Justin Sullivan

Verizon Communications (NYSE:VZ) is one of America’s three primary wireless telecom providers. The stock is known for its stability and blue-chip nature. However, 2022 has brought an unexpected development on that front as Verizon has suffered its worst price performance in many years.

I see the bull case for VZ stock as pretty straightforward. So, I’ll run through the main points quickly, and then spend more time on the possible downside and concerns that are causing the current slump in Verizon’s valuation.

VZ Stock’s Appeal

The value case for Verizon stock is not hard to identify. Shares are trading at 7x earnings and paying out a 7% dividend yield. We haven’t seen too many large-cap stocks offering sevens on both of those figures in recent years. The company should also be fairly resistant to recessions, as consumers will be loath to lose phone access even in a rough economy. Verizon throws off tremendous cash flows. Its industry has a limited number of competitors, which tends to provide further stability.

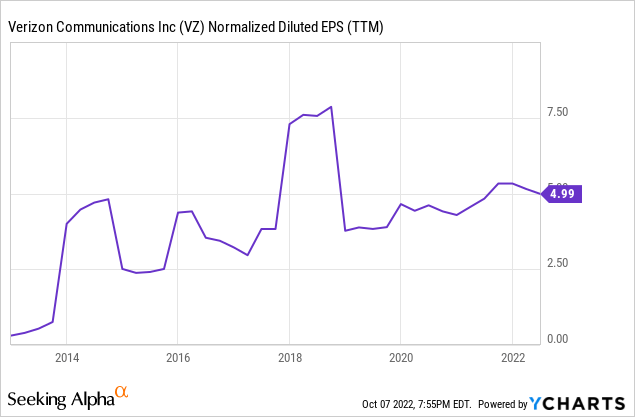

The company doesn’t scream value trap, either. It has generally grown both revenues and earnings in recent years. Earnings have had a number of short-term items that impacted results, but the general trend has been higher over the past decade:

The company recently hiked its dividend again, and management signaled that a share buyback may be in the cards depending on how quickly the company can get its debt/EBITDA ratio down to the firm’s target.

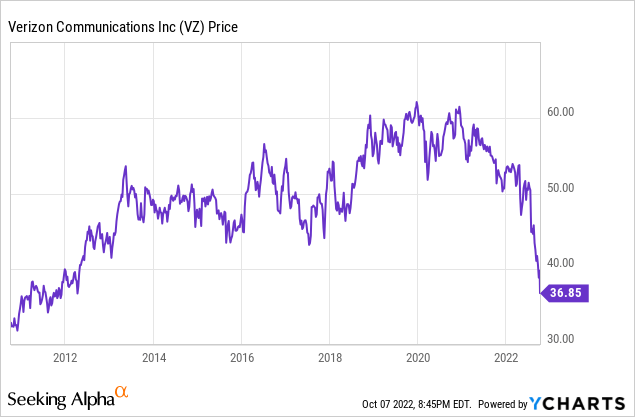

With all these pieces of reasonably upbeat news, why is VZ stock trading down to its lowest point in a decade?

Verizon: Reasons For Worry

There are two main factors holding Verizon shares back at the moment. The first is concerns around its execution in the wireless industry, and the second is due to broader macroeconomic factors.

On the first point, Verizon has ceded some market share to T-Mobile (TMUS) in recent years. T-Mobile ran an excellent business strategy, both operationally and in terms of marketing, under charismatic former CEO John Legere. Years ago, T-Mobile was far smaller than Verizon and AT&T (T) and earned correspondingly poor profit margins due to its inferior scale. However, aggressive marketing and network spend in addition to the Sprint merger have turned T-Mobile from a lower-tier player to a power.

Additionally, T-Mobile’s choice to not pay a fat dividend has arguably given the company more flexibility. With more cash from operations available, T-Mobile has been smartly able to allocate incremental capital into things such as spectrum auctions that have enhanced that company’s strategic positioning for the long-term. That’s not to say that AT&T and Verizon haven’t spent up on pricey spectrum or 5G deployments, of course. However, they’ve generally had to utilize large amounts of debt to fund both these expansions and the dividend, which is currently leading to consternation given the rising interest rate environment.

Will T-Mobile continue to be an unstoppable juggernaut going forward? I doubt it. For one, much of the low-hanging fruit has already been harvested for T-Mobile following the Sprint merger. And, it should be noted, Legere arguably played a huge role in T-Mobile’s comeback, and we shouldn’t necessarily believe that the company will continue to outpace its rivals so significantly under different leadership.

Yes, market share is absolutely a concern and Verizon is losing share to T-Mobile. I fully agree with Verizon’s doubters on these points. And until we see T-Mobile’s results start to waver, Verizon owners should keep a wary eye here. Stone Fox Capital had an excellent breakdown of the current market share situation and the challenges that it presents to Verizon’s outlook today. However, there’s another layer of nuance I’d add to the discussion.

