Nastassia Samal

Merger arbitrage (or merger arb for short) is an event-driven investment strategy allowing investors to bet on a successful outcome of an acquisition of a publicly-listed company. Generally, from the time a merger is announced until closing, there’s some uncertainty whether the transaction will close successfully. Normally, this leads to a difference between merger consideration and the target company’s trading price – this is referred to as a spread. In all-cash transactions, an investor can capture the spread by initiating a long position in the target company. Meanwhile, when the consideration is in stock, investor need to initiate hedged positions to capture the spread

Merger arbitrage can be an attractive event-driven investment strategy. It generally offers pre-defined returns which have a low correlation with the general market/macroeconomic movements, allowing investors to diversify their portfolios. Moreover, the timeline is usually short, making for high annualized returns.

However, it’s important to make a distinction between large-cap and smaller M&A transactions. Generally, larger mergers are well followed and covered by many professional analysts – and as a result of that the outstanding spread usually fairly reflects the potential risks. As explained by Joel Greenblatt in his book ‘You Can Be a Stock Market Genius’ (bible of special situation investors), these risks include:

These may include regulatory problems, financing problems, extraordinary changes in a company’s business, discoveries during the due diligence process (if you’ve ever purchased a home, this is sort of the house inspection of the merger world), personality problem, or any number of legally justifiable reasons people use when they change their mind.

In his work, Greenblatt goes on to explain why large-cap merger arbs do not offer the best risk/reward for the individual investors:

“Over the last decade, dozens of investment firms and partnerships have entered the risk arbitrage area, once considered a backwater of the securities business. This has made risk arbitrage a very competitive business despite the large volume of mergers. The ability of these firms to follow developments in deals all day long, armed with the advice of antitrust counsel, securities lawyers, and industry-specific investment experts, makes this a very difficult investment strategy for the individuals to try at home.”

While you can indeed still find interesting situations in the heavyweight space, generally large-cap risk arbitrage does not offer the most lucrative hunting grounds.

Luckily, small-cap risk arbitrage is a totally different animal and offers a much better risk/reward. Lower liquidity makes such situations unactionable/uninteresting for most funds whereas remaining investors sometimes tend to overlook important transactional nuances due to:

-

Disliked and/or underfollowed industries (e.g. junior mining, cannabis, etc.).

-

Complicated calculation of merger consideration.

-

International mergers involving foreign-listed stocks and FX impact (even though both can be easily hedged).

- Overestimated risk around hedging fees.

Ongoing Small-Cap Mergers

Below I highlight two interesting small-cap merger arbitrage cases that are currently actionable. Then, in the next section I turn to small-cap investing strategy in general and present seven examples of arbs trading that used to trade at wide spreads. Notably, both actionable situations are in the cannabis space and seem likely to close in the same way as happened to KSHB / GNLN and LHSIF / AYRWF transactions – these are discussed below.

Columbia Care (OTCQX:CCHWF)

-

Buyer: Cresco Labs (OTCQX:CRLBF)

-

Consideration: 0.5579 SNDL stock

-

Current Spread: 16%

Consolidation of two major US cannabis companies – Cresco Labs (OTCQX:CRLBF) is acquiring Columbia Care. The combination will create the largest multi-state operator in the US (second largest retail footprint + one of the largest wholesale platforms). Shareholder and antitrust approvals have already been received, though consents from the individual state regulators remain outstanding. In certain states, the parties will have to divest licenses in order to meet license caps and other restrictions, however both firms have been ready for that and stated that license sale proceeds will be used to reduce debt. Overall, it looks like the merger should close successfully and the management has recently reiterated that transaction is going forward as expected. Closing is expected in Q4’22. Plenty of shortable shares are available on IB at 0.7% fee.

