Andy Kropa/Getty Images Entertainment

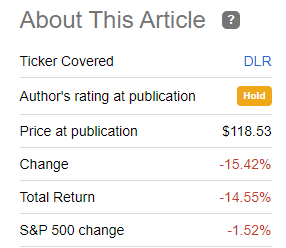

When we last covered Digital realty (NYSE:DLR.PK), we told you why it was such a dangerous stock. That logic stuck out from the usual cheerleading and focused on why risks were so much higher than they actually appeared. We left with this.

On the common equity side, things are heavily oversold. A bounce is of course probable and we just cannot issue a “sell” rating here. We are sticking with a “hold/neutral”. However, if we get a bounce to the 200-day moving average, which is sitting at near $140, we might consider going short.

Source: Jim Chanos Will Be Right, Stick To The Preferred Shares

The decision to not buy can be as important as the one where you go in. In this case avoiding the 15% drawdown and huge underperformance vs S&P 500 (SPY) was fantastic.

Last Seeking Alpha Article

Of course, the entire REIT sector has been hit hard and in these kinds of cases, it becomes difficult to decipher the signal and the noise. The most recent earnings though, helped elucidate the picture. We give you our three main takeaways.

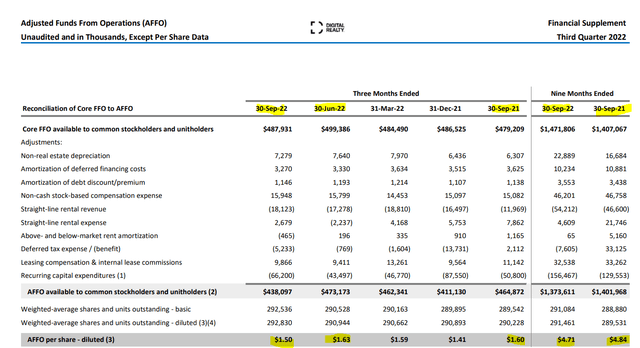

There Is No Growth

DLR lowered its guidance for the year. It was clearly apparent that whether you looked quarter over quarter, year over year for Q3-2022, or year over year for the first 9 months, growth was nowhere to be found. Adjusted funds from operations (AFFO) was down on all timeframes.

DLR Q3-2022 Supplemental

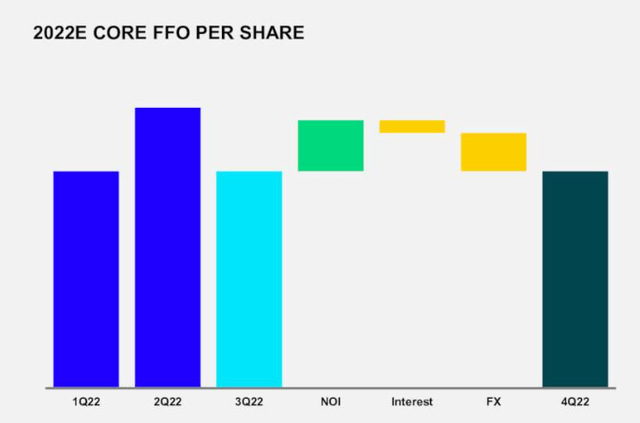

Yes, there were some currency headwinds.

DLR Q3-2022 Presentation

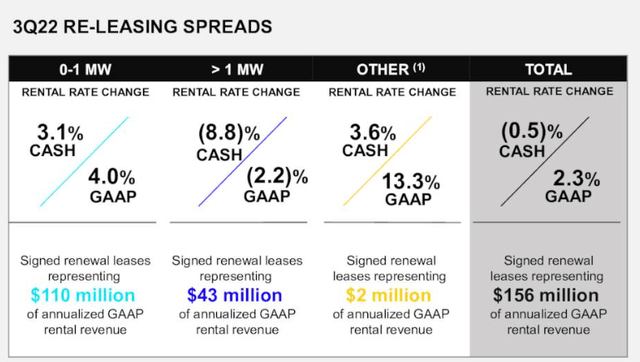

But this works both ways. If DLR is accessing extremely low-cost debt in Europe, which it is, it really cannot blame the Forex headwinds blowing in its face once in a while. The key driver for that weak growth was not US dollar strength, but rather extremely weak cash re-leasing spreads.

