ollo/E+ via Getty Images

Introduction

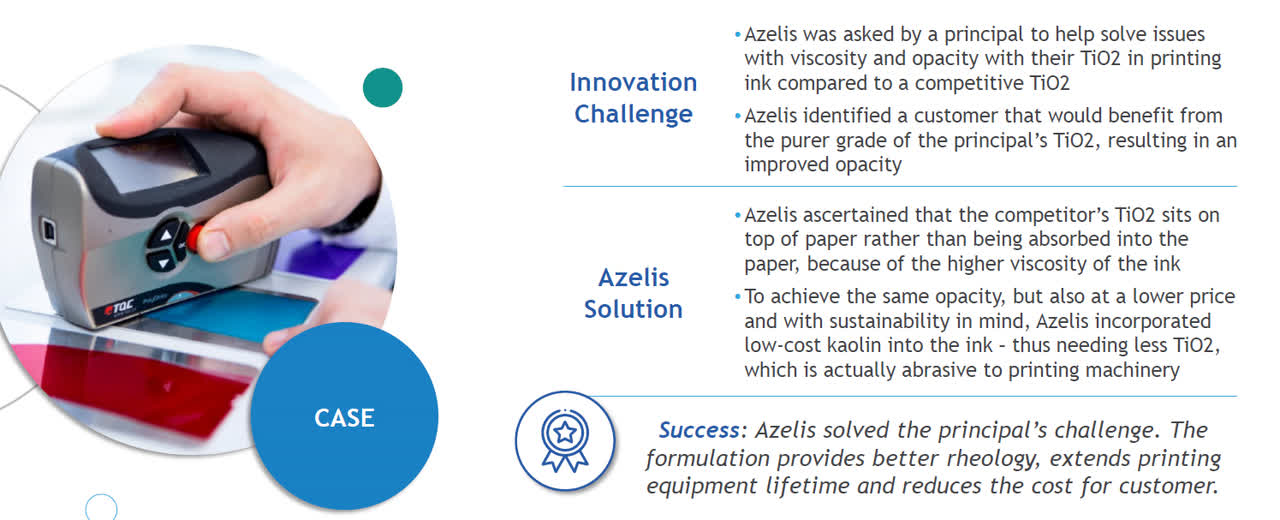

Azelis (OTCPK:AZLGF) is a service provider to the specialty chemicals and the food ingredients industry. That doesn’t sound very exciting but one of Azelis’ core areas of expertise is working on innovative formulations for its clients. The two images below from Azelis’ corporate presentation show examples of what the company deals with on a daily basis.

Azelis Investor Relations

Azelis is also working its magic in the specialty chemicals industry and I found this specific case quite interesting.

Azelis Investor Relations

While these are obviously just some examples, it gives you an idea of what Azelis does for its customers.

