Justin Sullivan

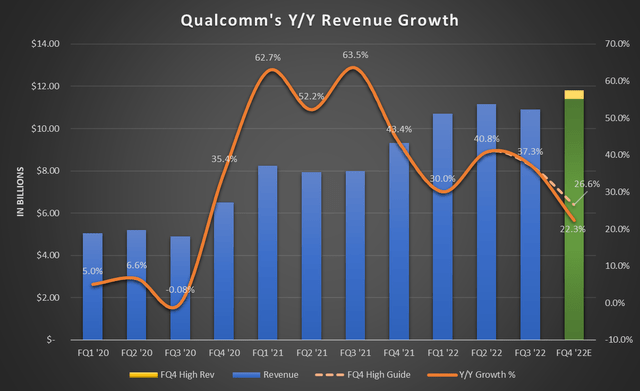

For many quarters analysts were woefully behind Qualcomm’s (NASDAQ:QCOM) heated pace of beat and raise quarters. As a result, the company was putting up numbers in different zip codes from where analysts’ numbers lived. But the company’s FQ3 earnings showed the macroeconomic environment has finally pressured the company’s retail-facing end-markets, while its FQ4 guidance solidifies analyst models have caught up to future growth expectations. The questions are now whether Qualcomm has what it takes to make it through this challenging environment and is the market willing to wait it out. Spoiler alert: The valuation says it’s willing.

Management had quite the streak of blowouts over the last five quarters, beating revenue consensus by an average of 5%, or over $400M each quarter on an absolute dollar basis. But analysts had been getting wrecked on predicting the current quarter’s estimates as management has, on average, raised guidance above consensus by 7%, or $654M over the same period. However, with FQ3’s report showing a more mediocre beat of 0.56% or $50M and guidance below estimates by $460M for FQ4, the question is whether the company has run out of growth runway and it’s time to cool the valuation, or if analyst models have gotten too aggressive for the economic times.

Growth Moderating

With guidance for FQ4 now out in the open, it’s apparent revenue growth is slowing, coming off the boost from the pandemic in FY21. Even so, the company will manage a new revenue record in FQ4. But this slowdown is a cause for concern, bringing about questions of macro uncertainty and internal product mix affecting overall revenue and margins.

Chart mine, data from Qualcomm’s Earnings Releases

On the call, management highlighted its product portfolio and the extension of its Samsung (OTCPK:SSNNF)(OTCPK:SSNLF) licensing deal for another seven years (the current agreement expires in 2023). These, of course, are long-term business dealings and validate the company’s long-term outlook and leadership position. However, the near and medium-term news interests investors and analysts as the “what can you do for me today” mentality is always the market’s six-month out perspective.

In the near term, Qualcomm isn’t impervious to recessionary and macroeconomic conditions. Its end-markets still have a significant retail attachment, so revenue and the bottom line are impacted. Management provided color on the areas affected by these economic or supply chain headwinds, providing me with data to work with.

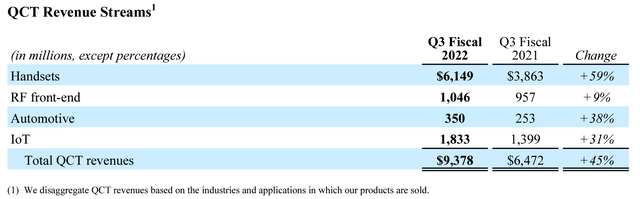

Handsets

The first was lowering its handset unit forecast, moving to 650M-700M 5G handsets, while the overall handset market was revised downward with a mid-single-digit percentage decrease. If you’ve looked at Qualcomm’s revenue breakdown in any given quarter, you’ll know Handsets is still its largest revenue center. FQ3 was no exception to this.

Qualcomm’s FQ3 ’22 Earnings Release

Therefore, adjustments to end-market units will affect the company’s revenue. But the reasons for this are important as it sheds light on how the company is performing amid softness in the market.

