Igor Kutyaev/iStock via Getty Images

The Blue Tower Global Value enjoyed another strong quarter of relative performance with our composite losing only -2.95% net of fees (-2.68% gross) in Q3 2022, much less of a decline than the overall market.

Please review your individual account statement to see the returns on your account as it will differ from the composite return. The sanctions on Russian investments, which prevent us from buying or selling Russian stocks, caused a dramatic increase in the internal dispersion of returns for our composites. Accounts that were opened after March 2022 will not own any Russian assets and will instead have a larger weight of all the remaining positions in the strategy.

Additionally, we will not be able to adjust the weighting of Russian stocks to account for deposits/withdrawals of existing investors. As Sberbank (OTC:AKSJF) shares declined in price this quarter, Blue Tower investors without Russia exposure had a better performance than our overall composite.

In this letter, we will do a deep dive in our investment in online lender Enova International (ENVA). We will also discuss the MBO of the Shinoken Group (OTC:SHIOF), an update on Russian sanctions, and overall market trends.

Shinoken Group Takeover

We exited our investment in Shinoken Group shortly after a management-led buyout at 1600¥ was announced in August. Prior the MBO announcement, the shares were trading at 1100¥. While this was a significant one-time gain and the biggest contributor to our Q3 performance, it is bittersweet to lose our opportunity to invest in this company. Shinoken has great future prospects for growth and we believe the intrinsic value of the company is more than the 1600¥ buyout price.

2022 has been the biggest year yet for acquisitions of our portfolio companies with Cornerstone Building Brands, Swedish Match (OTCPK:SWMAF), and LeoVegas (OTCPK:LEOVF) all being targeted for takeovers earlier in the year. Many value stocks are now trading at shockingly cheap bargain valuations, and we would not be surprised to see further buyouts in the fourth quarter of 2022. We currently have 19.2% of our portfolio invested in Japan, and 9.1% of the portfolio are Japanese stocks that trade at negative enterprise value, are profitable, and pay dividends.

Update on our Russian investments

There have been no indications from the Russian government as to when Western investors will be allowed to sell their investments. There are also restrictions on Western investors transferring cash balances in Russian banks and brokerage accounts abroad which have been extended to April 1st, 2023[1]. These restrictions will likely remain in place for the duration of the hostilities between Ukraine and Russia, and we believe that it is unlikely that we will have the ability to sell our investments this year or in 2023.

We also believe that it is unlikely that Russia will expropriate Western investors unless the Russian government’s assets in Western countries are seized as opposed to their current temporarily frozen status. Therefore, we believe there is still a very high probability that we will eventually have a positive outcome on our two Russian holdings.

We still have no changes in the status of our investment in TCS Group. As a Cyprus corporation, TCS is unaffected by the new Russian law banning foreign depository receipts. However, the London Stock Exchange continues to prevent trading of the global depository receipts (GDR) on their exchange. The USD-equivalent price of TCS Group on the Moscow Exchange and the pricing of our depository receipt at Interactive Brokers can be seen in the table below.

|

London GDR price @ Interactive Brokers |

MOEX Price (Rubles) |

GDR price in USD based on MOEX[2] |

|

|

TCS Group |

$3.19 |

2355.5₽ |

$38.18 |

|

Price as of October 7th, 2022 |

Market valuation and recession fears

Financial news headlines have been bleak recently and would make most observers fearful about the future.

Many commentators have predicted that a global recession is all but guaranteed for 2023, and investors have experienced losses YTD in almost all asset classes. Individual investors are bearish. The AAII investor sentiment survey[3], which polls individual investors in AAII about their predictions for stock market returns over the next six months, currently has a bull-bear spread of -30.9%. The average spread on the survey since 1987 has been +6.8%. Historically, this has been a contrarian indicator as equity investors have realized their best returns when other investors were pessimistic.

Some of the macroeconomic surveys are still optimistic for the United States. The architectural billings index[4] (ABI) is still reporting strong economic growth for August 2022 with a score of 53.3 compared to 51.0 in July. The ABI is a leading indicator of non-residential construction in the US economy with a lead time of roughly 9-12 months. The number indicates the seasonally adjusted percentage of architectural firms included in the survey that are reporting increases in their invoices to clients.

A score of 100 would indicate universal increases, and a 0 would indicate every architectural firm seeing declining business. Additionally, the S&P Global US Manufacturing PMI is still showing expansion of US manufacturing with a reading of 52 for September. While the rising dollar has suppressed US exports, a strong dollar also reduces the cost of importing manufacturing precursors.

This current environment is in uncharted territory due to the coincidence of so many huge macroeconomic events including high inflation in Europe and North America, rapidly rising interest rates, continuing Covid lockdowns in China, the energy crisis in Europe, military conflict in Ukraine, enduring supply chain issues, and the deglobalization from sanctions and tariffs.

