putilich/iStock via Getty Images

Q4 Financial Results

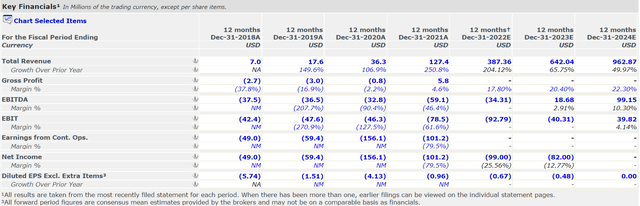

In Q4 2021, revenue grew 184% to $52.8 million, from $18.6 million a year ago. FY Net loss narrowed from $(100.9) in FY2020 to $(34.1) million in 2021. FY2021 contracted backlog increased from $449 million, compared to $184 million a year ago, a 144% increase.

With low profitability margins, Stem’s (NYSE:STEM) acquisition of AlsoEnergy is the first step in the right direction to capitalize on software’s high margin, while simultaneously expanding hardware sales. Synergies formed between the two companies could justify the $695 million spent on AlsoEnergy’s acquisition, further spurred by the 30% overlap in customer base. Current share price has come off its high of $37.79, to the current share price of $8.97 as of 10th March 2022. Phenomenal revenue growth is expected over the next 2 years, and valuations are attractive. However, key components in production could further delay EBITDA and net earning positive results in the near term.

Operations and Financing

Current concerns for Stem would be the turn in profitability, and evaluating the risk of further capital funding and subsequent dilution for current shareholders. LTM gross margin was at 4.6%, which is rather unfavorable, and is expected to be 22.30% only in FY2024, which would be equivalent to current median of competitors. Management guidance predicts 15-20% gross margin for 2022E, with the main boost being the high-margin acquisition of AlsoEnergy.

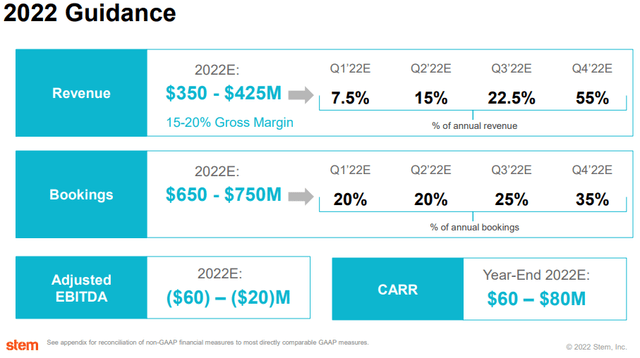

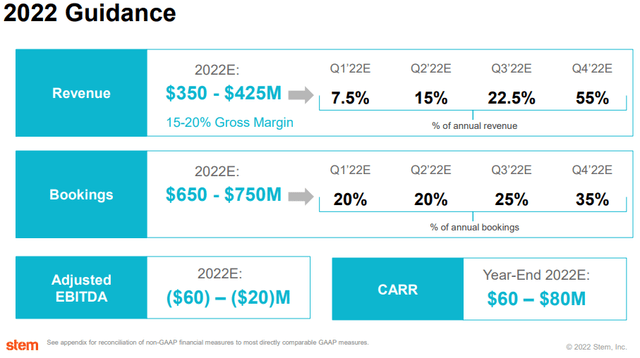

Stem’s 2022 Guidance (Stem Investor Presentation)

Stem is currently skewing towards software business integration. AlsoEnergy has a software revenue of $57 million, with an annual recurring revenue (ARR) at $23 million as of 2021. Further software acquisition would be highly beneficial for Stem, as current margins are high (60-80%), with software only accounting for 19% of total revenue. Cross-selling would also further spur revenue generation, as there exists a 30% overlap in Stem and AlsoEnergy’s customer base. Furthermore, Stem’s recurring software cash flow is secured by long term, 10-20 year contracts which provides stability, minimizing revenue variance. Pivoting towards greater expansion in the SaaS space, could improve operational margins and be the key to driving long-term profitability for Stem.

