slobo/E+ via Getty Images

Back in my younger days I used to play college basketball.

To be honest, I was a benchwarmer, but just like REITs, basketball was my passion.

I would spend countless hours shooting free throws and practicing three-pointers, similar to my work ethic today in the REIT sector.

As most of my followers know, the primary reason that I have more followers than anyone on this platform is because I love what I do.

I wake up every single day motivated to help educate Average Joe and Jane.

That’s why I’m especially excited to be writing another book, REITs for Dummies, in which I will cover “everything” imaginable in REIT-dom.

I plan to dedicate an entire section to Net Lease REITs, which happens to be the topic for this article today.

In basketball terms, these two net lease REITs are slam dunks – based on fundamentals and valuation.

So let’s get down to business…

Spirit Realty (SRC)

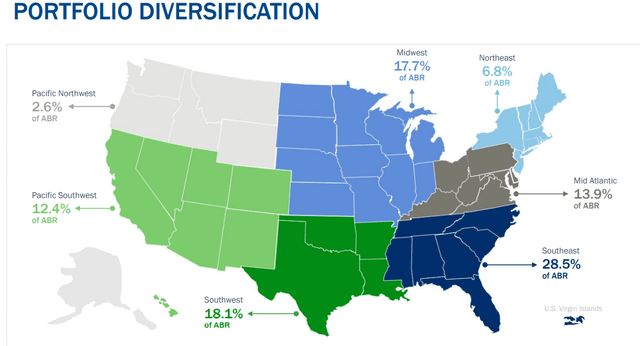

Spirit Realty was founded in 2003 and went public in 2012. It is a Triple-Net-Lease that invests in single-tenant free standing properties and is well diversified in its geographic locations, as well as its industry / tenant mix.

As of Q322, Spirit Realty has 2,118 properties across 49 states with 346 tenants in 34 different industries.

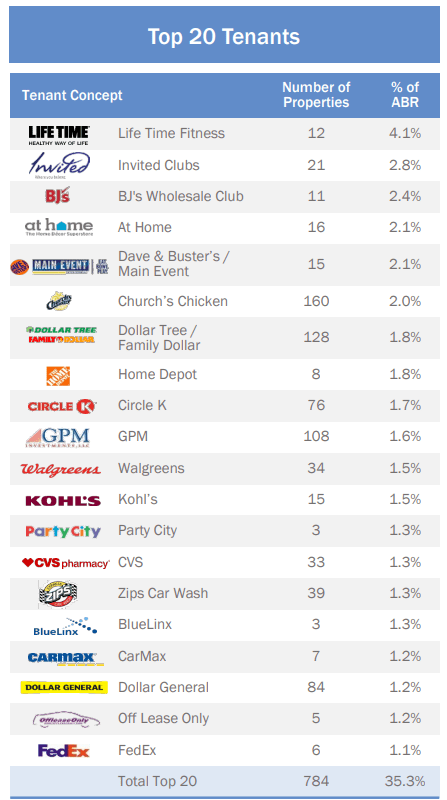

No single tenant makes up more than 4.1% of its annual base revenue (ABR) and its top 20 tenants combined only make up 35.3% of its ABR.

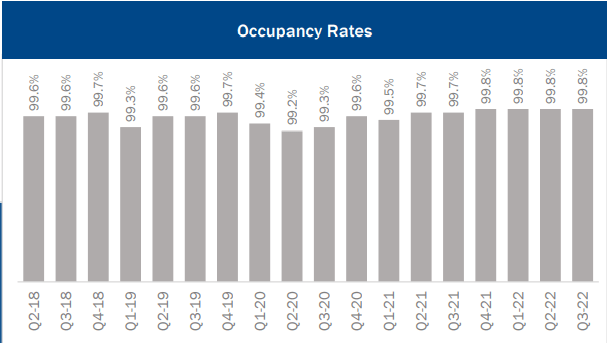

Spirit showed great resilience during the pandemic with occupancy rates staying above 99% throughout 2020. As of Q322, Spirit Realty has an occupancy rate of 99.8%.

