Ethan Miller

The 2022 midterm elections surprised many pundits and investors. It was not so much a red wave as it was a purple haze across the nation. In the financial markets, stocks generally took the political event in stride. Several industries were impacted from marijuana to renewable energy to even gun and ammo stocks. Smith & Wesson (NASDAQ:SWBI) shares have been on the rise lately despite the democrats faring better than expected in the midterms. I see more upside potential and a value case emerging.

According to Fidelity Investments, Smith & Wesson Brands, Inc. designs, manufactures, and sells firearms worldwide. The company offers handguns, including revolvers and pistols; long guns, such as modern sporting rifles, bolt action rifles; handcuffs; suppressors; and other firearm-related products under the Smith & Wesson, M&P, and Gemtech brands.

It also provides manufacturing services comprising forging, heat treating, rapid prototyping, tooling, finishing, plating, machining, and custom plastic injection molding to other businesses under the Smith & Wesson and Smith & Wesson Precision Components brand names.

The Massachusetts-based $533 million market cap Leisure Products industry company within the Consumer Discretionary sector trades at a low 4.6 trailing 12-month GAAP price-to-earnings ratio and pays a solid 3.4% dividend yield, according to The Wall Street Journal.

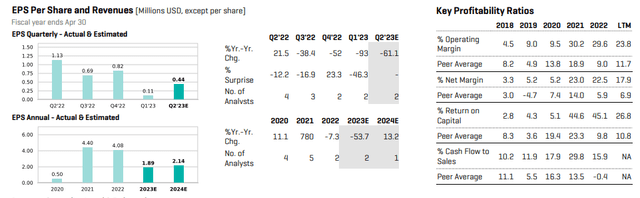

On valuation, earnings are expected to be very soft in the coming quarters and years. CFRA Research shows that the Q2 2023 consensus earnings forecast is just $0.44. That would be a more than 60% drop from the same period a year ago. For 2023 and ‘24, per-share profits might verify about half of what was seen in 2021 and 2022. Amid the deterioration in profitability, the stock’s valuation has fallen big, now just a mid-single-digit P/E consumer company.

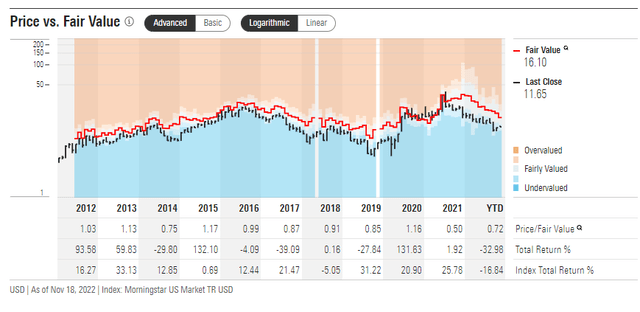

Still, operating margins have been decent over the last 12 months, above the industry average. SWBI trades well below its long-term valuation multiples and at an EV/EBITDA ratio of just 2.4, according to Seeking Alpha. Its PEG ratio of just 0.4 has an A rating. Morningstar notes its earnings yield is high at 22.2% and has been raising its dividend in the last few years. I see the dividend as sustainable given $2.38 of free cash flow per share in 2022, per CFRA.

SWBI: Earnings, Revenue Forecasts. Key Profitability Ratios

CFRA

Morningstar Price vs. Fair Value

Morningstar

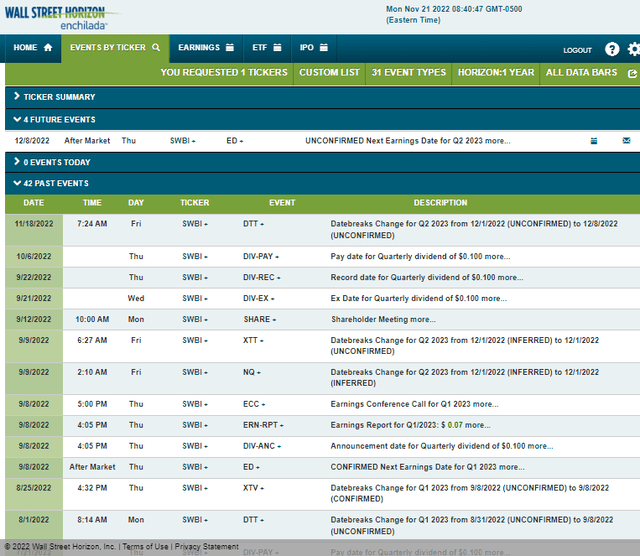

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q2 2022 earnings date of Thursday, December 8, after the closing bell. The event calendar is light aside from the earnings date.

Corporate Event Calendar

Wall Street Horizon

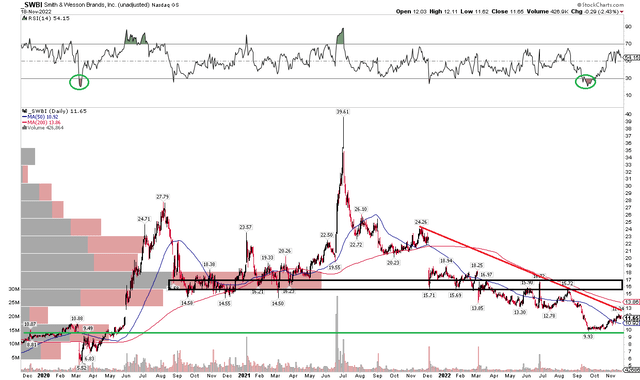

The Technical Take

SWBI has round-tripped to its pre-Covid peak near $10 in February 2020. The stock bottomed this year at $9.93 following its Q1 report in September. I see a tradeable low in place, but a broad downtrend remains intact. Moreover, the downward-sloping 200-day moving average comes into play just above the downtrend resistance line off the short-term peak in December 2021. Finally on the bearish side of the ledger is a high volume-by-price area in the $16 to $18 range – so even on a breakout from near-term resistance, there could be another tough zone for the bulls to climb through.

Overall, I think being long here with a stop under the September low can make sense, but gains should be taken on an approach of $16.

SWBI: Shares Holding The Early 2020 Highs, Eyeing A Possible Breakout

Stockcharts.com

The Bottom Line

I like the valuation on SWBI after shares have been crushed off the June 2021 high and December 2021 rebound move. After retracing back to its February 2020 peak and with an exceptionally low valuation, the stock could be worth a look here for value investors. Short-term technical traders have key price levels to watch, too.

Be the first to comment