Sundry Photography/iStock Editorial via Getty Images

After an incredible 3-year run that saw Lattice Semiconductor Corp (NASDAQ:NASDAQ:LSCC) shares soar 1,350%, LSCC stock has gone into a sharp reversal, falling from an all-time high of $84.99 on 15th Nov. 2021 to $45.37 in Thursday’s intraday session. Not surprisingly, the deep selloff has coincided with the broader semiconductor pullback, with iShares Semiconductor ETF (NASDAQ:SOXX) declining 35% from its all-time high in December 2021.

Back in August 2019, I had penned a bullish article on Lattice in whereby I discussed the company’s transition to primarily a provider of low-cost, small-form-factor FPGA products. The company had just brought in key personnel including Jim Anderson, president and CEO, who joined September 2018, Esam Elashmawi, former senior executive at Microsemi who joined as CMO and CSO in September of 2018, Sherri Luther, CFO, who joined in January 2019, Steve Douglass, SVP of R&D, who joined in September of 2018, Mark Nelson who joined as SVP Worldwide Sales in January 2019, and Glenn O’Rourke, senior executive at Xilinx, who joined as SVP Global Operations in December of 2018.

At that time, I wrote that the company appeared like it had plenty of gas to maintain its crazy run after the shares had rocketed 175% in the space of eight months — as long as the new team executed brilliantly. To be honest, I had no idea that they had enough gas to power the bull run uninterrupted till the all-time peak, meaning an investor who bought at my recommendation would be sitting on a handsome 138% return after the correction while those who sold around the peak would have realized a nearly 350% return.

But the bull run has now ended spectacularly, and the shares continue to fall with the rest of the market. LSCC is down 7.4% on Thursday’s session after the Fed announced a 0.75% rate hike, its biggest since 1994 as it desperately tries to contain sky-high inflation. The entire market is reeling from the news, with the S&P 500 down 2.9% in the session.

However, I remain confident that LSCC can still be profitable for long-term shareholders, especially those who will be able to catch it when it hits bottom.

Model Reboot

Over the past three years, Lattice CEO Jim Anderson has continuously reiterated the company’s mission to become the “low power programmable leader,” a radical shift from the company’s recent past where it tried to cover many bases including getting into a bunch of only tangentially related businesses such as HDMI and USB-C. Lattice now has a laser focus on low-powered FPGA verticals with high ROIs including 5G, servers, industrial IoT, ADAS (Advanced Driver-Assistance Systems) among others. The FPGA maker will now focus on FPGAs in the 1 mW to 1-watt power range and 2 mm2 to 100 mm2. Rival companies like AMD (AMD)-owned Xilinx and Intel (INTC)-owned Altera serve the higher-end with larger power-hungry FPGAs that operate at around 200 watts and 3,000 mm2.

The prize? Lattice says the lower end of the business is a $3 billion SAM (Serviceable Available Market) by 2022.

During the company’s latest earnings call, CEO Jim Anderson reported that LSCC has been seeing an accelerated pace of its customers converting designs from a competitor’s FPGA or microcontroller to a Lattice FPGA. Customers have been conveying their designs to Lattice to take advantage of the market-leading power efficiency, flexibility and software content that it provides.

Indeed, Anderson reported that the accelerated pace of design conversions has been the primary contributor to the strong revenue growth.

Lattice usually breaks its revenue down into two key segments: Communications and Computing, and Industrial and Automotive. Both segments have continued growing rapidly despite global supply chain disruptions.

I’m particularly excited about the company’s Automotive segment — where Lattice recorded 40% Y/Y and 16% sequential growth last term. The automotive market and its need for vast semiconductors will continue to grow, driven by growing demand for more intelligence levels in ADAS, infotainment, as well as traditional sensing equipment in the automotive space.

