acceleratorhams/iStock via Getty Images

Investment Thesis

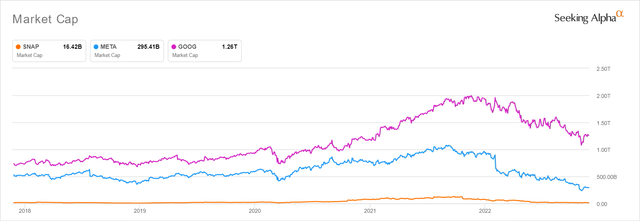

SNAP’s Underperforming Market Cap

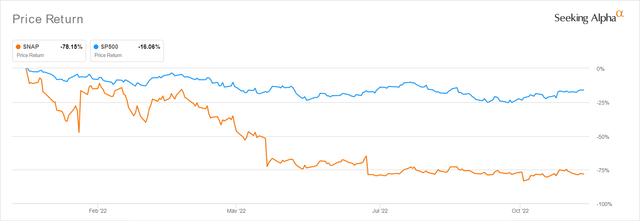

Snap (NYSE:SNAP) has inherently underperformed in the few years after it went IPO in 2017. Starting at $32.17B, the stock has dramatically see-sawed during the pandemic to reach a peak market cap of $132.21B, only to plunge catastrophically to $16.42B at the time of writing.

Therefore, it is no wonder that the SNAP stock had a poorer 5Y total price return of -25.2% against its better-performing peers, such as Alphabet (GOOG) at 86.4% and Twitter (TWTR) at 262.97%, before the latter was taken private by Elon Musk. Meanwhile, Meta (META) has also suffered terribly, with a 5Y return of -38.9%, due to the tragic correction from the Apple (AAPL) privacy changes and unpopular Metaverse strategy.

With the US advertising spending expected to continue decelerating at a CAGR of 10.59% through FY2024 against pre-pandemic levels of 35.53% and hyper-pandemic levels of 20.07%, it remains to be how SNAP expects to recover, due to the minimal catalyst ahead. Thereby, potentially triggering further sideways price action over the next few quarters.

SNAP May Continue Its Underperformance Ahead In A Weaker Ad-Spending Environment

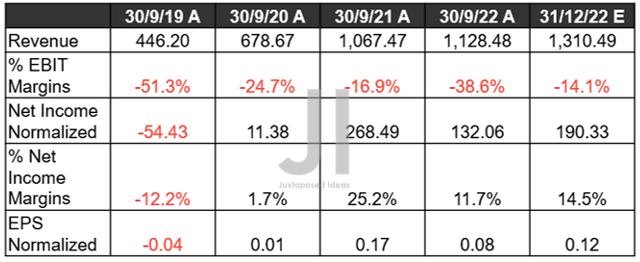

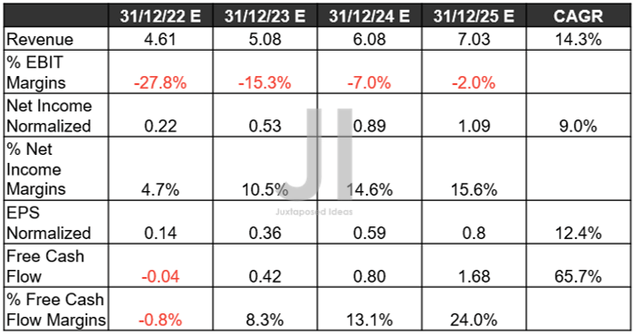

SNAP Revenue, Net Income ( in million $ ) %, EBIT %, and EPS

In its recent FQ3’22 earnings call, SNAP delivered sobering results, with top lines misses, though with notable adj. EPS beat. Despite competent cost management by -10.19% QoQ, it is evident that operating costs remain elevated YoY, triggering the poorer EBIT margins of -38.6%. Combined with the recent restructuring charge of $155M, the company reported impacted adj net income margins of 11.7% in the latest quarter, improved by 14.4 percentage points QoQ but impacted by -13.5 points YoY. Thereby, triggering an underwhelming EPS of $0.08 by FQ3’22.

On the other hand, despite the lack of management guidance, Mr. Market is cautiously optimistic that SNAP will deliver decent revenue growth of 16.12% QoQ and 1% YoY by FQ4’22. Furthermore, we may expect improved profit margins then, further expanding its adj. EPS to $0.12. We’ll see, though that number still indicates a -45.8% decline YoY.