That said, there are two issues/uncertainties that could explain the spread:

- The exchange rate is subject to proration adjustment by the amount of Columbia Care shares issued as an earn-out for its historical acquisition from Dec’20. The earn-out will be based on adj. EBITDA performance of the acquired company until June’22. As Columbia Care became public only in 2021, there’s no available information to check the likelihood and size of the payment. The maximum earn-out is $58m worth of Columbia Care shares. The exact number of shares to be issued was stated to be calculated at 10 days VWAP prior to the release of Columbia Care’s Q2 earnings (mid-Aug), however, the company has still not made any comments on the earn-out’s impact so far. At current prices, the maximum earn-out would lower the exchange rate to 0.4977 and reduce the spread to 3%.

- Downside is quite difficult to estimate. Shares of cannabis companies (represented by Global X Cannabis ETF (POTX)) have declined 53% since the merger was announced (on March 23), so pre-announcement levels are of little relevance in estimating the downside if the merger fails.

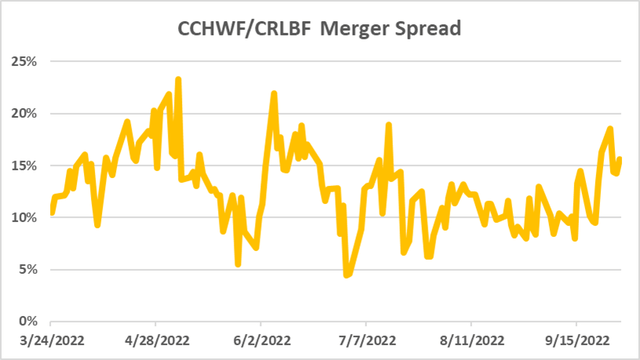

That said, even taking into account these risks, CCHWF / CRLBF seems to be an attractive merger arb opportunity – the transaction is very close to a done deal. The spread, however, has hovered around 6%-13% since mid-July only to widen to as much as 19% recently despite the lack of any material merger-related news. With the current spread of 16%, I believe this merger arb offers investors an attractive entry point.

Valens Company (VLNS)

-

Buyer: SNDL (SNDL)

-

Consideration: 0.3334 SNDL stock

-

Current Spread: 9%

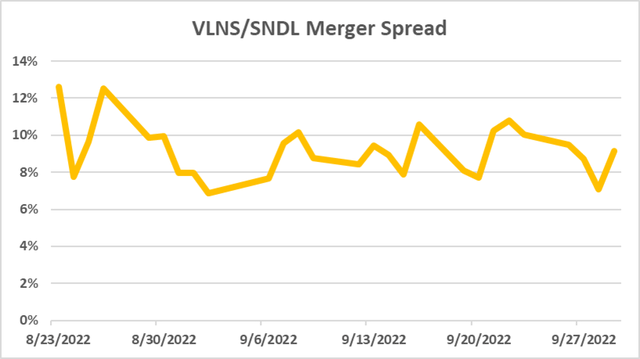

Acquisition by the largest Canadian distributor of cannabis. Merger will require approval from 2/3rds of VLNS shareholders. This should pass easily as VLNS is still a cash-burning machine and without this merger, the company would be on a brink of another dilutive financing. Shareholder meeting is expected by the end of November. Meanwhile, with this takeover, the buyer SNDL will add VLNS biomass sourcing and extraction expertise, white-label operations, and diversify its product line by adding VLNS brands to SNDL’s 350 retail stores. SNDL estimates C$15m adj. EBITDA synergies (vs. currently combined operating expenses of C$130m). The main reason behind the quite wide spread might be volatile borrow fees – currently at 4.5% per year but stood at 10%+ in Jan-Apr’22. That said, the fees would have to spike up to 25% to nullify the gains on this trade. Closing is expected in Jan’23.

Learning From Small-Cap Merger Arbs

In this section, I take a look at seven recent small-cap merger arbitrage cases. In my analysis, I emphasize what risks the market might have misperceived and why the odds of a merger closing successfully were mispriced. Looking at this transaction is a good learning framework on how to assess other situations.