We believe that there will be a near-term shift towards manufacturing in areas with cheaper energy. All economic activity requires the use of energy, and therefore high energy prices act as a tax on the entire economy of a country. It’s entirely possible, therefore, that the EU will be mired in a severe recession while the US is still experiencing economic expansion.

Many businesses will be impacted by some of the current crises affecting world markets, causing earnings declines. This fear has contributed to the sell-off we have seen in global equity markets as investors expect that earnings will be less than originally forecast. However, some businesses are more resilient to a negative economic environment and may even take market share or benefit in some other ways.

Due to the housing shortage in the US caused by underbuilding since 2008, it is likely that homebuilding will still be fairly active even with a weaker economy and higher mortgage rates. This sell-off has caused a “throwing out the baby with the bathwater” effect as even these more resilient businesses have seen steep share price declines. This environment is perfect for concentrated stock-picking strategies like ours, and I hope will lead to excellent relative performance for us in the future.

Enova

One of our portfolio holdings that we believe will be relatively resilient is Enova International (down 26% YTD). We last wrote about Enova in our Q3 2018 letter. Since that letter, the trailing twelve-month earnings of the company have quadrupled and tangible book value per share has grown more than 12x. Despite that huge growth, their stock is trading at almost the same price it was back then!

Enova is a subprime lender that uses machine learning methods to provide an automated underwriting of loans for a variety of different loan products. Enova has traded down to an extremely cheap valuation despite having strong organic growth and recently acquiring OnDeck Capital, a small business lender, at a bargain valuation. Enova is still in the process of realizing all of the synergies of combining its core business with OnDeck Capital and we should expect this combination to perform even better in the future.

Enova’s current cheap valuation is the result of two main fears; the regulatory risk against high interest loans and the potential impact that an impending recession will have on the company.

Business Overview

Enova is an online-only subprime lender that originally spun out of Cash America International in 2014. As an online-based business, they have more flexibility to scale up or scale down their lending than the brick-and-mortar lenders they have displaced. Another key advantage is that they are constantly building up data on their interactions with customers and can determine which customers are better credit risks.

New pools of customers tend to be less profitable to Enova than seasoned ones as the company has not yet figured out which customers are good credit risks. Therefore, in periods of business growth, we should expect the company to have compressed margins compared to their steady state. During 2020 and 2021, Enova became more conservative in their underwriting and faced reduced customer demand resulting in their net charge-offs falling dramatically to the lowest levels in the company’s history.

Like many business models based on machine learning and big data techniques, the database of the company builds into a growing competitive moat over time. Once Enova is deeply entrenched in an area of business, they will have enough data to know which customers are good credit risks. A new entrant will have too many nonperforming loans (NPLs) if competing directly on similar terms to Enova.

Most financial companies with a sustainable competitive advantage over peers have either a funding advantage or an underwriting advantage. We believe that Enova’s online-only lending model backed by their database containing hundreds of millions of customer interactions built over almost twenty years in business is an example of an underwriting advantage.

The importance of proper underwriting for these kinds of subprime loans can be seen in the investment of Enova’s human resources. The company spends more on operations and technology ($148M in 2021) and general and administrative expenses ($157M in 2021) than they do on net interest expense ($77M in 2021). This is a different business from traditional prime lending where the net interest expense is a greater component of cost.

Two similar publicly traded online lenders are Curo Group Holdings (CURO) and Elevate Credit (ELVT). Compared to these two businesses, Enova has managed to greatly outperform during the pandemic recession in both gross margins and net charge offs as a percentage of revenue. Curo has attempted to build out a data and algorithm platform for underwriting decision making in order to produce a “Curo Score” for each loan application. They are still lagging behind Enova in both the human resources (engineering and compliance talent) and database size.

Elevate Credit has invested in machine learning data tools for underwriting decisions since early in the company’s history. However, it still lacks the scale of Enova at less than a tenth of Enova’s market capitalization. As this business model requires large fixed investment in building out the IT and legal compliance infrastructure, it will be difficult for Curo or Elevate to compete with Enova long-term.

Recession Impact on Enova

Investors incorrectly assume that since we’re going into a recession, that this will have a disproportionate effect on subprime lenders. In reality, Enova held up well during 2008 and 2020. As CEO David Fisher explained, “in many ways, recessions have less of an impact on our customers than on prime borrowers.[5]” The increase in non-performing loans to be expected in a recession is relatively small compared to their normal rate of charge-offs. As their business model already assumes high charge-offs, the increase from a recession does not destroy their profitability.

A prime lender needs to have low rates of non-performing loans in their portfolio in order to remain profitable. Additionally, as many of their financial products are short-term, Enova has more of a capacity to adjust underwriting to macro conditions.