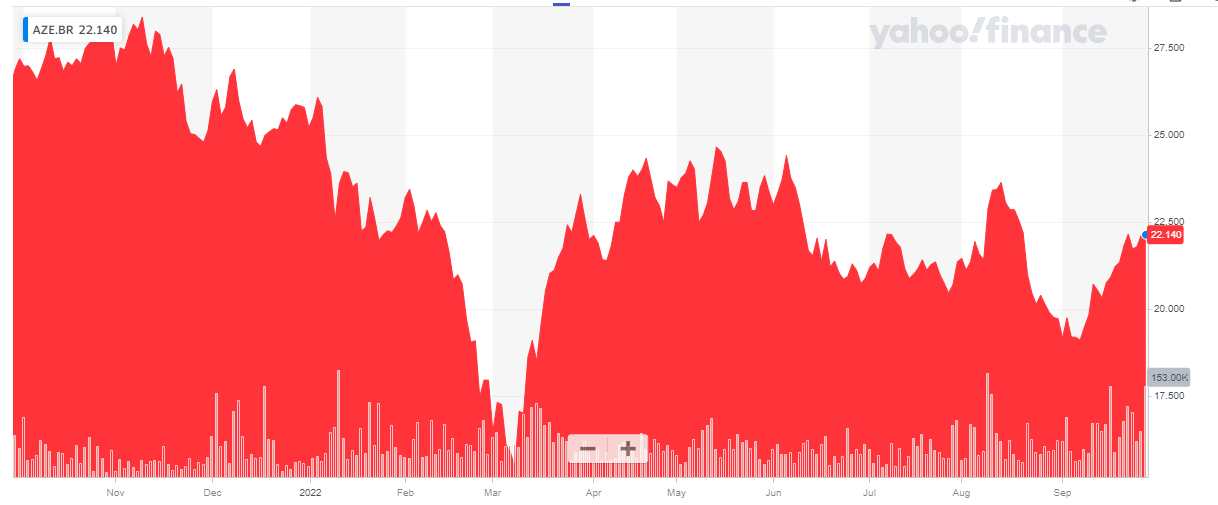

Yahoo Finance

Azelis has its primary listing on Euronext Brussels where it is trading with AZE as its ticker symbol and considering the average daily volume exceeds 60,000 shares per day, I would strongly recommend to trade in Azelis’ shares using the facilities of Euronext Brussels. As there are just under 234 million shares outstanding, the current market capitalization of the company is approximately 5.15B EUR.

Azelis reported surprisingly strong results in the first semester

I wouldn’t say Azelis is completely immune to economic shocks as a disappointing result for its customer base may reduce the R&D budgets which would, directly and indirectly, hurt Azelis as well. But for the time being, the company’s financial performance remains exceptionally strong.

In the first half of 2022, the company reported 54% revenue increase, and even if one would isolate the impact from M&A activities, the organic revenue growth was almost 28% and that is pretty impressive.

Azelis Investor Relations

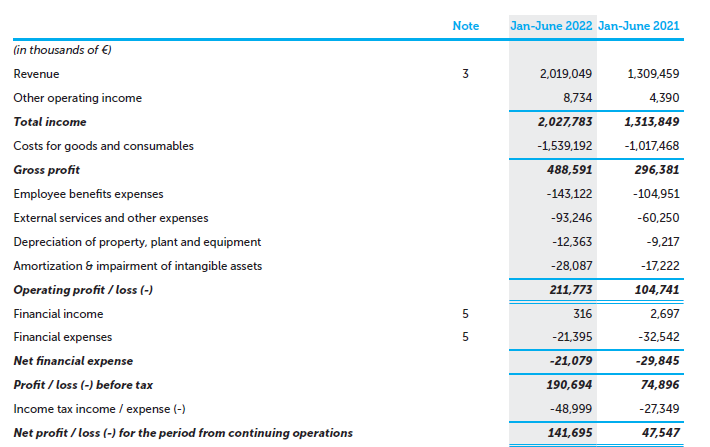

As you can see above, the company reported a total revenue of almost 2.03B EUR resulting in a gross profit of just under 490M EUR. This means the 54% reported revenue increase resulted in a 65% gross profit increase.

The operating profit actually more than doubled to 212M EUR and this, in combination with a decreasing financial expense (lower cost debt and a lower gross debt level), the pre-tax income jumped from 75M EUR to 191M EUR. An increase of in excess of 150%.

The net income came in at 141.7M EUR of which about 138.8M EUR was attributable to the common shareholders of Azelis with almost 2.9M EUR attributable to the non-controlling interests. The EPS in the first half of the year was 0.59 EUR. On an annualized basis this would yield a result of 1.2 EUR per share (and likely higher given Azelis’ continuous acquisition spree) and based on the current share price of in excess of 20 EUR per share, the stock does not look very appealing.

There is, however, more than meets the eye here as Azelis runs a very capex-light business model and the depreciation and amortization expenses are a multiple of the effective capex and lease expenses.