During Q&A on the earnings call, management shared there’s lower demand for handsets in lower tiers (below tier 1). But it reiterated premium tier handset demand is holding. However, inventory cautiousness is what’s holding back orders. As two examples, Apple (AAPL) and Samsung are likely ordering only enough to make it by on their end-demand so as not to build inventory. No one wants to be holding more inventory than necessary when economic conditions are flashing yellow at best. Therefore, Qualcomm is likely not receiving what would typically be a robust amount of orders as OEMs prepare for second-half flagship product launches.

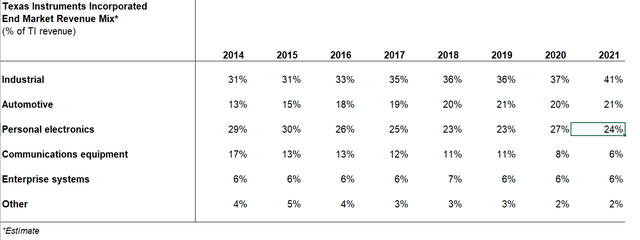

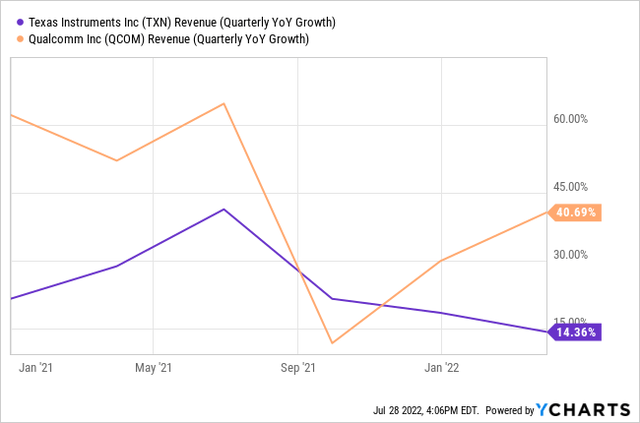

This inventory caution was mentioned more than a handful of times on the call, and it’s not surprising, considering we’re seeing this across the retail-facing chip industry. You might note Texas Instruments (TXN) had brighter things to say about its current quarter through its guidance, but it has a higher concentration in industrial and automotive end-markets, which are not weak. The breakdown shows TXN’s Personal Electronics, which includes handsets, made up only 24% of its revenue in 2021, whereas industrial made up 41%, an area consistently growing since 2014, while automotive made up 21%.

Texas Instruments End Market Revenue Breakdown 2021 Excel Sheet

Therefore, consider TXN a more recession-proof stock than QCOM as the economic headwinds appear to be majorly pointed at consumers. But CEO Cristiano Amon commented it’s still set to grow faster than its peers even with the additional consumer exposure:

…any consumer weakness has been offset by strength in industrial and enterprise. And so, when we look at those numbers, a 24% year-over-year growth (in revenue) is actually faster than some of our peers, (which) have even less consumer exposure than we do because of mobile.

Peers such as TXN, which guided to grow 10% next quarter on half the revenue dollar amount. This is critical to include in your investment thesis. Qualcomm might be more exposed to a recession, but it’s still managing materially more growth.

Getting back to Qualcomm’s retail-centric sensitivity, one of the other factors was mid and low-tier handsets affected by the China lockdowns. Still, the majority of the slowdowns have come in the “rest of world” region, not developed economies, where the impact was limited. And to provide further visibility, when CFO Akash Palkhiwala was asked about FQ1 ’23, he said the company still expects sequential growth from FQ4 into FQ1 in line with typical seasonality. However, he cautioned some of the same factors of FQ4 would likely be in play as it enters FQ1.

Insight From IoT Retail Weakness

IoT is the second largest revenue center for the company and, for several quarters, has been growing faster than handsets. But similar to handsets, IoT has a retail-facing end market. However, it can’t “tier its way out” to produce higher revenue. Handsets can be focused on premium-tier flagship products – how the impressive growth over the last several quarters was accomplished – but IoT doesn’t have the same tier market. Except for the latest technology like Wi-Fi 6 or Wi-Fi 7, it mostly comes back to 5G, which is just 5G and doesn’t provide a product step up to make up for lost demand.

