Just_Super

Investment thesis

Fortinet (NASDAQ:FTNT), being a cybersecurity stock, has benefited from the increasing awareness for the need for cybersecurity in our lives today. The company looks set to grow at 22% revenue CAGR in the next 3 years as the business momentum continues while producing solid operating and free cash flow margins. While it may be operating at least at the Rule of 40, the company will likely face some challenging next few quarters as it is seeing decelerating growth, amid increasing prudence by its customers as the macro backdrop remains uncertain. The withdrawal of the bookings and backlog disclosure further aggravated sentiment as investors are now raising an eyebrow as the company is doing so at an inopportune time. Fortinet management needs to execute well in the next few quarters to show that they can maintain growth and backlog to assure investors that the withdrawal of bookings and backlog disclosure does not have future near-term negative consequences for the company. As such, I initiate Fortinet with a Neutral rating and recommend investors to stay on the sidelines for a few quarters before re-considering investing in the company.

A take on 3Q22

I will firstly note some of the positives from the quarter. Firstly, Fortinet produced a 7-percentage points beat on product revenue as it grew 39% year on year and accelerating 4-percentage points sequentially. This beat is amazing considering that this was Fortinet’s toughest comparison quarter in the past 10 years. Secondly, this was the second consecutive quarter where services revenue accelerated, with a growth of 28% year on year. Thirdly, operating profit margins were ahead of market expectations by 3 percentage points, coming in at 28%. The contribution for the better operating margins came from FX benefits as well as improving operating leverage with increasing revenues.

That said, there were some negatives in the quarter that resulted in a more pessimistic view of the company. Firstly, billings came in at 33% year-on-year growth, showing a deceleration of 3 percentage points sequentially. In addition, the guidance for fourth quarter billings came in at 33%, likely further increasing pressure on shares as it was 3 percentage points below market expectations. Both the deceleration seen in the third quarter and further miss in expectations for fourth quarter billings do increase bearish sentiment around the company. There are worries that we are seeing peak demand and that the quarter further demonstrated that Fortinet’s shares will likely face increasing pressure as growth slows. Secondly, this was further aggravated by the removal of the company’s disclosure of bookings and backlog. This was to be expected, but the market was perhaps surprised that it came this soon. With the bad timing of the withdrawal of a key company disclosure, this further feeds to the negative sentiment that the business’s health seems to be deteriorating. As such, I think we will need to see improved fundamentals and stabilizing growth in the quarters ahead to assure investors that the removal of disclosures for bookings and backlog was not a result of weakening business fundamentals.

Delving deeper into growth drivers and misses

Amongst the major geographies, Europe was a positive surprise for me, growing 37% year on year, an acceleration of 9 percentage points sequentially. This was despite earlier fears that execution could result in a miss in the region. The Americas region also posted strong growth, accelerating 11 percentage points sequentially to 34% year-on-year growth. APAC was the weaker segment as the growth almost halved 23% year on year growth compared to the prior quarter as there was a leadership transition as well as the large base from the Alaxala deal.

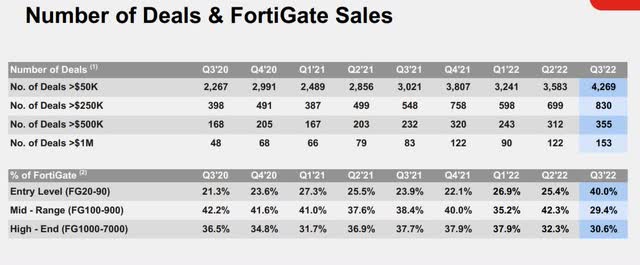

Also, we see that the number of large deals continues to grow, as the number of deals with more than $1 million reached 153 in the current quarter. The continued business momentum and increasing size of deals do show strong traction for the business even as the macroeconomic situation remains uncertain.

Fortinet number and size of deals (Fortinet IR)

In the Secure SD-WAN market, Fortinet gained market share in the segment in the current quarter as their offerings continue to provide better efficiency, performance, and security relative to other players. In 3Q22 the SD-WAN and OT bookings grew over 45% year on year and 75% year on year, respectively. They now represent more than 25% of total bookings. Management continues to remain optimistic about the segment and targets to reach the number 1 market share position in SD-WAN in a few years’ time. G2000 bookings came in slower at 40% year-on-year growth in 3Q22, compared to the 60% to 65% year-on-year growth we saw in the first half, but the deal sizes are growing as the number of $1 million and more deals are growing.

The commentary about the current business momentum does sound alright as they continue to point to a strong pipeline, while the lower billing guide was attributed to the customer supply chain behavior highlighted above and prudence around the current macro condition.