In fact, the booming auto and industrial electronics sectors are prompting chip makers to reorient their designs, and Lattice Semiconductor has unveiled a suite of FPGAs primarily targeting automotive applications. For instance, the company’s Certus-NX FPGA family is aimed at low-power, secure automotive electronics applications. In its Q1 2022 earnings call, the company said that CertusPro-NX — the fourth Nexus device family to enter production — began production shipments in Q1. Built on the Nexus platform, these FPGAs are designed to extend battery life in EVs while also taking care of critical thermal management that directly impacts processing performance and reliability. Power consumption and space constraints are among the most important design concerns for EV manufacturers. New Lattice FPGAs such as Certus-NX FPGA are aimed at auto applications such as in-vehicle networking, sensor data co-processing in ADAS and motor and LED controls. Among other enhancements, this FPGA architecture also offers a 100-fold decrease in soft-error rates.

According to Juju Joyce, Lattice Semiconductor’s product marketing manager, the company’s latest Nexus iteration is based on FD-SOI process technology, which enables the release of new products at a faster cadence.

Unlike ADAS chip leaders such as NVIDIA (NVDA) who focus on central processing of sensor and other data, Lattice Semiconductor concentrates on proliferating edge co-processing of sensor data including bridging and aggregation schemes used to communicate with all those sensors.

It’s the reason the chipmaker claims customers are moving away from conventional processor architectures that are “waterfalling” from higher-end data center implementations and even MCUs to more readily available FPGA designs.

Strong Execution

So, how well has the new team been executing?

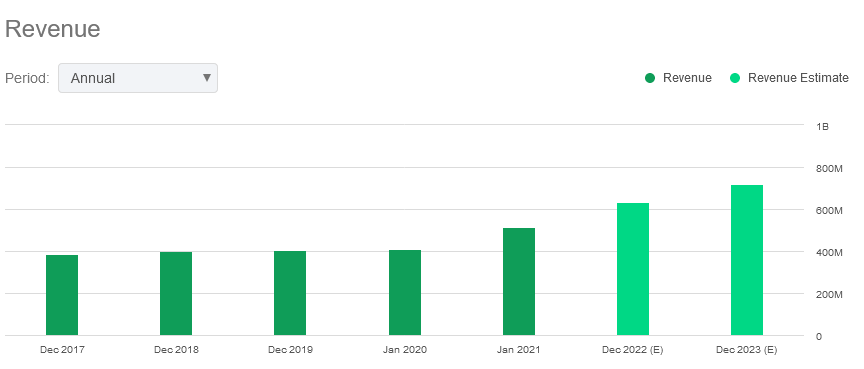

If FY 2023 full-year revenue comes in at Wall Street’s consensus of $718.01M, Lattice will have managed to grow its topline at 15.5% CAGR from 2019 through 2023. The company’s forward revenue growth of 20.72% per annum is considerably better than the industry median of 14.86%.

Lattice Semiconductor Historical and Projected Revenue (Seeking Alpha)

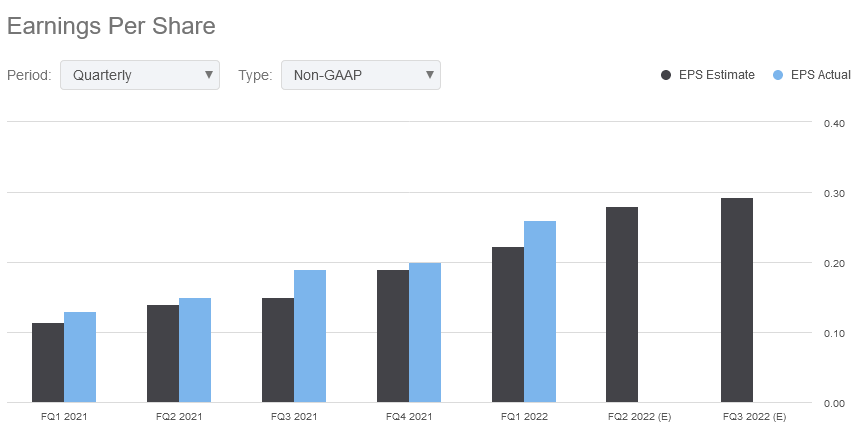

Lattice has not only managed to grow earnings over the past five consecutive quarters but has also managed to exceed Wall Street’s estimates. Its EBITDA growth of 62.86% last quarter was much better than the industry’s median of 21.46%.