The strategy to offset retail weakness only goes so far as handsets, resulting in IoT’s growth below the QCT average growth of 45% in revenue for FQ3. Therefore, the strategy to push harder in IoT – the once fastest-growing segment – will find resistance in this economic environment.

A Positive Qualcomm Will Retain Apple For A Little Longer

The headwinds prevalent in retail and, by proxy, mobile are difficult to combat when it’s the largest revenue center. However, as I analyzed last week, with Apple rumored to not be on track for a 2023 5G modem, Qualcomm has breathing room and a longer growth runway as economic headwinds intensify. Moreover, it can be viewed as a silver lining as this furthers the initiative to diversify and not rely significantly on the retail market.

This has long been in the works under Cristiano Amon and is proving to be terrific foresight under these conditions. If it weren’t for the diversification process, the 24% revenue growth in one of the most rapidly deteriorating quarters economically outside of the pandemic would not have been guide-able. This alone provides a strong investment thesis in QCOM, as management and its foresight is a vital pillar in my investing philosophy.

Is The Valuation Worthy?

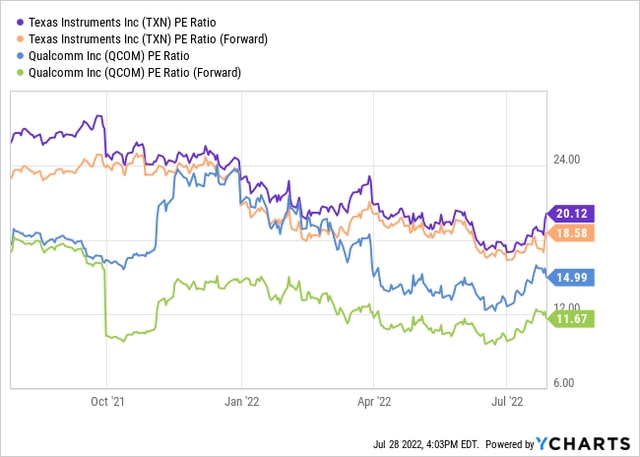

Slowing growth in the near-to-medium-term but a resilient long-term outlook keeps Qualcomm near the top of my list. I’m not as bullish after this report as I have been over the last few quarters’ beat and raises, but I’m not worried about my shares. And further comfort comes from the discount to peers the stock is trading at.

On a P/E basis, QCOM is cheaper than TXN by a wide margin. As I said above, TXN is more recession-proof than QCOM, but the difference in valuation plus the difference in growth rates adds a buffer in both directions – QCOM has higher growth with a lower valuation. The trailing and forward P/E ratios for QCOM are 26% and 37% lower than TXN, respectively.

Data provided by YCharts

Typically, a lower valuation dictates weaker growth, but this isn’t the case for these two companies.

Data provided by YCharts

The above chart has yet to include the 37% quarter QCOM reported or TXN’s 13.8% quarter reported earlier in the week. Then add the expectations for QCOM to have a 24% current quarter while TXN is expected to deliver a 10% current quarter, and it’s clear the valuation for QCOM doesn’t align with peers. Between the two, even with the recessionary insulation of TXN’s industrial and automotive portfolio, QCOM will deliver better numbers for cheaper.

Earnings Have Cooled, But The Valuation Is Still Low

I was looking forward to another in-your-face beat and raise from Qualcomm, but instead, Qualcomm reined in expectations. The issue is on the retail-sensitive divisions in handsets and IoT as the US enters a recession phase and macroeconomic uncertainties steal the show. The caution expressed by OEMs through fewer upfront orders while working through inventory is not a long-term issue but does affect the market’s outlook over the next two quarters.

However, QCOM’s valuation is not in a place where risk is inherently high. With the stock trading at a discount to peers and still delivering outperformance in growth, investors are provided a buffer. Moreover, the company will manage the recessionary headwinds by continuing on the path it set out to diversify and push toward high-margin, premium-tiered units where it can.

Be the first to comment