Stem’s Revenue and Profit Projections (Capital IQ)

Valuation Analysis

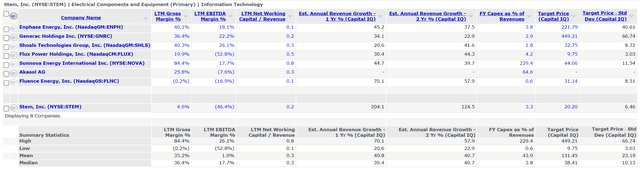

Stem currently has a target price of $20.20, with an underlying target price standard deviation of 6.46, relatively lower than many of its peers, implying a greater sense of analyst conviction and certainty. At the current share price of $9.20 as of 9th March 2022, this provides for a 120% upside.

Despite Stem’s late establishment relative to companies such as Generac Holdings (NYSE:GNRC) back in 1959, and three years after Enphase’s (NASDAQ:ENPH) inception in 2006, Stem is trying to make up for this loss of time with a violent (1 Yr) estimated annual growth rate of 204.1%, and (2 Yr) annual growth rate of 124.5%. This is supported by Stem’s FY2021 revenue of $127.4 million, and company guidance of $350-425 million in FY 2022. Note that company guidance would be inclusive of Stem’s recent acquisition of AlsoEnergy, with a FY2020 revenue of $49 million.

Stem’s Estimated Growth Rates and Operational Margins (Capital IQ)

If Stem actualizes its low and high end of guidance, it would result in a 175% and 234% revenue increase in FY2022 respectively. Investors should pay close attention to upcoming quarterly earnings against management guidance.

On the other hand, with the assumption that AlsoEnergy’s $49 million revenue is being extrapolated into 2022 and being netted off against guidance, if Stem actualizes its low and high end of guidance, it would result in a 136% and 195% revenue growth in FY2022, which is still phenomenal growth, noting that Stem is a high growth company.

Due to the Ukraine-Russia conflict, and the prices of crude oil reaching 13 year highs, there would inevitably be an increasing, macro-spurred need for energy cost-related optimization. I believe Stem would be able to meet its FY2022 revenue guidance, however investors should compare upcoming earnings with management’s guidance for further reassurances.

Stem’s 2022 Guidance (Jan 2022 Stem Investor Presentation)

Key Risk Factors

Supply chain disruptions could work against profit margins for Stem. Despite lithium-ion battery packs prices plummeting from $1200 per kWh in 2010 to $132 in 2021, demand has outstripped supply and prices could rise to $135 per kWh in 2022. On the contrary, in Stem’s projections, they believe potential oversupply due to growth of battery manufacturing can help to reduce cost of sales and improve profit margins over the next 3-4 years. As such, there lies uncertainty in key COGS input, which can eclipse that of high revenue generation, especially since hardware still comprise 84% of FY2021 total revenue. However, it might bring some comfort to know that Stem has secured most of its hardware components for FY2022.

Overall risk of delayed EBITA and net profits could be actualized if margins are stagnant. Cash and cash equivalents were $747.780 million as of 31 December 2021. With LTM cash from operations being $(101.27) million and reducing cash balance from 75% total consideration in cash from AlsoEnergy’s $695 million acquisition, net cash burn rate is at a decent 26.8. However, with greater expansion costs, potential further acquisitions and lack of profitability, Stem might require more cash, resulting to greater capital funding at a higher cost and a subsequent shareholder dilution.

Conclusion

Stem’s hardware and network integration sales act as a conduit between software sales and high profitability. As aforementioned, low margin hardware still comprise most of Stem’s revenue. FY2021’s record bookings and contracted backlogs were optimistic, and will continue in that direction, attributed to rising global cost of energy, and the increasing need for energy cost optimization and intelligence. Furthermore, valuation has come down significantly. However, I believe at this juncture macro factors including rate hikes will act as major headwinds in Stem’s journey towards net profitability. Stem still looks ripe for a long term play, but investors have to be prepared for further volatility and downside in the near term before finding Stem finds a foot hole, valuation-wise.

Be the first to comment