gevende/iStock via Getty Images

Published on the Value Lab 12/6/22

IAC (NASDAQ:IAC) is one of the Value Lab’s current high conviction investments. The main draw is the substantial undervaluation on a sum of the parts basis, but there are also notable network effects and antifragility in how some of IAC’s properties operate. They depend on ad revenue which has seen sequential decline, but in other areas exposed to consumer trends there is no strong evidence of recessionary forces. This is likely to be the case going forward according to our soft-landing expectation, which we believe the US and not Europe will manage thanks to geopolitical advantages. Overall, IAC remains very undervalued, and with costs likely to increment downwards associated with the migration of the Meredith properties, we are optimistic about incremental margin generation.

Key Q3 Takeaways

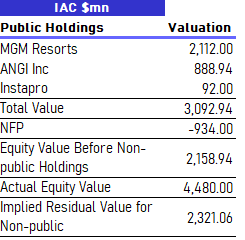

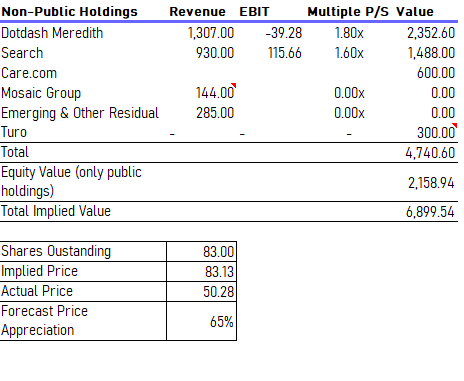

IAC is a complicated company and is comprised of many parts, both publicly and privately traded. Our valuation according to our previous research is here.

Public Holdings (VTS) SoTP (VTS)

Management attests to good activity in some of the more VC style exposures like Turo, but also the strong performance reported by major holdings like MGM Resorts (MGM) which is performing well thanks to some organic growth as well and resilience in regional gaming. BetMGM is a major draw for them as well.

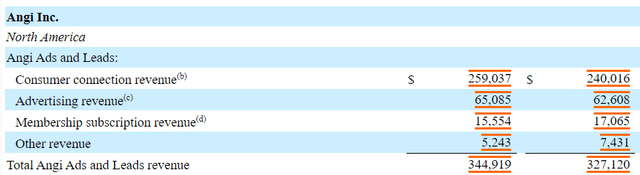

Consumer spending remains strong, and there are bright spots in the segment reporting thanks to that. The Angi (ANGI) leads revenue is up sequentially as the platform connecting homeowners to workers continues to grow.

Above is the YoY data which is showing growth despite a strong 2021, but sequentially revenues are up 2% as well, again a testament to the company’s performance. European revenues are struggling more, and roofing is slowed down because of disruption due to hurricanes in Florida where they’re located. At least hurricanes create some roofing demand too.

Angi is not as directly exposed to advertising, which is a more idiosyncratic market because it depends on corporate decision makers. It is lead generation, and there are elements of antifragility in their business model. Specifically, as times get tough, more workers require platforms like Angi to generate leads. Angi has a data edge and can add value here, even if overall activity at homes declines.

Bottom Line

There’s still a little to worry about in ad markets, which affects the bulk of their revenue from Dotdash Meredith which are equivalent in sales to Angi. Traffic is down 5% across DDM content platforms, and the uncertainty is amplified in revenues where ad buyers are holding back to wait for less volatility, as they have to be conservative with ad budgets and ROIs. The market is not great for ads. However, we believe in a soft landing. The US has pulled every geopolitical lever, and a recession simply hasn’t happened despite every effort by the Fed to cause one. Cost pressures are subsiding. We could see a major rally if peaking CPIs are backed up by another month of CPI data. If there’s a negative surprise, the IAC discount still provides a safety margin.

We think there are other catalysts to realising the upside. Any sale of major properties at market value should cause a revision in IAC. Moreover, about 15% bloat is occurring in G&A due to migrations of Meredith properties, which are 90% done. G&A should recede by about $30-40 million and bring down losses by 10%. Moreover, incremental sales in ad space as Meredith becomes better utilised should happen at higher margins. IAC is still guiding for traffic growth for 2023. With antifragility in major properties but also absurd SoTP discount, IAC remains a clear buy.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment