VioletaStoimenova/E+ via Getty Images

Heritage Insurance Holdings, Inc. (NYSE:HRTG) works in a turbulent market landscape. But its revenue growth and liquidity position allow it to stay afloat amidst the storms. Meanwhile, the stock price remains in a downtrend in line with market disruptions. It is not very cheap, but may still increase to $4.5-5 per share as per the P/TBV ratio. Also, the dividend yield is higher than the market average.

Company Performance

The state of Florida is becoming a harsh environment for P/C insurance companies. Many problems are bugging the industry, which causes more volatility and disruptions. It is no wonder that it is on the verge of the P/C insurance exodus. Since 2017, it has intensified with six companies leaving the state. Now, another three are liquidating, while at least one company cannot secure reinsurance.

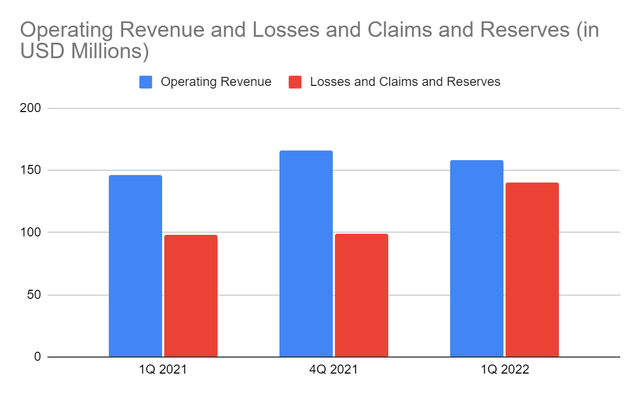

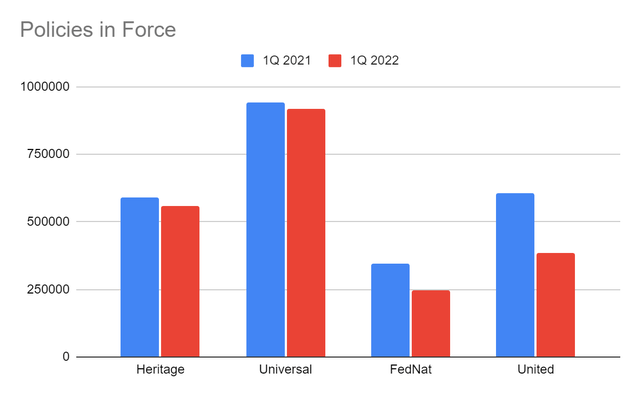

Heritage Insurance Holdings, Inc. is one of the popular P/C companies to remain in the state. But no matter how large and resilient it is, it continues to endure the blows of the harsh market. Roofing scams and excessive claims are some challenges it has to face. Despite this, it continues to prove the durability of its core business. For instance, its revenue of $158 million is an 8% YoY growth from 1Q 2021. Currently, its policies in force of 559,496 are 5.7% lower than 591,924 in the same quarter of 2021. Thanks to its strategic pricing and relatively solid customer base and popularity. These may help it stabilize its operations amidst the decline in policies in force. Note that there is a massive influx of policyholders applying for P/C claims. Also, rate adjustments allow it to cushion inflationary pressures.

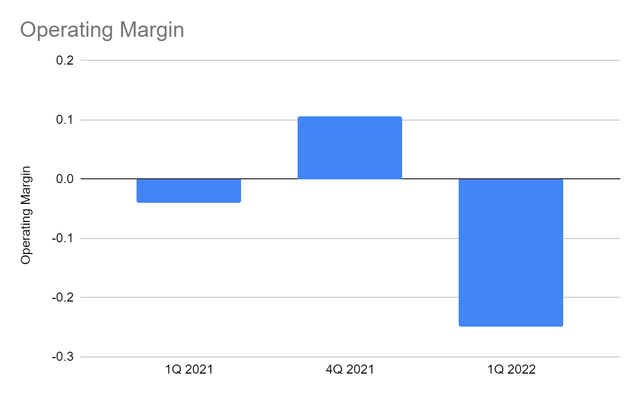

But HRTG must generate more revenues to offset the massive wave of claims. The actual claims surpassed the anticipated number. The amount of $140 million is 42% higher than in the previous year. The increase is also four times larger than the increase in premium revenues. Thankfully, its SG&A expenses and policy acquisition remain stable. But the net amount of revenues and claims is not enough to cover them. The decrease in independent insurance agents is another problem. As we can see, its operating capacity remains limited. In turn, the operating margin continues to plunge deeper at -0.249 vs. -0.039.

Operating Revenue and Losses Claims (MarketWatch)

Operating Margin (MarketWatch)

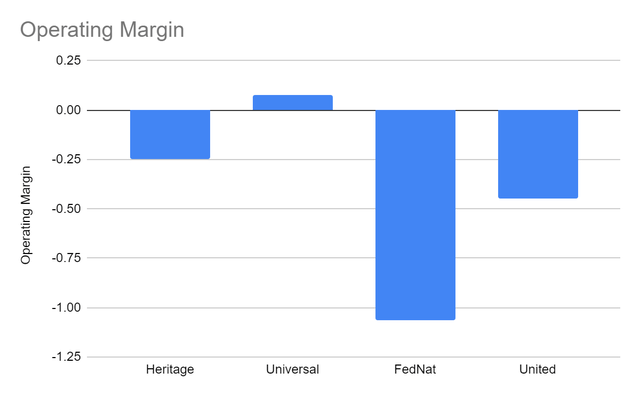

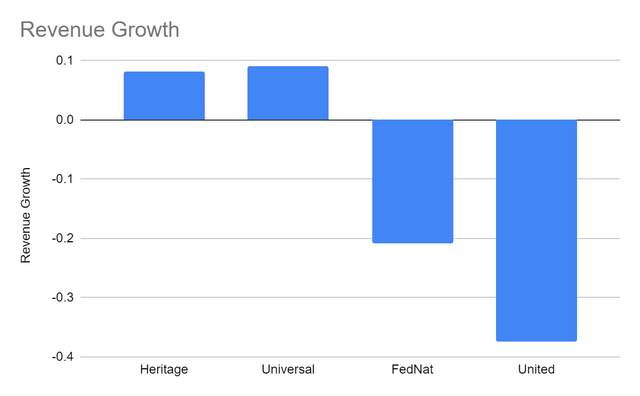

If we compare it to its Florida peers, Universal Insurance (UVE) shows the best core operations. Even so, HRTG is still doing better than FedNat (FNHC) and United Insurance (UIHC). Both FNHC and UIHC have a noticeable revenue decrease and margin contraction. Also, their policies in force are lower by about 30% than the comparative quarter. It may be due to policy cancellations under the restructuring plan. Inflation and higher reinsurance costs are other factors that affect their performance.

Operating Margin (MarketWatch)

Now, lawmakers are moving to combat abusive contractors and scammers. In 2021, a senate bill was approved to provide an added layer of protection. Today, the state prohibits contractors from reaching out to clients for roofing claims. But it can be another challenge for insurers. A stipulation prohibits them from denying claims if the roof is less than 15 years old. The useful life of a roof, in general, is 20 years. The threat of roofing scams is not banished completely. It has to be more careful, given that 79% of P/C insurance claims are facing lawsuits due to fraud. Even so, it may still be helpful, given that it will provide assistance to struggling companies. More areas are now defined, such as the number of years for roofing claims. Also, the abuses and scams by contractors may go down.

How Heritage Insurance Holdings, Inc. May Get Through The Stormy Market

Florida is literally and figuratively stormy. It is more exposed to hurricanes and floods than many other states. It is also facing a threat of P/C insurance crash due to many reasons. Higher prices, excessive and fraudulent claims, and insurance exodus must be solved. Even worse, above-normal storm expectations are set by NOAA. So, there may be more chances of property damages, leading to more P/C claims. P/C insurance companies must work hard to remain stable in a challenging market. Although higher demand may raise insurance rates, policies are decreasing. Also, claims appear to be higher than expected. With that, Heritage must be ready for more challenges this year.

