skynesher

Introduction

I first covered Bristol-Myers Squibb (NYSE:BMY) in April and compared it to the ugly duckling of 2019, AbbVie (ABBV). I concluded that I still think BMY stock is a good deal even in the $70 range, given the company’s extremely strong free cash flow from in-line products and promising, underappreciated pipeline. In this follow-up, I will discuss BMY’s Q2 2022 earnings, which were released on July 27 and elaborate on whether I am still as optimistic as I was a few months ago.

Revenue Growth, Earnings Growth, And Currency Headwinds

For the quarter, the company reported sales of $11.9 billion, up 2% year-on-year. The strong U.S. dollar impacted earnings by about three percentage points. This is not surprising, as Bristol-Myers generates 37% of its sales overseas and 23% in Europe. Aside from currency headwinds, the company saw a 16% decline in sales in international markets, nearly half of which was due to the loss-of-exclusivity (LOE) of Revlimid (see below). A small consolation is that marketing, selling and administrative expenses (MSGA) declined by more than 5% due to exchange rate effects. However, this should not be overstated as MSGA costs increased by 2% on a half-year basis. The strong U.S. dollar is also the reason for the updated sales guidance (slide 16, Q2 earnings presentation), which has been lowered to $46 billion, a decrease of 1% year-on-year. Excluding currency effects, sales are expected to increase by 2% compared to 2021. Foreign exchange effects are expected to negatively impact diluted earnings per share by approximately 7% on a GAAP basis. On a non-GAAP basis, management reiterated its previous midpoint guidance of $7.59, which represents a very favorable forward price-to-earnings ratio of below 10.

As a large multinational company, I would not overstate the current currency headwinds, as Bristol-Myers appears to be adequately hedging its currency exposures and is also benefiting from portfolio hedges. A strong U.S. dollar has its good and bad sides, but in the long run, a reversion to the mean seems realistic. However, even if exchange rates stabilize at current levels, BMY’s earnings are not expected to be significantly impacted going forward. Accordingly, I would not rule out BMY as an investment solely because of its significant international exposure. There are several advantages to geographic diversification, such as protecting a portion of the company’s revenues from the impending prescription drug pricing plan, which will certainly affect BMY given the broad indications and high prices of many of its products. Of course, it is not unrealistic to assume that the European Union will also introduce price controls at some point, given the poor financial situation in which many of its member countries find themselves.

Diluted earnings per share on a non-GAAP basis increased 18% year-over-year in the quarter ($1.93 vs. $1.63). GAAP earnings decreased 66% primarily due to the amortization of acquired intangible assets and tax effects that were excluded from non-GAAP earnings. 4.8% of the earnings growth was due to share repurchases. The company announced an additional $15 billion repurchase program in December 2021, bringing total authorization to $15.2 billion. The diluted weighted average number of shares outstanding decreased by 103 million or 4.6% year-on-year.

Bristol-Myers’ Portfolio In Q2 2022

Eliquis (apixaban), Revlimid (lenalidomide), and Opdivo (nivolumab) remain BMY’s top-selling drugs and accounted for 66% of the company’s quarterly revenue. In general, I think BMY is very well diversified, and the company is poised to replace upcoming LOEs with other potential blockbuster drugs.

Eliquis, the leading oral anticoagulant (which is marketed 50/50 with Pfizer, PFE), continues to grow strongly, up 16% in the quarter and 14% in the first half of 2022, but according to management, product sales are front-loaded slightly. Generic competition is noticeable but hardly significant, according to management’s expectation that the impact will be about $250 million in the second half of the year – in 2021, Eliquis generated $10.8 billion in sales. Patent protection for Eliquis is expected to expire in 2026, but BMY is slowly preparing milvexian, a Factor XIa inhibitor and thus potential successor to apixaban, for Phase 3 development. Milvexian has been studied for the prevention of venous thromboembolisms in patients undergoing surgery and was found to be effective and associated with a low risk of bleeding.

Another notable advance in BMY’s cardiovascular portfolio is the recent approval of mavacamten, added to BMY’s portfolio as a result of the $13 billion acquisition of MyoKardia in late 2020, for the treatment of symptomatic obstructive hypertrophic cardiomyopathy. It is not unreasonable to expect that the drug, now marketed as Camzyos, will also be approved for non-obstructive hypertrophic cardiomyopathy, which would broaden its application field considerably.

Revlimid has lost its main patent protection but still benefits from volume-limiting licenses granted to generic manufacturers. Nonetheless, related sales fell 22% to $2.5 billion in the quarter, suggesting a stepped-up sales decline due to generic competition, as Revlimid sales fell only 14% in the first half of 2022. For the full year, management expects Revlimid to generate sales of $9 billion to $9.5 billion. Previously, David Elkins – BMY’s CFO – has been outspoken about revenue erosion, even if the decline is somewhat faster than previously thought, particularly in Europe. However, it still seems reasonable to assume a decline in Revlimid sales of $2 billion to $2.5 billion per year.

Opdivo sales grew 8% in the quarter and 10% in the first half of 2022. Its LOE is still a long way off (2027) and the drug can be considered a competitor to Merck’s (MRK) Keytruda (see my mid-March article), as both are antibody-based cancer treatments with similar indications (melanoma, lung cancer, malignant pleural mesothelioma, renal cell carcinoma and Hodgkin lymphoma). In March, a combination of Opdivo with relatlimab (sold as Opdualag) was approved by the FDA for the treatment of patients with unresectable or metastatic melanoma. Management believes peak sales of Opdualag (on a non-risk-adjusted basis) of over $4 billion are not unrealistic, suggesting multiple indications are going to be targeted with this combination therapy. Current studies are investigating efficacy in colorectal cancer, liver cancer and lung cancer. Recently, a combination of Opdivo and Yervoy (ipilimumab) was approved as first-line treatment for unresectable advanced or metastatic squamous cell carcinoma of the esophagus.

In summary, nivolumab continues to be an important cash flow-generating asset in Bristol-Myers’ oncology portfolio and management is successfully expanding the indication base by combining it with other drugs. Other key growth areas in which the company is currently investing include Breyanzi (lisocabtagene maraleucel), BMY’s promising cell-based gene therapy for the treatment of large B-cell lymphoma.

As a big fan of AbbVie and Amgen’s (AMGN) immunology portfolios (AMGN, e.g., via Otezla, which it acquired from BMY/Celgene), I very much appreciate Bristol-Myers’ development of deucravacitinib, for which the FDA has assigned a Prescription Drug User Fee Act (PDUFA) target date later this year. The company plans to position the drug as a treatment for moderate-to-severe plaque psoriasis. Same as Xeljanz (Pfizer) and Rinvoq (AbbVie), it is an oral treatment. It could become a blockbuster with peak sales of $4 billion. Recently published two-year results from a Phase 3 study demonstrated superiority to both placebo and Otezla (apremilast), and the safety profile was consistent with previously reported results. Deucravacitinib demonstrated a Psoriasis Area and Severity Index (PASI) 75 response rate of 58.4% compared with 35.1% for Otezla. However, because it is a tyrosine kinase 2 inhibitor, it shares similarities with the Janus kinase inhibitors Xeljanz and Rinvoq, for which the FDA requires warnings about increased risk of serious heart-related events, cancer, blood clots, and death (i.e., a black box warning).

Concluding Remarks

Bristol-Myers continues to fire on all cylinders. The portfolio is showing resilience and eroding Revlimid revenues are more than offset by growth in Eliquis, Opdivo and a number of promising and potential future blockbusters. I appreciate the increasingly diversified portfolio. I am particularly excited about deucravacitinib and have been pleased with its positive results relative to Otezla. The approval of mavacamten for non-obstructive hypertrophic cardiomyopathy was expected, but is still good news.

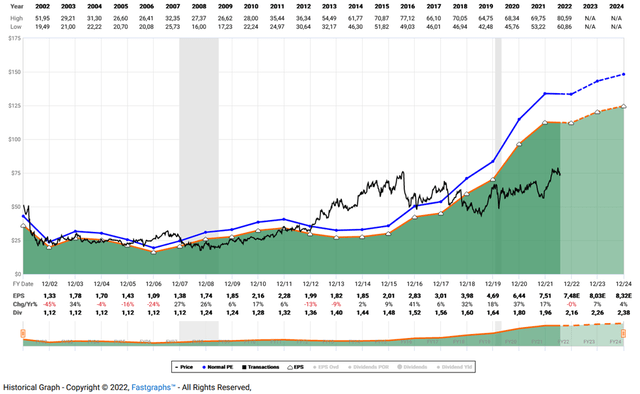

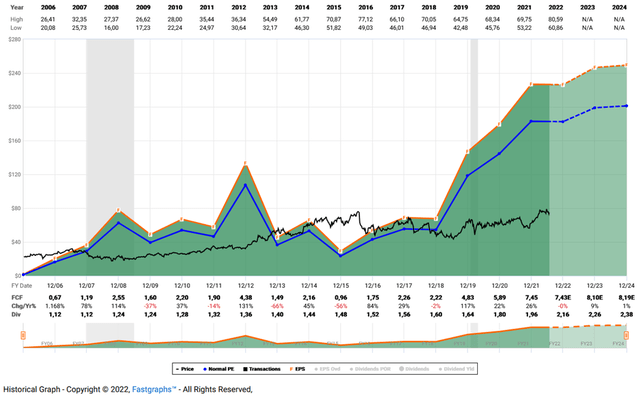

Finally, I would like to show an updated FAST Graphs chart of BMY that highlights the degree to which the stock is undervalued (Figure 1). In my opinion, the market is not fully appreciating BMY’s cash generation potential, which is best illustrated by the FAST Graphs free cash flow chart (Figure 2). One could make the argument that analysts view earnings and cash flow growth as too rosy, but I would counter that analysts have generally been quite good at predicting the company’s growth path and have even been quite conservative in recent years.

Accordingly, I have added to my position twice, in June and just a few days ago.

As an income-oriented investor, I also appreciate that BMY appears to have returned to strong dividend growth following the Celgene acquisition, highlighted for example by the latest increase by 10%. This is particularly encouraging given that Celgene itself has never paid a dividend (p. 34, 2018 10-K)

Figure 1: FAST Graphs chart for BMY, based on adjusted operating earnings (obtained with permission from www.fastgraphs.com, Copyright FAST Graphs)

Figure 2: FAST Graphs chart for BMY, based on free cash flow (obtained with permission from www.fastgraphs.com, Copyright FAST Graphs)

Thank you very much for taking the time to read my article. In case of any questions or comments, I’m very happy to read from you in the comments section below.

Be the first to comment