Charge-offs (net of recoveries) as a % of average combined loan and finance receivable balance for consumer loans actually fell from 14.1% in Q4 2019 to 5.5% in Q4 2020. As of Q1 2022, they had returned to pre-pandemic levels (14.2% for consumer loans and 1.9% for small business loans).

The company believes that the current environment is ripe for Enova to continue another round of business growth, especially in their small business loans, and Enova has been increasing their marketing spending. Marketing expenses totaled $93 million in Q1 2022 or 24% of revenue compared to $29 million or 11% of revenue in the first quarter of 2021.

OnDeck Acquisition and Regulatory Risk

In July 2020, Enova reached an agreement to acquire all outstanding shares of OnDeck in a cash and stock transaction valued at approximately $90 million. The transaction was highly accretive as OnDeck was focused on business lending and Enova was focused on consumer lending. The combined entity had many cost and revenue synergies which are still being realized.

Small Business Clients of OnDeck as of December 31st, 2021[6]

The acquisition of OnDeck also makes the company more robust against regulatory risks which limit their ability to lend to subprime risk consumers.

Currently, 17 states and the District of Columbia have passed laws preventing consumer loans that have higher interest than 36%. There are ways for subprime lenders to work around these rules, including through partnerships with nationally chartered banks which are not subject to state usury laws. In that case, the subprime lender would provide the marketing and underwriting while the bank partner makes the actual loan.

On July 28th 2021, Senator Sherrod Brown (D-OH) submitted a bill, Veterans and Consumers Fair Credit Act (US S2508), which would make this rate cap a national limit. If a national 36% cap were to be passed, short-term, unsecured subprime consumer lending would disappear as an industry in the United States.

Customers and other small businesses (May 2022 Enova Investor’s Presentation, research from Enova and KS&R, sample of Enova company)

There have been fears about regulatory threats to subprime lending for over a decade, and investors generally profited from ignoring them. Congress is unlikely to decide to eliminate these loan choices for subprime borrowers, and I predict this bill will die in committee. Some of the reforms that have come to pass have had a significant effect on Enova’s business. For example, the regulatory regime created in the UK led to Enova liquidating their subsidiary in that country and exiting the market.

With Enova’s business model being diversified across different geographies, customer types, and products, they will be able to survive whatever regulatory changes are thrown at them and adapt better than their smaller subprime competitors. However, even if not completely fatal, the impact of a national consumer interest rate cap would have a significantly negative impact on the earnings of Enova going forward.

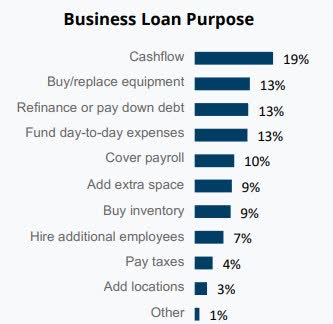

The OnDeck acquisition gave them the ability to grow with business customers that are not subject to these interest rate caps. These small business loans now make up the majority of Enova’s outstanding loan receivables. According to the company’s surveys, the most common reason businesses take these loans are to bridge short-term cashflow issues.

On May 24th, 2021, Enova received a Civil Investigative Demand (“CID”) from the CFPB relating to a handful of issues, several of which were self-reported. Enova will likely have to provide restitution to customers affected by the issues involved and pay a minor fine. The company said that this CID covered a small subset of customers. I do not anticipate this having a materially negative effect on the company.

Potential Risk of Future Entrants

Enova has a much higher cost of capital than prime lenders. If a company with a lower cost of capital was willing to bear the losses to copy the business model of Enova and compete against them long enough to establish a useful dataset of borrowers and brand awareness, they could eventually be a competitive threat to Enova.

We have a variant perception from the market consensus about the risks of Enova’s recession impact and regulatory interest rate caps. When the aforementioned interest rate cap bill does not get passed and the company maintains revenue growth and high profitability throughout the recession, Enova may rerate to a higher multiple. Enova’s competitive advantages will grow over time. The relative scale to other online only lenders will expand. Their underwriting algorithms will perform better as customer data increases.

I hope this exploration of our thesis for investing in Enova serves as a good demonstration of the care taken by Blue Tower in the protection and investment of our clients’ capital. This period of market volatility will likely continue until the underlying crises affecting the world are resolved. We will endeavor to react quickly to new information and changing circumstances to better position our capital.

Best regards,

Andrew Oskoui, CFA, Portfolio Manager

| Disclaimer: This commentary does not represent a recommendation to trade any particular security, but is intended to illustrate Blue Tower’s investment approach. These opinions are current as of the date of this commentary but are subject to change. The information contained herein has been obtained from sources believed to be reliable but the accuracy of the information cannot be guaranteed. Past performance is no guarantee of future results. |

Be the first to comment