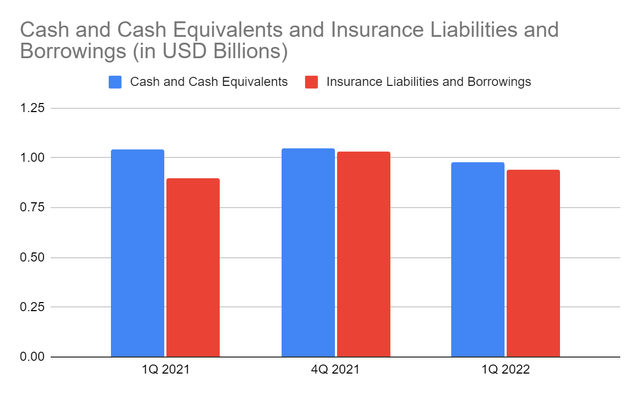

Thankfully, HRTG has a good liquidity position, allowing it to cover liabilities. For instance, its cash and cash equivalents remain high at $980 million. It is enough to make a single payment for insurance liabilities and borrowings. Borrowings are also stable, showing its ability to manage its financial leverage well. Timely payments of outstanding borrowings are more crucial, given the interest rate hikes. So even if its net income remains at a negative value, it still has enough to sustain its operations.

Cash and Cash Equivalents and Insurance Liabilities and Borrowings (MarketWatch)

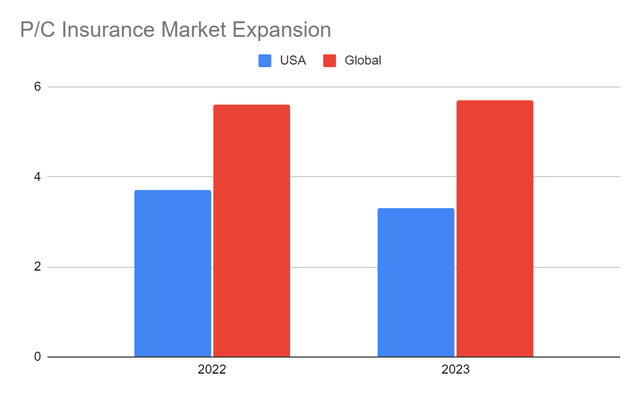

The hype in the housing market may also help it capture more demand. In a recent survey, 26 million Americans intend to buy houses this year. It is way higher than the average number of sold units at 5-6 million annually. Despite macroeconomic pressures, 34% of them are confident in their capacity to buy. It is no wonder that amidst the challenges in the P/C insurance market, its hype remains evident. Statistics estimate a 3.7% and 6% CAGR in the global and US P/C insurance market. In turn, it may raise the demand for P/C insurance. Being at the forefront of climate change, it remains a staple for many homeowners. But HRTG has to be more cautious, given all the possible challenges discussed earlier. Stepping back a bit and assessing its operations in Florida may help it make a sound judgment. Expanding in other states is a wise option, but it may take time to strengthen its market presence. It is a good thing that it continues to work on its geographical diversification. Hence, HRTG may become more stable, although growth may remain elusive.

P/C Insurance Market Expansion (Insurance Journal)

