Klaus Vedfelt/DigitalVision via Getty Images

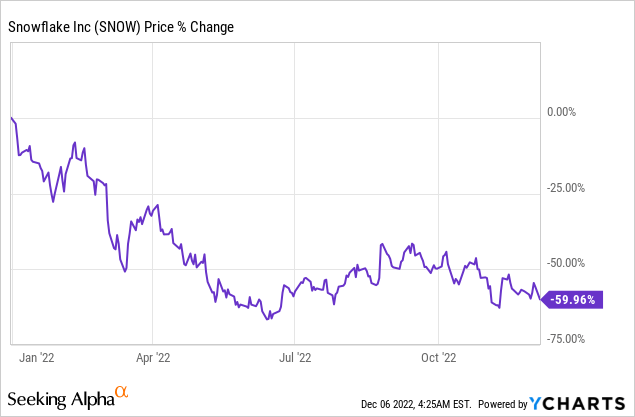

Shares of cloud-based data platform Snowflake Inc. (NYSE:SNOW) have revalued 60% to the downside so far in 2022 due to investor concerns about moderating top line growth and product adoption in a market that is slowing down post-pandemic. Although Snowflake has seen a major decline in its market cap, the company continues to grow its customer base and exhibits strong customer retention rates. While there are challenges stemming from moderating revenue growth in a post-pandemic world, I believe Snowflake is executing extremely well and SNOW stock has potential in the long term!

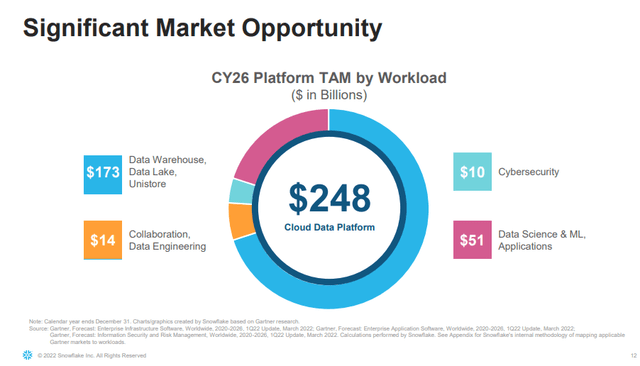

Large addressable market

Snowflake offers its customer base data storage, processing, and analytic solutions that are meant to help companies scale their businesses and create operating efficiencies. The cloud data platform market is growing as more workloads shift to the cloud and estimated to be worth about a quarter of a trillion dollars, with the sub-segment of warehousing and data storage — Snowflake’s core business — accounting for $173B (70%) of the total addressable market (“TAM”).

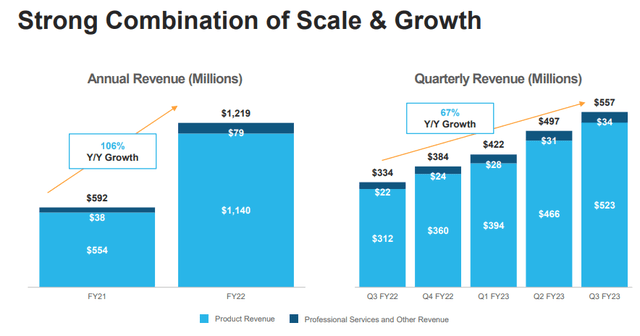

Snowflake’s business still produces robust top line growth, although the firm’s growth, like I indicated above, is moderating. Snowflake generated 67% year over year top line growth in FQ3’23 and grew to its revenues of $557M in the last quarter, $523M (94%) of which were product revenues. The company’s product revenues reflect revenues from compute, storage, and data transfer resources that the customer consumed during the reporting period. In the previous quarter, Snowflake saw 83% year-over-year topline growth, so while it is true that growth is slowing down sequentially, the 67% revenue growth rate achieved in FQ3’23 is still remarkable.

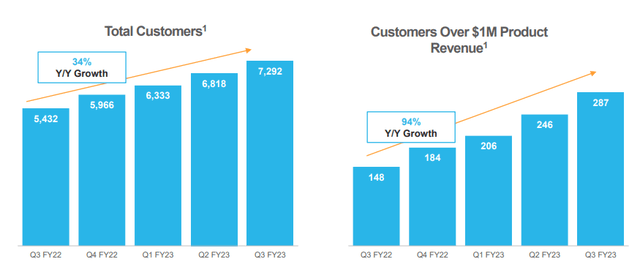

Momentum in customer acquisition

Snowflake is making inroads with the largest and most profitable accounts: corporate accounts that have an annual product-spend exceeding $1M. While total customer accounts grew 34% year-over-year to 7,292 accounts at quarter-end, the really lucrative accounts grew 2.8 times faster at a rate of 94% in FQ3’23. By the end of the September-quarter, Snowflake’s cloud platform had attracted 287 customers that spent more than $1M each year on Snowflake’s products and services.

