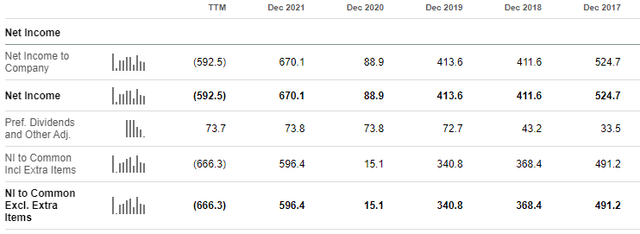

The drop in GAAP Book Value and Stockholders Equity both mean the Preferred shareholders have less protection. My calculation shows about a 3X coverage ratio for all four preferred issues. The next table shows how COVID and then the bounce back effected CIM’s Net Income; again 2022 is terrible!

seekingalpha.com/symbol/CIM/income-statement

Early this fall, another Seeking Alpha Contributor penned Chimera Investment: A Dividend Cut May Be Coming, which potential preferred buyers might want to read as such a cut could also negatively effect the preferred stock prices. After reviewing the data I found, I would have to agree.

Chimera Investment Corp. Preferred Stock review

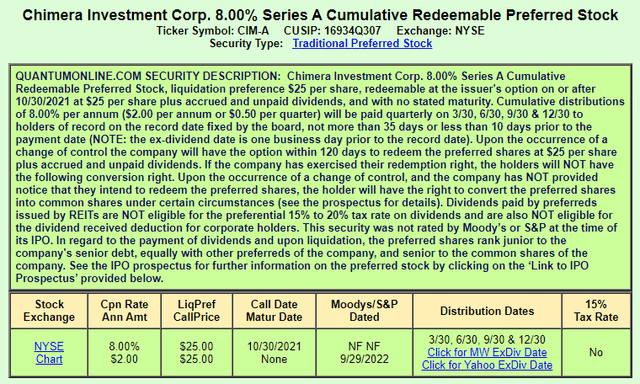

This preferred was issued in 2016 with $135m made available. Key feature include:

- It is cumulative, meaning past dividends must be made up before common shareholders receive payments. Unlike others, no payment was missed in 2020.

- The issue is currently callable.

- The coupon is fixed at 8%. Payments are not eligible for the 15% tax rate.

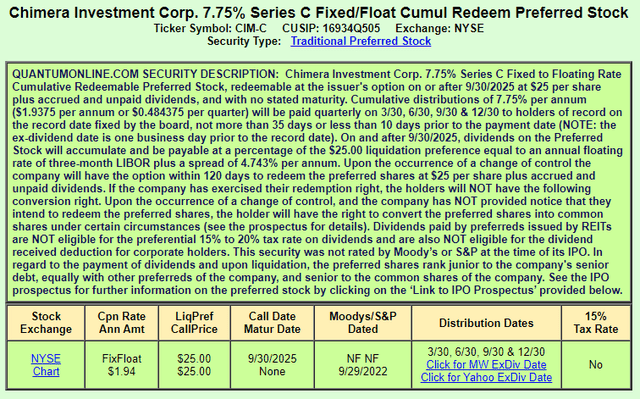

This preferred was issued in 2018 with $250m made available. Key feature include:

- It is also cumulative and payments were not missed.

- The issue cannot be called prior to 9/30/2025.

- If not called, the coupon converts from a fixed 7.75% rate to a fixed/floating rate of 4.743% + 3-month LIBOR (or replacement). The current 3-mo LIBOR is 4.76%. That would equate to a new coupon of 9.503%. Current forecasts have that rate about that level in 2025.

- Payments are not eligible for the 15% tax rate.

Comparing Preferreds (+ 4)

Along with the two review here, I am including basic data about two other recently reviewed positively:

- Rithm Capital Corp. 7% RT REST PFD D (RITM.PD): article link

- MFA Financial, Inc. PFD SER B (MFA.PB): article link

I also included the other two Preferreds from CIM.

| Ticker | Price | Coupon | Yield | Call Date | YTC | Float |

| CIM.PA | $19.91 | 8.00% | 9.85% | 10/31/21 | NA | NA |

| CIM.PC | $18.38 | 7.75% | 10.25% | 9/30/25 | 20.35% | 4.743%+3MoLIBOR |

| RITM.PD | $18.90 | 7.00% | 9.23% | 11/15/26 | 15.38% | 6.223%+5YTsy |

| MFA.PB | $19.19 | 7.50% | 9.47% | 4/15/18 | NA | NA |

| CIM.PB | $21.28 | 8.00% | 9.34% | 3/30/24 | 21.33% | 5.791%+3MoLIBOR |

| CIM.PD | $19.57 | 8.00% | 9.74% | 3/30/24 | 28.46% | 5.379%+3MoLIBOR |

If one only looked at current yield, the CIM.PC would be chosen. For those wanting to be called, CIM.PB should be first of that set, followed by “D”, “C”, then “A” if the 3-month LIBOR (or replacement rate, most likely SOFR) is high enough that CIM.PA’s 8% fixed rate is the lowest of the four. Where both floating components are now, “A” would survive; a year ago it would have had the highest coupon post-floating dates. The RITM.PD provides the longest call protection and highest risk of being called based on how its floating rate will be calculated. It appears the market is giving the two preferreds past their call date little chance of being called. For CIM, it doesn’t appear their finances would allow for outright redemption nor a lower coupon replacement.

Portfolio strategy

The Congressional Budget Office provides the current forecast out to 2032, with the key year of 2025 possible higher than now.

capital.com/projected-interest-rates

The current rate environment makes it hard to replace a callable issue with new one at a lower coupon, which was common in 2021. It is my belief if a company has multiple issues, as all of these do, they might not redeem the first callable issue and wait for a later one where the coupon will overtake the one with the earlier call date, such as I see the case for CIM and Rithm Capital Corp (RITM).

Investors considering owning preferreds with different call dates selling below Par have to decide which is more important between current yield, YTC (if applicable), and the call protection offered. Or between a known coupon and the unknown floating-rate coupon. My preference is take the fixed, known rate; others have indicated they look at a below-Par price and hope to make a “killing” when called. By owning multiple preferreds, one can do both strategies.

Final thought

The main reason I chose to review these preferred issues is another Seeking Alpha Contributor recently reviewed and liked the other two: Chimera Preferreds Offer Value; The Common Does Not. As the title states, they are not fans of Chimera Investment Corporation common stock.

Be the first to comment