SRC Q3-22 Presentation SRC Q3-22 Presentation

A critical piece of information with Spirit Realty is that it had a major overhaul in management starting with its new CEO Jackson Hsieh who was appointed in 2016 and then a fairly significant spin-off in 2018. Below is an excerpt from an interview with Jackson Hsieh –

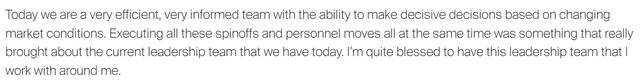

After the management change and spin-off, Spirit Realty is a much different and stronger company than it was prior to the changes, but its price multiple does not seem to reflect the improvements. Below is an illustration of the change in its asset mix since 2018 –

As shown above, Spirit increased its industrial properties from $29.1 million to $137.0 million and reduced its office exposure by roughly $2.0 million.

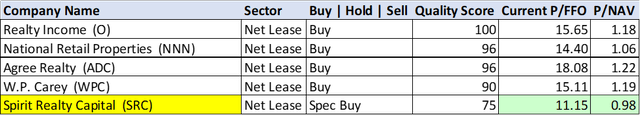

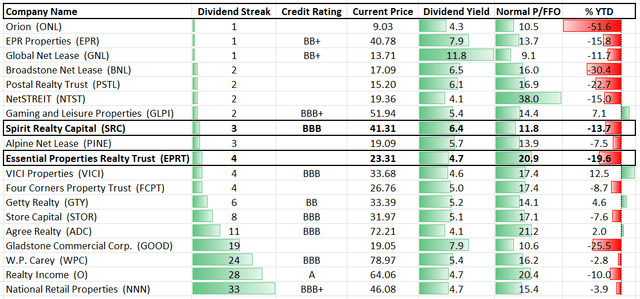

When comparing Spirit Realty with some of the premier Net Leases REITs, the difference in valuation really jumps out. Spirit does score lower on quality, but it trades at just 11.15 times its FFO, while the others are around 15 times FFO.

In my opinion, the drop in quality does not justify such a disparity in valuation, especially considering how it appears Spirit is putting more emphasis on industrial properties, which as a sector currently trades at higher multiples. Spirit Realty is also the only one below trading below its NAV.

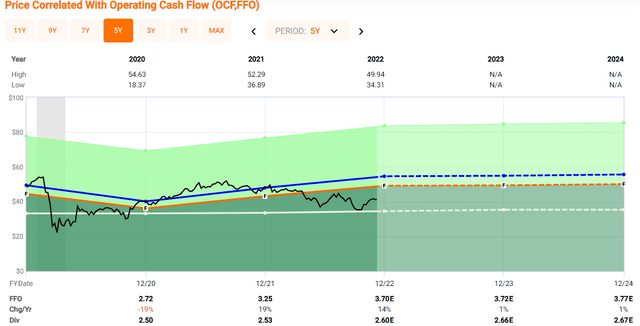

Likewise, Spirit is trading below its 5-year average P/FFO of 14.76x –

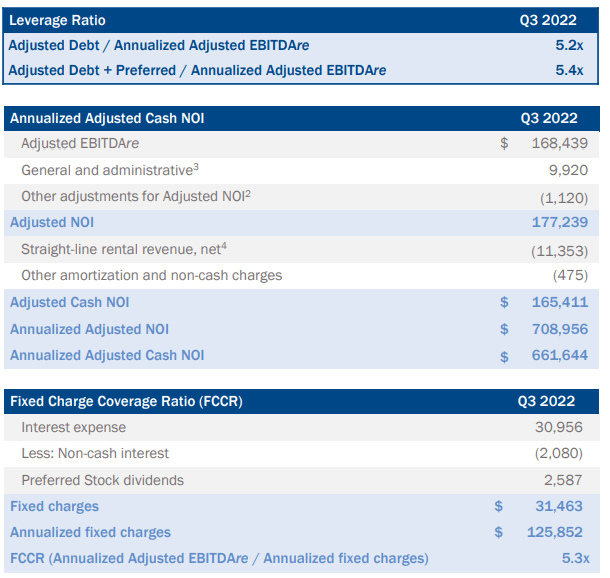

Spirit Realty is investment-grade rated with a BBB rating and its balance sheet is in a strong position with a leverage ratio of 5.4x and a fixed charge coverage ratio of 5.3x.

