peakSTOCK/iStock via Getty Images

InMode (NASDAQ:INMD) is one of the leading providers of aesthetic medical equipment globally. The company is well known for its hands-free and minimally-invasive surgical products. INMD has a growing number of patents and as of this writing, it has 8, up from 7 patented technologies in FY ’21. It continues to grow its operational scope and is currently operating in 78 countries, up from 61 countries in FY ’21. Furthermore, it still has numerous patent applications submitted in the US Patent and Trademark Office that are waiting to be approved. This implies more growth for InMode, making it attractive as of this writing.

Company Overview

One of the interesting catalysts for InMode is its effort to expand its portfolio which will drive more growth in its future reports. This comes with more innovation which the company aims to close the “treatment gap” in medical aesthetics. In fact, INMD debuted its Morpheus8 Body 3D and will launch a new product line, the second generation of Evoke, next year.

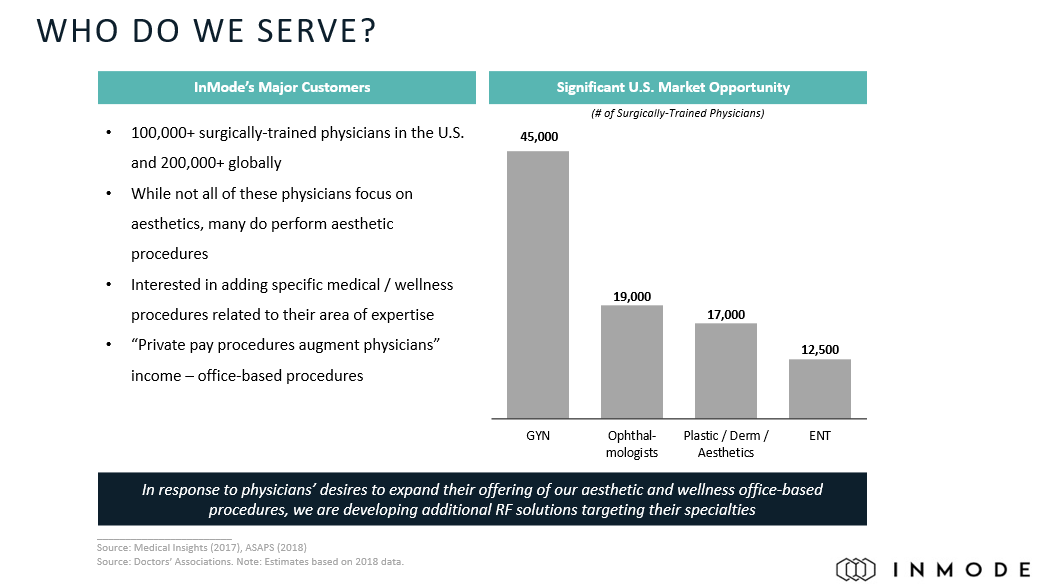

Additionally, INMD has a growing unit installed base of 15,500 globally, with 7,300 of them in the US, up from 11,600 in FY ’21. Interestingly, management still sees a huge addressable market in the US and much bigger market outside the country as shown in the image below.

INMD: Huge TAM (Source: INMD Investor Presentation)

INMD is also looking for a meaningful acquisition which will support its future growth as quoted below.

In addition to our active pipeline of new technology, we’re also exploring potential acquisition that could complement our presence in the wellness market. This could be companies with an established track record and an existing customer base in the U.S. and globally. Source: Q3 ’22 Earnings Call Transcript

Looking at its balance sheet, INMD remains liquid with total cash and short-term investment of $486.4 million with no long-term debt, making it well positioned to pursue such strategic investment. I believe INMD is well positioned to cater its growing opportunities in the global medical aesthetic market. Finally, the company has a strong buyback program of up to 1 million shares, which makes its Q4 ’22 more interesting.

Growing Opportunities In Women’s Wellness

One of the company’s unique drivers is its actual results in its mission to promote women’s wellbeing. As stated below, management continues to reassure investors with its improved outlook.

…we gave a target for Empower for the Women Health at the beginning of the year, we said it will be $20 million and then we raised it to $30 million, and now we’re raising it to $40 million.