Looking at the data Stone Fox cited in that report, Verizon’s network is the clear #2 on many quality metrics such as speed. Verizon isn’t beating T-Mobile, despite considerable capital expenditure. However, it is outpacing AT&T.

Long-time readers will know that I’m no fan of AT&T. The company has historically chased bright shiny objects instead of executing in its core business. DirecTV, the Mexico expansion, and then the Time Warner deal all speak to this point. Due to these ill-conceived moves, AT&T has had to retrench, selling off assets and slashing its dividend to pay down debt. These measures have helped reverse the slide to some extent, but AT&T was the world’s single most indebted company not that long ago. It’s going to be a long road back to stability let alone excellence for AT&T.

If Verizon were trading at a premium valuation, its significant shortcomings compared to T-Mobile could be a show-stopper. However, we’re talking about a company at 7x earnings which is well ahead of one of those peers in a three-vendor market. Also, it’s a market for a utility service that should hold up even in rough economic times. The T-Mobile competitive threat explains why Verizon stock isn’t trading at an optimistic price, but the valuation down here reflects far more than just that.

The other big issue is the macroeconomic headwinds. Stocks have gone into a bear market, and people are demanding much higher yields on stocks to adjust to higher interest rates on fixed income securities.

More specifically, Verizon has a ton of debt, and thus is perceived to be at great risk in a rising interest rate world. I disagree with this take, however, The company’s balance sheet is fine, earning an A- rating from Fitch and BBB+ from S&P. The company has very little variable interest rate debt, and a large portion of its fixed rate debt doesn’t mature until the 2040s and 2050s. There’s no wall of near-term debt that would endanger Verizon’s cash flows in the intermediate term.

In fact, the company is paying down debt and management has suggested that it may begin buying back stock as soon as it hits its preferred debt/EBITDA ratio. This is a night and day difference from AT&T, where its debt load forced drastic measures to improve the company’s financial position. Verizon has its share of longer-term concerns, but it’s in no way on the same footing as AT&T was in 2021.

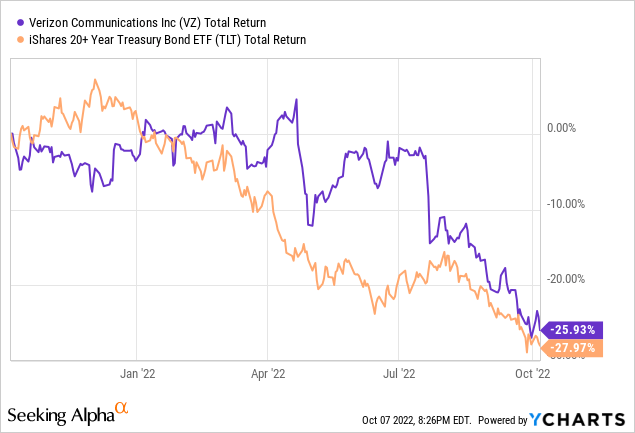

Switching gears, I’ve seen people saying that Verizon stock was supposed to act like a bond, and thus been disappointed with the company’s total returns in 2022. Yet, when you look at the long-term U.S. treasury bond ETF (TLT), it’s down virtually the same amount over the past 12 months, and correlation has become very high in recent weeks:

So, in a way, Verizon is delivering bond-like returns. The matter being rather that bonds are having their worst year of performance since the 1970s.

I’d argue that much of the worry about Verizon stock is because people haven’t appreciated the extent to which shares are acting like a fixed income asset. At some point, the Federal Reserve will reach a point where its concerns around inflation and unemployment balance out, rates stop going up, and bond-like instruments, such as VZ stock, settle down.

VZ Stock Verdict

I’d note that Morningstar’s latest report on the company is headlined “Verizon Will Likely Struggle to Grow as Rivals Gradually Gain Market Share.” Sounds negative, right? And yet, Morningstar’s Michael Hodel assigns a $59 price target to VZ stock, which is an 8.5x EBITDA multiple on this year’s projected results. Shares are more than a third undervalued at today’s price versus that target. Not so bad after all.

That should give you some sense of the current state of sentiment for VZ stock. Even some skeptics on the company who see it continuing to lose market share think shares are worth far more than today’s price.

It was perfectly reasonable to have a sell or avoid outlook on Verizon when the stock was in the $50s due to challenging industry dynamics. But at $37, you have to be forecasting a major decline in operating results for the share price to make much sense.

The company is generating a 13% earnings yield at starting levels, which covers the generous dividend with plenty of room to spare. Verizon is strengthening its balance sheet and has signaled that it will begin share repurchases if and when its debt reductions reach their desired level. The company also just raised its dividend again.

These are not the behaviors of a firm that is facing any meaningful financial strain. The stock price will be volatile for the duration of the current rate hike cycle, but the underlying business fundamentals support a share price significantly higher than $37.

Be the first to comment