Stock Price Assessment

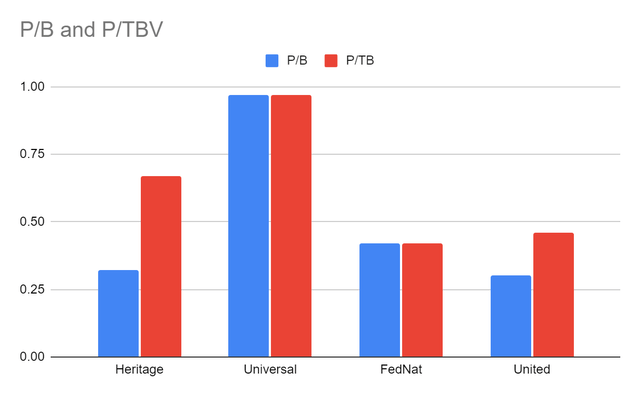

The stock price of Heritage Insurance Holdings, Inc. remains in a downtrend, even after its sharp decline in April. At $3.11, it has already been cut by 46% from the starting price. It is 57% lower than its peak in March. Using the P/B Ratio of 0.32, it appears that the price is a very good bargain. It may increase from $5.7-6.7. It is way lower than UVE and FNHC. P/B ratio is an ideal metric for insurance companies since it helps assess their value once they are completely liquidated. Also, it is timely, given that a number of P/C companies in Florida have been liquidated. We also want to determine the value of HRTG before we make a position.

It may be more accurate if we use the P/TBV ratio. The percentage more than doubles to almost 0.70. From there, we can see that the company has much goodwill, given the nature of its operations. The amount is reasonable relative to assets and lower than the value in the previous year. But goodwill impairment can tell that its acquired assets generate fewer cash inflows. As such, it must be more careful of its potential impact. It must watch out for market uncertainties, despite its good liquidity and sustainability. Aside from market disruptions, I believe the same ratio reached its limit last March. That may be another logical factor for the sharp decline. Today, the stock price is now a bit undervalued. Using the ratio, the price may go up to $4.5-5 per share.

P/B and P/TBV Ratio (Yahoo Finance)

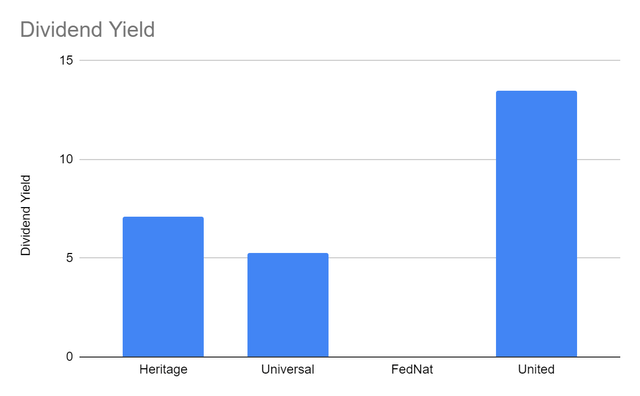

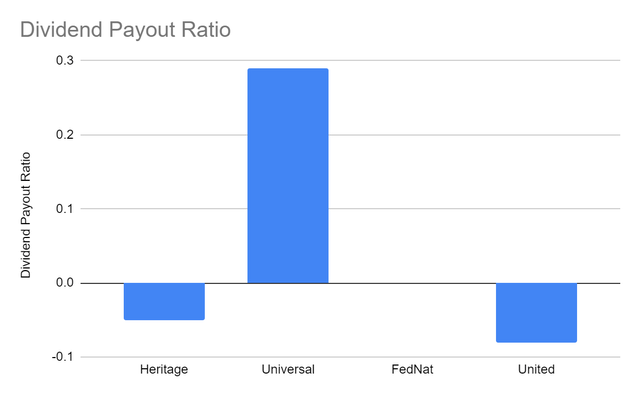

Meanwhile, dividends are consistent, although there has been no increase in recent years. The dividend yield of 7.08% is better than its Florida peers. It means that it produces more returns from dividends, making it relatively cheaper. But the dividend payout ratio using net income and FCF remains at a negative value. If cash flow continues to become a negative value, the capacity to sustain it may be affected.

Dividend Yield (Yahoo Finance)

Yahoo Finance (Dividend Payout Ratio)

Bottom Line

Heritage Insurance Holdings, Inc. remains durable amidst market uncertainties. Also, the decrease in its policies in force remains manageable compared to some of its peers. We hope that the efforts to reduce the scams will materialize. It is more crucial since claims may intensify with the above-normal hurricane forecasts. It may help stabilize the frequency of claims and help the market recover. Meanwhile, the stock price has potential undervaluation but not very cheap yet. The recommendation is that Heritage Insurance Holdings, Inc. is a hold.

Be the first to comment