So we are doing our best, and I believe that the success in the women health, which is a totally different category, it’s also aesthetic but it’s a totally different medical community and we’re very encouraged. So I would say that growing with 20% a year from now on is a good target for you to put in your model. Source: Q3 ’22 Earnings Call Transcript

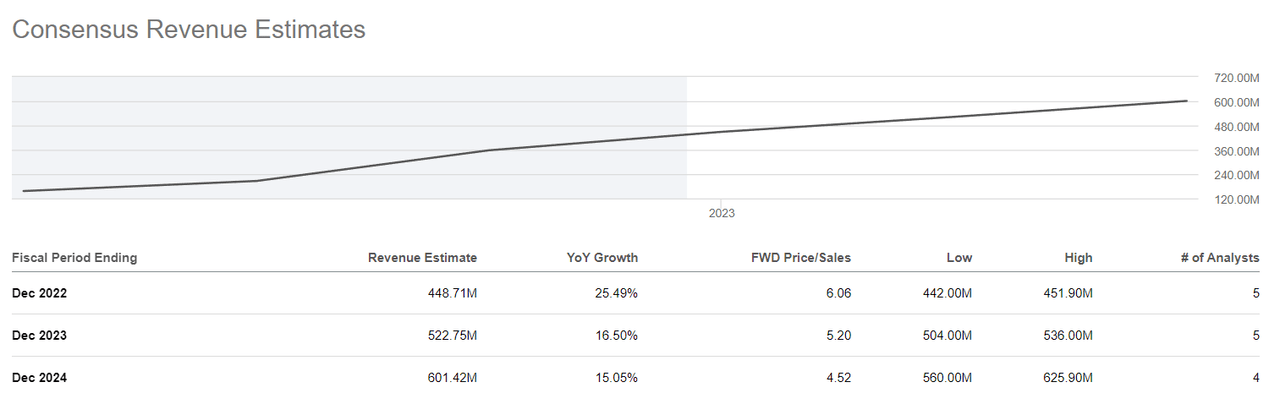

INMD: Growing Top Line (Source: Seeking Alpha)

Another interesting part is InMode’s vTone for pelvic floor rehabilitation, positioning the company to grab opportunities in the growing pelvic floor electric market, which is expected to reach $427.15 million by the end of 2028. Hence, I believe we might see upward revision on its current consensus revenue estimate.

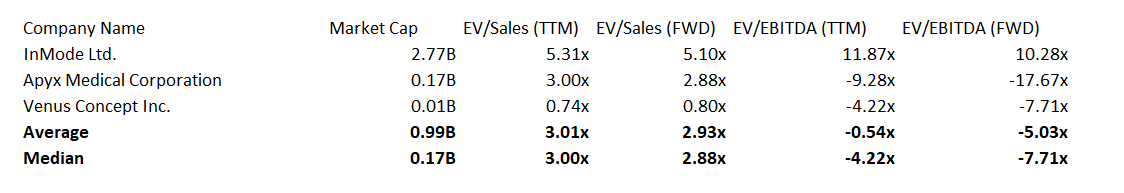

Relative Valuation

INMD: Relative Valuation (Source: Data from Seeking Alpha and S&P Cap IQ. Prepared by the Author)

Apyx Medical (NASDAQ:APYX), Venus Concept (NASDAQ:VERO)

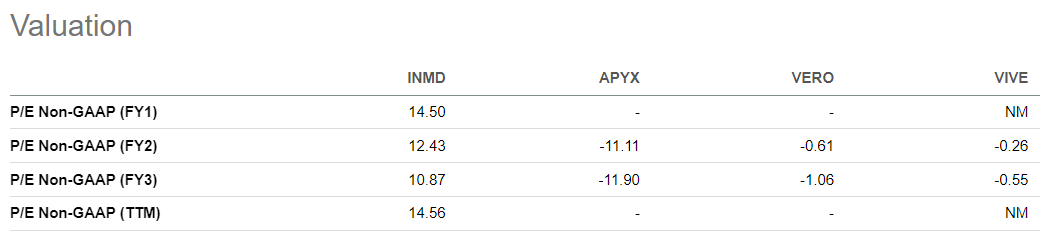

In this comparison, INMD remains strong, the only company with a positive EV/EBITDA of 11.87x. It looks attractive at its forward EV/EBITDA of 10.28x, trading at a 62% discount compared to its 3-year average of 27.1x. In fact, considering today’s P/E non-GAAP consensus, INMD will still remain the only profitable cosmetic med-tech company for the next few years as depicted in the image below.

INMD: P/E Non-GAAP Consensus (Source: Seeking Alpha)

Its forward EV/Sales multiple of 5.10x shows a significant discount as well compared to its 10.58x 3-year average. Using the wall street’s average target price of $52, I believe INMD trades attractively as of this writing.