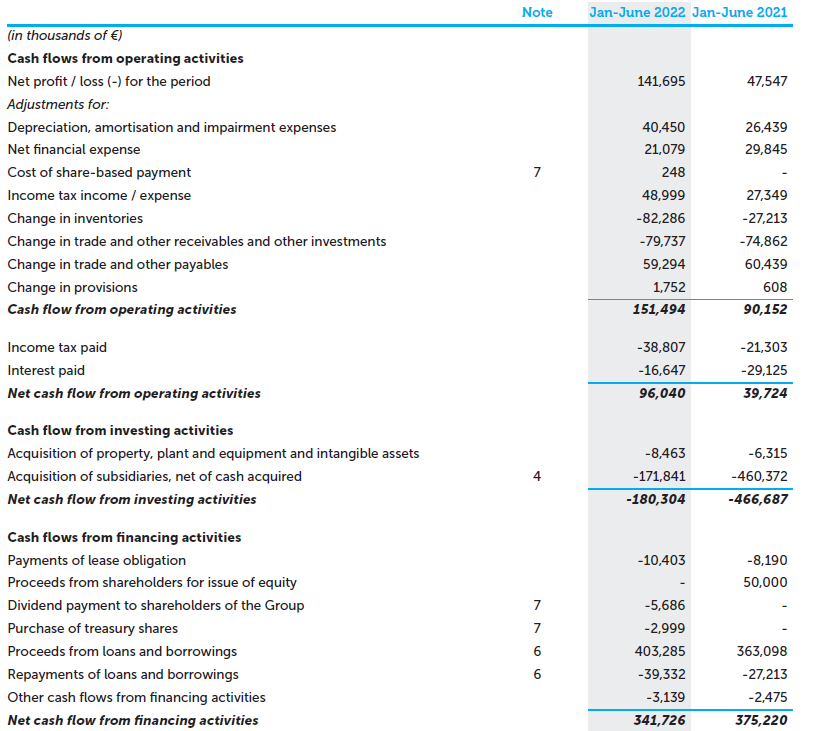

As you can see on the cash flow statement below, the company reported an operating cash flow of 96M EUR but unsurprisingly, there are a few adjustments we need to make here. First of all, we need to deduct an additional 10M EUR in taxes as the total income tax was approximately 49M EUR as per the income statement but Azelis only paid 38.8M EUR in cash taxes.

Secondly, the operating cash flow also includes a 101M EUR investment in the working capital position. So on an adjusted basis, the operating cash flow was 187M EUR. And after deducting the 10M EUR in lease payments, the adjusted operating cash flow was 177M EUR.

Azelis Investor Relations

And as the total capex was just 8.5M EUR, the free cash flow result was approximately 168M EUR and I estimate about 165M EUR of this was attributable to the common shareholders of Azelis. This represents a free cash flow per share of 0.70 EUR and that makes the stock already more attractive.

Azelis continues to pursue an M&A strategy whereby it identifies and acquires smaller bolt-on acquisitions. In the first half of the year, Azelis closed the acquisition of five companies while it expects to complete five more acquisitions in the current semester. The total commitment to acquire these five companies in the first half of the year was 172M EUR but these companies should add about 190M in annualized revenue. If Azelis can replicate its own EBITDA margins of approximately 12% on these acquisitions, the total EBITDA generated by the acquired companies would be around 24M EUR indicating an EBITDA multiple of 8 as acquisition cost which is pretty reasonable.

Azelis’ capital allocation priorities are pretty clear. The company pays a very symbolic dividend and prefers to use its incoming free cash flow to pursue new acquisitions to continue to grow the business.

I’m fine with a ‘buy and build’ strategy on the condition the balance sheet can handle it. As of the end of June, Azelis had approximately 386M EUR in cash while the gross debt increased to 1.29B EUR for a net debt position of approximately 900M EUR (excluding lease obligations). That is still fine considering I am expecting an EBITDA north of 500M EUR for the year. Azelis is guiding for a full-year EBITA (excluding depreciation expenses) of 410-425M EUR but the company may be a bit more conservative. In any case, even using a 450M EUR full-year EBITDA would still result in a debt ratio of just around two times EBITDA. Not bad at all.

Investment thesis

Azelis doesn’t have a lot of competitors and it’s difficult to figure out a fair value for the shares. But considering the free cash flow yield will come in at around 6.5% and the current EV/EBITDA ratio is just around 13 (which is more than okay for a relatively defensive company), I will be keeping an eye on Azelis.

The stock isn’t in bargain territory yet and right now there are plenty of other opportunities available. I’m not a buyer of Azelis at the current share price but will monitor its progress and cash flow evolution.

Be the first to comment