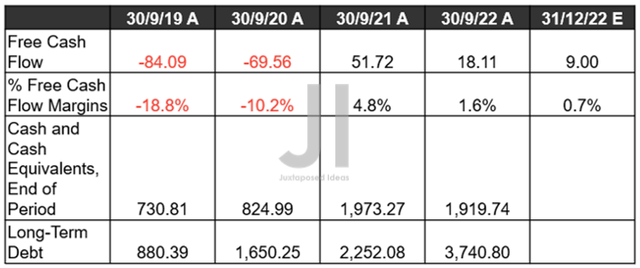

SNAP Cash/ Equivalents, FCF ( in million $ ) %, and Debts

Therefore, it is not a surprise that SNAP reported a lower Free Cash Flow (FCF) generation of $18.11M and FCF margins of 1.6% in FQ3’22, with another halving expected by FQ4’22. Ouch, since the company has also been increasing its reliance on long-term debts by 66.1% YoY to $3.74B. In the meantime, its balance sheet remains well-position for the uncertain macroeconomics through 2023, with $1.91B of cash and equivalents and $282.42M of long-term debts due May 2025.

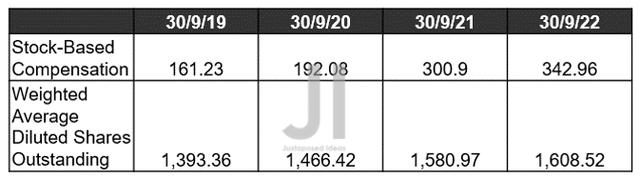

SNAP Share Dilution & SBC Expenses ( in million $ )

Though the SNAP management has tried to temper some of those headwinds with a $500M stock repurchase in the quarter, it is apparent that its reliance on Stock-Based Compensation remains elevated at $342.96M. It indicates another increase of 7.57% QoQ and 13.97% YoY, respectively, bringing the sum to $1.23B over the last twelve months (LTM), against GAAP net incomes of -$1.11B at the same time.

It is no wonder that SNAP continues to report a lack of profitability in FQ3’22, despite a 4.61% QoQ and 18.62% YoY growth in its user growth to 363M thus far. Even the 1.5M Snapchat+ subscription at $3.99 a month did not have the desired effect on its top and bottom lines at all.

SNAP Projected Revenue, Net Income ( in billion $ ) %, EBIT %, EPS, and FCF %

SNAP’s underwhelming delivery in FQ3’22 and uncertain FQ4’22 performance have had the unfortunate impact of top and bottom-line downgrades over the next few years, between FY2021 and FY2025. Market analysts have reduced their projections by -10% and -23.77%, respectively, indicating the company’s uncertain prospects in its Snapchat+ and AR-based advertising ahead, despite the supposed softer landing through 2024.

In the meantime, we encourage you to read our previous article on SNAP, which would help you better understand its position and market opportunities.

- Snap: Not Keeping Up? 2023 May Be Its Break Out Year

So, Is SNAP Stock A Buy, Sell, or Hold?

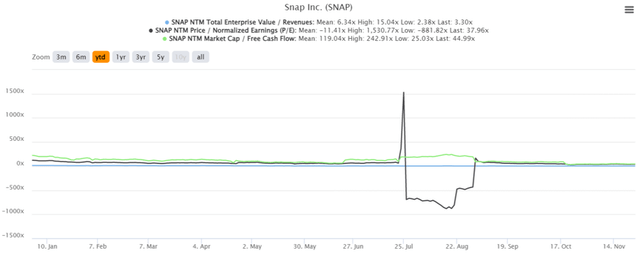

SNAP YTD EV/Revenue, P/E, and Market Cap/ FCF Valuations

SNAP is currently trading at an EV/NTM Revenue of 3.30x, NTM P/E of 37.96x, and NTM Market Cap/FCF of 44.99x, much lower than the start of the year at 4.90x, 120.42x, and 221.80x, respectively. However, it is apparent that at such levels, the stock is still relatively over-valued compared to its peers, such as GOOG at NTM P/E and NTM Market Cap/FCF valuations of 19.82x/17.30x and META at 15.44x/42.49x.

Combined with SNAP’s underperforming profitability at net income margins of -24.3% and FCF margins of 3% over the last twelve months, compared to GOOG’s 23.7%/22.2% and Meta’s 24.4%/22.4%, it is a wonder why the former continues to enjoy elevated valuations thus far.

SNAP YTD Stock Price

The SNAP stock is trading at $10.18, down -81.45% from its 52 weeks high of $54.89. Unfortunately, for those who have missed out on the recent bottom, the stock has rallied too optimistically by 38.88% from its 52 weeks low of $7.33 since mid-October 2022. It is no wonder that the stock has also maxed out its forward potential, against the consensus estimate’s price target of $10.78 and a minimal 5.89% upside from current prices. Given the minimal margin of safety and apparent over-valuation, we prefer to continue rating SNAP stock as a Hold. Do not chase this stock here. It is better to patiently wait again, for our previous price target of between the $7 and $8 range.

Be the first to comment