Marrone Bio Innovations (MBII)

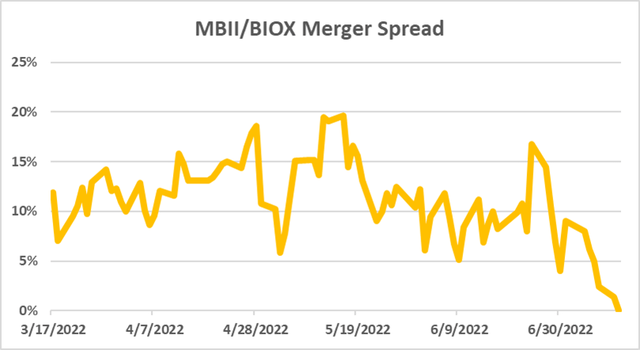

An interesting merger in the agricultural biological industry – MBII was getting acquired by a larger peer Bioceres Crop Solutions (BIOX). The spread used to fluctuate between 10%-20% even though the transaction seemed very likely to close:

- Shareholder approval was guaranteed by the support agreements with MBII’s two major shareholders.

- Regulators were unlikely to oppose the transaction given the small size of the companies – ~$600m market cap of the buyer and ~$200m for the target.

The spread seemed to partly exist due to tighter borrow availability for hedging – BIOX borrow fees stood at 8% annual fee at the time. However, the spread still appeared overblown as the hedging fees would have reduced the upside by only 2%-3%. The main explanation here might have been the fact that both companies were small and the transaction took place in a rather young, fast-growing but speculative industry that many investors simply avoided.

Golden Valley Mines (GZZ.V)

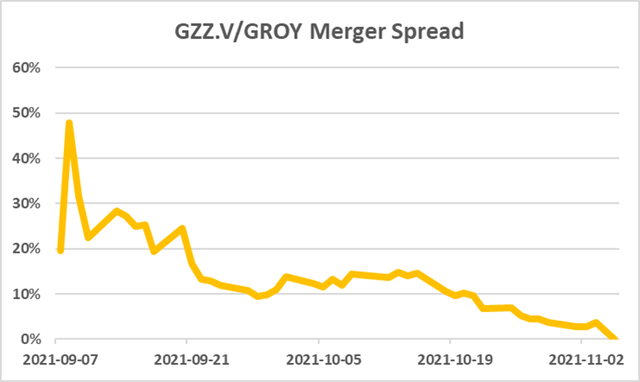

This was an M&A in the gold mining industry. In early Sep’21, Gold Royalty (GROY) announced an acquisition of two Canadian-listed gold miners – Golden Valley and Abitibi. The spread on GROY / GZZ.V merger hovered around 20%+, even when it seemed to be a low risk transaction:

- The buyer GROY appeared credible and was already on an acquisition spree to grow its royalties portfolio.

- GZZ shareholders were very likely to approve the merger given the initial support for the deal and all-time high GZZ share price at the time.

- Even though the borrow for hedging was expensive (at 24% in early Sep’21), the timeline until transaction closing was short, with hedging fees expected to account for only 4% of the spread.

The wide spread was mainly driven simply by market’s ignorance – the situation was clearly overlooked by investors given it was a small-cap cross-border merger with the Canadian target listed on Venture exchange. Over the next two months, the spread gradually narrowed without any incremental news.

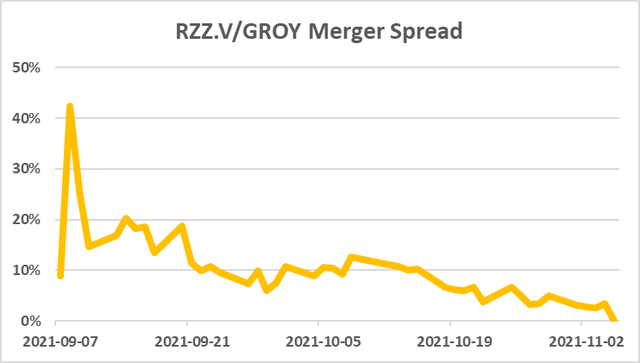

Abitibi Royalties (RZZ.V)

The second part of GROY’s “package deal” described above. Similarly to the GZZ / GROY merger, the successful closing of the transaction seemed very likely as the buyer was clearly interested in Abitibi’s core assets while 65% of Abitibi’s shareholders already supported the merger. Despite this, the spread hovered at 10%-15% over the next month. Looking back, this merger arb had a very solid risk/return – I would explain the excessive spread by small transaction size and the fact that the target company was listed on a Venture exchange in Canada (identically to the GZZ / GROY transaction).