Lattice Semiconductor Historical And Projected Earnings (Seeking Alpha)

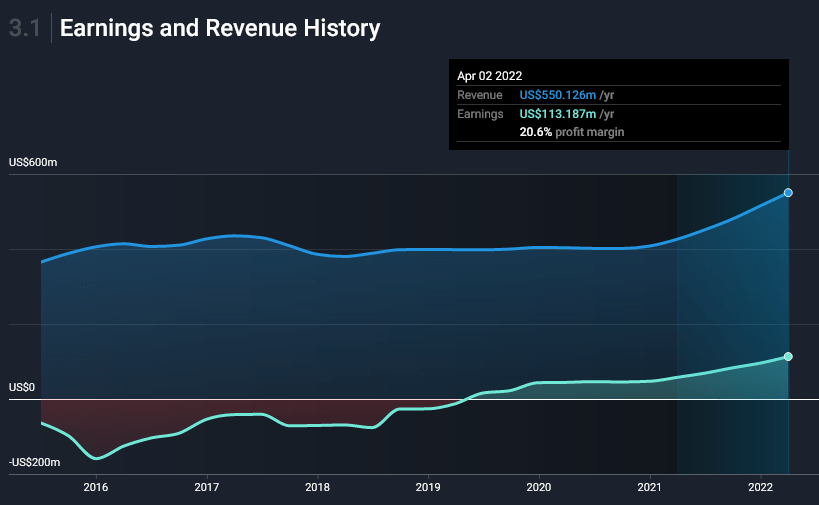

Lattice Semiconductor Revenue and Earnings History (Simply Wall Street)

For the last quarter (Q1 2022), Lattice managed to exceed both top-and bottom-line expectations. Here were the highlights from that report:

-

First quarter revenue clocked in at $150.52M, good for +30.1% Y/Y and 6% Q/Q growth

-

First quarter gross margin expanded by 590 basis points Y/Y to 66.9% on a GAAP basis and by 670 bps to 61.7% /Y on a non-GAAP basis

-

Net income improved 100% Y/Y to $0.26 and 68% Y/Y on a non-GAAP basis to $0.37 per diluted share

Full-year 2022 revenue is expected to clock in at $637.04M, good for 23.0% Y/Y growth while topline growth in FY 2023 is expected to come in at 13.2%.

With global semiconductors shortage in the supply chain, it would be reasonable to expect Lattice to run into a slowdown, too. However, the company’s latest earnings call indicates that the operations team has managed to put the company in an excellent position to manage demand through the shortage.

Little wonder, Wall Street loves LSCC:

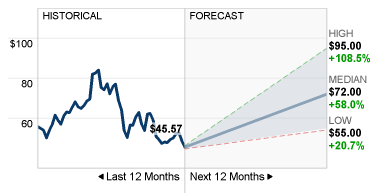

Lattice Semiconductor Price Targets (CNN Money)

LSCC has nine analysts covering the stock. The analysts have a 12-month median price target of $72.00, with a high estimate of $95.00 and a low estimate of $55.00. The median estimate represents a healthy +58.7% increase from the current price of $45.37.

Investor Takeaway

Lattice Semiconductor appears to be successfully carving out an important niche in the low-power FPGA space, with the company’s sharp focus enabling growth and differentiation. The strong revenue and earnings growth gives investors confidence that the team is executing well.

The ongoing semiconductor and broader market selloff makes it hard to call a bottom on LSCC shares, which have declined a shocking 40% year-to-date. Nobody knows when this bear will finally die, with Seeking Alpha editor Brian Stewart suggesting that we have another 10 months to go before it attains the average U.S. bear market life of 16 months. But Lattice Semiconductor is one company that investors should watch closely and get ready to pull the trigger when the market bottoms out.

Be the first to comment