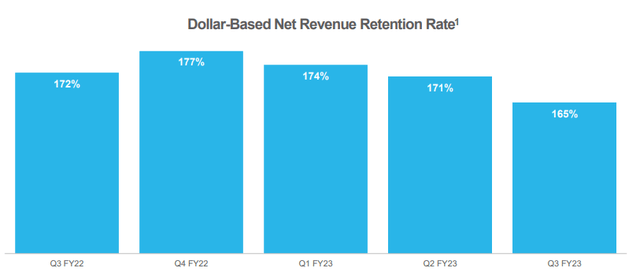

Very strong customer retention and monetization

Snowflake measures its customer monetization success through a figure called dollar-based net revenue retention rate/DBNRR. In short, this measure expresses by how much existing customers are increasing their platform-spend from one reporting to the next. A retention rate of 165% (Snowflake’s DBNRR in FQ3’23), as an example, shows that customers increased their spending on the Snowflake platform by 65% year over year.

And although the net revenue retention rate declined 6 PP quarter over quarter to 165%, the firm’s retention rate compares very favorably to those of other cloud-based platforms. Fastly (FSLY) had a net retention rate of 122% in Q3’22 (source), while Datadog (DDOG) had a dollar-based net retention rate of 130% (source) in the last quarter. Customers clearly appreciate Snowflake’s platform offering and strategy, and reward the company with higher-than-average retention rates.

Growing free cash flow

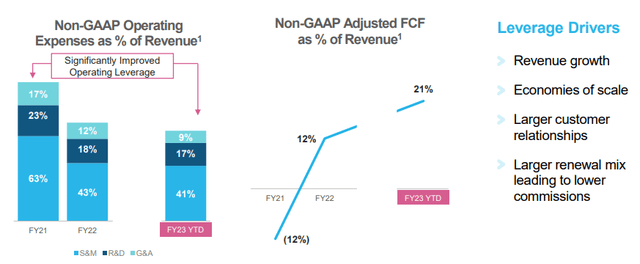

Snowflake has a lever to grow free cash (margins), and this layer is called operating leverage. The cloud company is reducing operating costs while at the same time scaling its product offering, which results in strong margin growth. Specifically, Snowflake has reduced spending on sales & marketing in FY 2023 and improving customer monetization especially has made this possible. Given Snowflake’s positive operating leverage, the cloud company has seen a dramatic improvement in free cash flow margins from (12)% last year to 21% so far in FY 2023.

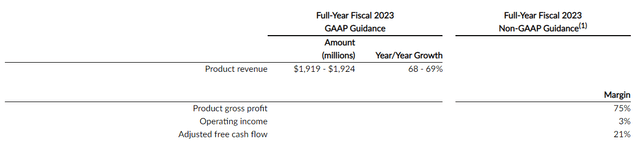

Raised outlook for FY 2022

Due to strong customer acquisition and retention, Snowflake raised its FY 2023 revenue outlook from $1,905-1,915M to $1,919-1,924 million, showing an increase of $14M at the low end and $9M at the top end of guidance. In total, Snowflake expects 68-69% topline growth this year. Snowflake’s long-term goal is to grow product revenues 30% annually, which would put the firm on a path to reach $10B in revenues by FY 2029.

Snowflake’s valuation

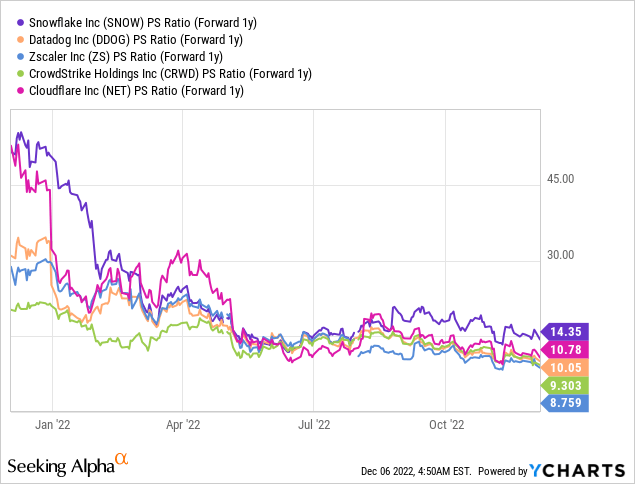

Snowflake is trading at a FY 2023 P/S ratio of 14.3 X which makes it the most expensive publicly-traded cloud company. However, Snowflake has industry-leading retention and the company’s strong penetration of the large corporate account market ($1M+ annual revenues) which I believe are deserving of a premium. I believe that Snowflake is attractively valued given its long-term market opportunity, revenue growth and positive free cash flow margins.

Risks with Snowflake

Snowflake has been pushed into a down-leg at the start of the year that effectively lasts to this day. The reason is that investors have become more cautious about highly valued cloud platforms, many of which are still struggling with the generation of positive free cash flow. The biggest risk I see for Snowflake is slowing top line growth and weakening customer retention, because this is largely what my bull case for Snowflake is focused on.

A steep deterioration in customer monetization (decline in Snowflake’s DBNRR rate) and large corporate accounts leaving the Snowflake platform would be two reasons for me to revisit my investment in Snowflake.

Final thoughts

Snowflake is executing well and the number of customer accounts is still growing rapidly. Additionally, Snowflake has strong and improving customer monetization — as measured by the dollar-based net retention rate — and although it has to be admitted that Snowflake is not growing as fast as it did during the COVID-19 pandemic, I believe investors should not be bickering about a 67% year over year revenue growth rate. Snowflake also has a large addressable market and continues to make inroads in the highly lucrative segment of corporate accounts that spend more than 1M annually. Given these facts, I believe Snowflake’s P/S ratio can be justified!

Be the first to comment