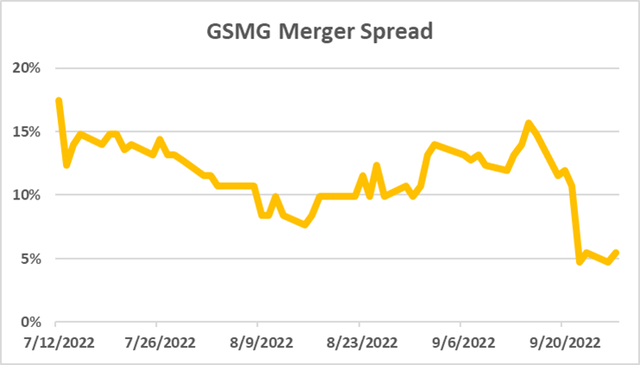

Glory Star New Media Group (GSMG)

An ongoing Chinese US-listed privatization where the spread has now materially narrowed. In July, the management and a US-based hedge fund Shah Capital submitted a definitive acquisition agreement to acquire a Chinese media services company Glory Star New Media Group. Importantly, my study on Chinese US-listed company privatizations (available to Special Situation Investing subscribers) shows that once a definitive agreement is signed, the transaction has a very high chance of closing (with only 2 exceptions so far). However, despite the fact that the acquisition proposal here was definitive, the spread was wide at 10%-15%, even peaking to 25% in intraday on September 15. Such a spread seemed way overblown considering that:

- The offer had already been raised after the initial $1.27/share bid was rejected by the conflicts committee – this showed strong commitment from the buyer consortium to proceed with the acquisition.

- Shareholder approval was guaranteed due to 73% ownership by the buyer’s group.

Reflecting back on the wide spread, it seems that investors stayed away from this merger arb given that GSMG is a Chinese company. On top of that, the transaction was announced during significant market turbulence – generally, merger arbitrage spreads tend to widen in times like these, thus presenting compelling risk arbitrage setups.

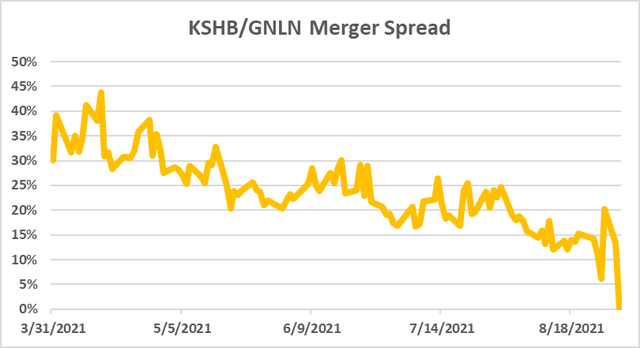

KushCo Holdings (OTCQX:KSHB)

Merger between two suppliers of ancillary cannabis products. The spread at 20%-25%-plus seemed too wide given there was a very high chance the merger would be completed successfully:

- The acquisition seemed highly strategic for the buyer who in effect bought a better-performing peer at a relatively low valuation – 1.12x EV/E2021 revenues versus 1.08x that Greenlane (GNLN) was trading at the time.

- Approvals from GNLN and KSHB shareholders seemed likely given both, the strong strategic rationale for the buyer as well as the fact that 12.5% of KSHB shareholders were already in support.

- Plenty of borrow for hedging was available at 1% annual fee.