SRC Q3-22 Presentation

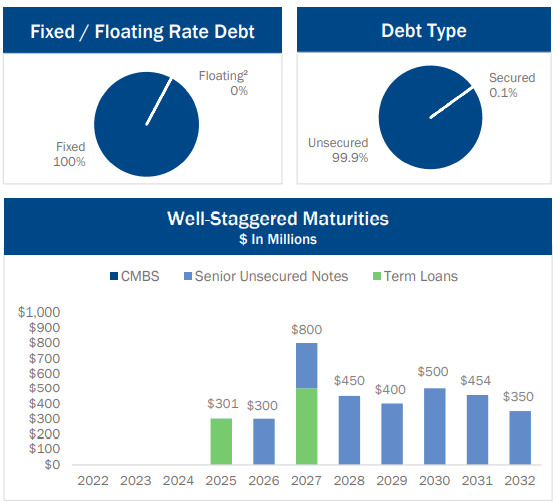

In terms of its debt, 100% is fixed and 99.9% of it is unsecured and no maturities come due until 2025. This sets Spirit up well for the current interest rate environment and should allow them to weather whatever storm may come in 2023.

SRC Q3-22 Presentation

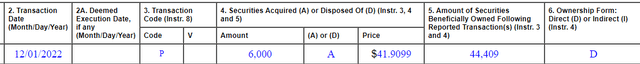

To sweeten the pot a little more, according to a recent Form 4 filing, an insider bought 6,000 shares on 12/1/22, which reflects confidence in the company.

Between its dividend yield of 6.43%, a strong balance sheet and attractive valuation we at iREIT rate Spirit Realty as a BUY. In addition, we consider SRC a prime-time takeover target – and Realty Income (O) is the most likely buyer (we plan to model this M&A deal for iREIT on Alpha members).

Essential Properties (EPRT)

A more recent addition to the Net-Lease space is Essential Properties which was founded in 2016 and went public in 2018.

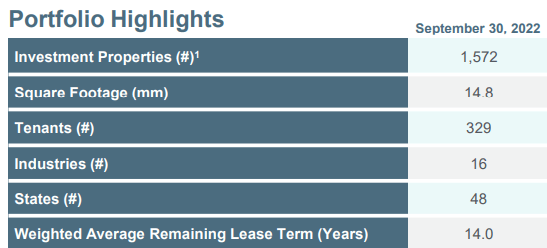

EPRT focuses on Service-Oriented and Experience-Based Tenants and is widely diversified. As of 3Q22, EPRT owned 1,572 properties in 16 different industries across 48 states. They have a 14-year weighted average lease term (WALT) and currently have an occupancy rate of 99.8%

EPRT Q3-22 Presentation

Additionally, EPRT is well diversified among its tenants with its largest tenant making up only 3.7% of its annual base revenue.

EPRT Q3-22 Presentation

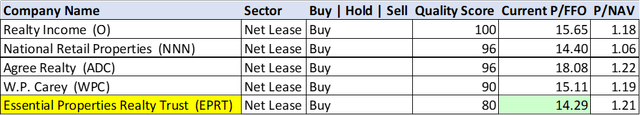

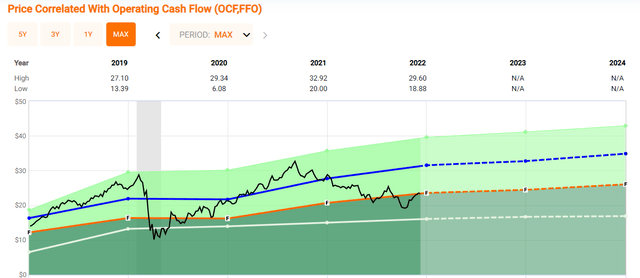

When comparing EPRT to some of its premium Net Lease peers they trade at a slightly lower FFO multiple of 14.29. But when comparing EPRT’s current multiple against its normal multiple of 20.85 it appears to be trading at a significant discount.