For what it is worth, management continued to reiterate their medium-term targets that should be accomplished by calendar year 2025. These targets include $10 billion in billings and $8 billion in revenues, implying a billings and revenue CAGR of 22% from the current 2022 guidance. This also includes an expectation for adjusted free cash flow margins to be in the middle to high 30% range and the operating margins to be at least 25%. I think that this continues to illustrate that management has confidence in the long-term potential of its business model and in its execution abilities. At the same time, the focus continues to be on balancing growth and profitability as they will likely still be operating at least at the Rule of 40.

Further insight into the disclosure withdrawal

During the management call, I note that management reiterated that this decision would have gone through regardless of the third quarter results. The management reiterated that the backlog growth was plateauing, and the exit backlog was between $400 million to $500 million. This was lower than the earlier exit expectations of $500 million.

To dive further deeper into the lower exit expectations today compared to one year ago, the main explanation for this is due to normalized buying behavior that has influenced backlog build. This was because one year ago, many of Fortinet’s US customers were facing supply chain challenges that resulted in them placing orders in order to reserve a place in the line in the event that inventory was available. This was primarily because of the huge uncertainty we see in the supply chain, and this resulted in the earlier higher exit backlog expectations were. In 2022, management commented that the supply chain situation improved, and it made customers better able to forecast how to buy the proper amount of inventory they required and no longer place orders in advance to reserve a place in the line as they returned to more traditional buying methods. Thus, the earlier higher exit backlog expectations were a result of customers actually almost doubling or tripling their orders to stay ahead of the curve, which is the challenging supply chain situation.

In general, I remain positive that management continues to reiterate that they see a plateau in the backlog growth. Furthermore, it’s definitely a positive that their commentary suggests that cancellation rates have not been concerning. I will continue to monitor commentary from future quarters to see how this pans out. The steadfast attitude to the withdrawal of backlog and bookings disclosure will likely raise eyebrows, as it should, and we will likely need to see further evidence of stability in the business before investors start dipping their toes in the stock again.

Valuation

For my 1-year target price for Fortinet, I will apply an equal weight of the EV/Sales and EV/FCF methods. This is due to the company’s current public company history, as well as its relative size and profitability levels. I assume a forward 2023 EV/Sales and EV/FCF multiples of 9x and 25x respectively. While this may seem elevated, these multiples are only a slight premium to the 5-year average of 7x and 20x respectively. I think that a premium over the historical is warranted given the improved profitability profile, durable growth, and recurring revenue profile of the company.

With that, my 1-year price target for Fortinet is $58 implying a 10% upside from current levels. I think that the valuation for Fortinet is somewhat stretched, as its risk-reward perspective is fairly balanced in my view. As such, I initiate Fortinet with a Neutral rating.

Risks

Competition

Other networking vendors may increase competitive pressures and cause the competitive landscape to change and Fortinet to lose market share in the SD-WAN segment. This may be detrimental especially if these competitors increase discounting pressures in the SD-WAN market, leading to slower growth and lower margins for Fortinet.

Cyclical concerns

Given the hardware-oriented business model, this raises some concerns in the market that the company’s business model is prone to cyclicality. If so, this may lead to a lower multiple assigned to the company as the market prices in a less defensive and resilient business.

Supply chain issues

The potential for supply chain issues to come up again increases the risks to Fortinet. The past supply chain challenges have led to product growth hiccups in the past and there is the risk that this may happen again in the future.

Conclusion

I think that Fortinet will continue to be challenged in the current environment. Given the removal of the bookings and backlog disclosure, this has led to many investors pivoting away from the stock given the near-term uncertainty about how the business will pan out. At the same time, the explanation about the customer supply chain behavior as well as increasing prudence from customers as macro uncertainties weigh on them are near-term headwinds for the business. I expect the next few quarters to be challenging for Fortinet and valuation remains stretched as the shares are trading at a forward EV/Sales multiple of 9x and EV/EBITDA of 30x. My 1-year price target for Fortinet is $58 implying 10% upside from current levels. The valuation for Fortinet is somewhat elevated as the risk-reward perspective is fairly balanced, in my view. As such, I initiate Fortinet with a Neutral rating and urge investors to stay on the sidelines for the next few quarters for the reasons highlighted above.

*Author’s note: I am starting a marketplace service, Outperforming the Market, which will be launching on 10 Jan 2023. Outperforming the Market aims to help investors identify high conviction growth and value stocks to form a barbell portfolio that outperforms the market.

Mark your calendars, because early subscribers can reserve a spot as a Legacy Discount Member, which gives you generous introductory prices. Thank you for reading and following my work. See you there!

Be the first to comment