One of the reasons explaining the spread could have been risky industry aura. During 2019 and 2020, a number of cannabis mergers were canceled due to the cannabis oversupply crisis and the subsequent COVID-19 outbreak. However, after Nov’20 elections cannabis industry players started to anticipate significant legalization tailwinds as the US federal cannabis approval was expected in 2021. As a result, industry consolidation ramped up, and apparently only one cannabis merger had failed after Nov’20. This, however, was clearly overlooked by the market which continued to view the cannabis space as speculative and risky.

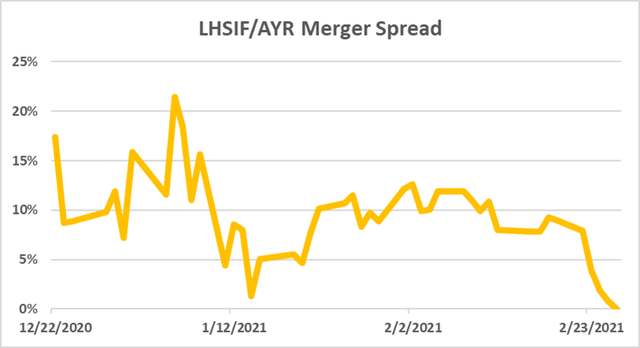

Liberty Health Sciences (OTCQX:LHSIF)

Acquisition of a vertically-integrated medical cannabis retailer in Florida by its peer. The spread fluctuated at 12%-plus from Jan’21, occasionally narrowing down despite no transaction-related news. Once again, the negative aura surrounding the cannabis industry could explain why the market was mispricing the situation. Despite the fact that numerous cannabis mergers had closed successfully, investors tended to stay away from transactions occurring within the space.

The (OTCQX:LHSIF) / (OTCQX:AYRWF) merger itself seemed highly likely to close and seemingly had almost no risks:

- 29% of equity holders already had voting agreements.

- The companies had limited geographical overlap, suggesting that regulatory risk was very low.

- Given the strategic importance of the transaction for the buyer – expansion into several US states – and seemingly low price, the risk of (OTCQX:AYRWF) terminating the merger seemed quite low.

- Plenty of hedging was available, though at somewhat higher 9% annual fee. However, given a short expected closing timeline, arb returns were unlikely to be significantly impacted by the borrow fees.

Tyme Technologies (TYME)

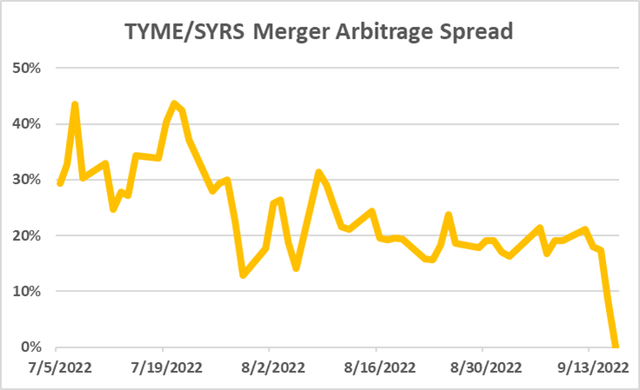

Merger between two clinical-stage biopharma companies. The acquisition was highly likely to satisfy all closing conditions, including approvals from shareholders of both companies, yet the spread stood at a staggering 22% when I highlighted this opportunity to Special Situation Investing readers on the 12th of September. I struggled to find an explanation for such a wide spread besides general investor skepticism to micro-cap biopharma acquisitions. The merger closed the same week. For an in-depth analysis of TYME / SYRS merger and SYRS prospects going forward, check out my recently published exclusive article.

Conclusion

Unlike large-cap risk arbitrage, smaller merger arbs often present potentially lucrative investment setups where individual investors can obtain a sizable edge. There are patterns that allow to differentiate likely-to-close and low-risk small-cap merger arbs from the ones that do not offer a solid risk-adjusted return. Currently, several interesting transactions are VLNS / SNDL and CCHW / CRLBF. With spreads of 9% and 16%, respectively, the market might be mispricing these arbitrages.

Be the first to comment