Florent Molinier

SoFi’s (NASDAQ:SOFI) year-to-date stock price is not great with the company’s common shares down 68%. There are signs that more dread is to come with the talk about a Fed pivot increasingly looking unhinged. The hawks are here to stay and the stock market likely stands to make new lows until inflation is under control. For SoFi bears the current outcome was always to be expected as the now dominant risk-off trade started to form just over a year ago when it was clear inflation would not be transitory. But their focus on broader macro factors betrays the core weakness of the short base; SoFi’s operational performance is strong and set to get even better.

Hence, the crux of the bear trade tends to gravitate around three main points. Firstly, the market for the financial products offered by SoFi is saturated with traditional banks and VC-funded startups alike chasing market share. Indeed, Robinhood (HOOD) before its collapse and rounds of employee layoffs was planning on offering current account services to its customers. There has also been a rush of similar fintech companies going public from MoneyLion (ML) to Dave (DAVE). Non-bank lender Chime has also tapped Goldman Sachs (GS) for a public offering likely in the next year. For the bears, the barriers to entry for fintech are low and SoFi is not particularly unique or deserving of its retail investor following.

The second focus of bears is on the company’s flywheel strategy itself. This strategy is built on SoFi offering its members a full suite of different financial products that can be layered on top of each other to keep customers engaged and within the ecosystem. It holds the potential to deliver strong shareholder value in the years ahead by boosting the lifetime values of each new member whilst simultaneously reducing customer acquisition costs. Bears see the focus on numerous financial products from banking, to insurance, to investing as making SoFi too much of a generalist. Essentially, a jack of all trades but a master of none.

Thirdly, and finally, bears think the broader macro context is itself set to continue to be fiercely against unprofitable mid-cap fintech companies that recently went public in the back of a now-dead SPAC boom. There likely stands to be more pain to come as bulls get beaten trying to fight the FED. The continuation of the risk-off trade could continue to push SoFi to new lows even into the new year and against the expiration of the student loan repayment moratorium.

Don’t Fight The Flywheel Strategy

Firstly, banking services have always been ubiquitous. What drives value and in turn addresses the second bearish case is breadth and scale. Whilst SoFi is not yet profitable, the company expects to reach this position in the near future due to its flywheel strategy.

Fundamentally, profitability is a function of scale. Hence, the bundling of different financial products drives large economies of scale whilst reducing customer acquisition costs and expanding their lifetime value. This combined with its banking license and leadership position in student loan refinancing helps differentiate SoFi from its competitors. SoFi stands to be a general specialist precisely because it is able to derive value from many intersectional lines of business that keep its members within its own ecosystem consuming new products without extra marketing spending.

The company’s banking arm is also taking in billions of dollars in deposits, driving down SoFi’s core financing cost. This not only helps SoFi offer more competitive rates to its members, but it will also be a key driver of profitability in the future.

The third argument that there is more pain ahead is right. The Fed has provided no indication that it will pivot and recent moves by OPEC+ to cut their production quota will help keep gasoline prices higher for longer. The markets crashed on the back of the most recent job report that showed more Americans are employed and have jobs to spend on the real economy. This emphasises how skewed the current market sentiment is. Such a dichotomy from historically bullish macro news is a reflection of the unique conditions of our time. How long such unique conditions stay will be a function of how low energy prices can fall to drive down inflation. Inflation will eventually come down SoFi’s valuation will rise to match its underlying operational strength when the Fed pivots.

The Bears Will Come Around Soon

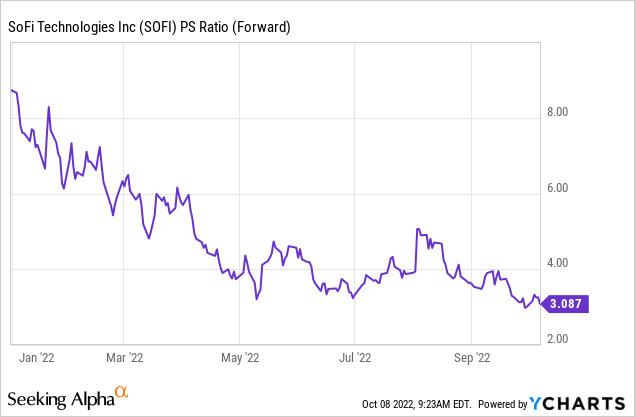

SoFi’s price-to-sales ratio has fallen to a multiple of 3.09x. Even more jarring is when you compare this against a forecasted 3-year compound annual growth rate until fiscal 2025 set to be at least 34%.

This should see revenue for fiscal 2025 come in at $3.65 billion. SoFi could very well outperform this to realize quarterly revenue that tops $1 billion. Hence, applying the current record low forward multiple of 3.09x could see the company’s market cap trade at $11.27 billion, more than 2.3x its current market cap. Further, a valuation expansion is likely against the current basement market sentiment reverting to its mean. This would have a positive upward effect on SoFi’s commons. Against this, it’s hard not to remain long SoFi.

Be the first to comment