Andrzej Rostek/iStock via Getty Images

Investment Thesis

Peabody (NYSE:BTU) is a coal mining company with a relatively simple investment thesis. Coal prices are up and the multiple that investors are willing to pay for the stock is abnormally low. Why?

There are many different explanations. You can look to ESG mandates stopping significant capital from being deployed into this space. Also, you can look to ephemeral ideas such as demand destruction. Or you can blame it on interest rates and inflation culminating in an economic crash landing.

Also, you can make the case that the stock has rallied significantly in the past twelve months.

There are many reasons to doubt Peabody’s near-term potential and to sound smart doing so.

But ultimately, I don’t believe they address the core issue of where this stock is actually headed. Indeed, I make the argument that the stock will go higher over the next twelve months.

I rate this stock a buy. Here’s why:

Peabody’s Near-Term Prospects

The markets are really shaky period right now, where Q2 results can’t come fast enough. Investors are desperate for some tangible results and hard data points to figure out what’s what.

As has been widely reported, Peabody had a really poor result in Q1 where a $300 million hedge loss on the back of EBITDA of $328 million caused Peabody to report a $120 million net loss.

However, looking ahead right now, what was once a highly disappointing quarter and the focus of the narrative when considering Peabody, now isn’t as pertinent.

The focus now has moved on and investors are more seriously discussing whether there’s a possibility that coal prices could remain higher for longer than previously estimated. And that’s what I believe.

As everyone knows, when sanctions were put on Russia coal prices shot up. But then coal prices rapidly fell back down.

However, now prices for coal are back to near all-time highs. This immediately implies that Peabody’s Q2 will be very strong.

Why Should Coal Prices Stay High?

But what happens if the party doesn’t end in Q2?

Could it be the case that 2022 as a whole will sizzle? And then, to push further the argument, could it be the case that 2023 will also be equally strong?

For now, this is just my hypothesis. While I acknowledge that nobody can actually forecast coal prices out to next year.

Yet, the fact remains that analysts following Peabody are expecting that after Q2 2022 is out, going forward, everything reverts back to normal.

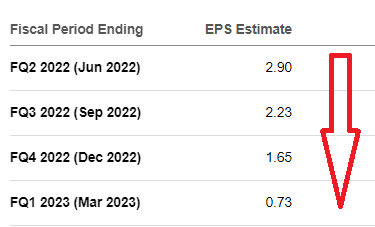

Peabody EPS estimates

As you can see above, by Q4 2022, analysts are expecting that EPS will be nearly 45% lower than the EPS expected for Q2. But what if this isn’t the case?

Indeed, remember, as long as natural gas prices are higher than approximately $4 or $5 mmbtu, you can get more equivalent energy from coal.

And as you know, even though the Freemont natural gas exporting facility is out of use temporarily, and there’s “supposedly” an oversupply of natural gas in the US, this has not materially dented natural gas prices. In fact, natural gas prices appear to have stabilized at around $7 mmbtu.

This further supports coal prices to remain higher for longer.

BTU Stock Valuation – Cheap Enough

In my previous article, I discussed Peabody’s capital return policy or lack thereof. I won’t repeat it now.

However, this is what I know, Peabody finished Q1 2022 with a net debt position of $276 million. I believe that when Peabody reports its Q2 results, its balance sheet will once again be in a net neutral position where cash and debt are equal to each other.

What’s more, given that most analysts are expecting Peabody to report approximately $1.7 billion of free cash flow in 2022, this puts the stock priced at somewhere around 2x to 3x free cash flow.

The one blemish in the bull case is that, unlike Peabody’s coal mining peers, Peabody has not made a serious commitment to a clear shareholder return program.

However, I believe that given Peabody’s net neutral balance sheet, and a lack of options to invest for growth, management will now be more eager to return capital to shareholders.

Accordingly, investors will have to be just a little patient here, but not for too much longer.

The Bottom Line

Stocks don’t trade in a vacuum. It’s all relative. Right now, there are plenty of options for investors to consider.

Do they “buy the dip” on tech stocks? Personally, I’m not convinced that backing up the truck on stock-based compensation “printing machines” makes for a worthwhile investment.

Recall, stock-based compensation moves inversely with share prices. If share prices come down, as you know they have, that means stock-based compensation needs to go up to compensate management teams.

Or do they buy into energy stocks at this stage in the game? I believe that it depends on whether or not one believes that paying 2x to 3x free cash flows could ever be cheap enough to compensate investors for a lot of unknowns. In sum, I believe that an investment in Peabody makes a ton of sense.

Be the first to comment