There are two things that really stand out to me when looking at EPRT – their debt profile and the FFO growth they have exhibited.

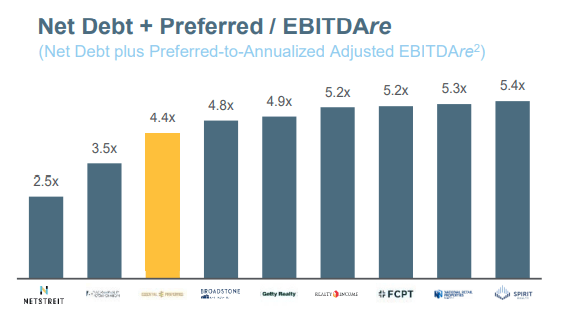

Per FastGraphs they have grown FFO at 13.5% annually since 2019. Growth estimates have slowed to 4% and 7% in years 2023 and 2024 respectively, but those expected growth rates compare favorably to other Net Lease peers like Realty Income which is expected to grow FFO at 2% for both 2023 and 2024.

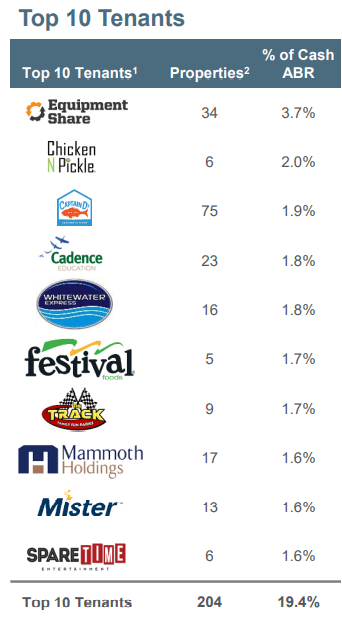

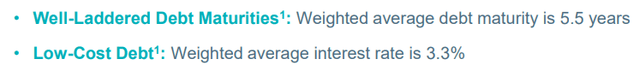

EPRT’s debt profile really stands out in a good way. Their weighted average debt maturity is 5.5 years with no maturity due until 2024 and their weighted average interest rate sits at 3.3%.

In terms of overall leverage EPRT has a Net Debt / Annualized Adjusted EBITDAre of just 4.4x which is lower than most of its peers.

EPRT Q3-22 Presentation

At the same time, EPRT is expected to grow AFFO at a higher rate than all but one of its peers.

EPRT Q3-22 Presentation

With EPRT trading at FFO multiples slightly under its premium Net-Lease peers, but with an expected growth rate exceeding most of its peers, it appears that EPRT is attractively priced right now. Especially when considering the strength of their balance sheet and the normal FFO multiple it has traded at in the past.

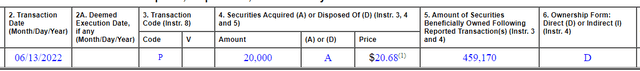

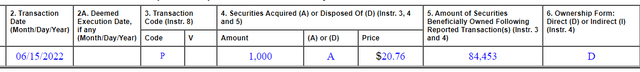

Like Spirit Realty, there has been recent insider buying at EPRT.

Not quite as recent as the insider buy at Spirit, but in June of this year, two insiders purchased shares for approximately $434,000. EPRT now trades at a higher price, but this still shows insider confidence in the underlying business.

EPRT trades at an attractive valuation compared to its peers and compared to its normal multiple, especially in light of the strength of its balance sheet and expected growth rates going forward. At iREIT we rate EPRT as a BUY.

In Closing…

Both SRC and EPRT present compelling opportunities.

I see SRC as being penalized for its past management and the market has not “caught up” to the management and structural changes of the company. The company trades at one of the lowest FFO multiples in the Net Lease space with a dividend yield of 6.42%.

EPRT on the other hand trades at multiples more in line with where the Net Lease space currently trades, but with a larger FFO rate of growth and lower leverage than most of its peers.

As always, thank you for reading and commenting.

Happy SWAN Investing!

Be the first to comment