Potential Bottom Set-up

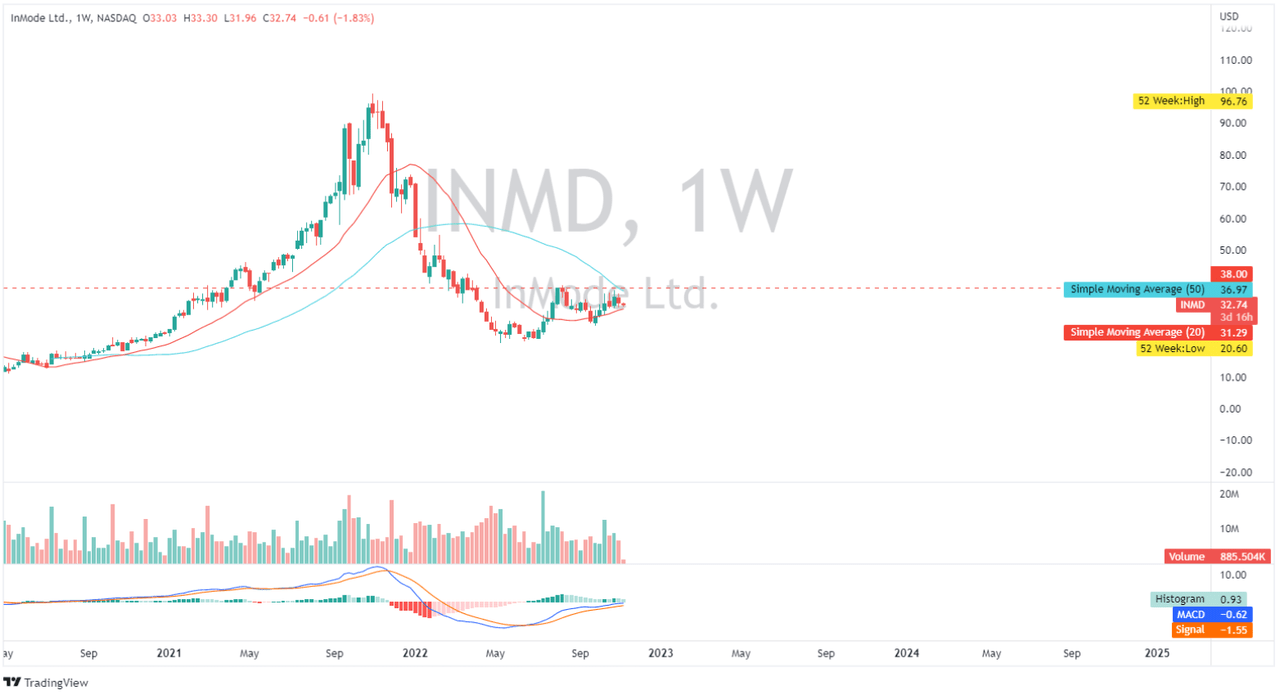

INMD: Weekly Chart (Source: TradingView.com)

INMD is currently consolidating between the $20 and $38 zone. Looking at its price action, bearish momentum seems to be weakening. A break of its $38 and consolidation above that level will confirm its potential bottom. It is currently sitting above its 20-day simple moving average; this serves as its dynamic support to monitor. A breakout of its 50-day SMA will act as another confluence in its potential double bottom set-up. MACD indicator is still in negative territory but showed some bullishness with its previous bullish crossover last July.

Caveat

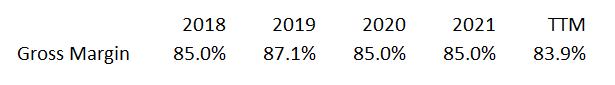

Based on the image below, one of the risks INMD has is its weaker gross margin performance.

INMD: Gross Margin Trend (Source: Data from Seeking Alpha. Prepared by the Author)

This is especially true considering the uncertainties from its potential acquisition plan, which could add pressure to its current performance. While INMD’s non-GAAP gross margin of 85% this Q3 ’22 seems weaker than its 86% recorded in the same quarter last year, management reassures its investors with their outlook of 83% to 85% for FY ’22. This at least aligns with its long-term target of 85%, which is in my opinion impressive, especially considering today’s high inflationary environment.

Furthermore, INMD completed the quarter with a lower sales ratio from outside the US, which might be an early warning indication of a challenging global demand environment.

Of the total sales in Q3, 67% came from the U.S. and 33% came from the rest of the world, compared to 66% and 34%, respectively for the same quarter in 2021. Of our international contributors, Canada, Europe and Latin America were the biggest markets driving our growth rate. Source: Q3 ’22 Earnings Call Presentation

Conclusion

InMode maintains a strong presence in the market with over 70% share, according to the management. Despite today’s challenging operating environment, it has maintained its growing human capital resource of 437 employees, up from 362 employees in FY ’21 and 311 employees in FY ’20. INMD has a strong expansion catalyst and a maintained margin, leading me to believe that this stock is attractive and a buy at today’s weakness.

Thank you for reading and good luck everyone!

Be the first to comment