DLR Q3-2022 Presentation

Margins Are Extremely Weak

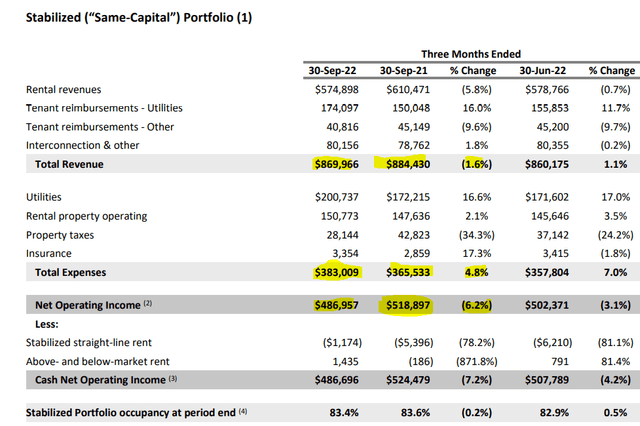

Comparing the same store portfolio shows that revenues were down 1.6% in a heavily inflationary environment while expenses were up.

DLR Q3-2022 Supplemental

Net operating income was down 6.2% leading to a NOI margin of 55.9%. You get that number by dividing $486,957 by $869,966. Some might consider it weird to call a 55.9% NOI margin as weak, but REITs tend to have very high margins. Even looking at DLR’s history, it stands out as extraordinarily weak. Q3-2021 for example also shown above, had a 58.6% NOI margin. Let’s go a bit further back.

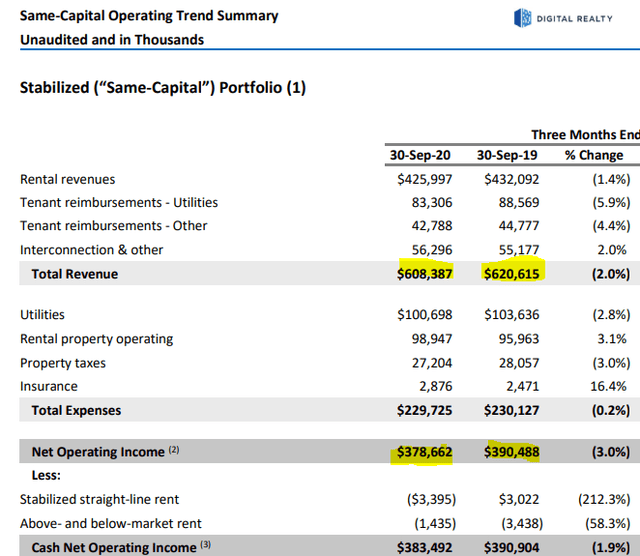

DLR Q3-2020 Supplemental

Q3-2020 had a 62.2% NOI margin. Q3-2019 was at 62.9%. How about going even further back?

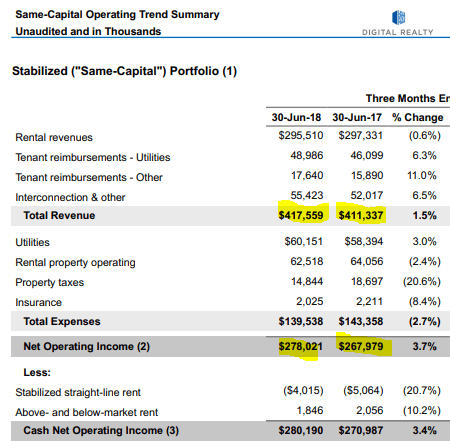

DLR Q3-2018 Supplemental

Q2-2018 was at 66.6% and Q2-2017 at 65.1%.

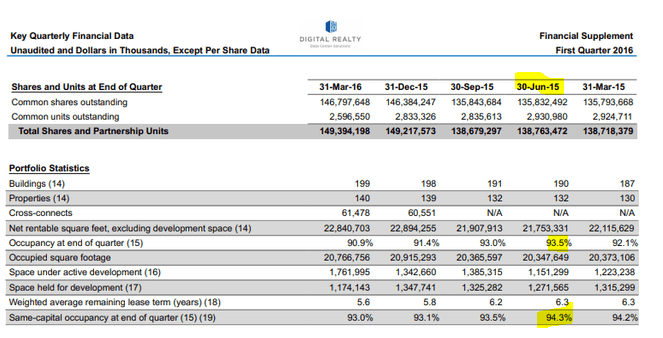

So the trend is very obvious to us and does not bode well for the REIT. Of course, as to the “why”, it is fairly obvious. As we have repeatedly highlighted, it is hard to say with a straight face that there is an insane amount of demand for data centers when occupancy has generally been falling in a straight line for the last 7 years. Stabilized occupancy is currently at 83.4% and was at 94.3% in June 2015.

DLR Q1-2016 Supplemental

Capex Is Still Monumental

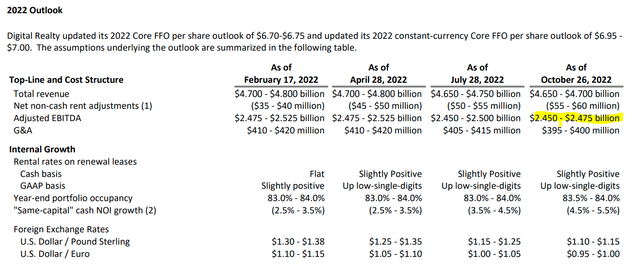

We are not growth chasers. Sometimes a best thing a company can do is to not attempt to grow. So steady state AFFO or FFO numbers would not bother us if other fundamentals were good. What worries us in the case of DLR is the capital expenditures that are going into keeping AFFO flat. DLR plans to spend $2.45 billion in 2022.

DLR Q3-2022 Supplemental

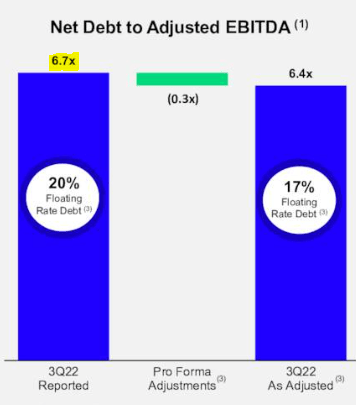

Keep in mind that DLR’s total AFFO is about 30% lower than that capital expenditures number. DLR also sends about 80% of its AFFO to shareholders in the form of dividends. So, spending $2 billion above its cash flow seems a very dangerous proposition. Sure, some of it will come via equity and that reduces risks. But Debt to EBITDA is on the high side for a sub 85% occupancy REIT with very weak pricing power.

DLR Q3-2022 Presentation

Verdict

We stand by our assertion that if DLR could not produce FFO growth in the last 12 months, while issuing equity at 25X multiples and while interest rates were rock bottom, it won’t do so in the next 12. The results were very weak but our main worries come from capex and the future refinancings. In a recession, we could easily see a 7X plus debt to EBITDA number and that might lead to credit downgrades. The risks are too high in our opinion. If readers disagree, they can present 3 REITs that have a lower occupancy than DLR and plan to spend 130% of their current AFFO in capex.

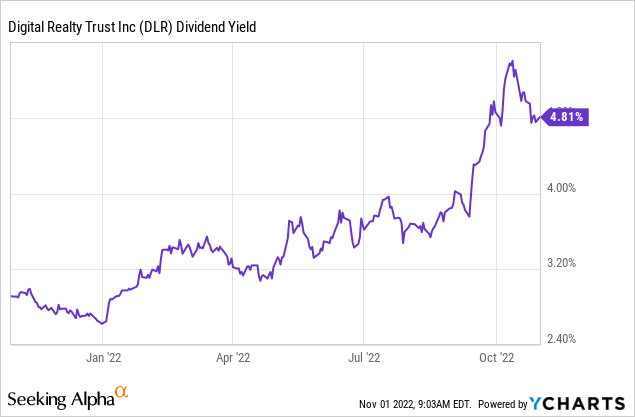

Those enamored by DLR’s dividend yield should realize that they have other alternatives.

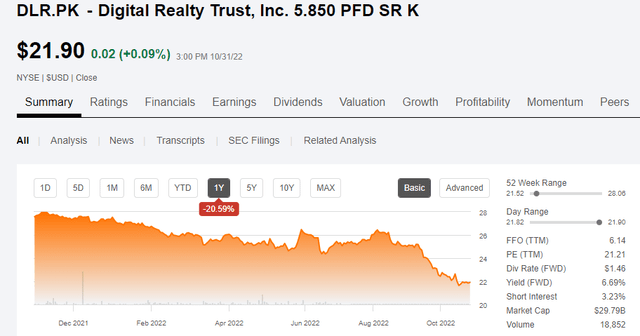

Digital Realty Trust, Inc. 5.850 PFD SR K (DLR.PK) is one issue we would consider.

Seeking Alpha

With a current yield of 6.7%, it gives you a higher place in the capital structure and the possibility of capital appreciation if interest rates fall. We don’t own this one yet, as we think the risks are still too high for even the preferred shares, but if we had to own either of the two, we would go for the preferreds.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment